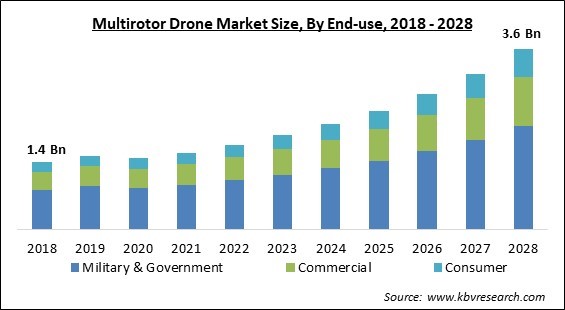

The Global Multirotor Drone Market size is expected to reach $3.6 billion by 2028, rising at a market growth of 13.4% CAGR during the forecast period.

Multirotor drones have more than two rotors, each of which spins at a fixed pitch to produce lift. The drone can be made to climb, hover, or drop by adjusting the rotor speed such that the thrust produced is higher than, equal to, or less than the forces exerted on the airplane by drag and gravity. The drone can also be made to turn or move horizontally by changing the speed of some of its rotors.

Multirotor drone typically has three, four, six, or eight rotors, and these kinds of aircraft are referred to as tricopters, quadcopters, hexacopters, and octocopters, respectively. The most popular design is the quadcopter, which has fewer parts than hexacopters or octocopters and a less complicated stabilizing mechanism than tricopters. A multirotor drone can hoist a higher payload and generate more propulsion if it has more rotors.

Hexacopters and octocopters are frequently used in heavy lift multirotor drones that deliver payloads or very heavy industrial cameras. In the event of a single rotor failure, drones with more than four rotors still have a degree of redundancy that enables them to descend gradually. Due to their VTOL capabilities, Multirotor drones may operate in a wider range of conditions than fixed-wing drones because they don't need a separate area to take off and land.

They are perfect for some imaging tasks and surveillance missions since they can hover still. The majority of multicopters, especially smaller ones, can only run on batteries, which has an impact on how long they can fly. Even though certain multirotor can be equipped with fuel cells to extend their flying periods, internal combustion engines are too heavy and unresponsive for multicopter drone operation, which depends on making quick adjustments to rotor speeds.

Several applications have raised the demand for various drone kinds, including multirotor drones with lightweight payloads like cameras to record ground events from the air, in the event of the COVID-19 pandemic. Flight cancellations, travel restrictions, and the imposition of quarantine procedures were brought on by the COVID-19 outbreak, which severely disrupted logistics and supply chains. Two significant issues that negatively impacted the drone producers were a revenue shortfall and increased maintenance expenses.

More than 50 times faster than conventional methods, drones collect data. Due to the size of most solar farms, a drone with an adequate thermal camera can scan the entire installation more quickly than a hand-held thermal camera on the ground. Inspections of wind turbines are carried out manually, either by climbing or by taking long-range photographs. Drone inspections can eliminate risks introduced by manual inspections that require climbing. The detail and adaptability that a drone can offer are lacking in ground-based data collecting, which may be slow and laborious.

Drones are becoming more and more likely to be used in a variety of occupations. These flying machines give complete and valuable findings quickly because of their speed and agility. At the moment, drones with sensors and cameras are proving their value in obtaining real-time video that can be saved for later analysis. Compared to conventional approaches, unmanned aerial systems can find malfunctioning structures and equipment faster and more affordably.

At the moment, drones can only take flight for 15 to 30 minutes before needing new batteries or recharge. Even while some drones can carry payloads of almost twenty pounds, those that weigh five pounds or less are more widely used. The fact that there is an inverse relationship between payload weight and flight endurance, which means that increasing cargo results in shorter flight times, further complicates matters.

On the basis of Type, the Multirotor Drone Market is divided into Hexacopters, Tricopters, Quadcopters, and Octocopters. The quadcopters segment acquired the highest revenue share in the multirotor drone market in 2021. It is because quadcopters can be flown manually or automatically. It is sometimes referred to as a quadrotor or helicopter. It is a member of the multicopter or multirotor family of aerial vehicles, which is a more inclusive group. Quadcopters are perfect for surveillance and aerial photography since they have consistent flight performance.

Based on the Payload, the Multirotor Drone Market is segmented into Camera & Imaging Systems, Control Systems, Tracking Systems, and Others. The tracking system segment registered a substantial revenue share in the multirotor drone market in 2021. It is because of continuously monitoring moving and static targets inside the complicated environment of Drone and other fast-moving platforms. The tracking module handled the panning, zooming, and rotation of the target as well as the image affine conversion brought on by the platform's rapid movement perfectly.

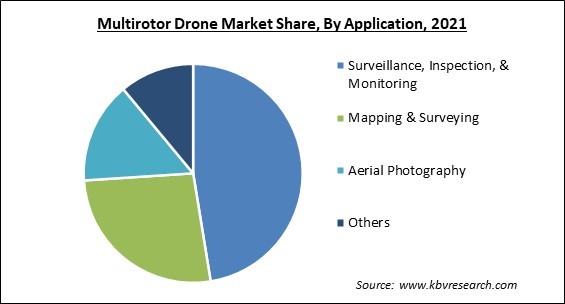

By Application, the Multirotor Drone Market is classified into Mapping and Surveying, Surveillance, Inspection, and Monitoring, Aerial Photography, and Others. The mapping and surveying segment recorded a significant revenue share in the multirotor drone market in 2021. It is because, for GIS specialists, drone surveying has immense potential. Drones can take topographic surveys in a fraction the time and with the same level of precision as more conventional methods. This significantly lessens the expense of a site survey and the burden on local experts.

Based on the End-Use, the Multirotor Drone Market is bifurcated into Commercial, Military and Government, and Consumer. The military & government segment acquired the largest revenue share in the multirotor drone market in 2021. The military's use of them for reconnaissance, surveillance, and targeted assaults is their most well-known and contentious application. Particularly the United States has dramatically boosted its usage of drones since the 9/11 terrorist strikes.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 1.5 Billion |

| Market size forecast in 2028 | USD 3.6 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 13.4% from 2022 to 2028 |

| Number of Pages | 262 |

| Number of Tables | 470 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Payload, End-use, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the Multirotor Drone Market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America Region procured the highest revenue share in the multirotor drone market in 2021. Due to its advanced technological infrastructure, North America has a higher adoption rate for drone technology. The adoption of advanced unmanned autonomous systems (UAS) technology to minimize human labor and enhance output quality across the number of industries has significantly increased in the region.

Free Valuable Insights: Global Multirotor Drone Market size to reach USD 3.6 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include AeroVironment, Inc., SZ DJI Technology Co., Ltd., Autel Robotics, ideaForge Technology Pvt. Ltd., Draganfly Inc., Embention Sistemas Inteligentes SA, Aero Systems West Inc., Australian UAV Pty Ltd, Centeye, Inc., and Cyberhawk Innovations Ltd.

By End-use

By Payload

By Type

By Application

By Geography

The Multirotor Drone Market size is projected to reach USD 3.6 billion by 2028.

Increasing Utilization Of Multirotor Drones For Inspections Purposes are driving the market in coming years, however, Limited Payload And Flight Duration Of The Multirotor Drones restraints the growth of the market.

AeroVironment, Inc., SZ DJI Technology Co., Ltd., Autel Robotics, ideaForge Technology Pvt. Ltd., Draganfly Inc., Embention Sistemas Inteligentes SA, Aero Systems West Inc., Australian UAV Pty Ltd, Centeye, Inc., and Cyberhawk Innovations Ltd.

The Camera & Imaging Systems segment acquired maximum revenue share in the Global Multirotor Drone Market by Payload in 2021 thereby, achieving a market value of $1.5 billion by 2028.

The Surveillance, Inspection, & Monitoring segment is leading the Global Multirotor Drone Market by Application in 2021 thereby, achieving a market value of $1.7 billion by 2028.

The North America market dominated the Global Multirotor Drone Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $1.4 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.