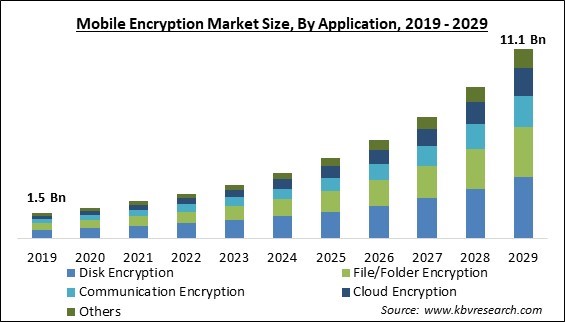

The Global Mobile Encryption Market size is expected to reach $11.1 billion by 2029, rising at a market growth of 23.3% CAGR during the forecast period.

Retail sector is adopting Mobile Encryption solutions due to its mobile payment systems and e-commerce platforms. Consequently, Retail sector is expected to generate approximately 1/5th share of the market by 2029. End-to-end encryption of data on mobile devices is made possible by mobile encryption solutions, making it more difficult for unauthorized users to access critical data. Credit card data and customer information fall under this category in the retail sector. Retailers may safeguard the privacy and integrity of their customers' data by deploying mobile encryption solutions.

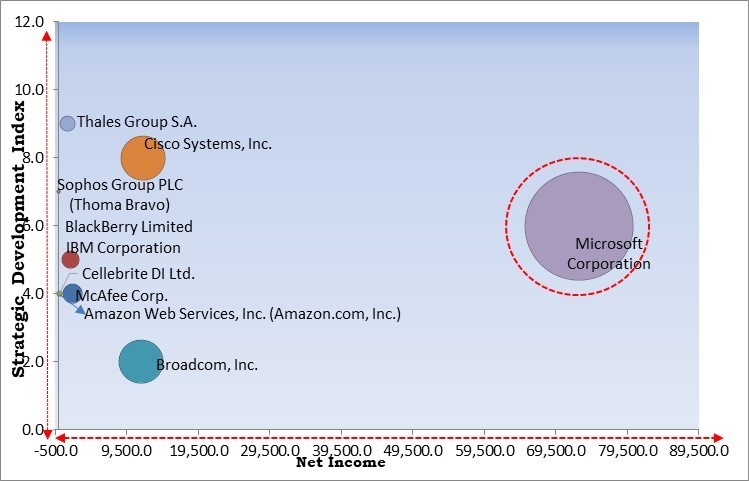

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In November, 2022, IBM came into partnership with Vodafone to protect data through more sophisticated, quantum-safe cybersecurity measures. Additionally, In April, 2021, McAfee extended its partnership with Samsung to provide enhanced security solutions for Samsung’s new smartphones, consisting of the Galaxy S23 series and Galaxy Book3 series. The partnership makes sure that Samsung customers have access to McAfee’s antivirus protection with pre-installed software devices.

Based on the Analysis presented in the KBV Cardinal matrix; Microsoft Corporation are the forerunners in the Market. In December, 2020, Microsoft extended its partnership with Deutsche Telekom Group to integrate the strength of Deutsche Telekom’s network and Microsoft’s cloud to deliver customers with more opportunities to be more resilient, boost innovation, and eventually drive success. Companies such as Thales Group S.A., Cisco Systems, Inc. and Broadcom, Inc. are some of the key innovators in Market.

Mobile encryption protects consumer data by rendering it unreadable to outsiders, ensuring it remains private and safe. It is more difficult to retrieve encrypted data in the current environment. The data may be retrieved even after the user wipes the phone clean to sell it. Once data has been encrypted, there is only one way to unencrypt it: factory reset the phone. More data needs to be protected against cyber risks due to the expansion of digital payments, improved applications, and information interchange via mobile. As a result, data can be secured from these crimes by using mobile encryption software, fueling the market's expansion.

The rise in the use of smartphones as a payment method has significantly boosted the number of digital payments. Organizations are working to integrate blockchain with mobile payment to enhance the current payment technology. The efficiency of blockchain, which sets a standard for secure and encrypted transactions, is its key characteristic. Blockchain technology provides a very safe environment for transactional activities. There are new options for the customer and the business when using blockchain for payment processing. Nobody can break into the system and change the data because of the cryptographic hash function. Blockchain protects the network in this manner from both internal and external assaults. As a result, businesses anticipate seeing the integration of mobile encryption and blockchain open up new market prospects.

The demand for key management and verification solutions for encrypting keys is one of the main barriers to the growth of the market. Sensitive data, folders, files, and emails are protected using encryption methods. Solutions for encryption key management shield cryptographic keys from theft. These password-like cryptographic keys are a combination of numbers and letters. Hackers can access the present and past text if encryption keys are compromised. As a result, the market may not expand as quickly as it could if encryption keys are constantly being created, provided, and managed.

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

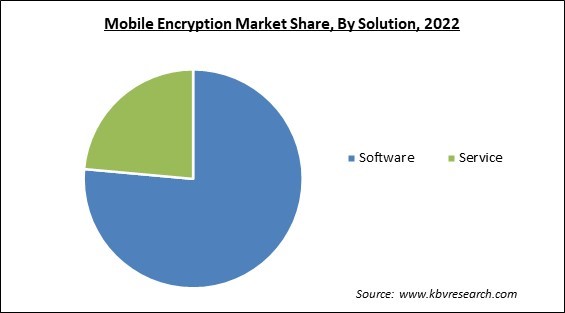

Based on solution, the market is segmented into software, and services. In 2022, the services segment garnered a significant revenue share in the market. The management and security of mobile devices utilized for work-related tasks are handled completely by mobile encryption services. These services are created to give businesses the ability to boost output, improve security, and guarantee compliance while giving workers the freedom and comfort to use their mobile devices for work.

On the basis of deployment, the market is fragmented into cloud, and on-premise. In 2022, the cloud segment generated the largest revenue share in the market. One of its primary advantages is that cloud-based mobile encryption software solutions offer a high level of security for data saved on mobile devices. This is especially crucial for companies and organizations that manage sensitive information like customer information, financial data, and intellectual property.

By application, the market is bifurcated into disk encryption, file/folder encryption, communication encryption, cloud encryption and others. In 2022, the disk encryption segment dominated the market with the maximum revenue share. Because of the advantages it provides, disk encryption is being employed more and more. One of the main advantages of disk encryption systems is that mobile devices can store sensitive data with a high level of security. Mobile disk encryption programs can protect this data from theft and unwanted access by encrypting it.

Based on enterprise size, the market is classified into small & medium-sized enterprises, and large enterprises. In 2022, the SMEs segment garnered a significant revenue share in the market. SMEs are utilizing mobile encryption solutions more frequently to safeguard sensitive data on the devices used by their staff. SMEs are more susceptible to cyberattacks than larger companies since they sometimes have fewer resources and might not have an equal level of cybersecurity experience. Mobile encryption tools can add another degree of security and assist SMEs in safeguarding their data from unlawful access.

On the basis of vertical, the market is categorized into BFSI, IT & telecom, retail, healthcare, education, transportation & logistics, manufacturing, government, and others. In 2022, the IT & Telecom segment held the highest revenue share in the market. One of the major contributors to in the market is the IT & telecom sector. These solutions are used by the IT and telecom industries to safeguard consumer data, including personal data, credit card information, and transaction data. Furthermore, these solutions aid in safeguarding confidential business data such as trade secrets and intellectual property.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 2.6 Billion |

| Market size forecast in 2029 | USD 11.1 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 23.3% from 2023 to 2029 |

| Number of Pages | 351 |

| Number of Table | 583 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Solution, Deployment, Enterprise Size, Application, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the market is analysed across North America, Europe, Asia Pacific and LAMEA. In 2022, the North America region led the market by generating the largest revenue share. The need for these solutions in North America has grown due to the rising use of mobile devices for work and the rising worries regarding data privacy and security. In addition, the region is home to a number of sectors that deal with sensitive data, including the government, healthcare, and financial services, all of which were early adopters of mobile encryption technologies.

Free Valuable Insights: Global Mobile Encryption Market size to reach USD 11.1 Billion by 2029

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include BlackBerry Limited, Broadcom, Inc., McAfee Corp., IBM Corporation, Thales Group S.A., Cisco Systems, Inc., Microsoft Corporation, Sophos Group PLC (Thoma Bravo), Cellebrite DI Ltd., and Amazon Web Services, Inc. (Amazon.com, Inc.)

By Application

By Solution

By Deployment

By Enterprise Size

By Vertical

By Geography

The Market size is projected to reach USD 11.1 billion by 2029.

Incorporation of blockchain in encrypted payments are driving the Market in coming years, however, Requirement of verification solutions & key management for encryption keys restraints the growth of the Market.

BlackBerry Limited, Broadcom, Inc., McAfee Corp., IBM Corporation, Thales Group S.A., Cisco Systems, Inc., Microsoft Corporation, Sophos Group PLC (Thoma Bravo), Cellebrite DI Ltd., and Amazon Web Services, Inc. (Amazon.com, Inc.)

The Software segment acquired maximum revenue share in the Market by Solution in 2022 thereby, achieving a market value of $8.1 billion by 2029.

The Large Enterprises segment is leading the Market by Enterprise Size in 2022 thereby, achieving a market value of $7.2 billion by 2029.

The North America market dominated the Market by Region in 2022 and would continue to be a dominant market till 2029; thereby, achieving a market value of $4 billion by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.