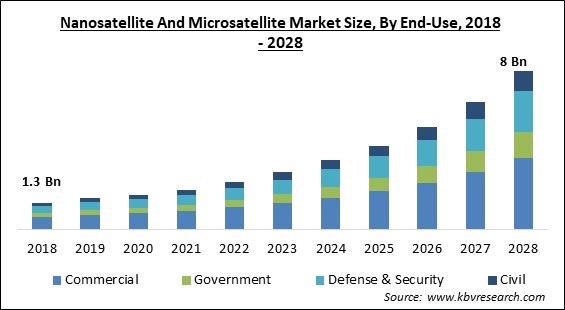

The Global Nanosatellite And Microsatellite Market size is expected to reach $8 billion by 2028, rising at a market growth of 22.3% CAGR during the forecast period.

Nanosatellite and microsatellite are small satellites, which are also known as miniature satellite or smallsat, has a low mass, and is typically under 1,200 kg in size (2,600 lb.). Small satellites can be developed to cut down on the heavy price of launch systems and construction expenses. For some applications, such as the radio relay and collection of scientific data, miniature satellites, particularly in huge numbers, are considered more helpful than fewer, larger ones.

Small spacecraft missions serve an essential and appealing role in space-based science and technology projects. They have significantly decreased the time required to achieve scientific and technological results. Small spacecraft missions are typically adaptable, allowing them to respond rapidly to new prospects or technical demands.

The shorter development durations for smaller operations can cut overall costs, so providing pleasant budgetary options for space programs with severely constrained funds. In general, satellite systems are shifting from a single satellite approach towards the cooperative sensing strategy. For missions needing continuous or global coverage within a relatively brief period of time or in real-time, deploying a cluster of satellites has proven to be advantageous.

Small artificial satellites within the wet weight range of 10 to 100 kilograms are termed microsatellites. This weight range is not an established norm, and therefore, satellites that are either bigger or smaller than that can be put in the category. Microsatellites that operate cooperatively or in a cluster are sometimes included in plans or suggested designs for various spacecraft. Both satlet and the general term small satellite, often known as smallsat, are occasionally used to refer to microsatellites.

COVID-19 along with unrestricted price declines, and bankruptcy disturbed the satellite business to its core. Big, moderate, and small players all had to discover strategies to survive in the near term while planning for the new standard in the medium to long term. As the industry took steps to manage the impact of these three, stakeholders in the supply chain were searching for the appropriate market indicators. With time major companies targeted key verticals and recalibrated their value propositions for a rebound. Nevertheless, despite the detrimental impact of COVID-19, the increasing engagement of private actors, and the rise in mission capacity, the nanosatellite and microsatellite market is experiencing an increase in small satellite development and launch activity.

The use of nanosatellites and microsatellites for providing cutting-edge services like satellite TV, broadband internet, and other services has been facilitated by satellite manufacturers' intense focus on lowering the cost of small satellites. The hardware and technology needed to build nano- and microsatellites are reusable and affordable. Because they are small and light, nanosatellites and microsatellites do not need a specific launch vehicle like conventional satellites, which further lowers launch costs.

Monitoring agricultural fields, spotting climate changes, disaster preparedness, meteorology, and other areas are all covered by earth observation services. With the ability to use images for a variety of tasks, including precision management of water, land, and forest resources, the need for Earth imaging with high-resolution has expanded across verticals. Space-based insights can be very helpful for catastrophe management both before and after the occurrence.

The development of the small satellite habitat and industry is influenced directly or indirectly by national and international policies. There isn't currently a thorough domestic or global on-orbit regulation framework. There are rules governing the spectrum and remote sensing satellite launches and re-entry like Space Situational Awareness (SSA), rendezvous & proximity operations, or RF mapping but there are none governing on-orbit operations.

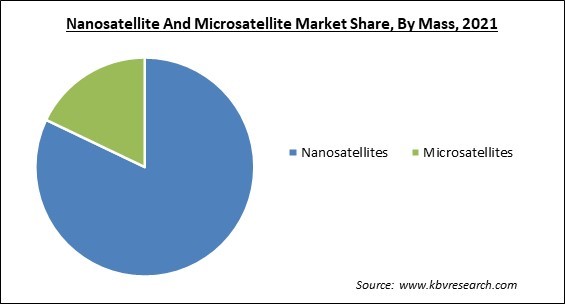

Mass Based on mass, the nanosatellite and microsatellite market is bifurcated into nanosatellites and microsatellites. The nanosatellite segment garnered the highest revenue share in the nanosatellite and microsatellite market in 2021. The increase is attributable to the expanding use of nanosatellites for earth monitoring missions. The information provided by earth observation satellites has been found to be incredibly useful for applications such as enhancing water management, monitoring refugee populations, conducting relief operations, and bolstering national defense.

On the basis of application, the nanosatellite and microsatellite market is divided into communication & navigation, earth observation/remote sensing, scientific research, and technology & academic training. The communication and navigation segment recorded a substantial revenue share in the nanosatellite and microsatellite market in 2021. Smallsats are increasingly used for communication and navigation as a result of the rising popularity of cutting-edge services like Internet Protocol Television (IPTV) and Over-The-Top (OTT) services. In addition, miniature communication satellites are meticulously developed for great performance.

Based on end use, the nanosatellite and microsatellite market is categorized into government, defense & security, commercial, and civil. The commercial segment procured the maximum revenue share in the nanosatellite and microsatellite market in 2021. This is due to a surge in broadcasting, communication, and navigation operations. Small satellites have become a potential investment for private firms owing to their speedier production and potential to be deployed for commercial usage.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 2 Billion |

| Market size forecast in 2028 | USD 8 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 22.3% from 2022 to 2028 |

| Number of Pages | 203 |

| Number of Tables | 359 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Mass, Application, End-use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

On the basis of region, the nanosatellite and microsatellite market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment acquired the highest revenue share in the nanosatellite and microsatellite market in 2021. The expansion is attributable to increased spending on space-related activities. NASA, for instance, assigns a specified expenditure for space-related activities such as space technology, science, aeronautics, exploration, as well as other space operations each year.

Free Valuable Insights: Global Nanosatellite And Microsatellite Market size to reach USD 8 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Dauria Aerospace, GomSpace Group AB, ISISPACE Group, Sierra Nevada Corporation (SNC), Spire Global, Inc., AAC Clyde Space, Surrey Satellite Technology Limited (SSTL), The Boeing Company, and Tyvak International

By End-Use

By Application

By Mass

By Geography

The global Nanosatellite And Microsatellite Market size is expected to reach $8 billion by 2028.

Increasing Commercial Sector's Need For Nano- And Microsatellites are driving the market in coming years, however, Government laws that are too strict impede growth restraints the growth of the market.

Dauria Aerospace, GomSpace Group AB, ISISPACE Group, Sierra Nevada Corporation (SNC), Spire Global, Inc., AAC Clyde Space, Surrey Satellite Technology Limited (SSTL), The Boeing Company, and Tyvak International.

The expected CAGR of the Nanosatellite And Microsatellite Market is 22.3% from 2022 to 2028.

The Earth Observation/Remote Sensing segment acquired maximum revenue share in the Global Nanosatellite And Microsatellite Market by Application in 2021 thereby, achieving a market value of $4.1 billion by 2028.

The North America market dominated the Global Nanosatellite And Microsatellite Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $3.3 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.