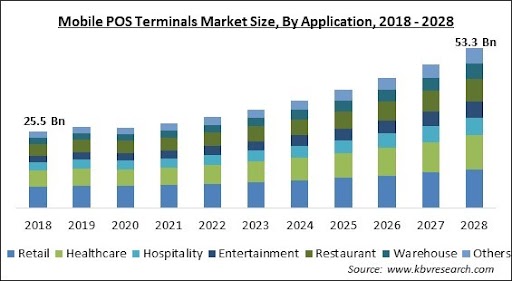

The Global Mobile POS Terminals Market size is expected to reach $53.3 billion by 2028, rising at a market growth of 9.8% CAGR during the forecast period.

Mobile point-of-sale (mPOS) is a portable system that can be installed on a tablet or smartphone to allow the payment process. Mobile POS system aids the merchants to serve their customers at any place, as this system is operable by only installing it on their mobile devices like smartphones or tablets. Mobile POS has rapidly evolved as a primary tool that allows merchants to accept cards payment irrespective of their size.

One can use the mPOS system to allow customers to pay on the go or remotely. They make it possible for the shopper outside the immediate geographic location, for instance, a storefront, to securely and rapidly complete their payments. A mobile POS system is ideal for a more flexible and convenient payment experience for customers.

A mobile POS sale system can accept the following types of frictionless payments like contactless credit cards, QR code payments, debit and credit cards with EMV chips or magnetic stripes, digital wallets, and from technologies like click-to-play that user near field communication (NFC). To operate the mobile POS system, one needs a stable internet connection, an app downloaded from their wireless device to process and accept transactions, and a card reader.

Depending on the mPOS system the user is investing in, some may even have an offline mode to accept payments even if the internet connection stops. Once the step is completed, the user can download a point-of-sale app and connect the reader to their mobile device, after which the device is ready to process and accept mobile payments. A can also connect their mPOS system with other POS hardware like a cash drawer or barcode scanner for extra convenience.

COVID-19 positively impacted the mobile POS terminals market. Digitization in the retail and hospitality sector has increased due to the rising emphasis on social distancing to avoid COVID-19. Many financial service providers have increased the limit of contactless payment, allowing simpler and more smooth cashless transactions. Due to this, mobile POS terminals attained popularity as they give a faster and more seamless payment option. The growth of the mobile POS terminals systems during the pandemic enabled the interaction of customer relationship management (CRM) and other financial solutions for organizations.

mPOS vendors must provide customized solutions for mPOS that suit the needs of specific industry verticals. Some of the significant VAS (value-added service) contain gift cards & vouchers, reward and loyalty programs, cash-back promotions, and mobile discounts. The usage of mPOS is expected to increase to encourage pre- and post-shopping activities through reward schemes. Moreover, services like the ordering cycle, the customer's buying pattern, and analytics that give recommendations to the merchants are related to the optimal inventory. Such innovative features of the mPOS are likely to increase the adoption and drive the growth of the mobile POS terminals market in the projected period.

Mobile POS systems accept digital payments through near-field communication (NFC), a contactless communication between devices that allows a user to wave the device over another NFC-compatible device to initiate a contactless payment. Contactless NFC mobile payments save both customers and the business during the time of transaction and maintain the privacy of the transaction while also ensuring the customer and the mPOS user remain socially distanced during the whole process. The benefits associated with digital payments and the rise in their popularity, especially after the pandemic, is expected to surge the mobile POS terminals market’s growth.

Cyber attackers use mobile point-of-sale apps to steal sensitive and personal information, such as information on the credit or debit card, which results in damaged credit standings for unsuspecting customers and financial losses. Customers are more likely to buy from retailers that they believe will protect their information. Compromised retailers suffer consequences from point-of-sale hacks, as their customers may choose other retailers. Also, they have might have to go through the burden of a potential lawsuit, which could hamper the business's image and profits. The lack of security in the mobile POS terminals market is expected to hamper the market growth in the projected period.

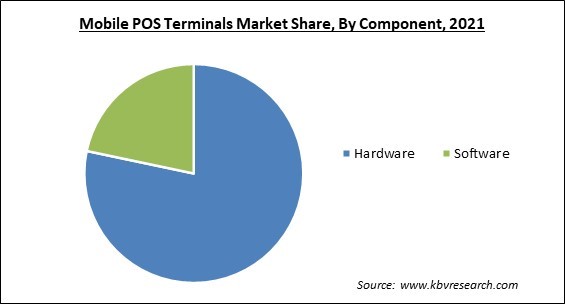

Based on component, the mobile POS terminals market is segmented into hardware and software. The hardware segment dominated the mobile POS terminals market with maximum revenue share in 2021. This is due to the increasing need for a portable payment device which reduces the overall time for checkout. Markey players are introducing devices that are handheld terminals, mobile computers, and tablets. Also, these devices operate without any restrictions, with functions supported by contactless card readers and applications. The assistance in decreasing the time for checkout joined with other features, will propel the segment’s growth.

On the basis of type, the mobile POS terminals market is divided into tablets and handheld terminals, smartphone & others. The tablets segment procured a significant revenue share in the mobile POS terminals market in 2021. This is because of the enhanced system integration tablet POS to attain numerous opportunities. These include customer relationship management and accounting analysis sales. Also, tablets provide transparency and flexibility to the POS system. The benefits provided by the tablets are expected to boost the growth of the segment in the projected period.

Based on the application, the mobile POS terminals market is classified into restaurant, hospitality, healthcare, retail, warehouse, entertainment and others. The retail segment held the highest revenue share in the mobile POS terminals market in 2021. This is because of the increasing penetration of digital payment in both e-commerce and brick & mortar. Mobile payment wallets have further increased the requirement for mPOS terminals in the retail sector. Also, retailers benefit by engaging customers in an omnichannel shopping experience where mPOS keeps the sales associates more informed for live assistance. The increasing penetration of the digital payment system and mobile payment wallets will increase the segment’s growth.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 28.2 Billion |

| Market size forecast in 2028 | USD 53.3 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 9.8% from 2022 to 2028 |

| Number of Pages | 228 |

| Number of Table | 370 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Application, Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the mobile POS terminals market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region led the mobile POS terminals market by generating the maximum revenue share in 2021. The growth is attributed to a large number of restaurants and retail businesses in the region that are accepting digital payment and are shifting towards the mPOS terminals. Many large retailers are also gradually adopting mPOS in addition to their existing fixed POS terminals. In addition, SMBs are likely to choose only mPOS in their stores for transactions. These factors are expected to surge the market growth of Mobile POS terminals in the region.

Free Valuable Insights: Global Mobile POS Terminals Market size to reach USD 53.3 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Fiserv, Inc., Oracle Corporation, Panasonic Holdings Corporation, Samsung Electronics Co., Ltd., Hewlett Packard Enterprise Company (HP Development Company L.P.), NEC Corporation, VeriFone Holdings, Inc. (Francisco Partners), Zebra Technologies Corporation, and PAX Global Technology Limited.

By Component

By Type

By Application

By Geography

The global Mobile POS Terminals Market size is expected to reach $53.3 billion by 2028.

The added value to the business by MPOS are driving the market in coming years, however, Security related issues with MPOS restraints the growth of the market.

Fiserv, Inc., Oracle Corporation, Panasonic Holdings Corporation, Samsung Electronics Co., Ltd., Hewlett Packard Enterprise Company (HP Development Company L.P.), NEC Corporation, VeriFone Holdings, Inc. (Francisco Partners), Zebra Technologies Corporation, and PAX Global Technology Limited.

The expected CAGR of the Mobile POS Terminals Market is 9.8% from 2022 to 2028.

The Handheld Terminals, Smartphone & Others segment acquired maximum revenue share in the Global Mobile POS Terminals Market by Type in 2021 thereby, achieving a market value of $38.6 billion by 2028.

The North America market dominated the Global Mobile POS Terminals Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $18.6 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.