North America Alfalfa Seeds Market Size, Share & Trends Analysis Report By Type (Non-Dormant Seed, and Dormant Seed), By Application (Agriculture, Health Food, and Others), By Country and Growth Forecast, 2024 - 2031

Published Date : 24-May-2024 |

Pages: 102 |

Formats: PDF |

COVID-19 Impact on the North America Alfalfa Seeds Market

The North America Alfalfa Seeds Market would witness market growth of 6.7% CAGR during the forecast period (2024-2031). In the year 2020, the North America market's volume surged to 4,769.60 Tonnes, showcasing a growth of 15.8% (2020-2023).

Dormant seeds are those that do not germinate immediately upon planting, even under favourable conditions, due to their hard seed coat that resists water absorption and gas exchange. This trait is particularly valued in alfalfa cultivation, as it allows for a staggered germination process, providing a more extended period of emergence and establishing a resilient stand over time. Thus, Canada market utilized 452.66 Tonnes of dormant alfalfa seeds in the market in 2023.

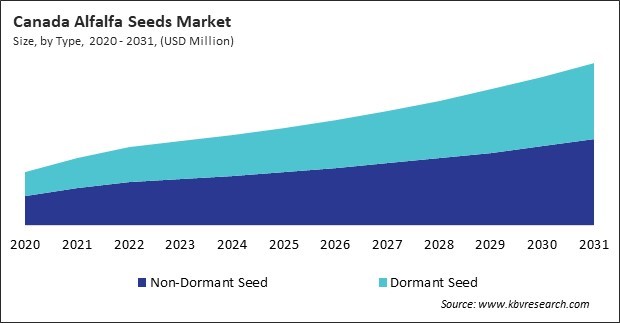

The US market dominated the North America Alfalfa Seeds Market by Country in 2023 and would continue to be a dominant market till 2031; thereby, achieving a market value of $153.4 Million by 2031. The Canada market is experiencing a CAGR of 8.7% during (2024 - 2031). Additionally, The Mexico market would exhibit a CAGR of 8% during (2024 - 2031).

The presence and dynamics of the livestock industry also influence the adoption of alfalfa seeds. Regions with a strong dairy, beef, or sheep industry often have higher demand for high-quality forage crops like alfalfa, leading to increased adoption among farmers. Livestock producers prioritizing animal nutrition, productivity, and health are more inclined to incorporate alfalfa into their feeding programs.

Additionally, the alfalfa seeds market is shaped by evolving trends and dynamics that reflect broader agricultural shifts, consumer preferences, sustainability initiatives, and technological innovations. For instance, the growing demand of plant-based diets and vegetarian lifestyles has fueled demand for plant-derived protein sources, including alfalfa. As consumers seek alternatives to animal-derived products, alfalfa seeds offer a plant-based protein option with nutritional benefits and culinary versatility. The rise of plant-based diets is expected to drive demand for alfalfa seeds in human nutrition and livestock feed sectors.

As agriculture expands across Canada, forage production, including alfalfa cultivation, may expand to meet the feed requirements of livestock. Increased acreage devoted to forage crops like alfalfa could drive up demand for alfalfa seeds in Canada. According to the Government of Canada, over the last 50 years, the average farm size in Canada has nearly doubled, reaching 62.2 million hectares, which represents 6.2% of the country’s land area. Therefore, the rising agriculture sector and the increasing food processing industry in the region drive the market’s growth.

Free Valuable Insights: The Alfalfa Seeds Market is Predict to reach USD 804.2 Million by 2031, at a CAGR of 6.9%

Based on Type, the market is segmented into Non-Dormant Seed, and Dormant Seed. Based on Application, the market is segmented into Agriculture, Health Food, and Others. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- Allied Seed, LLC

- Bayer AG

- S&W Seed Company

- Royal Barenbrug Group

- Nutrien Ltd. (Dyna-Gro Seed)

- Great Basin Seed

- DLF Seeds A/S

- Forage Genetics International, LLC

- The Dow Chemical Company

- Syngenta Crop Protection AG

North America Alfalfa Seeds Market Report Segmentation

"By Type (Volume, Tonnes, USD Million, 2020-31)

- Non-Dormant Seed

- Dormant Seed

By Application (Volume, Tonnes, USD Million, 2020-31)

- Agriculture

- Health Food

- Others

By Country (Volume, Tonnes, USD Million, 2020-31)

- US

- Canada

- Mexico

- Rest of North America

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 North America Alfalfa Seeds Market, by Type

1.4.2 North America Alfalfa Seeds Market, by Application

1.4.3 North America Alfalfa Seeds Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

3.3 Porter’s Five Forces Analysis

Chapter 4. Recent Strategies Deployed in Alfalfa Seeds Market

Chapter 5. North America Alfalfa Seeds Market by Type

5.1 North America Non-Dormant Seed Market by Region

5.2 North America Dormant Seed Market by Region

Chapter 6. North America Alfalfa Seeds Market by Application

6.1 North America Agriculture Market by Country

6.2 North America Health Food Market by Country

6.3 North America Others Market by Country

Chapter 7. North America Alfalfa Seeds Market by Country

7.1 US Alfalfa Seeds Market

7.1.1 US Alfalfa Seeds Market by Type

7.1.2 US Alfalfa Seeds Market by Application

7.2 Canada Alfalfa Seeds Market

7.2.1 Canada Alfalfa Seeds Market by Type

7.2.2 Canada Alfalfa Seeds Market by Application

7.3 Mexico Alfalfa Seeds Market

7.3.1 Mexico Alfalfa Seeds Market by Type

7.3.2 Mexico Alfalfa Seeds Market by Application

7.4 Rest of North America Alfalfa Seeds Market

7.4.1 Rest of North America Alfalfa Seeds Market by Type

7.4.2 Rest of North America Alfalfa Seeds Market by Application

Chapter 8. Company Profiles

8.1 Allied Seed, LLC

8.1.1 Company Overview

8.1.2 SWOT Analysis

8.2 Bayer AG

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Segmental and Regional Analysis

8.2.4 Research & Development Expense

8.2.5 Recent strategies and developments:

8.2.5.1 Partnerships, Collaborations, and Agreements:

8.2.6 SWOT Analysis

8.3 S&W Seed Company

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Regional Analysis

8.3.4 Research & Development Expense

8.3.5 Recent strategies and developments:

8.3.5.1 Acquisition and Mergers:

8.3.6 SWOT Analysis

8.4 Royal Barenbrug Group

8.4.1 Company Overview

8.4.2 Recent strategies and developments:

8.4.2.1 Acquisition and Mergers:

8.4.3 SWOT Analysis

8.5 Nutrien Ltd. (Dyna-Gro Seed)

8.5.1 Company Overview

8.5.2 SWOT Analysis

8.6 Great Basin Seed

8.6.1 Company Overview

8.6.2 SWOT Analysis

8.7 DLF Seeds A/S

8.7.1 Company Overview

8.7.2 Recent strategies and developments:

8.7.2.1 Acquisition and Mergers:

8.7.3 SWOT Analysis

8.8 Forage Genetics International, LLC

8.8.1 Company Overview

8.8.2 SWOT Analysis

8.9 The Dow Chemical Company

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Segmental and Regional Analysis

8.9.4 Research & Development Expenses

8.9.5 SWOT Analysis

8.10. Syngenta Crop Protection AG

8.10.1 Company Overview

8.10.2 Recent strategies and developments:

8.10.2.1 Product Launches and Product Expansions:

8.10.3 SWOT Analysis

TABLE 2 North America Alfalfa Seeds Market, 2024 - 2031, USD Million

TABLE 3 North America Alfalfa Seeds Market, 2020 - 2023, Tonnes

TABLE 4 North America Alfalfa Seeds Market, 2024 - 2031, Tonnes

TABLE 5 North America Alfalfa Seeds Market by Type, 2020 - 2023, USD Million

TABLE 6 North America Alfalfa Seeds Market by Type, 2024 - 2031, USD Million

TABLE 7 North America Alfalfa Seeds Market by Type, 2020 - 2023, Tonnes

TABLE 8 North America Alfalfa Seeds Market by Type, 2024 - 2031, Tonnes

TABLE 9 North America Non-Dormant Seed Market by Region, 2020 - 2023, USD Million

TABLE 10 North America Non-Dormant Seed Market by Region, 2024 - 2031, USD Million

TABLE 11 North America Non-Dormant Seed Market by Region, 2020 - 2023, Tonnes

TABLE 12 North America Non-Dormant Seed Market by Region, 2024 - 2031, Tonnes

TABLE 13 North America Dormant Seed Market by Region, 2020 - 2023, USD Million

TABLE 14 North America Dormant Seed Market by Region, 2024 - 2031, USD Million

TABLE 15 North America Dormant Seed Market by Region, 2020 - 2023, Tonnes

TABLE 16 North America Dormant Seed Market by Region, 2024 - 2031, Tonnes

TABLE 17 North America Alfalfa Seeds Market by Application, 2020 - 2023, USD Million

TABLE 18 North America Alfalfa Seeds Market by Application, 2024 - 2031, USD Million

TABLE 19 North America Alfalfa Seeds Market by Application, 2020 - 2023, Tonnes

TABLE 20 North America Alfalfa Seeds Market by Application, 2024 - 2031, Tonnes

TABLE 21 North America Agriculture Market by Country, 2020 - 2023, USD Million

TABLE 22 North America Agriculture Market by Country, 2024 - 2031, USD Million

TABLE 23 North America Agriculture Market by Country, 2020 - 2023, Tonnes

TABLE 24 North America Agriculture Market by Country, 2024 - 2031, Tonnes

TABLE 25 North America Health Food Market by Country, 2020 - 2023, USD Million

TABLE 26 North America Health Food Market by Country, 2024 - 2031, USD Million

TABLE 27 North America Health Food Market by Country, 2020 - 2023, Tonnes

TABLE 28 North America Health Food Market by Country, 2024 - 2031, Tonnes

TABLE 29 North America Others Market by Country, 2020 - 2023, USD Million

TABLE 30 North America Others Market by Country, 2024 - 2031, USD Million

TABLE 31 North America Others Market by Country, 2020 - 2023, Tonnes

TABLE 32 North America Others Market by Country, 2024 - 2031, Tonnes

TABLE 33 North America Alfalfa Seeds Market by Country, 2020 - 2023, USD Million

TABLE 34 North America Alfalfa Seeds Market by Country, 2024 - 2031, USD Million

TABLE 35 North America Alfalfa Seeds Market by Country, 2020 - 2023, Tonnes

TABLE 36 North America Alfalfa Seeds Market by Country, 2024 - 2031, Tonnes

TABLE 37 US Alfalfa Seeds Market, 2020 - 2023, USD Million

TABLE 38 US Alfalfa Seeds Market, 2024 - 2031, USD Million

TABLE 39 US Alfalfa Seeds Market, 2020 - 2023, Tonnes

TABLE 40 US Alfalfa Seeds Market, 2024 - 2031, Tonnes

TABLE 41 US Alfalfa Seeds Market by Type, 2020 - 2023, USD Million

TABLE 42 US Alfalfa Seeds Market by Type, 2024 - 2031, USD Million

TABLE 43 US Alfalfa Seeds Market by Type, 2020 - 2023, Tonnes

TABLE 44 US Alfalfa Seeds Market by Type, 2024 - 2031, Tonnes

TABLE 45 US Alfalfa Seeds Market by Application, 2020 - 2023, USD Million

TABLE 46 US Alfalfa Seeds Market by Application, 2024 - 2031, USD Million

TABLE 47 US Alfalfa Seeds Market by Application, 2020 - 2023, Tonnes

TABLE 48 US Alfalfa Seeds Market by Application, 2024 - 2031, Tonnes

TABLE 49 Canada Alfalfa Seeds Market, 2020 - 2023, USD Million

TABLE 50 Canada Alfalfa Seeds Market, 2024 - 2031, USD Million

TABLE 51 Canada Alfalfa Seeds Market, 2020 - 2023, Tonnes

TABLE 52 Canada Alfalfa Seeds Market, 2024 - 2031, Tonnes

TABLE 53 Canada Alfalfa Seeds Market by Type, 2020 - 2023, USD Million

TABLE 54 Canada Alfalfa Seeds Market by Type, 2024 - 2031, USD Million

TABLE 55 Canada Alfalfa Seeds Market by Type, 2020 - 2023, Tonnes

TABLE 56 Canada Alfalfa Seeds Market by Type, 2024 - 2031, Tonnes

TABLE 57 Canada Alfalfa Seeds Market by Application, 2020 - 2023, USD Million

TABLE 58 Canada Alfalfa Seeds Market by Application, 2024 - 2031, USD Million

TABLE 59 Canada Alfalfa Seeds Market by Application, 2020 - 2023, Tonnes

TABLE 60 Canada Alfalfa Seeds Market by Application, 2024 - 2031, Tonnes

TABLE 61 Mexico Alfalfa Seeds Market, 2020 - 2023, USD Million

TABLE 62 Mexico Alfalfa Seeds Market, 2024 - 2031, USD Million

TABLE 63 Mexico Alfalfa Seeds Market, 2020 - 2023, Tonnes

TABLE 64 Mexico Alfalfa Seeds Market, 2024 - 2031, Tonnes

TABLE 65 Mexico Alfalfa Seeds Market by Type, 2020 - 2023, USD Million

TABLE 66 Mexico Alfalfa Seeds Market by Type, 2024 - 2031, USD Million

TABLE 67 Mexico Alfalfa Seeds Market by Type, 2020 - 2023, Tonnes

TABLE 68 Mexico Alfalfa Seeds Market by Type, 2024 - 2031, Tonnes

TABLE 69 Mexico Alfalfa Seeds Market by Application, 2020 - 2023, USD Million

TABLE 70 Mexico Alfalfa Seeds Market by Application, 2024 - 2031, USD Million

TABLE 71 Mexico Alfalfa Seeds Market by Application, 2020 - 2023, Tonnes

TABLE 72 Mexico Alfalfa Seeds Market by Application, 2024 - 2031, Tonnes

TABLE 73 Rest of North America Alfalfa Seeds Market, 2020 - 2023, USD Million

TABLE 74 Rest of North America Alfalfa Seeds Market, 2024 - 2031, USD Million

TABLE 75 Rest of North America Alfalfa Seeds Market, 2020 - 2023, Tonnes

TABLE 76 Rest of North America Alfalfa Seeds Market, 2024 - 2031, Tonnes

TABLE 77 Rest of North America Alfalfa Seeds Market by Type, 2020 - 2023, USD Million

TABLE 78 Rest of North America Alfalfa Seeds Market by Type, 2024 - 2031, USD Million

TABLE 79 Rest of North America Alfalfa Seeds Market by Type, 2020 - 2023, Tonnes

TABLE 80 Rest of North America Alfalfa Seeds Market by Type, 2024 - 2031, Tonnes

TABLE 81 Rest of North America Alfalfa Seeds Market by Application, 2020 - 2023, USD Million

TABLE 82 Rest of North America Alfalfa Seeds Market by Application, 2024 - 2031, USD Million

TABLE 83 Rest of North America Alfalfa Seeds Market by Application, 2020 - 2023, Tonnes

TABLE 84 Rest of North America Alfalfa Seeds Market by Application, 2024 - 2031, Tonnes

TABLE 85 Key Information – Allied Seed, LLC

TABLE 86 Key Information – Bayer AG

TABLE 87 Key Information –-S&W Seed Company

TABLE 88 Key Information – Royal Barenbrug Group

TABLE 89 Key Information – Nutrien Ltd.

TABLE 90 Key Information – Great Basin Seed

TABLE 91 Key Information – DLF Seeds A/S

TABLE 92 Key Information – Forage Genetics International, LLC

TABLE 93 Key Information – The Dow Chemical Company

TABLE 94 Key Information – Syngenta Crop Protection AG

List of Figures

FIG 1 Methodology for the research

FIG 2 North America Alfalfa Seeds Market, 2020 - 2031, USD Million

FIG 3 Key Factors Impacting Alfalfa Seeds Market

FIG 4 Porter’s Five Forces Analysis - Alfalfa Seeds Market

FIG 5 North America Alfalfa Seeds Market share by Type, 2023

FIG 6 North America Alfalfa Seeds Market share by Type, 2031

FIG 7 North America Alfalfa Seeds Market by Type, 2020 - 2031, USD Million

FIG 8 North America Alfalfa Seeds Market share by Application, 2023

FIG 9 North America Alfalfa Seeds Market share by Application, 2031

FIG 10 North America Alfalfa Seeds Market by Application, 2020 - 2031, USD Million

FIG 11 North America Alfalfa Seeds Market share by Country, 2023

FIG 12 North America Alfalfa Seeds Market share by Country, 2031

FIG 13 North America Alfalfa Seeds Market by Country, 2020 - 2031, USD Million

FIG 14 SWOT Analysis: Allied Seed, L.L.C.

FIG 15 Swot Analysis: Bayer AG

FIG 16 SWOT Analysis: S&W Seed Company

FIG 17 SWOT Analysis: Royal Barenbrug Group

FIG 18 SWOT Analysis: Nutrien Ltd.

FIG 19 SWOT Analysis: Great Basin Seed

FIG 20 SWOT Analysis: DLF Seeds A/S

FIG 21 SWOT Analysis: Forage Genetics International, LLC

FIG 22 SWOT Analysis: The Dow Chemical Company

FIG 23 SWOT Analysis: Syngenta Crop Protection AG