The North America ASIC Chip Market would witness market growth of 7.5% CAGR during the forecast period (2023-2030).

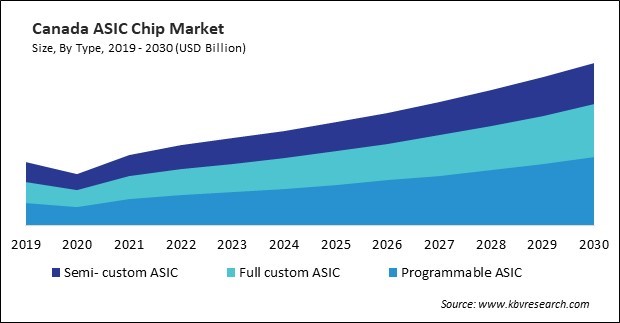

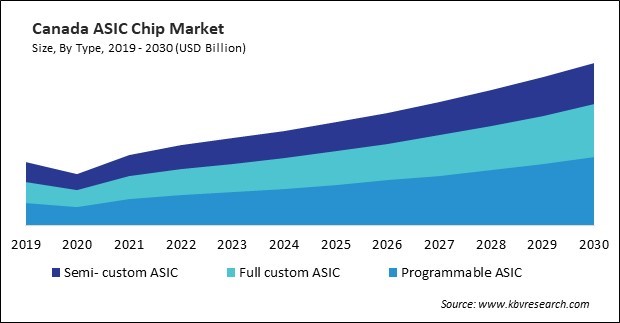

The US market dominated the North America ASIC Chip Market by Country in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $7,201.5 million by 2030. The Canada market is showcasing a CAGR of 9.9% during (2023 - 2030). Additionally, The Mexico market would register a CAGR of 8.9% during (2023 - 2030).

As the demand for edge computing intensifies, innovations in ASICs cater to the specific needs of edge devices. Specialized ASICs designed for edge AI applications, including inference engines and neural processing units (NPUs), exemplify the industry's commitment to delivering high-performance computing at the edge of networks. Edge devices operate in diverse and resource-constrained environments, necessitating specialized solutions to meet their unique computational demands. ASICs designed for edge computing are crafted to deliver optimal performance while considering power efficiency, compact form factors, and the ability to operate in harsh conditions.

Additionally, security innovations in ASICs address the growing concerns related to cybersecurity. Secure elements embedded within ASIC designs enhance the protection of sensitive data and cryptographic operations, making ASICs more resilient to potential security threats. Cryptographic operations form a cornerstone of many secure applications, including secure communication, digital signatures, and data encryption. ASICs with embedded secure elements enhance the execution of cryptographic algorithms, bolstering the overall security of these operations. This is particularly vital in industries where data integrity and authenticity are paramount.

In addition, Canada has a robust aerospace manufacturing sector with companies involved in producing aircraft components, avionics, and satellite technologies. The demand for ASIC chips in avionics systems, navigation equipment, and communication systems is driven by the need for innovative and high-performance solutions. As per the data from the Government of Canada, the regional development agencies (RDAs) of Canada implemented the Aerospace Regional Recovery Initiative (ARRI) with a total budget of $250 million over three years (until March 31, 2024). It served as a supplement to the assistance extended to the aerospace sector via the Strategic Innovation Fund and Canada’s COVID-19 Economic Response Plan, respectively, by Industry, Science, and Economic Development (ISED). Therefore, North America’s growing aerospace and automotive sectors will assist in the growth of the regional ASIC chip market.

Free Valuable Insights: The ASIC Chip Market is Predict to reach USD 35.5 Billion by 2030, at a CAGR of 8.2%

Based on Type, the market is segmented into Semi- custom ASIC, Full custom ASIC, and Programmable ASIC. Based on End User, the market is segmented into Data Processing Systems, Telecommunication Systems, Aerospace Subsystem & Sensors, Consumer Electronics, Medical Instrumentation, and Others. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- Advanced Micro Devices, Inc.

- Samsung Electronics Co., Ltd. (Samsung Group)

- ON Semiconductor Corporation

- Taiwan Semiconductor Manufacturing Company Limited

- NVIDIA Corporation

- Intel Corporation

- Infineon Technologies AG

- Texas Instruments, Inc.

- Seiko Epson Corporation

- BITMAIN Technologies Holding Company

North America ASIC Chip Market Report Segmentation

By Type

- Semi- custom ASIC

- Full custom ASIC

- Programmable ASIC

By End User

- Data Processing Systems

- Telecommunication Systems

- Aerospace Subsystem & Sensors

- Consumer Electronics

- Medical Instrumentation

- Others

By Country

- US

- Canada

- Mexico

- Rest of North America

Chapter 1. Market Scope & Methodology

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 North America ASIC Chip Market, by Type

1.4.2 North America ASIC Chip Market, by End User

1.4.3 North America ASIC Chip Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Competition Analysis - Global

4.1 KBV Cardinal Matrix

4.2 Recent Industry Wide Strategic Developments

4.2.1 Partnerships, Collaborations and Agreements

4.2.2 Product Launches and Product Expansions

4.2.3 Acquisition and Mergers

4.3 Market Share Analysis, 2022

4.4 Top Winning Strategies

4.4.1 Key Leading Strategies: Percentage Distribution (2019-2023)

4.4.2 Key Strategic Move: (Partnerships, Collaborations & Agreements: 2024, Feb – 2019, Feb) Leading Players

4.5 Porter Five Forces Analysis

Chapter 5. North America ASIC Chip Market by Type

5.1 North America Semi- custom ASIC Market by Country

5.2 North America Full custom ASIC Market by Country

5.3 North America Programmable ASIC Market by Country

Chapter 6. North America ASIC Chip Market by End User

6.1 North America Data Processing Systems Market by Country

6.2 North America Telecommunication Systems Market by Country

6.3 North America Aerospace Subsystem & Sensors Market by Country

6.4 North America Consumer Electronics Market by Country

6.5 North America Medical Instrumentation Market by Country

6.6 North America Others Market by Country

Chapter 7. North America ASIC Chip Market by Country

7.1 US ASIC Chip Market

7.1.1 US ASIC Chip Market by Type

7.1.2 US ASIC Chip Market by End User

7.2 Canada ASIC Chip Market

7.2.1 Canada ASIC Chip Market by Type

7.2.2 Canada ASIC Chip Market by End User

7.3 Mexico ASIC Chip Market

7.3.1 Mexico ASIC Chip Market by Type

7.3.2 Mexico ASIC Chip Market by End User

7.4 Rest of North America ASIC Chip Market

7.4.1 Rest of North America ASIC Chip Market by Type

7.4.2 Rest of North America ASIC Chip Market by End User

Chapter 8. Company Profiles

8.1 Advanced Micro Devices, Inc.

8.1.1 Company Overview

8.1.2 Financial Analysis

8.1.3 Segmental and Regional Analysis

8.1.4 Research & Development Expenses

8.1.5 Recent strategies and developments:

8.1.5.1 Product Launches and Product Expansions:

8.1.5.2 Acquisition and Mergers:

8.1.6 SWOT Analysis

8.2 Samsung Electronics Co., Ltd. (Samsung Group)

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Segmental and Regional Analysis

8.2.4 Recent strategies and developments:

8.2.4.1 Partnerships, Collaborations, and Agreements:

8.2.5 SWOT Analysis

8.3 ON Semiconductor Corporation

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Segmental and Regional Analysis

8.3.4 Research & Development Expense

8.3.5 Recent strategies and developments:

8.3.5.1 Partnerships, Collaborations, and Agreements:

8.3.5.2 Acquisition and Mergers:

8.3.6 SWOT Analysis

8.4 Taiwan Semiconductor Manufacturing Company Limited

8.4.1 Company overview

8.4.2 Financial Analysis

8.4.3 Regional Analysis

8.4.4 Research & Development Expenses

8.4.5 SWOT Analysis

8.5 NVIDIA Corporation

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Segmental and Regional Analysis

8.5.4 Research & Development Expenses

8.5.5 Recent strategies and developments:

8.5.5.1 Acquisition and Mergers:

8.6 Intel Corporation

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Segmental and Regional Analysis

8.6.4 Research & Development Expenses

8.6.5 Recent strategies and developments:

8.6.5.1 Partnerships, Collaborations, and Agreements:

8.6.5.2 Product Launches and Product Expansions:

8.6.5.3 Acquisition and Mergers:

8.6.6 SWOT Analysis

8.7 Infineon Technologies AG

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Segmental and Regional Analysis

8.7.4 Research & Development Expense

8.7.5 Recent strategies and developments:

8.7.5.1 Partnerships, Collaborations, and Agreements:

8.7.5.2 Product Launches and Product Expansions:

8.7.5.3 Acquisition and Mergers:

8.7.6 SWOT Analysis

8.8 Texas Instruments, Inc.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Segmental and Regional Analysis

8.8.4 Research & Development Expense

8.8.5 SWOT Analysis

8.9 Seiko Epson Corporation

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Segmental and Regional Analysis

8.9.4 Research & Development Expenses

8.9.5 SWOT Analysis

8.10. BITMAIN Technologies Holding Company

8.10.1 Company Overview

8.10.2 Recent strategies and developments:

8.10.2.1 Partnerships, Collaborations, and Agreements:

8.10.2.2 Product Launches and Product Expansions:

8.10.3 SWOT Analysis

TABLE 1 North America ASIC Chip Market, 2019 - 2022, USD Million

TABLE 2 North America ASIC Chip Market, 2023 - 2030, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– ASIC Chip Market

TABLE 4 Product Launches And Product Expansions– ASIC Chip Market

TABLE 5 Acquisition and Mergers– ASIC Chip Market

TABLE 6 North America ASIC Chip Market by Type, 2019 - 2022, USD Million

TABLE 7 North America ASIC Chip Market by Type, 2023 - 2030, USD Million

TABLE 8 North America Semi- custom ASIC Market by Country, 2019 - 2022, USD Million

TABLE 9 North America Semi- custom ASIC Market by Country, 2023 - 2030, USD Million

TABLE 10 North America Full custom ASIC Market by Country, 2019 - 2022, USD Million

TABLE 11 North America Full custom ASIC Market by Country, 2023 - 2030, USD Million

TABLE 12 North America Programmable ASIC Market by Country, 2019 - 2022, USD Million

TABLE 13 North America Programmable ASIC Market by Country, 2023 - 2030, USD Million

TABLE 14 North America ASIC Chip Market by End User, 2019 - 2022, USD Million

TABLE 15 North America ASIC Chip Market by End User, 2023 - 2030, USD Million

TABLE 16 North America Data Processing Systems Market by Country, 2019 - 2022, USD Million

TABLE 17 North America Data Processing Systems Market by Country, 2023 - 2030, USD Million

TABLE 18 North America Telecommunication Systems Market by Country, 2019 - 2022, USD Million

TABLE 19 North America Telecommunication Systems Market by Country, 2023 - 2030, USD Million

TABLE 20 North America Aerospace Subsystem & Sensors Market by Country, 2019 - 2022, USD Million

TABLE 21 North America Aerospace Subsystem & Sensors Market by Country, 2023 - 2030, USD Million

TABLE 22 North America Consumer Electronics Market by Country, 2019 - 2022, USD Million

TABLE 23 North America Consumer Electronics Market by Country, 2023 - 2030, USD Million

TABLE 24 North America Medical Instrumentation Market by Country, 2019 - 2022, USD Million

TABLE 25 North America Medical Instrumentation Market by Country, 2023 - 2030, USD Million

TABLE 26 North America Others Market by Country, 2019 - 2022, USD Million

TABLE 27 North America Others Market by Country, 2023 - 2030, USD Million

TABLE 28 North America ASIC Chip Market by Country, 2019 - 2022, USD Million

TABLE 29 North America ASIC Chip Market by Country, 2023 - 2030, USD Million

TABLE 30 US ASIC Chip Market, 2019 - 2022, USD Million

TABLE 31 US ASIC Chip Market, 2023 - 2030, USD Million

TABLE 32 US ASIC Chip Market by Type, 2019 - 2022, USD Million

TABLE 33 US ASIC Chip Market by Type, 2023 - 2030, USD Million

TABLE 34 US ASIC Chip Market by End User, 2019 - 2022, USD Million

TABLE 35 US ASIC Chip Market by End User, 2023 - 2030, USD Million

TABLE 36 Canada ASIC Chip Market, 2019 - 2022, USD Million

TABLE 37 Canada ASIC Chip Market, 2023 - 2030, USD Million

TABLE 38 Canada ASIC Chip Market by Type, 2019 - 2022, USD Million

TABLE 39 Canada ASIC Chip Market by Type, 2023 - 2030, USD Million

TABLE 40 Canada ASIC Chip Market by End User, 2019 - 2022, USD Million

TABLE 41 Canada ASIC Chip Market by End User, 2023 - 2030, USD Million

TABLE 42 Mexico ASIC Chip Market, 2019 - 2022, USD Million

TABLE 43 Mexico ASIC Chip Market, 2023 - 2030, USD Million

TABLE 44 Mexico ASIC Chip Market by Type, 2019 - 2022, USD Million

TABLE 45 Mexico ASIC Chip Market by Type, 2023 - 2030, USD Million

TABLE 46 Mexico ASIC Chip Market by End User, 2019 - 2022, USD Million

TABLE 47 Mexico ASIC Chip Market by End User, 2023 - 2030, USD Million

TABLE 48 Rest of North America ASIC Chip Market, 2019 - 2022, USD Million

TABLE 49 Rest of North America ASIC Chip Market, 2023 - 2030, USD Million

TABLE 50 Rest of North America ASIC Chip Market by Type, 2019 - 2022, USD Million

TABLE 51 Rest of North America ASIC Chip Market by Type, 2023 - 2030, USD Million

TABLE 52 Rest of North America ASIC Chip Market by End User, 2019 - 2022, USD Million

TABLE 53 Rest of North America ASIC Chip Market by End User, 2023 - 2030, USD Million

TABLE 54 Key information – Advanced Micro Devices, Inc.

TABLE 55 Key Information – Samsung Electronics Co., Ltd.

TABLE 56 Key Information – ON Semiconductor Corporation

TABLE 57 Key Information– Taiwan Semiconductor Manufacturing Company Limited

TABLE 58 Key Information – NVIDIA Corporation

TABLE 59 Key Information – Intel Corporation

TABLE 60 Key Information – Infineon Technologies AG

TABLE 61 Key Information – Texas Instruments, Inc.

TABLE 62 Key Information – Seiko Epson Corporation

TABLE 63 Key Information – BITMAIN Technologies Holding Company

List of Figures

FIG 1 Methodology for the research

FIG 2 North America ASIC Chip Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting ASIC Chip Market

FIG 4 KBV Cardinal Matrix

FIG 5 Market Share Analysis, 2022

FIG 6 Key Leading Strategies: Percentage Distribution (2019-2023)

FIG 7 Key Strategic Move: (Partnerships, Collaborations & Agreements: 2024, Feb – 2019, Feb) Leading Players

FIG 8 Porter’s Five Forces Analysis – ASIC Chip Market

FIG 9 North America ASIC Chip Market share by Type, 2022

FIG 10 North America ASIC Chip Market share by Type, 2030

FIG 11 North America ASIC Chip Market by Type, 2019 - 2030, USD Million

FIG 12 North America ASIC Chip Market share by End User, 2022

FIG 13 North America ASIC Chip Market share by End User, 2030

FIG 14 North America ASIC Chip Market by End User, 2019 - 2030, USD Million

FIG 15 North America ASIC Chip Market share by Country, 2022

FIG 16 North America ASIC Chip Market share by Country, 2030

FIG 17 North America ASIC Chip Market by Country, 2019 - 2030, USD Million

FIG 18 Recent strategies and developments: Advanced Micro Devices, Inc.

FIG 19 SWOT Analysis: Advanced Micro Devices, Inc.

FIG 20 SWOT Analysis: Samsung Electronics Co., Ltd

FIG 21 Recent strategies and developments: ON Semiconductor Corporation

FIG 22 SWOT Analysis: ON Semiconductor Corporation

FIG 23 SWOT Analysis: Taiwan Semiconductor Manufacturing Company Limited

FIG 24 SWOT Analysis: NVIDIA Corporation

FIG 25 Recent strategies and developments: Intel Corporation

FIG 26 SWOT Analysis: Intel corporation

FIG 27 Recent strategies and developments: Infineon Technologies AG

FIG 28 SWOT Analysis: Infineon Technologies AG

FIG 29 SWOT Analysis: Texas Instruments, Inc.

FIG 30 SWOT Analysis: Seiko Epson Corporation

FIG 31 Recent strategies and developments: BITMAIN Technologies Holding Company

FIG 32 SWOT Analysis: BITMAIN Technologies Holding Company