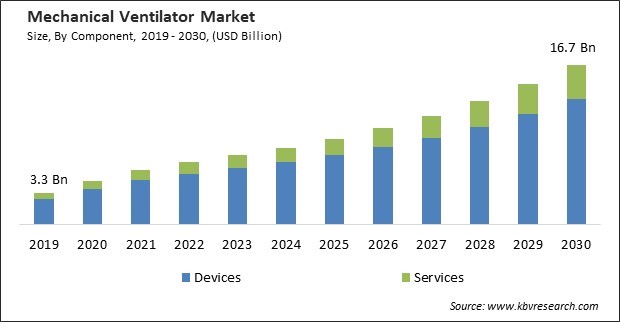

The Global Mechanical Ventilators Market size is expected to reach $16.7 billion by 2030, rising at a market growth of 12.6% CAGR during the forecast period. In the year 2022, the market attained a volume of 1,039.4 thousand units, experiencing a growth of 27.4% (2019-2022).

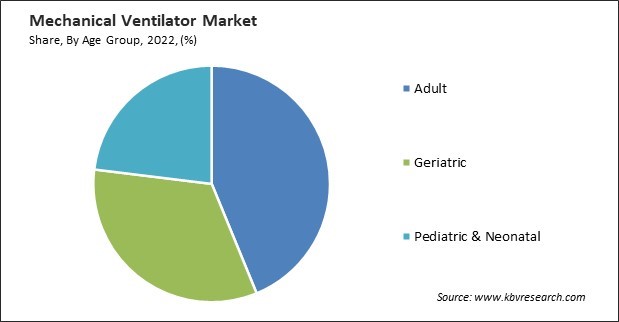

As per the World Health Organisation, one in six people will be 60 or older by 2030. The number of people 60 and older in the world will increase from 1 billion in 2020 to 1.4 billion in 2050. By 2050, there will be 2.1 billion people in the world who are 60 or older. Mechanical ventilators are essential for managing these age-related respiratory issues. Consequently, the Geriatric segment captured $2,172.9 million revenue in the market in 2022. It plays a vital role in enhancing the quality of life for older adults by providing advanced respiratory support tailored to their physiological nuances. The elderly population is susceptible to respiratory complications due to weakened respiratory muscles, decreased lung function, and comorbidities.

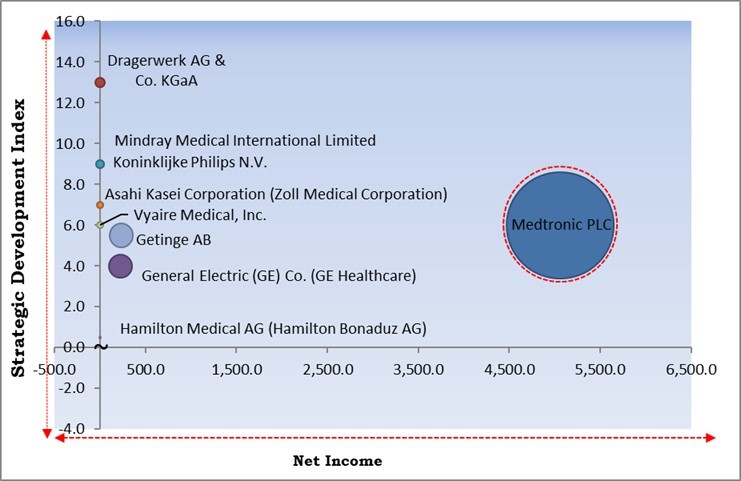

The major strategies followed by the market participants are Partnerships, Collaborations & Agreements as the key developmental strategy to keep pace with the changing demands of end users. For instance, In June, 2023, Koninklijke Philips N.V. collaborated with Biotronik, aimed to widen the range of cardiovascular devices available for Philips SymphonySuite customers. Additionally, ZOLL Medical Corporation teamed up with Cogmedix, aimed to boost the production of ventilators during the COVID-19 pandemic.

Based on the Analysis presented in the KBV Cardinal matrix; Medtronic PLC is the forerunners in the Market. For Instance, In April, 2022, Medtronic PLC collaborated with GE Healthcare focused on the unique needs and demand for care at Ambulatory Surgery Centers (ASCs) and Office Based Labs (OBLs). Under this collaboration, customers can access extensive product portfolios, financial solutions, and exceptional service. Companies such as General Electric (GE) Co., Koninklijke Philips N.V., Dragerwerk AG & Co. KGaA are some of the key innovators in Market.

The most immediate and visible impact of COVID-19 on the market was the unprecedented surge in demand for these life-saving devices. As the virus rapidly spread and overwhelmed healthcare systems in various countries, there was a significant shortage of ventilators to support critically ill patients. Hospitals and healthcare facilities faced an acute need to increase their ventilator capacity to manage the influx of COVID-19 patients. COVID-19 accelerated the adoption of remote monitoring and telehealth solutions, including integrating ventilators into telemedicine networks. These designs focused on essential functions to address the surge in demand, even if they lacked some of the advanced features of traditional ventilators. While these innovations provided short-term relief, they also raised concerns about the quality and safety of rapidly developed devices. Thus, the COVID-19 pandemic had a positive effect on the market.

Respiratory diseases such as COPD, asthma, and interstitial lung diseases are highly prevalent, particularly in aging populations. These conditions often require long-term or intermittent ventilatory support, creating a sustained demand for mechanical ventilators. Various chronic conditions, such as heart failure and neuromuscular disorders, can result in respiratory complications that require mechanical ventilation for optimal patient care. The co-occurrence of these conditions adds to the demand for ventilators. The prevalence of pediatric and neonatal respiratory disorders, such as respiratory distress syndrome and bronchiolitis, necessitates specialized neonatal and pediatric ventilators. The prevalence of respiratory diseases has driven the integration of mechanical ventilators with telemedicine networks and remote monitoring technologies. This permits healthcare providers to remotely monitor patients with respiratory conditions and adjust ventilator settings, improving access to care. The rising prevalence of respiratory diseases is a significant driver of growth in the market.

Home ventilation programs create a growing demand for mechanical ventilators in home settings. These ventilators are often more compact, user-friendly, and easy to operate, making them suitable for patients and caregivers. Patients with chronic respiratory conditions, such as COPD, neuromuscular disorders, and obesity hypoventilation syndrome, may require long-term ventilatory support. Home ventilation programs provide a solution for these patients, extending the use of ventilators. Home ventilators are designed with a focus on patient comfort. Telemedicine is frequently integrated into home ventilation programs, allowing patients to access specialist consultations remotely. This is especially important for patients in remote or underserved areas. The expansion of home ventilation programs has been a pivotal factor in driving the growth of the market.

Supply chain disruptions can make it challenging for manufacturers to produce and deliver ventilators to healthcare facilities in a timely manner. Increased demand and supply chain disruptions can delay the provision of life-saving equipment to needy patients. Shortages can drive up the prices of mechanical ventilators, making them less affordable for healthcare facilities, especially in resource-constrained settings. Higher costs can strain the budgets of healthcare providers. In some cases, supply chain disruptions can lead to a rush to procure ventilators, potentially compromising the quality of devices purchased. Decisions about resource allocation can be emotionally taxing for clinicians. The disruption of the supply chain can result in logistical challenges, including delays in transporting ventilators to healthcare facilities and difficulties in storing and distributing them effectively. Thus, supply chain disruptions hampering timely production and delivery can slow down the growth of the market.

Based on mode, the market is divided into invasive ventilation and non-invasive ventilation. In 2022, the invasive ventilation segment registered the maximum revenue share in the market. Invasive ventilation is utilized across various clinical applications, including ICUs, operating rooms, emergency departments, and post-operative recovery. This versatility ensures consistent demand for invasive ventilators. Invasive ventilators are equipped with advanced monitoring and alarm systems to ensure patient safety. This includes tracking parameters such as airway pressure, tidal volume, and oxygen levels. Invasive ventilation is crucial for patients who have suffered traumatic injuries, near-drowning incidents, or other life-threatening emergencies. These patients may require immediate intubation and mechanical ventilation.

On the basis of component, the market is bifurcated into devices and services. The services segment garnered a significant revenue share in the market in 2022. Healthcare facilities often require professional assistance for the proper installation and setup of mechanical ventilators. Technical support and help desk services provide timely assistance to healthcare providers when they encounter issues with ventilators. This support ensures quick problem resolution and minimizes disruptions in patient care. Some service providers offer remote monitoring and troubleshooting capabilities, allowing them to access ventilators and diagnose issues from a distance. This can decrease the number of on-site service contacts and expedite the resolution of issues.

By product type, the market is categorized into intensive care unit/critical care, transport/portable/ambulatory, and neonatal care. In 2022, the intensive care unit/critical care segment held the highest revenue share in the market. The intensive care unit/critical care segment utilizes mechanical ventilators for a wide range of conditions, including respiratory failure, trauma, infections, surgery recovery, and more. ICUs often manage patients with chronic respiratory conditions, such as COPD, who may require ventilatory support during acute exacerbations. This chronic care aspect contributes to sustained demand in the intensive care unit /critical care segment.

Based on age group, the market is classified into adult, geriatric, and pediatric & neonatal. The geriatric segment acquired a substantial revenue share in the market in 2022. Elderly individuals are more prone to age-related respiratory conditions, such as COPD, pneumonia, and obstructive sleep apnea. Geriatric patients often have multiple comorbidities, which can complicate respiratory conditions and lead to a greater need for mechanical ventilation. Common comorbidities include heart disease, diabetes, and neurological disorders. Many elderly individuals require surgical interventions for various medical conditions, such as heart surgery or hip replacement. Post-surgical mechanical ventilation may be necessary for geriatric patients during their recovery, contributing to the demand for ventilators.

By end user, the market is fragmented into hospital & clinic, ambulatory surgical center, home care, and others. In 2022, the hospital & clinic segment led the market by generating highest revenue share. Hospitals & clinics segment are central in managing patients with chronic respiratory conditions. Mechanical ventilators are essential for patients with neuromuscular disorders or severe asthma. Hospitals & clinics often use transport ventilators to safely transfer patients between units, departments, or healthcare facilities while maintaining proper ventilation. Hospitals often provide home ventilation services, extending the use of mechanical ventilators into patients' homes. This includes the provision of portable ventilators and training for patients and their caregivers.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 6.6 Billion |

| Market size forecast in 2030 | USD 16.7 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 12.6% from 2023 to 2030 |

| Number of Pages | 485 |

| Number of Table | 955 |

| Quantitative Data | Volume in Thousand Units, Revenue in USD Billion, and CAGR from 2019 to 2030 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Product Type, Age Group, Component, Mode, End User, Region |

| Country scope |

|

| Companies Included | GE HealthCare Technologies, Inc., Koninklijke Philips N.V., Medtronic PLC, Dragerwerk AG & Co. KGaA, Getinge AB, Asahi Kasei Corporation (Zoll Medical Corporation), Hamilton Medical AG (Hamilton Bonaduz AG), Carl Reiner GmbH, Mindray Medical International Limited and Vyaire Medical, Inc. |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region led the market by generating the highest revenue share. North America, particularly the United States and Canada, has a rapidly aging population. The elderly are more susceptible to respiratory illnesses and may require mechanical ventilation for various medical conditions. North America has a high prevalence of chronic respiratory diseases such as COPD and asthma. Mechanical ventilators are essential for managing these conditions, especially during exacerbations.

Free Valuable Insights: Global Mechanical Ventilators Market size to reach USD 16.7 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include GE HealthCare Technologies, Inc., Koninklijke Philips N.V., Medtronic PLC, Dragerwerk AG & Co. KGaA, Getinge AB, Asahi Kasei Corporation (Zoll Medical Corporation), Hamilton Medical AG (Hamilton Bonaduz AG), Carl Reiner GmbH, Mindray Medical International Limited and Vyaire Medical, Inc.

By Mode (Volume, Thousand Unit, USD Billion, 2019-30)

By Component (Volume, Thousand Unit, USD Billion, 2019-30)

By Product Type (Volume, Thousand Unit, USD Billion, 2019-30)

By Age Group (Volume, Thousand Unit, USD Billion, 2019-30)

By End User (Volume, Thousand Unit, USD Billion, 2019-30)

By Geography (Volume, Thousand Unit, USD Billion, 2019-30)

This Market size is expected to reach $16.7 billion by 2030.

Rising prevalence of respiratory diseases are driving the Market in coming years, however, Supply chain disruptions hampering timely production and delivery concerns restraints the growth of the Market.

GE HealthCare Technologies, Inc., Koninklijke Philips N.V., Medtronic PLC, Dragerwerk AG & Co. KGaA, Getinge AB, Asahi Kasei Corporation (Zoll Medical Corporation), Hamilton Medical AG (Hamilton Bonaduz AG), Carl Reiner GmbH, Mindray Medical International Limited and Vyaire Medical, Inc.

In the year 2022, the market attained a volume of 1,039.4 thousand units, experiencing a growth of 27.4% (2019-2022).

The Devices segment is leading the maximum revenue in the Market by Component in 2022;there by, achieving a market value of $13.1 billion by 2030.

The North America region dominated the Market by Region in 2022 and would continue to be a dominant market till 2030;there by, achieving a market value of $5.9 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.