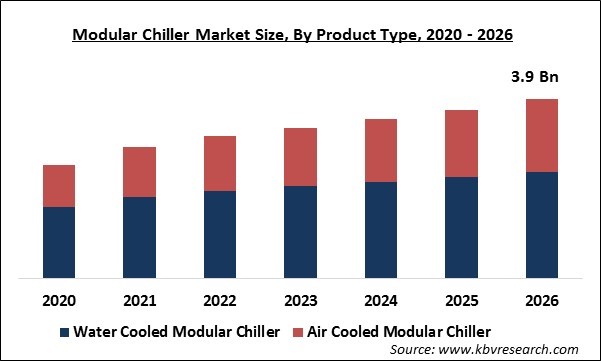

The Global Modular Chiller Market size is expected to reach $3.9 billion by 2026, rising at a market growth of 7.8% CAGR during the forecast period. Chillers play an essential role as a HVAC component across various commercial facilities such as hotels, hospitals, industrial, restaurants, sports arenas, & manufacturing units, etc. The chiller systems are the ones that consume maximum energy and various industries have accepted this fact.

In order to create a single large chiller, a modular chiller is integrated with other modules & it is considered as a packaged chiller. Every module has refrigerants, compressors & regulators; if one module unable to work, the rest modules can continue the operations. In order to expand the cooling capacity of a chiller system, these modules are joined in parallel from 6 units to 12 units. A modular chiller is considered as a solution for cooling, tight spaces, and retrofits and aids in keeping an ideal indoor temperature. Modular chillers offer various features such as expandability, high capacity controls, flexibility, serviceability, redundancy, and are energy-efficient.

The growth of the modular chiller market is anticipated to boost due to a high demand for compact, ventilation, small heating, and energy-efficient, air conditioning, and ventilation systems to regulate room temperature. Moreover, the growth of the modular chiller market is expected to stimulate due to high investments in construction activities by developing countries like India, China, Brazil, and others.

Based on Product Type, the market is segmented into Water Cooled Modular Chiller and Air Cooled Modular Chiller. In 2019, the water-cooled modular chiller was the leading segment as they are energy-efficient in comparison to air-cooled products. Water-cooled products have low wet-bulb temperatures as compared to dry-bulb temperature, causing a lower condensing pressure & temperature in water-cooled chillers in comparison to air-cooled. For the water-cooler chiller systems, there is a requirement for a high supply of water so that it can replace the evaporated volume of water.

Based on Application, the market is segmented into Commercial, Industrial and Residential. In 2019, the commercial sector acquired the highest revenue share of the global market. Commercial facilities such as courts, banks, and corporate offices have massive load variations and need cooling all-round the year. As these facilities cannot be closed, it is simple to install a modular chiller on the basis of cooling needs, assembled on the factory job floor.

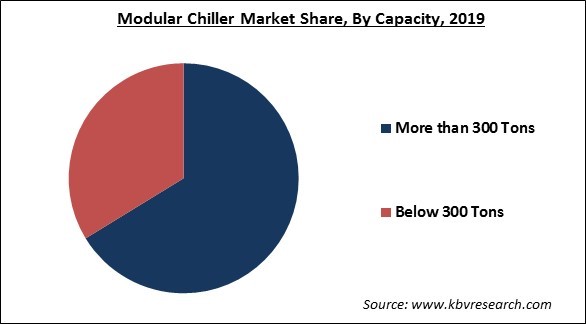

Based on Capacity, the market is segmented into More than 300 Tons and Below 300 Tons. In 2019, more than 300 Tons capacity segment dominated the modular chiller market. Modular chillers help in giving cooling throughout the anodizing process, in which a high quantity of heat is produced during the hard coating processes. Moreover, these cooling devices are also used in several machine tools processes like plasma cutting, milling, laser cutting, drilling, turning, and welding machines.

| Report Attribute | Details |

|---|---|

| Market size value in 2019 | USD 2.6 Billion |

| Market size forecast in 2026 | USD 3.9 Billion |

| Base Year | 2019 |

| Historical Period | 2016 to 2018 |

| Forecast Period | 2020 to 2026 |

| Revenue Growth Rate | CAGR of 7.8% from 2020 to 2026 |

| Number of Pages | 199 |

| Number of Tables | 332 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling, Competitive Landscape |

| Segments covered | Product Type, Application, Capacity, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Free Valuable Insights: Global Modular Chiller Market to reach a market size of $3.9 billion by 2026

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2019, the Asia-Pacific appeared as the dominating region in the global modular chiller market. This is credited to the increasing investments in commercial & residential construction activities across the region. Moreover, the regional market is expected to boost due to a high number of construction & residential activities across the region, along with increasing demand for HVAC and refrigeration.

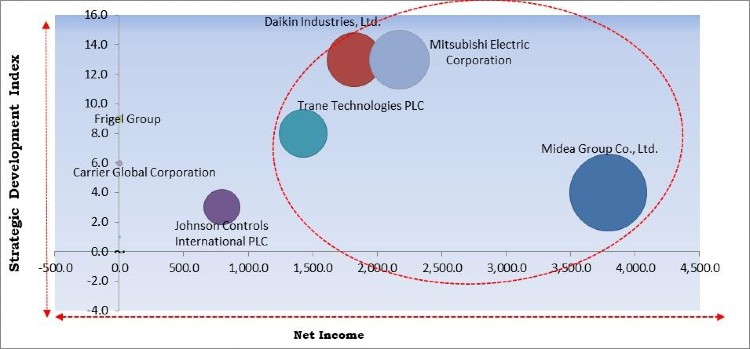

The major strategies followed by the market participants are Product Launches and Acquisitions. Based on the Analysis presented in the Cardinal matrix; Trane Technologies PLC, Mitsubishi Electric Corporation, Daikin Industries Ltd., and Midea Group Co., Ltd. are the forerunners in the Modular Chiller Market. Companies such as Frigel Group, Carrier Global Corporation, and Johnson Controls International PLC are some of the key innovators in the market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Johnson Controls International PLC, Trane Technologies PLC, Midea Group Co., Ltd., Daikin Industries, Ltd., Mitsubishi Electric Corporation, Haier Group Corporation, Carrier Global Corporation, Multistack International Limited, Gree Electric Appliances, Inc., and Frigel Group.

By Product Type

By Application

By Capacity

By Geography

The global modular chiller market size is expected to reach $3.9 billion by 2026.

The major factors that are anticipated to drive the modular chiller industry include demand for modular chillers is increasing due to home automation.

The air-cooled modular chillers segment would display a promising growth rate during the forecast period.

Johnson Controls International PLC, Trane Technologies PLC, Midea Group Co., Ltd., Daikin Industries, Ltd., Mitsubishi Electric Corporation, Haier Group Corporation, Carrier Global Corporation, Multistack International Limited, Gree Electric Appliances, Inc., and Frigel Group.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.