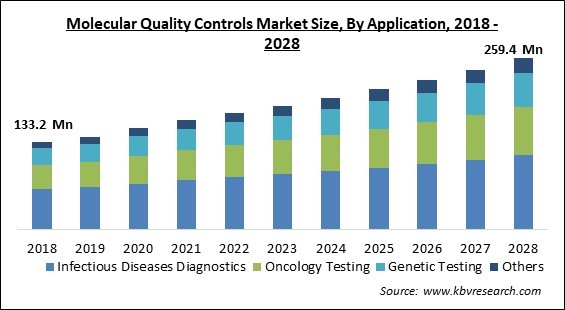

The Global Molecular Quality Controls Market size is expected to reach $259.4 million by 2028, rising at a Market growth of 6.6% CAGR during the forecast period.

Molecular quality controls are used to assess the performance of molecular tests like leukocyte reduced apheresis platelet (LRAP) units, virus load assays, pathogen detection, and healthcare-associated infections (HAIs) such as pneumonia and urinary tract infections, among others. For research and clinical laboratories, blood diagnostic centers, and IVD makers, these products are primarily focused on quality control, defect detection, and validation panels to aid in the installation and monitoring of assay-kit lot performance.

According to the World Health Organization, early detection and treatment of cancer can avert 30-50 percent of cancer-related deaths. In this case, personalized medicine appears to be the most effective alternative for addressing diseases that aren't well-known for responding well to current therapies or cures. According to research provided by the PMC (Personalized Medicine Coalition), personalized medicines accounted for only 5% of novel FDA-approved molecular entities in 2005, but more than 25% in 2016. Furthermore, 42% of all compounds in the pipeline and 73% of oncology compounds have the potential to be individualized therapies. Biopharmaceutical companies' R&D investments in personalized pharmaceuticals have nearly doubled in the last five years, according to the PMC, and are predicted to expand by 33% in the next few years. Biopharmaceutical researchers estimate a 69% increase in the number of individualized medications in development over the next five years, according to the same survey.

The COVID-19 outbreak had a negative impact on various business domains. Lockdowns stemming from the COVID-19 pandemic compelled to postpone medical appointments, reducing the number of tests performed and reagent sales. However, as governments increasingly loosen travel restrictions, there is a rebound in testing numbers. With the COVID-19 pandemic, dealing with contagious diseases has become a major medical concern around the world. Aside from vaccinations and therapeutic medications, there is an increasing demand for more accurate and simple testing technologies, as well as the proliferation of testing structures. This is bound to result in an increase in the demand for molecular quality control in the near future. As governments of various countries and health professionals face unprecedented problems, COVID-19 has had an impact on the regulatory environment and practices.

Clinical laboratories have proven to be one of the most important components of the modern healthcare value chain. Clinical laboratory tests have aided not only in the diagnosis of disease but also in the monitoring of therapy efficacy, and thus their demand has grown among the people. Clinical laboratories all around the world are attempting to gain accreditation on a national and international level in order to provide more dependable and better laboratory services. Molecular diagnostic laboratories undertake more complicated tests, are subject to stricter regulatory criteria, and are subject to a higher level of regulatory control.

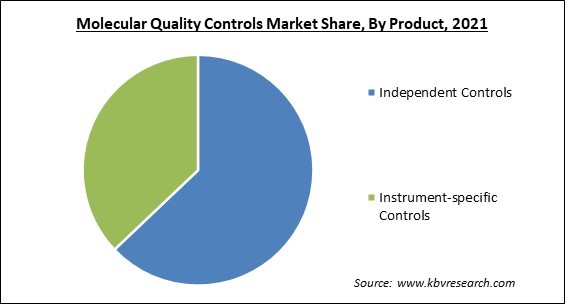

Since they are manufactured independently of the instrument, reagents, and calibrators, independent controls are expected to have the largest Market share in the molecular quality controls Market due to their highly accurate, impartial, and independent assessment of a testing system or method performance test results in a short time with the highest sensitivity rate. Furthermore, a sharp increase in the usage of these products among third-party independent quality controls is likely to boost the Market , owing to advantages such as a wide range of applications and lower operational costs.

Regulatory and regulatory standards for in vitro diagnostics (including molecular diagnostics), generally known as IVD, are growing more stringent in the United States and Europe. In the United States and Europe, regulatory and legal criteria for including molecular diagnostics are getting more stringent as well. As a result, any changes to the device will necessitate the creation of new guidance manuals. IVD products are defined and regulated in the United States under 21 CFR 809, the same rules that apply to medical devices. New FDA guidance materials have been released by the FDA. Device manufacturers must file a 510(k) application to the US Food and Drug Administration for any future modifications to a device.

Based on Analyte Type, the Market is segmented into Single-analyte Controls and Multi-analyte Controls. The multi-analyte segment witnessed a significant revenue share in the molecular quality controls Market in 2021. As a result of technological advancements, new multi-analyte and multi-instrument controllers have been developed. Clinical laboratories can save money by combining many instrument-specific controls into a single control. Furthermore, by removing the need for separate QC processes for each analyte, these controls save time. Due to the widespread availability of such molecular quality controls for infectious disease diagnostics and other uses, the Market growth is likely to accelerate in the near future.

Based on Application, the Market is segmented into Infectious Diseases Diagnostics, Oncology Testing, Genetic Testing, and Others. The infection diseases diagnostics segment acquired the largest revenue share in the molecular quality controls Market in 2021. The advent of sophisticated assays for infectious diseases, a significant increase in the prevalence of infectious diseases, and increased awareness in the medical community about the efficient use of molecular diagnostic technologies to control the occurrence and spread of infectious diseases are all factors contributing to this segment's size.

Based on Product, the Market is segmented into Independent Controls and Instrument-specific Controls (PCR, DNA Sequencing & NGS, and Others). The instrument-specific controls segment witnessed a substantial revenue share in the molecular quality controls Market in 2021. Clinical laboratories are able to save money by combining multiple instrument-specific controls into a single control. Furthermore, by removing the need for separate QC procedures for each analyte, these controls save time.

Based on End User, the Market is segmented into Diagnostic Laboratories, Hospitals, IVD Manufacturers & CROs, Academic & Research Institutes, and Others. The diagnostic laboratories segment acquired the largest revenue share in the molecular quality controls Market in 2021. The number of accredited diagnostic laboratories is expected to increase in the coming years, providing potential prospects. Due to the increased need for molecular quality control, growing adoption of QC techniques, rising occurrences of regulatory actions, and rising expenditure on molecular diagnostics, the diagnostic laboratories segment is an important segment in the Market . Clinical Laboratory Improvement Amendments (CLIA) were introduced by the Centers for Medicare & Medicaid Services, and they have been instrumental in increasing the rate of adoption of Molecular Quality Control procedures in clinical laboratories.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 165.4 Million |

| Market size forecast in 2028 | USD 259.4 Million |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 6.6% from 2022 to 2028 |

| Number of Pages | 320 |

| Number of Tables | 540 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Analyte Type, Product, Application, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the Market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. North America acquired the largest revenue share in the molecular quality controls Market in 2021. It is due to the substantially developed healthcare systems in the United States and Canada, the existence of many leading molecular quality control product manufacturers in the region, and easy access to technologically advanced products.

Free Valuable Insights: Global Molecular Quality Controls Market size to reach USD 159.8 Million by 2028

The Market research report covers the analysis of key stake holders of the Market . Key companies profiled in the report include Grifols, S.A, Abbott Laboratories, Quidel Corporation, Thermo Fisher Scientific, Inc., Bio-Rad Laboratories, Inc., Seegene, Inc., Randox Laboratories Limited, F. Hoffmann-La Roche Ltd., Bio-Techne Corporation, and Microbiologics, Inc.

By Analyte Type

By Application

By Product

By End User

By Geography

The molecular quality controls market size is projected to reach USD 259.4 million by 2028.

The Rising Number of Accredited Clinical Laboratories are driving the market in coming years, however, evolving regulatory framework growth of the market.

Grifols, S.A, Abbott Laboratories, Quidel Corporation, Thermo Fisher Scientific, Inc., Bio-Rad Laboratories, Inc., Seegene, Inc., Randox Laboratories Limited, F. Hoffmann-La Roche Ltd., Bio-Techne Corporation, and Microbiologics, Inc.

The expected CAGR of the molecular quality controls market is 6.6% from 2022 to 2028.

The Single-analyte Controls segment is leading the Global Molecular Quality Controls Market by Analyte Type 2021; thereby, achieving a Market value of $179.3 million by 2028.

The North America region is the fastest growing region in the Global Molecular Quality Controls Market by Region 2021, and would continue to be a dominant Market till 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.