The Global Medical Aesthetics Market size is expected to reach $31.1 billion by 2030, rising at a market growth of 10.4% CAGR during the forecast period.

Skin aesthetic devices offer various treatment options, making them suitable for addressing skin concerns. This includes treatments for wrinkles, fine lines, acne scars, pigmentation issues, vascular conditions, and skin laxity. Therefore, the Skin Aesthetic Devices segment will capture approximately 10% share in the market by 2030. Many skins aesthetic devices are non-invasive or minimally invasive, reducing patient downtime and discomfort compared to surgical procedures. This appeals to a broad patient demographic, including those hesitant about surgery. Advancements in technology have led to skin aesthetic devices with high efficacy and safety profiles. When trained professionals use these devices, patients can achieve noticeable results with minimal risk of adverse effects.

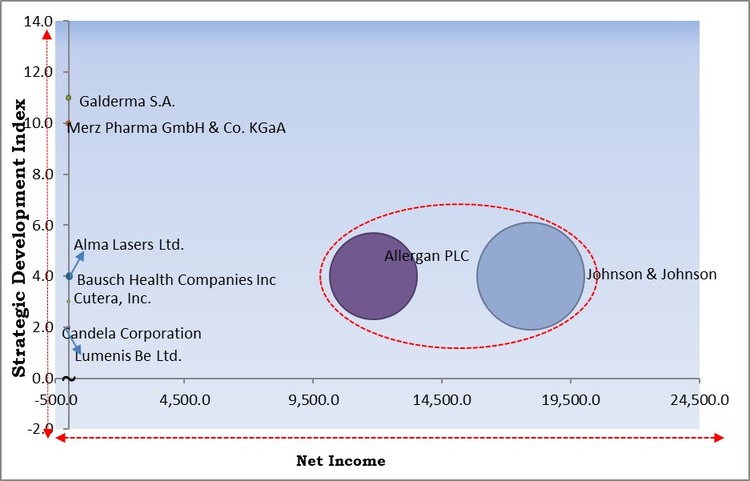

The major strategies followed by the market participants are Acquisitions as the key developmental strategy to keep pace with the changing demands of end users. For instance, In December, 2022, Johnson & Johnson acquired Abiomed, to broaden its offerings in the rapidly growing cardiovascular sector by incorporating heart recovery solutions into our globally leading Biosense Webster electrophysiology business. In January, 2022, Galderma S.A. took over ALASTIN Skincare, to develop products that complement company’s high-quality product lineup.

Based on the Analysis presented in the KBV Cardinal matrix; Allergan PLC and Johnson & Johnson are the forerunners in the Market. In December, 2021, Allergan PLC took over Soliton, Inc, to enhance Allergan Aesthetics' range of non-invasive body sculpting solutions by introducing a proven method for addressing the appearance of cellulite. Companies such as Galderma S.A., Merz Pharma GmbH & Co. KGaA, Alma Lasers Ltd., are some of the key innovators in the Market.

During the initial phases of the pandemic, many aesthetic clinics and medical spas had to temporarily close or limit their operations due to lockdowns, social distancing measures, and concerns about virus transmission. This led to a decline in patient visits and revenue for aesthetic providers. As the pandemic unfolded, many individuals shifted their priorities away from elective cosmetic procedures toward health and safety concerns. The economic uncertainty also made some patients more cautious about discretionary spending on aesthetic treatments. The COVID-19 impact has a significant impact on the market.

An aging global population has led to increased demand for medical aesthetics procedures. Individuals frequently pursue anti-aging treatments to combat fine lines, wrinkles, and sagging skin as they age. The demographic of patients seeking medical aesthetics procedures has expanded to include those in their 40s, 50s, and beyond and younger individuals interested in preventative and early intervention treatments to maintain a youthful appearance. Therefore, the aging population's influence on the market is expected to persist as longevity increases and individuals prioritize their appearance and well-being.

Minimally invasive and non-surgical procedures typically have shorter recovery periods than traditional surgical interventions. These treatments allow patients to resume their daily activities more rapidly, making them appealing to individuals with hectic schedules. Minimally invasive procedures generally carry a lower risk of complications compared to surgery. Patients are drawn to treatments with a lower likelihood of adverse events. The growing popularity of minimally invasive and non-surgical treatments has led to an expanding market for medical aesthetics.

Stringent regulations can make it difficult for new players to enter the market. Meeting the necessary regulatory requirements and obtaining approvals can be time-consuming and expensive. Developing and testing new aesthetic products and treatments to meet safety and efficacy standards can be costly. Manufacturers may need to invest significant resources in research and development. Stringent regulatory compliance and safety standards in the market present challenges.

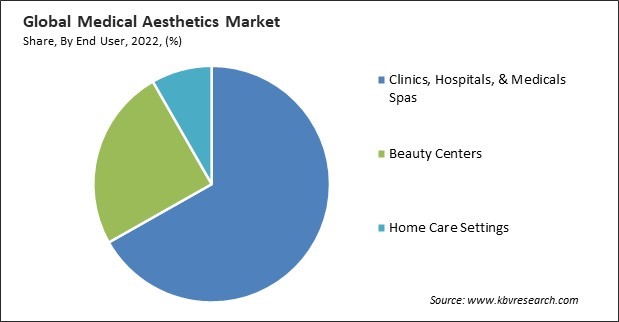

On the basis of end user, the market is divided into clinics, hospitals, & medicals spas, beauty centres, and home care settings. In 2022, the clinics, hospitals, and medicals spas segment dominated the market with maximum revenue share. Clinics provide a safe and professional environment for patients to meet with healthcare providers, such as plastic surgeons, dermatologists, or nurse practitioners, for consultations and assessments. During these sessions, patients discuss their aesthetic goals and concerns, and healthcare providers evaluate their suitability for various treatments. Hospitals have advanced medical facilities, resources, and various medical specialists.

Based on procedure, the medical aesthetics market is classified into surgical procedures and non-surgical procedures. The surgical procedures acquired a substantial revenue share in the medical aesthetics market in 2022. Surgical procedures in the medical aesthetics market continue to evolve with advancements in techniques and technology, focusing on achieving natural-looking results with minimized scarring and shorter recovery times. Patient safety, board-certified surgeons, and informed decision-making are essential components of the surgical aspect of medical aesthetics.

Under surgical procedures type, the market is categorized into breast augmentation, facelift & body lift, rhinoplasty, and others. In 2022, the breast augmentation segment registered the maximum revenue share in the market. Breast augmentation is one of the most popular surgical procedures in the medical aesthetics market. Many individuals seek breast augmentation to enhance the size and shape of their breasts, improving overall body proportions and boosting self-confidence. Women of various ages and backgrounds consider breast augmentation, and it's a procedure that appeals to a broad range of patients.

By product, the market is categorized into facial aesthetic products, cosmetics implant, skin aesthetic devices, body contouring devices, physician-dispensed cosmeceuticals & skin lighteners, hair removal devices, tattoo removal devices, and others. The cosmetics implant segment covered a considerable revenue share in the market in 2022. Cosmetic implants have been a longstanding and important component of the medical aesthetics market. They are used to enhance and reshape various facial features and body contours, and they can provide long-lasting results. One of the most well-known cosmetic surgery operations is the enlargement of the breasts with silicone or saline breast implants.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 13.9 Billion |

| Market size forecast in 2030 | USD 31.1 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 10.4% from 2023 to 2030 |

| Number of Pages | 400 |

| Number of Table | 603 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Product, Procedure, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the medical aesthetics market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region led the medical aesthetics market by generating the highest revenue share. Non-surgical treatments are particularly popular in North America. Common procedures include Botox and dermal filler injections, laser therapy, chemical peels, and microdermabrasion. The aging population in North America has contributed to expanding the medical aesthetics market as individuals seek treatments to address signs of aging and maintain a youthful appearance.

Free Valuable Insights: Global Medical Aesthetics Market size to reach USD 31.1 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Allergan PLC (AbbVie, Inc.), Alma Lasers Ltd. (Sisram Medical Ltd.), Bausch Health Companies Inc, Anika Therapeutics, Inc, Johnson & Johnson, Merz Pharma GmbH & Co. KGaA, Candela corporation, Lumenis Be Ltd., Galderma S.A., and Cutera, Inc.

By End User

By Procedure

By Product

By Geography

This Market size is expected to reach $31.1 billion by 2030.

Growing Proportion of Aging Population are driving the Market in coming years, however, Stringent Regulatory Compliance and Safety Standards restraints the growth of the Market.

Allergan PLC (AbbVie, Inc.), Alma Lasers Ltd. (Sisram Medical Ltd.), Bausch Health Companies Inc, Anika Therapeutics, Inc, Johnson & Johnson, Merz Pharma GmbH & Co. KGaA, Candela corporation, Lumenis Be Ltd., Galderma S.A., and Cutera, Inc.

The expected CAGR of this Market is 10.4% from 2023 to 2030.

The Non-Surgical Procedures segment is generating the highest revenue in the Market by Procedure in 2022; thereby, achieving a market value of $20.5 billion by 2030.

The North America region is registering maximum revenue in the Market by Region in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $10.9 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.