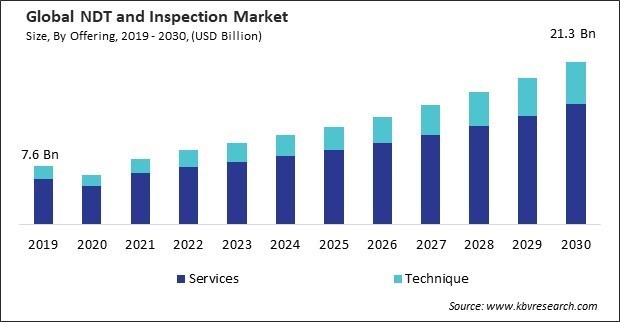

“Global NDT and Inspection Market to reach a market value of USD 21.3 Billion by 2030 growing at a CAGR of 10.4%”

The Global NDT and Inspection Market size is expected to reach $21.3 billion by 2030, rising at a market growth of 10.4% CAGR during the forecast period.

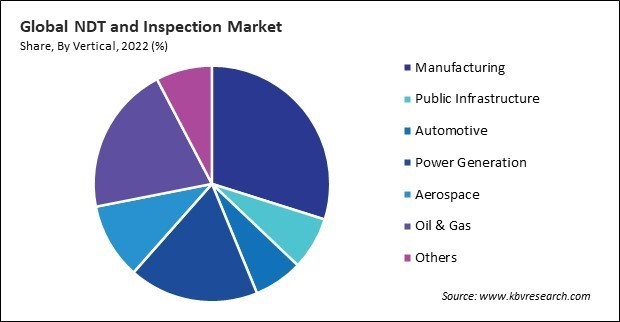

In aerospace production, sophisticated materials such as alloys, composites, and rare metals have increased. Consequently, the aerospace segment generated $1,012.3 million revenue in the market in 2022. These materials often require specialized NDT techniques for accurate and reliable inspection. The demand for advanced NDT methods grows as the aerospace industry continues to innovate with new materials to enhance performance and reduce weight. Thus, these factors can assist in the expansion of the segment.

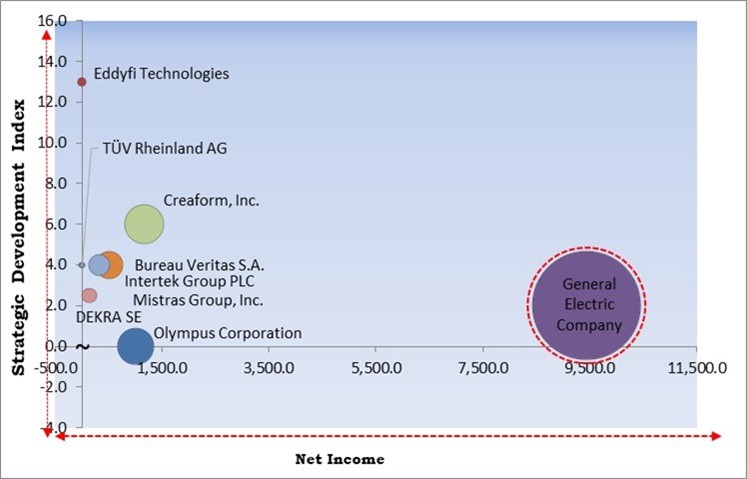

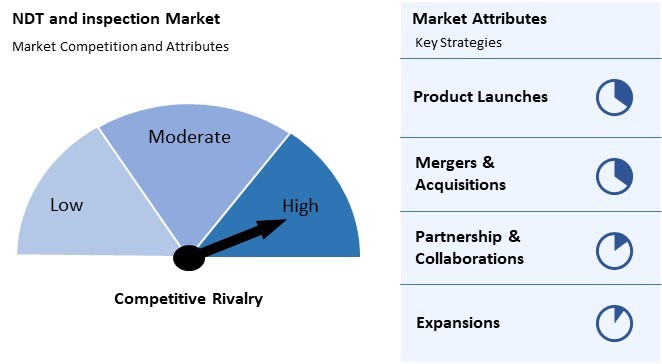

The major strategies followed by the market participants are Mergers & Acquisition as the key developmental strategy to keep pace with the changing demands of end users. For instance, In October, 2023, TÜV Rheinland AG acquired Burotec to enhance its technical capabilities and personnel expertise in the inspection market. The acquisition will significantly widen and enhance TÜV Rheinland's service range in Spain, while also providing new development potential in the non-statutory local inspection sector. Additionally, In April, 2023, Intertek Group PLC acquired Controle Analítico Análises Técnicas Ltd. The acquisition of Controle Analítico is a compelling strategic fit for Intertek and strengthens its existing service offerings in Brazil.

Based on the Analysis presented in the KBV Cardinal matrix; General Electric Company is the forerunner in the Market. Companies such as Creaform, Inc., Bureau Veritas S.A., Intertek Group PLC are some of the key innovators in Market. For Instance, In May, 2021, Bureau Veritas S.A. acquired Sievert, a leading provider of non-destructive testing (NDT) services, to make it one of the world's leaders in non-destructive testing. Through this acquisition, the company will enhance new construction, pipeline installation, in-service inspection, and expansion projects.

Quality assurance is paramount across diverse industries, including manufacturing, construction, aerospace, and more. As supply chains become more globalized, adherence to international quality standards becomes imperative. NDT techniques are instrumental in quality control processes, ensuring that materials and components meet specified standards and comply with the requirements of a globalized market. Therefore, these factors can assist in the growth of the market.

Additionally, the continuous expansion of global infrastructure development projects, encompassing the construction of bridges, pipelines, buildings, and other critical structures, is a significant driver for the demand for non-destructive testing (NDT) and inspection services. According to the United Kingdom Office for National Statistics data, in 2021, total infrastructure investments by the general government increased by 15.2% compared to 2020, reaching £23.8 billion at current prices. The same source revealed when compared with 2020, the energy industry received higher investment in 2021 (up by £377.3 million, a 7.3% increase).

However, acquiring sophisticated equipment for advanced NDT techniques requires a substantial initial investment. Smaller businesses that cannot afford advanced NDT methods may face a competitive disadvantage. Larger competitors with greater financial resources can invest in cutting-edge technology, potentially outperforming smaller players in efficiency and reliability. Thus, these factors can restrain the growth of the market.

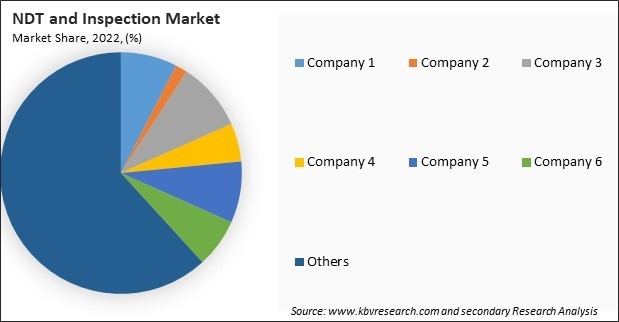

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

The technique segment is further segmented into ultrasonic testing (UT), visual testing (VT), magnetic particle testing (MPT), liquid penetrant testing (LPT), eddy-current testing (ECT), radiographic testing (RT), and acoustic emission testing (AET). The ultrasonic testing (UT) segment held 33.86% revenue share in the market in 2022. UT relies on transmitting ultrasonic waves into a material and analyzing the waves that are reflected back. Discontinuities or defects within the material can cause reflections, which are detected and analyzed to determine the flaw’s size, shape, and location.

On the basis of vertical, the market is divided into manufacturing, oil & gas, aerospace, public infrastructure, automotive, power generation, and others. The manufacturing segment procured 29.86% revenue share in the market in 2022. Stringent quality assurance standards and industry regulations mandate comprehensive inspection and testing processes in manufacturing.

By offering, the market is divided into services and technique. In 2022, the technique segment witnessed a 22.70% revenue share in the market. Different industries, including aerospace, oil and gas, manufacturing, and construction, rely heavily on NDT and inspection techniques to ensure the integrity of materials and components. As these industries continue to grow, the demand for reliable and advanced inspection methods is likely to increase.

The services segment is divided into inspection services, equipment rental services, calibration services, and training services. The inspection services segment recorded 38.08% revenue share in the market in 2022. Industries such as manufacturing, aerospace, oil and gas, and construction are placing a higher emphasis on safety and quality assurance. Inspection services ensure that products and structures meet stringent safety and quality standards.

Free Valuable Insights: Global NDT and Inspection Market size to reach USD 21.3 Billion by 2030

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. In 2022, the Europe segment acquired a considerable revenue share in the market. Europe has ongoing infrastructure development projects, such as the construction of bridges, pipelines, and power plants. Inspection and nondestructive testing are essential for ensuring these structures' safety and integrity. Europe has a diverse and robust manufacturing sector, including automotive, aerospace, and electronics.

The Market witness intense competition among key players, including technology providers, service providers, and equipment manufacturers, as they strive to offer innovative solutions for non-destructive testing (NDT) and inspection across various industries such as aerospace, automotive, oil and gas, and manufacturing. This competitive landscape is driven by the growing demand for reliable quality assurance and regulatory compliance, leading companies to invest in research and development to enhance inspection technologies, expand service offerings, and improve efficiency, accuracy, and cost-effectiveness. Additionally, globalization and stringent safety standards further intensify competition, prompting players to differentiate themselves through partnerships, mergers and acquisitions, and geographic expansion strategies, thereby shaping a dynamic and rapidly evolving market environment.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 9.8 Billion |

| Market size forecast in 2030 | USD 21.3 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 10.4% from 2023 to 2030 |

| Number of Pages | 345 |

| Number of Tables | 524 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Offering, Vertical, Region |

| Country scope |

|

| Companies Included | General Electric Company, Mistras Group, Inc., Olympus Corporation, Eddyfi Technologies, Intertek Group PLC, Bureau Veritas S.A., TÜV Rheinland AG, DEKRA SE, Carestream Health, Inc. (Onex Corporation), Creaform, Inc. (AMETEK, Inc.) |

By Offering

By Vertical

By Geography

This Market size is expected to reach $21.3 billion by 2030.

Increasing demand for quality assurance are driving the Market in coming years, however, Challenges related to technological complexity and cost restraints the growth of the Market.

General Electric Company, Mistras Group, Inc., Olympus Corporation, Eddyfi Technologies, Intertek Group PLC, Bureau Veritas S.A., TÜV Rheinland AG, DEKRA SE, Carestream Health, Inc. (Onex Corporation), Creaform, Inc. (AMETEK, Inc.)

The expected CAGR of this Market is 10.4% from 2023 to 2030.

The Services segment is leading the Market by Offering in 2022; there by, achieving a market value of $15.7 billion by 2030.

The North America region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; there by, achieving a market value of $7.4 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges