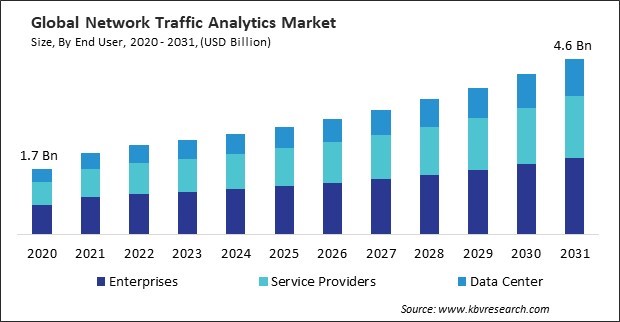

“Global Network Traffic Analytics Market to reach a market value of USD 4.6 Billion by 2031 growing at a CAGR of 8.2%”

The Global Network Traffic Analytics Market size is expected to reach $4.6 billion by 2031, rising at a market growth of 8.2% CAGR during the forecast period.

Network Traffic Analytics is essential for managing the increased complexity and volume of data traffic associated with these technologies, ensuring seamless integration and operation. According to International Trade Administration (ITA), the Bulgarian ICT industry has seen a 300 percent increase in revenue over from 2018 to 2024 and has reached EUR 2.5 billion. Hence, in 2023, the Europe region generated a 28% revenue share in the market. Network Traffic Analytics helps in monitoring and optimizing the performance of this infrastructure, supporting the growth and efficiency of digital transformation initiatives. Analytics solutions help identify and respond to advanced persistent threats (APTs) and other emerging cybersecurity risks that are becoming more prevalent in the region.

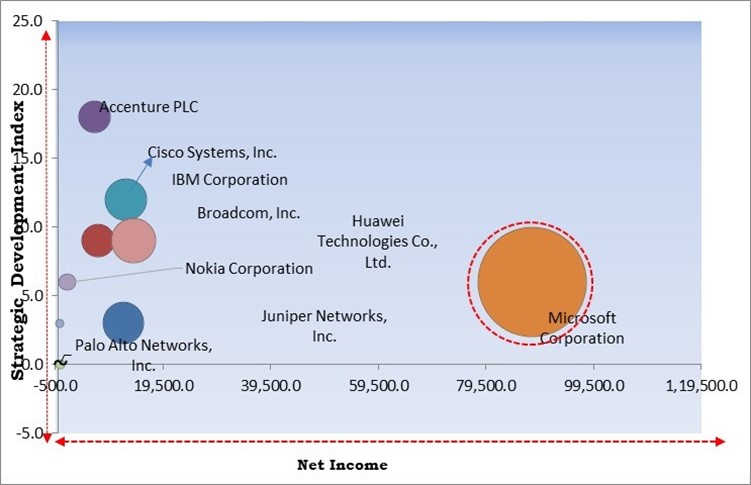

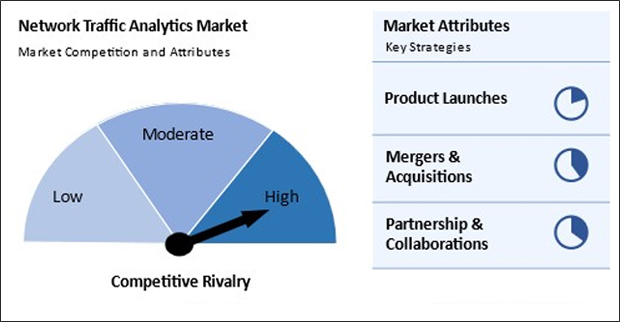

The major strategies followed by the market participants are Acquisitions as the key developmental strategy to keep pace with the changing demands of end users. For instance, In September, 2023, Cisco Systems Inc. completed the acquisition of Splunk Inc., an American software company. Through this acquisition, the companies helped to make organizations more secure and resilient. Additionally, In March, 2024, IBM has announced the acquisition of Pliant, a leading provider of network and IT infrastructure automation products. This acquisition will enhance IBM's software portfolio, including SevOne and Cloud Pak for Network Automation, by providing advanced automation, observability, and control across hybrid cloud environments.

Based on the Analysis presented in the KBV Cardinal matrix; Microsoft Corporation is the forerunners in the Network Traffic Analytics Market. In January, 2023, Microsoft acquired Fungible, a startup focused on data processing units (DPUs. This acquisition reinforces Microsoft’s dedication to advancing data center infrastructure, aiming to enhance latency, server density, energy efficiency, and cost-effectiveness. Companies such as Cisco Systems, Inc., IBM Corporation and Broadcom, Inc. are some of the key innovators in Network Traffic Analytics Market.

The widespread use of applications that require substantial bandwidth, such as video streaming services, online gaming, and video conferencing, contributes to increased data traffic. Modern networks often incorporate a mix of traditional on-premises infrastructure, cloud-based resources, and hybrid environments. Managing and optimizing traffic across these diverse architectures requires sophisticated analytics tools that can provide comprehensive visibility and insights. Thus, the surge in data traffic and network complexity drives the market's growth.

In today's digital landscape, end-users expect seamless, high-speed access to applications and services. Poor network performance, such as slow loading times or frequent interruptions, can lead to dissatisfaction and negatively impact customer retention and engagement. Effective optimization involves managing and allocating network resources based on demand. Network traffic analytics help organizations understand traffic patterns and allocate bandwidth, accordingly, ensuring critical applications receive the necessary resources to perform optimally. Therefore, the rising need for network performance optimization drives the market's growth.

Network traffic analytics tools collect and store detailed information about network activity, including sensitive personal information, financial details, or proprietary business information. Ensuring the privacy and security of this data is crucial to prevent unauthorized access and potential misuse. To address privacy concerns, network traffic analytics solutions often implement data anonymization techniques to obscure sensitive information. However, achieving effective anonymization while maintaining the usefulness of the data for analysis can be challenging. Thus, data privacy and security concerns are impeding the market's growth.

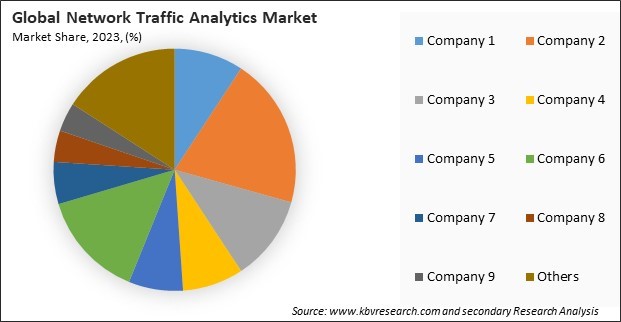

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Mergers & Acquisition.

Based on component, the market is divided into solution and services. The services segment procured a 35% revenue share in the market in 2023. Network traffic analytics often requires specialized knowledge and expertise to implement and manage effectively. Organizations increasingly seek professional services to guide them through the complex processes of setting up and optimizing analytics tools.

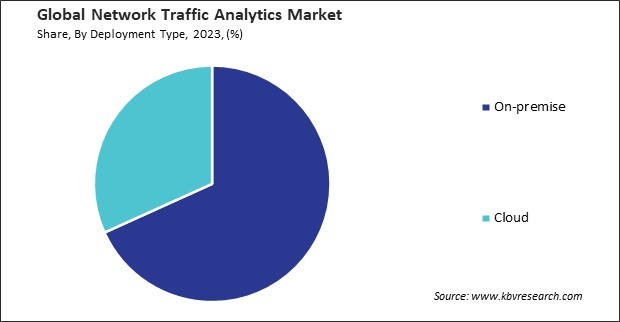

On the basis of deployment type, the market is segmented into on-premise and cloud. The on-premise segment recorded a 68% revenue share in the market in 2023. On-premise solutions provide organizations with full control over their data and network infrastructure. This is crucial for businesses dealing with sensitive or confidential information, where ensuring data security and privacy is paramount.

Based on end user, the market is categorized into enterprises, service providers, and data center. The service providers segment witnessed a 35% revenue share in the in 2023. Service providers need to ensure high-quality service and optimal performance for their customers. Network Traffic Analytics allows for real-time monitoring of network performance, helping identify and quickly resolve issues affecting customer experience. Analytics tools help manage quality of service (QoS) by monitoring and prioritizing traffic based on application type, user requirements, and service level agreements (SLAs).

By organization size, the market is bifurcated into small & medium-sized enterprises and large enterprise. In 2023, the large enterprise segment registered a 61% revenue share in the market. Large enterprises often operate complex and extensive network infrastructures span multiple locations, data centers, and remote offices. Network Traffic Analytics provides the tools to monitor and manage these vast networks effectively. Large enterprises use many network components, including routers, switches, firewalls, and cloud services.

Free Valuable Insights: Global Network Traffic Analytics Market size to reach USD 4.6 Billion by 2031

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region witnessed a 38% revenue share in the market 2023. North America, especially the United States and Canada, is home to some of the world's most advanced and complex network infrastructures. Network Traffic Analytics is essential for managing and optimizing these sophisticated environments, which include extensive data centers, cloud services, and high-speed networks.

The Network Traffic Analytics market is highly competitive, driven by rising network security demands and increasing data traffic. Key players focus on real-time monitoring, AI, and cloud-based solutions, while smaller firms innovate in niche areas. Market growth is fueled by digital transformation, IoT expansion, and evolving cyber threats.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 2.5 Billion |

| Market size forecast in 2031 | USD 4.6 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 8.2% from 2024 to 2031 |

| Number of Pages | 266 |

| Number of Tables | 413 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Component, Deployment Type, Organization Size, End User, Region |

| Country scope |

|

| Companies Included | Accenture PLC, Cisco Systems, Inc., Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), IBM Corporation, Juniper Networks, Inc., Microsoft Corporation, Nokia Corporation, Broadcom, Inc. (Symantec Corporation), Allot Ltd., Palo Alto Networks, Inc. |

By Component

By Deployment Type

By End User

By Organization Size

By Geography

This Market size is expected to reach $4.6 billion by 2031.

Surge In Data Traffic and Network Complexity are driving the Market in coming years, however, High Implementation and Maintenance Costs restraints the growth of the Market.

Accenture PLC, Cisco Systems, Inc., Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), IBM Corporation, Juniper Networks, Inc., Microsoft Corporation, Nokia Corporation, Broadcom, Inc. (Symantec Corporation), Allot Ltd., Palo Alto Networks, Inc.

The expected CAGR of this Market is 8.2% from 2024 to 2031.

The Solution segment generated the highest revenue in the Market by Component in 2023; thereby, achieving a market value of $2.9 billion by 2031.

The North America region dominated the Market by Region in 2023; thereby, achieving a market value of $1.6 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges