“Global Multi-layer Ceramic Capacitor Market to reach a market value of USD 15.97 Billion by 2031 growing at a CAGR of 5.3%”

The Global Multi-Layer Ceramic Capacitor Market size is expected to reach $15.97 billion by 2031, rising at a market growth of 5.3% CAGR during the forecast period.

The increasing adoption of MLCCs in smartphones, laptops, and home appliances further contributed to the segment’s growth. This is driven by its extensive use in consumer electronics, automotive systems, and industrial applications. These capacitors offer high reliability, stability, and cost-effectiveness, making them a preferred choice for power management, signal processing, and noise suppression in various electronic devices. Thus, the general capacitor segment acquired 30% revenue share in the market in 2023.

The increasing adoption of consumer electronics such as smartphones, tablets, laptops, gaming consoles, and smart home devices is a major factor driving the market. These electronic devices rely on MLCCs for power management, filtering, decoupling, and noise suppression. As manufacturers push for more compact and high-performance devices, the demand for high-capacitance and miniaturized MLCCs continues to grow. In conclusion, rising demand for consumer electronics is driving the market's growth.

Additionally, the global shift toward Industry 4.0 and the adoption of smart manufacturing technologies significantly drive the market. Industrial automation relies on robotics, programmable logic controllers (PLCs), and IoT-enabled machinery, all requiring MLCCs for power stabilization and signal processing. As industries increasingly integrate AI-driven automation and predictive maintenance, the demand for robust electronic components, including MLCCs, continues to grow. In conclusion, the expansion of industrial automation and smart manufacturing is driving the market's growth.

However, the market is highly sensitive to fluctuations in raw material prices, as these capacitors are manufactured using precious metals such as palladium, nickel, silver, and ceramic materials. Geopolitical tensions, mining regulations, trade policies, and global supply chain disruptions influence the prices of these raw materials. When material costs rise, MLCC manufacturers face increased production expenses, which impact profit margins and pricing strategies. Therefore, volatility in raw material prices is hindering the market's growth. Therefore, volatility in raw material prices is hindering the market's growth.

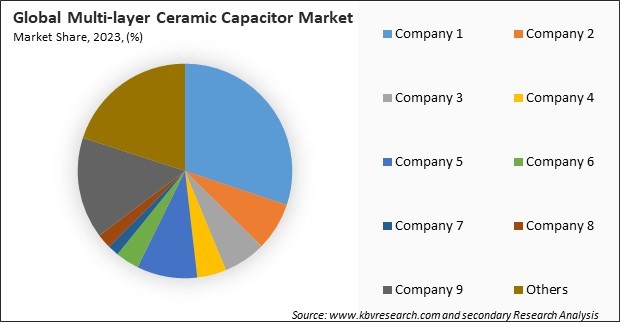

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

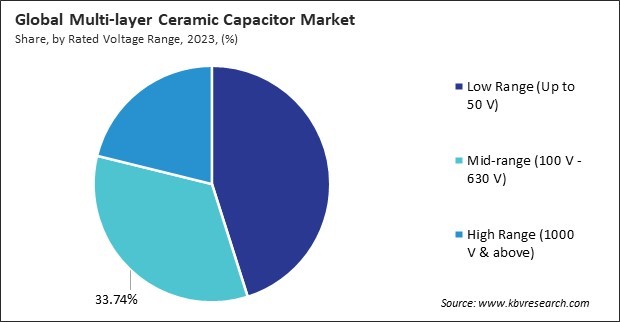

Based on rated voltage range, the market is characterized into low range (Up to 50 V), mid-range (100 V - 630 V), and high range (1000 V & above). The low range (Up to 50 V) segment garnered the highest revenue share in the market in 2023. This is primarily due to its extensive use in consumer electronics, including smartphones, laptops, and wearable devices.

By case size, the market is categorized into 0603-1206 inches, less than 0603 inches, and more than 1206 inches. The less than 0603 inches segment held 30% revenue share in the market in 2023. This is primarily due to the increasing miniaturization trend in electronic devices. These ultra-compact capacitors are widely used in advanced wearables, IoT devices, and high-density printed circuit boards (PCBs), where space constraints are a critical factor.

On the basis of type, the market is segmented into general capacitor, array, serial construction, mega cap, and others. The serial construction segment held 20% revenue share in the market in 2023. This is supported by its growing application in high-voltage and high-reliability circuits. These capacitors are commonly used in industrial automation, power electronics, and electric vehicle systems, where enhanced voltage endurance and thermal stability are essential.

By dielectric type, the market is segmented into X7R, X5R, C0G, Y5V, and others. The X5R segment procured 24% revenue share in the market in 2023. This is primarily due to its extensive use in consumer electronics and mobile devices. These capacitors provide high capacitance values in compact sizes, making them suitable for power management and decoupling applications in smartphones, tablets, and wearable devices.

On the basis of end-use, the market is classified into industrial, electronics, automotive, telecommunication, data transmission, and others. The electronics segment acquired 31% revenue share in the market in 2023. The growing demand for smartphones, tablets, laptops, gaming consoles, and other portable electronic devices has significantly driven the need for MLCCs, which are essential for circuit stability and miniaturization.

Free Valuable Insights: Global Multi-layer Ceramic Capacitor Market size to reach USD 15.97 Billion by 2031

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment recorded 30% revenue share in the market in 2023. The strong presence of key industries such as consumer electronics, automotive, aerospace, and telecommunications has driven the demand for MLCCs in the region.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 10.76 Billion |

| Market size forecast in 2031 | USD 15.97 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 5.3% from 2024 to 2031 |

| Number of Pages | 386 |

| Number of Tables | 601 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Rated Voltage Range, Case Size, Type, Dielectric Type, End-use, Region |

| Country scope |

|

| Companies Included | Murata Manufacturing Co., Ltd., TAIYO YUDEN CO., LTD., Kyocera Corporation, Yageo Corporation, TDK Corporation, Walsin Technology Corporation, Panasonic Holdings Corporation, Kemet Corporation, Vishay Intertechnology, Inc., Darfon Electronics Corporation and Samsung Electro-Mechanics Co., Ltd. (Samsung Group) |

By Rated Voltage Range

By Case Size

By Type

By Dielectric Type

By End-use

By Geography

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges