“Global Mobile Virtual Network Operator (MVNO) Market to reach a market value of USD 132.99 Billion by 2031 growing at a CAGR of 7.4%”

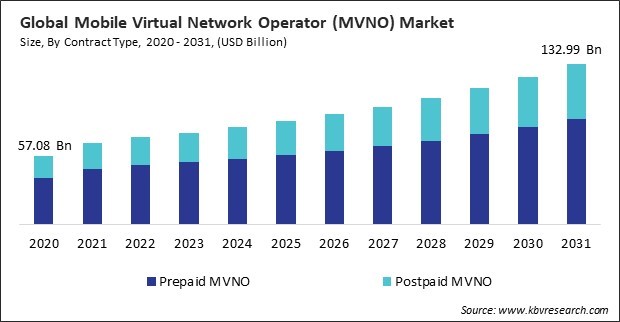

The Global Mobile Virtual Network Operator (MVNO) Market size is expected to reach $132.99 billion by 2031, rising at a market growth of 7.4% CAGR during the forecast period.

Media-focused MVNOs offer bundled services integrating mobile connectivity with streaming platforms, content subscriptions, and exclusive digital experiences. These operators target customers who seek entertainment-driven mobile plans, often including access to music, video, and gaming services. Therefore, the media segment attained 7% revenue share in the market in 2023. The growing consumption of digital content and the rise of streaming platforms have fuelled demand for media-centric MVNO services, making this segment a key player in the market.

The increasing mobile data usage has led to a shift in consumer preferences toward flexible, contract-free plans. Users prefer to pay-as-you-go, data rollover, or unlimited data options, which MVNOs often provide greater flexibility than traditional carriers. This trend is particularly strong among younger consumers, digital nomads, and businesses that require scalable mobile solutions for their workforce. Furthermore, 5G technology enhances the Internet of Things (IoT) ecosystem, which presents another opportunity for MVNOs. Smart cities, connected vehicles, and industrial automation rely on robust mobile networks to function efficiently. As 5G adoption increases, MVNOs can capitalize on IoT-driven connectivity demand by offering cost-effective and scalable solutions to businesses and governments. In conclusion, the expansion of 5G technology is propelling the market's growth.

However, the terms of wholesale agreements with MNOs can be restrictive, limiting MVNOs’ ability to offer aggressive pricing or customized services. If network access costs remain high, MVNOs may face challenges in maintaining profitability while competing with major carriers. These constraints create barriers to expansion and market penetration, particularly for new entrants. In conclusion, limited access to network infrastructure and dependence on host MNOs hinder the market's growth.

Based on type, the market is characterized by business, discount, M2M, media, migrant, retail, roaming, and telecom. The discount segment garnered 22% revenue share in the market in 2023. This segment primarily caters to cost-conscious consumers by offering affordable mobile plans with competitive pricing. Discount MVNOs attract a large customer base by leveraging wholesale network access agreements with major telecom providers, allowing them to offer lower-priced services without the overhead costs of maintaining physical infrastructure. The rising demand for budget-friendly mobile plans and increasing competition among telecom providers have driven growth in this segment.

On the basis of operational model, the market is classified into full MVNO, reseller MVNO, and service operator MVNO. The reseller MVNO segment recorded 29% revenue share in the market in 2023. Reseller MVNOs purchase wholesale network services from MNOs and resell them under their brand without managing network infrastructure. This low-cost entry model enables rapid market expansion and scalability, attracting businesses seeking to offer mobile services with minimal operational investment. The segment’s growth is driven by increasing partnerships between telecom providers and retailers, media companies, and enterprises looking to add mobile services to their existing offerings. The demand for cost-effective and value-added mobile plans has contributed to the continued success of reseller MVNOs.

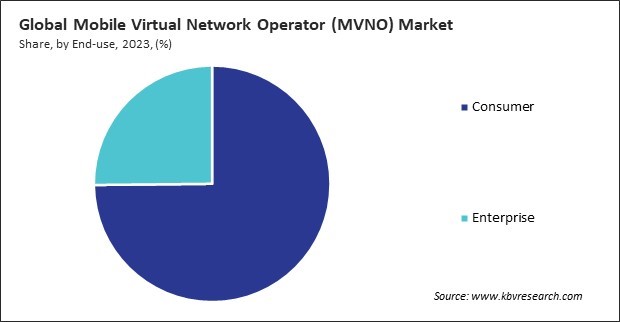

By end-use, the market is bifurcated into consumer and enterprise. The enterprise segment acquired 25% revenue share in the market in 2023. Businesses increasingly leverage MVNO solutions to provide seamless employee connectivity, optimize operational efficiency, and support emerging technologies such as IoT and cloud-based applications. Enterprise MVNOs offer tailored communication solutions, including secure data networks, workforce mobility services, and cost-effective international roaming plans. As organizations continue to embrace remote work and digital transformation, the demand for enterprise-focused MVNO services is expected to grow.

By service type, the market is divided into 4G MVNO, 5G MVNO, and others. The 5G MVNO segment garnered 24% revenue share in the market in 2023. The increasing deployment of 5G networks and the rising demand for high-speed, low-latency connectivity have fuelled the growth of this segment. 5G MVNOs leverage next-generation network capabilities to provide enhanced mobile experiences, including ultra-fast data speeds, improved streaming quality, and advanced IoT applications. As more telecom operators expand their 5G infrastructure, MVNOs are expected to capitalize on the technology by offering innovative services tailored to healthcare, smart cities, and industrial automation.

Based on contract type, the market is segmented into prepaid MVNO and postpaid MVNO. The prepaid MVNO segment procured 68% revenue share in the market in 2023. Prepaid plans' affordability, flexibility, and lack of long-term commitments have made them a preferred choice for consumers, especially in price-sensitive markets. Prepaid MVNOs cater to a diverse customer base, including budget-conscious individuals, students, migrant workers, and travellers, by offering cost-effective plans with customizable data and calling options. The growing penetration of digital payment solutions and online recharges has further boosted the demand for prepaid MVNO services.

Free Valuable Insights: Global Mobile Virtual Network Operator (MVNO) Market size to reach USD 132.99 Billion by 2031

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe segment witnessed 43% revenue share in the market in 2023. The region’s well-regulated telecom industry, growing adoption of MVNO services among cost-conscious consumers, and multiple MVNO players have driven market expansion. Countries like Germany, the UK, and France have seen significant growth in MVNOs catering to niche markets, including migrant communities, digital nomads, and enterprise solutions. The increasing focus on eSIM technology, roaming services, and competitive pricing strategies has further strengthened the MVNO landscape in Europe.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 76.42 Billion |

| Market size forecast in 2031 | USD 132.99 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 7.4% from 2024 to 2031 |

| Number of Pages | 345 |

| Number of Tables | 558 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Contract Type, End-use, Service Type, Operational Model, Type, Region |

| Country scope |

|

| Companies Included | Deutsche Telekom AG, Verizon Communications Inc., AT&T Inc., Boost Mobile, Consumer Cellular, Inc., Red Pocket, Lyca Mobile, FreenetAG |

By Contract Type

By End-use

By Service Type

By Operational Model

By Type

By Geography

This Market size is expected to reach $132.99 billion by 2031.

Rising Demand for Cost-effective Mobile Services are driving the Market in coming years, however, Limited Access to Network Infrastructure and Dependence on Host MNOs restraints the growth of the Market.

Deutsche Telekom AG, Verizon Communications Inc., AT&T Inc., Boost Mobile, Consumer Cellular, Inc., Red Pocket, Lyca Mobile, FreenetAG

The expected CAGR of this Market is 7.4% from 2023 to 2031.

The Full MVNO segment is leading the Market by Operational Model in 2023; thereby, achieving a market value of $75.77 billion by 2031.

The Europe market dominated the Market by Region in 2023; thereby, achieving a market value of $56.14 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges