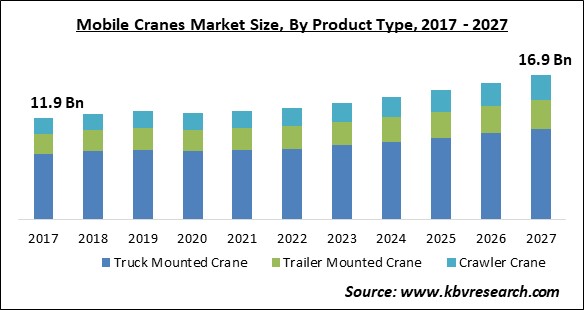

The Global Mobile Cranes Market size is expected to reach $16.9 billion by 2027, rising at a market growth of 4.8% CAGR during the forecast period.

Mobile cranes are large pieces of equipment that help lift heavy items around a construction site. For simple transportation of the machinery through both rough and smooth terrains, they are either tire-mounted or crawler-mounted. In addition, mobile cranes also feature self-erection capabilities, making them ideal for use in congested metropolitan areas and building sites.

These pieces of equipment are essential for construction projects since they aid in the movement of components and materials both within the construction site and between offsite facilities. The demand for these equipment is expected to be driven by continued urbanisation and consequent measures aimed at constructing new and upgrading current infrastructure.

Constant technological advancements, as well as a strong focus on automation and machine safety is supporting the growth of the market. The majority of the advancements are focused on creating personalized solutions for these machines.

Modern equipment now includes novel features such as GPS tracking and fleet management, as well as telematics solutions, which is the result of the integration of cutting-edge technologies. For example, Terex Corporation’s products are delivered with the IC-1 Plus control system that assists operators in determining the lifting capability for each position of the boom. Due to this incorporation of modern systems such as telematics in the mobile cranes, the demand and growth of the market would witness a spike in the coming years.

The outbreak of the COVID-19 pandemic has significantly impacted almost all the domains of the business verticals. The imposition of various regulations to curb the spread of the virus like partial or complete lockdown, travel band and temporary ban on imports & exports have negatively impacted various market segments.

The COVID-19 pandemic had just a little impact on the market for mobile cranes. Due to government lockdown orders, several construction and infrastructure sites around the world, which are key commercial locations for cranes, have been shut down. However, because mining activities were designated important and continued to operate throughout the lockdown in some areas, the commercial possibility for mobile cranes was preserved.

There is an increasing demand for renewable energy sources due to the rising focus on sustainable development. For generating wind, solar and thermal energy, several machines are being utilized, and mobile crane is one of them. Few machines can match the efficiency and safety of mobile cranes when it comes to installing wind turbines for wind farms. A mobile crane is appropriate for such project site, whether farmers are carrying rail siding or other key components.

Since mobile cranes can be utilised for a number of tasks, a user won't need to hire a different crane for each task. Because of the adaptability of mobile cranes, companies may save money by using one crane for all components of the project. This not only helps in keeping everything under budget, but it also saves more time because companies won't have to wait for each piece of equipment to arrive before it can get started. Larger cranes may also require specialised permits to operate, resulting in increased costs for any project.

The majority of injuries, fatalities, and accidents on the job site are due to a lack of crane operator training. Because these cranes may come into touch with electric lines by mistake, it is critical to obtain clearances from the electrical lines as well as verifiable sources such as government electrical safety directives. Due to a lack of understanding of load indicating devices, technological developments are hampered, resulting in an increase in accidents caused by falling loads.

On the basis of product type, the mobile crane market is segmented into Truck Mounted Crane, Trailer Mounted Crane and Crawler Crane. The crawler crane segment is anticipated to register a promising growth rate over the forecast period. Crawler cranes are small and easy to use, making them ideal for small building sites, particularly in urban settings. Crawler cranes are the most powerful cranes for usage in large-scale building projects involving big industrial items.

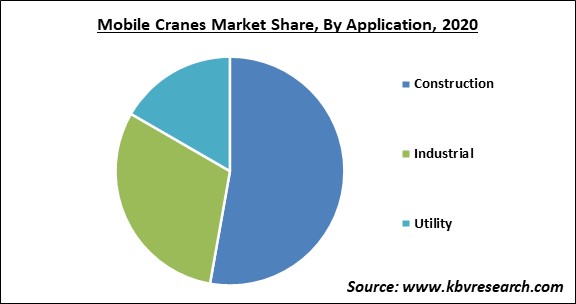

Based on application, the mobile cranes market is divided into Construction, Industrial and Utility. In 2020, the construction segment procured the maximum revenue share in the mobile cranes market and is expected to maintain this dominance during the forecast period. It is due to ongoing residential and commercial infrastructure projects around the world. Once placed, tower cranes cannot be moved until the project is finished. As a result, builders who work on a variety of projects often favour mobile cranes since they are portable.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 12.5 Billion |

| Market size forecast in 2027 | USD 16.9 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 4.8% from 2021 to 2027 |

| Number of Pages | 151 |

| Number of Tables | 260 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Product Type, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the mobile cranes market is classified into North America, Europe, Asia Pacific and LAMEA. In 2020, Asia Pacific emerged as the leading region in the mobile cranes market with the highest revenue share and is anticipated to continue this trend over the forecast period. The rising building activity in emerging nations like China, India, and the Philippines along with various projects like the Bharatmala Yojana infrastructure development project of the Indian government, which aims to strengthen the country's road network would also fuel the regional market growth.

Free Valuable Insights: Global Mobile Cranes Market size to reach USD 16.9 Billion by 2027

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include BAUER AG, The Manitowoc Company, Inc., Kobelco Construction Machinery Co., Ltd. (Kobe Steel, Ltd.), Liebherr-International AG, Manitex International, Inc., Palfinger AG, Sarens N.V. /S.A., Terex Corporation, Zoomlion Heavy Industry Science & Technology Co., Ltd., and Xuzhou Construction Machinery Group Co., Ltd.

By Product Type

By Application

By Geography

The mobile cranes market size is projected to reach USD 16.9 billion by 2027.

Rising demand for renewable energy resources are driving the market in coming years, however, lack of properly trained workers limited the growth of the market.

BAUER AG, The Manitowoc Company, Inc., Kobelco Construction Machinery Co., Ltd. (Kobe Steel, Ltd.), Liebherr-International AG, Manitex International, Inc., Palfinger AG, Sarens N.V. /S.A., Terex Corporation, Zoomlion Heavy Industry Science & Technology Co., Ltd., and Xuzhou Construction Machinery Group Co., Ltd.

The Truck Mounted Crane is leading the Global Mobile Cranes Market by Product Type 2020, and would continue to be a dominant market till 2027.

The Asia Pacific market dominated the Global Mobile Cranes Market by Region 2020, and would continue to be a dominant market till 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.