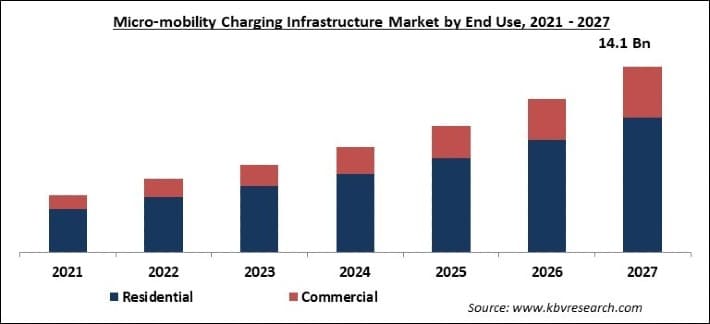

The Global Micro-mobility Charging Infrastructure Market size is expected to reach $14.1 billion by 2027, rising at a market growth of 21.7% CAGR during the forecast period. Micro-mobility is emerging as an efficient alternative to public transportation as cities around the world focus on solving their transportation crisis despite growing concerns about gas-powered emissions.

The rising adoption of e-scooters and e-bikes to reduce environmental impact and improve the mode of transportation is expected to drive market growth over the forecast years. Many firms have raised venture capital around the world, providing potential for this market to flourish further.

The market is expected to rise due to the rapidly increasing demand for mobility solutions over the forecast period. These days, riders have a plethora of handy and cost-effective travel options. Consumer tastes have evolved swiftly away from automobile ownership and toward more convenient and alternative modes of transportation as a result of micro-mobility. Micro-mobility charging infrastructure vendors are concentrating their efforts on monetizing this micro-mobility landscape.

The COVID-19 epidemic is predicted to have a detrimental impact on the market growth. As businesses closed and people stayed at home more because of the Covid-19 outbreak, demand for public transportation declined. Due to this, the companies' profits have suffered to a large extent. Lack of a solid policy framework, as well as a low amount of public awareness, is expected to hinder market expansion throughout the forecast period.

Millions of individuals have been impacted by the COVID-19 pandemic, which has bankrupted businesses and thrown the global economy into chaos. While lockdowns and stay-at-home orders have helped restrict the coronavirus, they have also put a strain on the economy. The micro-mobility industry which encompasses a range of lightweight vehicles such as bicycles, e-scooters, and mopeds is facing devastating declines in ridership and revenue as a result of a new reality of working from home, canceling trips, and even outings to restaurants and grocery stores.

Based on Charger Type, the market is segmented into Wired and Wireless. The wired segment procured the maximum revenue share of the micro-mobility charging infrastructure in 2020. Companies are concentrating on installing wired charging stations since they are more convenient. Due to the rising demand for e-scooters and e-bikes, they are concentrating on expanding the deployment of wired charging stations. The expansion of the wired charger segment is projected to be aided by these factors.

Based on Power Source, the market is segmented into Battery Powered and Solar Powered. The solar-powered segment would be the fastest growing segment over the forecast period. The increase can be ascribed to a growing awareness of the socially responsible and environmentally friendly alternative for short travels. In comparison to battery-powered stations, these solar-powered micro-mobility charging stations require less maintenance. The aspects would contribute to segment growth over the forecast period.

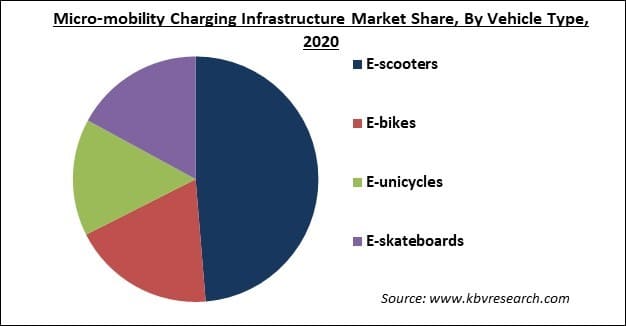

Based on Vehicle Type, the market is segmented into E-scooters, E-bikes, E-unicycles and E-skateboards. The e-bikes segment is expected to increase significantly over the forecast period. Higher deployment of e-bike charging stations in tourist and public places is likely to drive the segment growth over the forecast period. Multiple e-bikes can be charged at the same time at these charging points. These charging stations may also be easily and rapidly placed on a wall or free-standing.

Based on End User, the market is segmented into Residential and Commercial. The commercial segment is expected to grow significantly over the forecast period. The micro-mobility method of transportation has a wide range of business applications. This method of transportation finds massive applications in transporting heavy loads over short distances. It is thought to be more cost-effective than conventional systems. These factors are expected to boost the segment’s expansion in the coming years.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 3.3 Billion |

| Market size forecast in 2027 | USD 14.1 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 21.7% from 2021 to 2027 |

| Number of Pages | 229 |

| Number of Tables | 420 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Charger Type, Power Source, Vehicle Type, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Norway, Netherlands, China, Japan, India, South Korea, Singapore, Taiwan, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. North America would exhibit the fastest growth rate over the forecast period. Aspect like a growing awareness of environmental issues is responsible for the massive growth rate of the region. Moreover, the region's natural features and urban development encourage the usage of Micro-mobility charging infrastructure. Moreover, the presence of a significant number of well-known companies in the region is likely to boost the regional market growth.

Free Valuable Insights: Global Micro-mobility Charging Infrastructure Market size to reach USD 14.1 Billion by 2027

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Robert Bosch GmbH, Bike-energy, Bikeep, Swiftmile, Inc., Get Charged, Inc. (Charge Enterprises, Inc.), Flower Turbines, Inc., Giulio Barbieri Srl, Ground Control Systems, Magment GmbH, and The Mobility House GmbH

By Charger Type

By Power Source

By Vehicle Type

By End User

By Geography

The micro-mobility charging infrastructure market size is projected to reach USD 14.1 billion by 2027.

Shift in consumer preferences and usage patterns are driving the market in coming years, however, Regulations on safety have limited the growth of the market.

Robert Bosch GmbH, Bike-energy, Bikeep, Swiftmile, Inc., Get Charged, Inc. (Charge Enterprises, Inc.), Flower Turbines, Inc., Giulio Barbieri Srl, Ground Control Systems, Magment GmbH, and The Mobility House GmbH

In 2020, Asia Pacific emerged as the leading region in the Micro-mobility charging infrastructure market, accounting for the maximum share of global revenue.

In 2020, the e-scooters segment dominated the market, accounting for a larger percentage of global revenue. E-scooters have become increasingly popular among riders since they are easy to park and recharge.

The wireless segment would be the fastest growing segment rate over the forecast period.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.