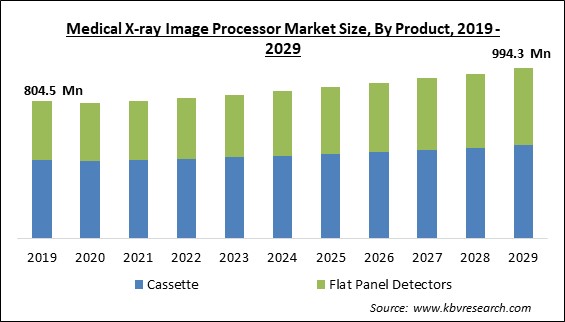

The Global Medical X-ray Image Processor Market size is expected to reach $994.3 Million by 2029, rising at a market growth of 2.8% CAGR during the forecast period.

The medical X-ray image processor is the most crucial component of X-ray image processing, which is utilized to interpret the data from attenuated X-ray beams when they travel through tissues. They transform the invisible image into something visible. A radiation-sensitive, photographically active substance manufactured in the form of an emulsion and put on a backing substance known as a base makes up the majority of an X-ray image.

The image is exposed to different chemical solutions for a planned amount of time in the processing. Five steps make up the majority of the processing of X-ray film: development, halting the development, fixing, washing, and drying. Two medical X-ray film processors, including a semi-automated image processor and a completely automatic image processor, are offered on the market, depending on the product type.

An effective tool called an X-ray film processor transfers medical X-ray films from one solution to another without the need for humans to manually insert film or cassettes. The market is anticipated to expand over the projected period due to increased technological developments in medical X-ray image processors, an increase in the number of chronic diseases needing imaging technologies, and expanding X-ray usage in a number of industries like dental and orthopedics.

Medical X-rays are commonly used in the treatment and diagnosis of chronic disorders. For example, medical X-ray imaging is used to assess the risk of fractures in individuals with osteoporosis and estimate their bone density. X-ray imaging may be employed to identify abnormalities in the joints brought on by arthritis, such as bone spurs and a narrowing of the joint space. X-ray imaging can be used to evaluate the level of lung damage in patients with chronic obstructive pulmonary disease (COPD).

COVID-19 had a negative impact on the economy globally and caused several difficulties for patients and clinical healthcare providers. Because of the stringent lockdowns that the governments of most countries applied, COVID-19 has also impacted different levels of the value chain. In addition, newer packaging guidelines and country-imposed lockdown procedures have also impacted the turnaround time for the delivery of goods and services. All of these elements have a detrimental effect on the medical X-ray image processor supply chain and manufacturing processes.

X-ray imaging tests are a crucial diagnostic tool for various medical procedures and assessments in the healthcare industry. They provide guidance to healthcare professionals during procedures such as catheter or stent placement, tumor treatment, and the removal of blood clots or other obstructions within the body. They also support noninvasive and painless illness diagnosis and therapy monitoring. The doctor uses X-ray diagnostics when other procedures like blood testing, ultrasonography, or endoscopy cannot make a clear diagnosis. The technique frequently allows for, validates, or can initially specify discoveries.

Oral cancer is amongst the most common cancer and comprises malignancies of the lip, other mouth regions, and the oropharynx. Globally, lip and oral cavity cancer will have 177,757 deaths and 377,713 new cases in 2020. Additionally, it varies considerably according to socioeconomic class. One of the main causes of oral cancer is the consumption of alcohol, areca nuts (betel quid), and tobacco. Because oral cancer and other oral illnesses are so prevalent, X-rays will be more frequently required to diagnose them, boosting demand for medical X-ray image processors and propelling the market growth.

Due to the demand for imaging procedures, hospitals that cannot afford to purchase new imaging systems opt for refurbished alternatives. Refurbished systems are frequently less expensive than brand-new ones. However, the growing demand for refurbished devices poses a significant obstacle for market participants, particularly small manufacturers. The high cost of these devices, which is forcing many end-users to opt for refurbished X-rays, and the fact that market players are forced to sell their products at lower prices to create their presence are expected to decrease the adoption of medical X-ray image processors and thus hamper the market growth.

Based on product, the medical X-ray image processor market is segmented into cassette and flat panel detectors. The flat panel detectors segment acquired a significant revenue share in the medical X-ray image processor market in 2022. This is due to the fact that more developed and emerging nations are increasingly embracing digital X-ray systems. The usage of digital X-ray equipment is also anticipated to increase in the near future because they are more effective, capable of viewing images quickly, and small. Since flat panel detectors are used in digital X-ray systems, the segment is expected to grow significantly in the projected period.

On the basis of application, the medical X-ray image processor market is divided into dental, mammography, orthopedic and others. The orthopedic segment held the highest revenue share in the medical X-ray image processor market in 2022. This is because many orthopedic practices use X-ray systems to diagnose and treat bone and joint disorders. X-rays can be used to diagnose fractures and identify whether a bone is shattered. This is crucial for identifying fractures and figuring out how severity. In addition, X-rays can identify various joint conditions, including rheumatoid arthritis, osteoarthritis, and gout.

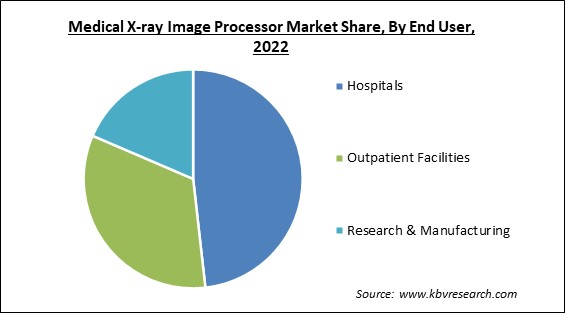

By end-user, the medical X-ray image processor market is classified into hospitals, outpatient facilities and research & manufacturing. The hospitals segment witnessed the largest revenue share in the medical X-ray image processor market in 2022. This is due to the growing hospital industry, an increase in the number of orthopedic surgeries performed, and an increase in the number of patients of all ages. Additionally, orthopedic surgery cases are increasing globally. The need for medical X-ray image processors is anticipated to increase as a result.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 822 Million |

| Market size forecast in 2029 | USD 994.3 Million |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 2.8% from 2023 to 2029 |

| Number of Pages | 194 |

| Number of Table | 350 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Product, Application, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the medical X-ray image processor market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region led the medical X-ray image processor market by generating the maximum revenue share in 2022. This is due to the growing number of surgical procedures and the presence of significant market participants in the region. In addition, this region's market is expanding as a result of the high rate of novel technology adoption and the presence of a strong healthcare infrastructure. Such events will aid the region in propelling the medical X-ray image processor market growth.

Free Valuable Insights: Global Medical X-ray Image Processor Market size to reach USD 994.3 Million by 2029

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Baker Hughes Company, Konica Minolta, Inc., Agfa-Gevaert Group, Fujifilm Holdings Corporation, Carestream Health, Inc. (Onex Corporation), Zimed Healthcare, Inc., Euroteck Systems UK Ltd, Hexagon International (GB) Ltd, AFP Manufacturing Corporation and PROTEC GmbH & Co. KG.

By End User

By Product

By Application

By Geography

The Market size is projected to reach USD 994.3 Million by 2029.

Advantages associated with X-ray are driving the Market in coming years, however, High-priced X-ray devices forcing end-users to opt for refurbished equipment restraints the growth of the Market.

Baker Hughes Company, Konica Minolta, Inc., Agfa-Gevaert Group, Fujifilm Holdings Corporation, Carestream Health, Inc. (Onex Corporation), Zimed Healthcare, Inc., Euroteck Systems UK Ltd, Hexagon International (GB) Ltd, AFP Manufacturing Corporation and PROTEC GmbH & Co. KG.

The expected CAGR of this Market is 2.8% from 2023 to 2029.

The Cassette segment acquired maximum revenue share in the Global Medical X-ray Image Processor Market by Product in 2022 thereby, achieving a market value of $545.6 Million by 2029.

The North America market dominated the Market by Region in 2022, and would continue to be a dominant market till 2029; thereby, achieving a market value of $320.2 Million by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.