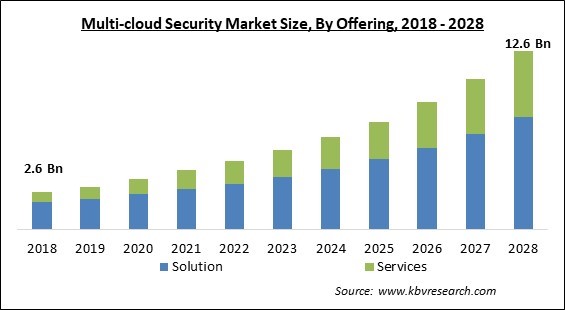

The Global Multi-cloud Security Market size is expected to reach $12.6 billion by 2028, rising at a market growth of 17.4% CAGR during the forecast period.

A system known as multi-cloud security aids in defending the company's assets, such as confidential customer applications and data, against cyberattacks across all of the cloud environments. Additionally, utilizing cloud services from various cloud service providers is referred to as multi-cloud. The company can manage various projects across various cloud environments from various cloud service providers using multi-cloud. The adaptability and affordability of multi-cloud are its major advantages.

In addition, when managing the movement of assets and data between various systems and the cloud, multi-cloud provide greater freedom. Cyberattacks have become a frequent and seriously dangerous threat to the majority of businesses, as they bring brand harm and loss of income. In addition, security lapses and data leaks are also detrimental to the ongoing operations of the company. The exposure hazards associated with any unsecured cloud environment are faced by more sectors as they adopt multi-cloud architectures.

Unprotected cloud settings frequently experience increased noncompliance, data loss, unwanted access, and a lack of transparency across many cloud environments. In addition, a lone cyberattack can have a detrimental impact on the company, creating a distrustful client base, expensive repairs, and revenue loss. To assist in preventing these negative effects, any multi-cloud plan should have a multi-cloud security solution. In addition, multi-cloud security implementation can provide numerous advantages.

Multi-cloud security provides greater dependability by keeping the company's assets safe, ensuring that the data is secure and that the vital apps continue to run smoothly. In addition, only authorized users can access programs in a more protected cloud, reducing the risk of sensitive data leaks. Additionally, with a more protected cloud environment, the company can receive notifications about important security updates as well as round-the-clock tracking of exposure risks and cyberattacks.

Organizations worked with firms like AWS, Microsoft, and Zscaler in addition to installing specialized solutions to assist their staff in working remotely to increase agility while serving clients and ensuring proper data protection in the aftermath of the pandemic's uncertainty. Because of the COVID-19 outbreak, banks and other financial organizations were increasingly shifting their data to the cloud. However, particularly for smaller institutions attempting to stay up with the swiftly evolving standards, there were security and resilience advantages that can be challenging and expensive to reproduce on-premises. Therefore, the COVID-19 pandemic had a positive impact on the multi-cloud security market.

The functioning of the multi-cloud security sector is governed by several laws. Worldwide, businesses and governments are choosing to implement multi-cloud infrastructures. For example, a Multi-Cloud Security Public Working Group (MCSPWG) is being established by the National Institute of Standards and Technology to study the best procedures for securing intricate cloud solutions, including several service providers and clouds. The MCSPWG project will concentrate on identifying the difficulties in building secure multi-cloud networks and offering recommendations and best practices for overcoming such difficulties.

Work-from-home (WFH) and BYOD policies are being adopted by businesses more frequently. Employers who use cloud-based technology and the BYOD concept allow employees to work from home while still connected to the workplace network. Enterprises are gradually transitioning to a multi-cloud deployment approach due to the rising popularity of various cloud solutions and BYOD rules. Remote employment promotes public health and helps businesses avoid productivity loss. Many businesses have widely implemented work-from-home policies for their employees due to the economic and health crises caused by the COVID-19 outbreak and the necessary physical distance precautions.

The essential technical abilities and knowledge are needed to implement multi-cloud security solutions. Additionally, a talent pool with high experience is needed due to the growing number of cloud-native businesses and startups. The increased use of cloud computing worldwide has increased the need for workers with expertise in complex technologies. However, hiring personnel with the necessary skill set is difficult as the firms recover from the economically hindering lockdowns of COVID-19. Consequently, it is anticipated that the growing use of the cloud will increase the demand for personnel to manage security solutions, a lack of which hinders the growth of the multi-cloud security market.

Based on offering, the multi-cloud security market is bifurcated into solutions and services. The solutions segment garnered the highest revenue share in the multi-cloud security market in 2021. Enterprise data management, risk, compliance, governance, enterprise performance management, and analytics solutions are all expanding as part of the cloud environment adoption strategy. The adoption of corporate performance management solutions is also projected to be fueled by improved user experience and simplified administrations across multiple domains.

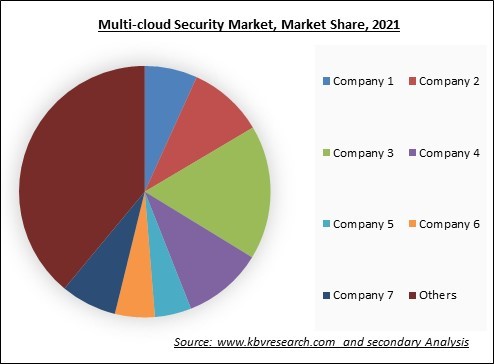

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

On the basis of vertical, the multi-cloud security market is divided into BFSI, healthcare, telecommunications, IT & ITeS, retail & eCommerce, media & entertainment, manufacturing, and others. The BFSI segment acquired the largest revenue share in the multi-cloud security market in 2021. Regardless of their size or mix of businesses, most financial institutions are starting to use cloud & multi-cloud technology solutions. Finance and insurance organizations must adhere to the strictest security standards specified by monetary regulatory bodies due to the extensive deployment of cloud computing platforms.

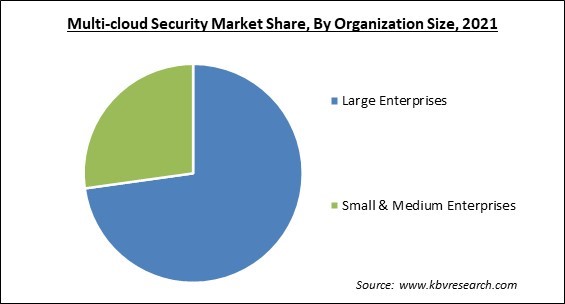

Based on organization size, the multi-cloud security market is segmented into SMEs and Large enterprises. The small and medium sized enterprises (SMEs) segment acquired a substantial revenue share in the multi-cloud security market in 2021. SMEs are increasingly using cybersecurity products to safeguard themselves due to the rising prevalence of fraud. SMEs are more vulnerable to cyberattacks since their servers are easier to access than those of larger networks. SMEs are expected to devote more money to multi-cloud security products in the coming years due to the rise in cyber-induced assaults and the expansion of mandatory rules during the pandemic.

On the basis of cloud model, the multi-cloud security market is fragmented into Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). The Infrastructure as a Service (IaaS) segment recorded the highest revenue share in the multi-cloud security market in 2021. IaaS is a part of the platform's layers for cloud computing. Customers can contract out their IT infrastructures, including servers, networking, computing, virtual machines, storage, and other resources. Consumers employ a pay-per-use business model to access various resources on the Internet.

Based on application, the multi-cloud security market is categorised into network security, application security, and endpoint & IoT device security. The application security segment procured a significant revenue share in the multi-cloud security market in 2021. Data and applications in collaborative cloud settings can be safeguarded by businesses using an application security system, which is a system of policies, procedures, and controls. To retain visibility of all cloud-based assets, safeguard cloud-based applications against cyberattacks, and restrict access to only authorized users, application security contains application-level policies, technologies, tools, and regulations.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 4.2 Billion |

| Market size forecast in 2028 | USD 12.6 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 17.4% from 2022 to 2028 |

| Number of Pages | 328 |

| Number of Table | 564 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Operation, Railway Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

On the basis of region, the multi-cloud security market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region acquired the maximum revenue share in the multi-cloud security market in 2021. In terms of market share, North America is anticipated to dominate the multi-cloud security market globally. In past years, the region has seen an increase in digitalization. Organizations are moving their systems from on-premises environments to cloud infrastructure at an increasing rate. As a result, multi-cloud security solutions are used more frequently due to the region's growing digitalization.

Free Valuable Insights: Global Multi-cloud Security Market size to reach USD 12.6 Billion by 2028

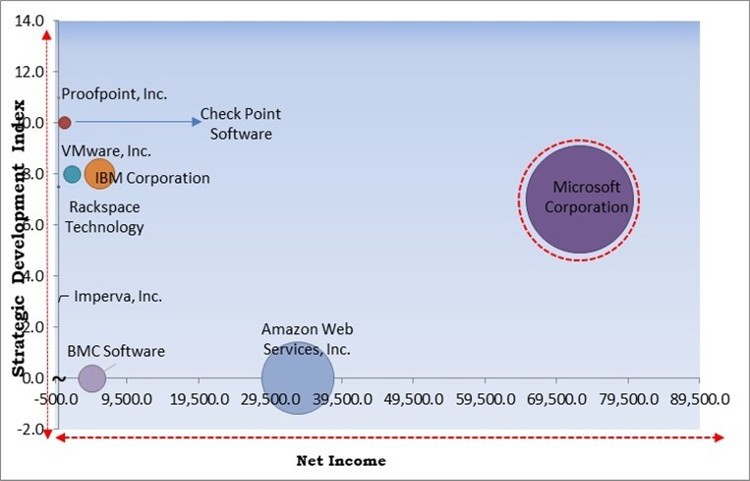

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; Microsoft Corporation is the forerunner in the Multi-cloud Security Market. Companies such as Amazon Web Services, Inc., IBM Corporation, and Check Point Software Technologies Ltd. are some of the key innovators in Multi-cloud Security Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Microsoft Corporation, VMware, Inc., Rackspace Technology, Inc., Check Point Software Technologies Ltd., Amazon Web Services, Inc. (Amazon.com, Inc.), IBM Corporation, BMC Software, Inc. (KKR & Co., Inc.), Proofpoint, Inc., Aqua Security Software Ltd., and Imperva, Inc.

By Offering

By Application

By Cloud Model

By Organization Size

By Vertical

By Geography

The global Multi-cloud Security Market size is expected to reach $12.6 billion by 2028.

Adoption of remote working and BYOD models are driving the market in coming years, however, Limited technical competence in multi-cloud security solution deployment restraints the growth of the market.

Microsoft Corporation, VMware, Inc., Rackspace Technology, Inc., Check Point Software Technologies Ltd., Amazon Web Services, Inc. (Amazon.com, Inc.), IBM Corporation, BMC Software, Inc. (KKR & Co., Inc.), Proofpoint, Inc., Aqua Security Software Ltd., and Imperva, Inc.

The expected CAGR of the Multi-cloud Security Market is 17.4% from 2022 to 2028.

The Network Security segment acquired maximum revenue share in the Global Multi-cloud Security Market by Application in 2021 thereby, achieving a market value of $5,299 million by 2028.

The North America market dominated the Global Multi-cloud Security Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $4.4 million by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.