The Global Medical Disinfectant Wipes Market size is expected to reach $5.6 billion by 2027, rising at a market growth of 6.9% CAGR during the forecast period.

Wipes are a necessary sanitary product for maintaining hygiene and cleanliness in homes and environments. The personal care sector arose as people became more conscious of the importance of health and hygiene. Manufacturers such as Kimberly Clark Corporation, Johnson & Johnson, Edgewell Personal Care, Rockline Industries, and Procter & Gamble are concentrating their efforts on inventing diverse sized, shaped, and coloured hygienic sanitary items in order to appeal to consumers.

Disinfectant wipes are specialized wipes that are used to guard against viruses, germs, and other hazardous microorganisms. Textile materials such as cellulosic fibers and thermoplastic fibers are used in the majority of disinfection wipes. Cotton, viscose, wood pulp, and lyocell are examples of cellulosic fibres. Polyethylene terephthalate and polypropylene are examples of thermoplastic fibres. Disinfectant wipes' overall effectiveness and efficacy in surface cleaning and hand sanitization are heavily influenced by their chemical composition.

DIWs (disinfectant-impregnated wipes) are towels soaked with diluted disinfectant and other chemical compounds such as surfactants, preservatives, enzymes, and fragrances, among others. When two materials collide, their interaction is not insignificant and frequently has an impact on their original function. The following elements of the wipe, application method, disinfectant, interaction between them, wiping strategy, and storage period are all factors that could potentially influence the system's disinfection efficacy.

As customers have become more environmentally concerned and seek for sustainable product choices, the demand for biodegradable disinfection wipes has grown dramatically. Biodegradable disinfection wipes are being developed by major brands, which are investing considerably in R&D. For example, in 2020, Pal International introduced Pal TX surface disinfectant wipes, a new surface disinfection product line. These wipes were created to meet the newest food industry rules for maximum residual levels (MRLs) for surface disinfectants.

The COVID-19 pandemic has boosted the demand for medical disinfectant wipes, especially in nations like Russia, the United States, Brazil, India, and the United Kingdom, which are among the worst-affected. To reduce the virus burden, the pandemic has asked for increasing usage of these items in public places, transit, hospitals, nursing homes, and even ordinary houses around the world. Manufacturers around the world have been working around the clock to fulfill the rise in product demand, according to The American Cleaning Institute (ACI), a U.S.-based trade organization for the cleaning goods sector.

Because of a major rise in product demand during the COVID-19 pandemic, several firms have been investing in the US medical disinfection wipes market. The pandemic, for example, caused a 50 percent increase in demand for Reckitt Benckiser's Lysol brand. Apart from hospitals and other medical facilities, the product has been used to prevent the spread of coronavirus in commercial areas, educational institutions, and offices.

The demand for bathroom and toilet tissues is increasing as people become more concerned about their personal hygiene. In addition, rising air pollution and dust difficulties have boosted housekeepers' use of kitchen tissue to efficiently clean utensils and other kitchenware items. The growing popularity of nuclear families around the world is driving up demand for cleaning supplies.

Various governments have done a number of initiatives to raise public awareness about the importance of maintaining basic hygiene. The pandemic of COVID-19 has raised public awareness about the significance of maintaining a minimal degree of sanitation in all places. The majority of diseases are caused by unsanitary conditions, which either cause them or aid in their transmission. As a result, government or non-government groups' campaigns have aided in raising awareness and, as a result, increased demand for medical disinfectant wipes.

Manufacturers have been forced to develop in biodegradable wipes as consumer awareness of the environmental impact of disposable disinfection wipes has grown. They are putting more effort into developing products that are manufactured from renewable and sustainable materials. Disinfectant wipes manufacturers are working to provide products that are suitable with static-sensitive surfaces and equipment. Robust biodegradable disinfection wipes are gaining popularity in the market for treating extremely contaminated regions that need the most effort.

The product's demand is likely to be limited due to the widespread availability of hygiene and cleaning items like towels, brushes, handkerchiefs, and other surface cleaners. Furthermore, growing concerns about deforestation, severe fire, rain, and temperature rise as a result of excessive tree cutting hinder enterprises' ability to obtain sufficient raw materials to make pulp and paper-based products, disrupting supply. Disinfectant sprays are cost-effective and have minimum impact on humans and environment, which is compelling medical authorities to opt for them instead of disinfectant wipes.

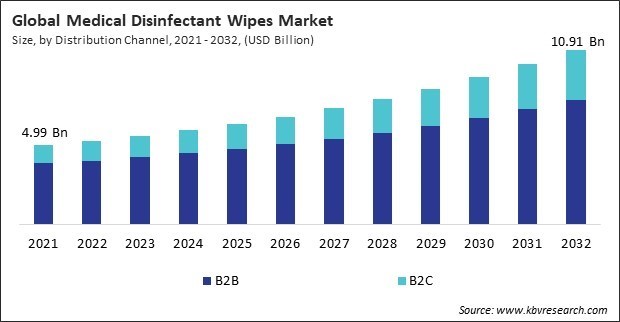

Based on Distribution Channel, the market is segmented into B2B and B2C (Pharmacies/Drug Stores, Hypermarkets/Supermarkets, Online, and Others). The B2C segment accounted for a significant revenue share in the medical disinfectant wipes market in 2020. Because of the expanding presence of large offline and online businesses, the B2C category is steadily growing. In the market for medical disinfection wipes, companies use a combination of offline and online distribution channels.

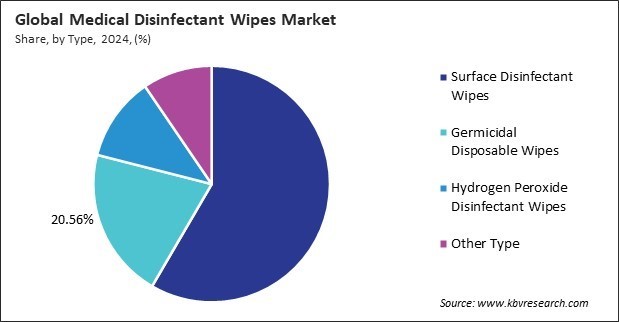

Based on Type, the market is segmented into Surface Disinfectant Wipes, Germicidal Disposable Wipes, Hydrogen Peroxide Disinfectant Wipes, and Others. The Surface Disinfectant Wipes segment acquired the highest revenue share in the medical disinfectant wipes market in 2020. This growth is attributed to the rising adoption due to the increasing availability of virucidal, bactericidal, and fungicidal surface disinfectant wipes. EarthSafe Chemical Alternatives, for example, introduced "EvaClean Disposable Surface Disinfection Wipes" in March 2021 to combat new infections like the COVID-19 virus.

Based on Application, the market is segmented into Hospitals & Clinics, Dental Clinic, Nursing Home, and Others. The hospital & Clinics segment recorded the maximum revenue share in the medical disinfectant wipes market in 2020. The growing number of hospitals and healthcare facilities around the world would boost demand for medical disinfection wipes. Clorox healthcare disinfection products are used in over 5,000 hospitals in the United States, according to The Clorox Company.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 4.3 Billion |

| Market size forecast in 2027 | USD 5.6 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 6.9% from 2021 to 2027 |

| Number of Pages | 255 |

| Number of Tables | 460 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Distribution Channel, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. Asia Pacific is anticipated to acquire a rapid growth rate in the medical disinfectant wipes market during the forecast period. In countries such as China and Japan, there has been a rise in the adoption of cleanliness methods to prevent the spread of illnesses contracted in hospitals. The need for medical disinfection wipes in Asia Pacific is predicted to increase as a result of this.

Free Valuable Insights: Global Medical Disinfectant Wipes Market size to reach USD 5.6 Billion by 2027

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Steris PLC, 3M Company, The Clorox Company, Metrex Research, LLC, Maxill, Inc., Sunshine Global LLC, Kimberly-Clark Corporation, PDI Healthcare, Inc., Reckitt Benckiser Group PLC, and Weiman Products, LLC.

By Distribution Channel

By Type

By Application

By Geography

The global medical disinfectant wipes market size is expected to reach $5.6 billion by 2027.

Increasing requirement for cleanliness & sanitation are driving the market in coming years, however, availability of other substitute products limited the growth of the market.

Steris PLC, 3M Company, The Clorox Company, Metrex Research, LLC, Maxill, Inc., Sunshine Global LLC, Kimberly-Clark Corporation, PDI Healthcare, Inc., Reckitt Benckiser Group PLC, and Weiman Products, LLC.

Yes, COVID-19 pandemic has boosted the demand for medical disinfectant wipes. Because of a major rise in product demand during pandemic several firms have been investing in the US medical disinfection wipes market.

The B2B segment acquired maximum revenue share in the Global Medical Disinfectant Wipes Market by Distribution Channel 2020, thereby, achieving a market value of $4.1 billion by 2027.

The North America is the fastest growing region in the Global Medical Disinfectant Wipes Market by Region 2020, and would continue to be a dominant market till 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.