North America Ceramide Market Size, Share & Trends Analysis Report By Application (Cosmetics, Food, and Others), By Process (Plant Extract, and Fermentation), By Type (Natural, and Synthetic), By Country and Growth Forecast, 2023 - 2030

Published Date : 29-Mar-2024 |

Pages: 118 |

Formats: PDF |

COVID-19 Impact on the North America Ceramide Market

The North America Ceramide Market would witness market growth of 5.1% CAGR during the forecast period (2023-2030). In the year 2019, the North America market's volume surged to 108.47 tonnes, showcasing a growth of 2.4% (2019-2022).

Cosmetics infused with ceramides have become popular in the skincare industry due to their ability to address various skin concerns effectively. Ceramides, being natural components of the skin's outermost layer, play a crucial role in maintaining skin hydration and integrity. In cosmetics, it is incorporated into formulations such as moisturizers, serums, creams, and masks to enhance the skin's barrier function, improve moisture retention, and promote overall skin health. Therefore, the US market consumed 52.63 tonnes of Ceramide in Cosmetics in 2022.

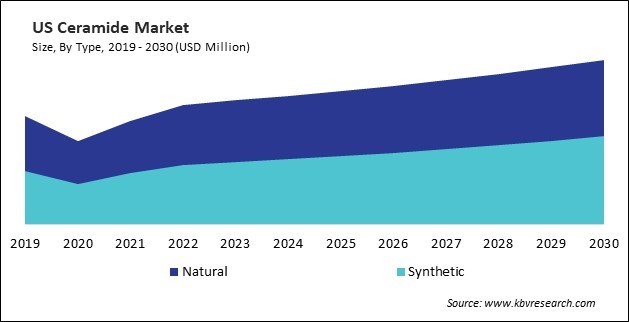

The US market dominated the North America Ceramide Market, By Country in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $26,261.2 Thousands by 2030. The Canada market is experiencing a CAGR of 7.5% during (2023 - 2030). Additionally, The Mexico market would exhibit a CAGR of 6.6% during (2023 - 2030).

With the rise of personalized skincare regimens fueled by advancements in digital technology and data analytics, there is a growing demand for its products tailored to individual skin types, concerns, and lifestyles. Companies are leveraging AI-driven algorithms, skin analysis tools, and DNA testing to formulate bespoke skincare solutions that optimize delivery and efficacy for each consumer.

Moreover, these are critical in maintaining skin barrier integrity, hydration, and overall health. Due to their versatility and compatibility with various skin types and conditions, the products are well-suited for personalized skincare formulations. By integrating ceramides into customized skincare regimens, organizations can promote skin health and resilience while addressing particular skin issues, including dehydration, sensitivity, aging, and inflammatory conditions.

The Canadian cosmetics industry is known for its innovation in product formulations. Cosmetic companies in Canada often invest in research and development to create high-quality, effective skincare products. As per the data provided by the International Trade Administration in 2021, the cosmetics sector in Canada generated approximately USD 1.24 billion in revenue. Industry revenue is expected to reach USD 1.8 billion by 2024. Hence, North America’s rising cosmetics and pharmaceutical sectors can lead to an increased demand for ceramides.

Free Valuable Insights: The Ceramide Market is Predict to reach USD 146.0 Million by 2030, at a CAGR of 5.6%

Based on Application, the market is segmented into Cosmetics, Food, and Others. Based on Process, the market is segmented into Plant Extract, and Fermentation. Based on Type, the market is segmented into Natural, and Synthetic. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- Ashland Inc.

- Toyobo Co., Ltd.

- Doosan Corporation

- Arkema S.A.

- Evonik Industries AG (RAG-Stiftung)

- Cayman Chemical Company, Inc.

- Kao Corporation

- Croda International PLC

- Vantage Specialty Chemicals (H.I.G. Capital, LLC)

- Incospam Co., Ltd.

North America Ceramide Market Report Segmentation

By Application (Volume, Tonnes, USD Million, 2019-2030)

- Cosmetics

- Food

- Others

By Process

- Plant Extract

- Fermentation

By Type (Volume, Tonnes, USD Million, 2019-2030)

- Natural

- Synthetic

By Country (Volume, Tonnes, USD Million, 2019-2030)

- US

- Canada

- Mexico

- Rest of North America

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 North America Ceramide Market, by Application

1.4.2 North America Ceramide Market, by Process

1.4.3 North America Ceramide Market, by Type

1.4.4 North America Ceramide Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Opportunities

3.2.3 Market Restraints

3.2.4 Market Challenges

3.3 Porter’s Five Forces Analysis

Chapter 4. Strategies Deployed in Ceramide Market

Chapter 5. North America Ceramide Market, By Application

5.1 North America Cosmetics Market, By Country

5.2 North America Food Market, By Country

5.3 North America Others Market, By Country

Chapter 6. North America Ceramide Market, By Process

6.1 North America Plant Extract Market, By Country

6.2 North America Fermentation Market, By Country

Chapter 7. North America Ceramide Market, By Type

7.1 North America Natural Market, By Country

7.2 North America Synthetic Market, By Country

Chapter 8. North America Ceramide Market, By Country

8.1 US Ceramide Market

8.1.1 US Ceramide Market, By Application

8.1.2 US Ceramide Market, By Process

8.1.3 US Ceramide Market, By Type

8.2 Canada Ceramide Market

8.2.1 Canada Ceramide Market, By Application

8.2.2 Canada Ceramide Market, By Process

8.2.3 Canada Ceramide Market, By Type

8.3 Mexico Ceramide Market

8.3.1 Mexico Ceramide Market, By Application

8.3.2 Mexico Ceramide Market, By Process

8.3.3 Mexico Ceramide Market, By Type

8.4 Rest of North America Ceramide Market

8.4.1 Rest of North America Ceramide Market, By Application

8.4.2 Rest of North America Ceramide Market, By Process

8.4.3 Rest of North America Ceramide Market, By Type

Chapter 9. Company Profiles

9.1 Ashland Inc.

9.1.1 Company Overview

9.1.2 Financial Analysis

9.1.3 Segmental and Regional Analysis

9.1.4 Research & Development Expenses

9.1.5 SWOT Analysis

9.2 Toyobo Co., Ltd.

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Segmental and Regional Analysis

9.2.4 SWOT Analysis

9.3 Doosan Corporation

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Segmental and Regional Analysis

9.3.4 Research & Development Expenses

9.3.5 SWOT Analysis

9.4 Arkema S.A.

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Segmental and Regional Analysis

9.4.4 Research & Development Expenses

9.4.5 Recent strategies and developments:

9.4.5.1 Acquisition and Mergers:

9.4.6 SWOT Analysis

9.5 Evonik Industries AG (RAG-Stiftung)

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Segmental and Regional Analysis

9.5.4 Research & Development Expenses

9.5.5 Recent strategies and developments:

9.5.5.1 Product Launches and Product Expansions:

9.5.5.2 Geographical Expansions:

9.5.6 SWOT Analysis

9.6 Cayman Chemical Company, Inc.

9.6.1 Company Overview

9.6.2 SWOT Analysis

9.7 Kao Corporation

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Segmental and Regional Analysis

9.7.4 Research & Development Expenses

9.7.5 Recent strategies and developments:

9.7.5.1 Product Launches and Product Expansions:

9.7.6 SWOT Analysis

9.8 Croda International PLC

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Segmental and Regional Analysis

9.8.4 Recent strategies and developments:

9.8.4.1 Acquisition and Mergers:

9.8.5 SWOT Analysis

9.9 Vantage Specialty Chemicals (H.I.G. Capital, LLC)

9.9.1 Company Overview

9.9.2 Recent strategies and developments:

9.9.2.1 Partnerships, Collaborations, and Agreements:

9.9.2.2 Geographical Expansions:

9.9.3 SWOT Analysis

9.10. Incospam Co., Ltd.

9.10.1 Company Overview

9.10.2 SWOT Analysis

TABLE 2 North America Ceramide Market, 2023 - 2030, USD Thousands

TABLE 3 North America Ceramide Market, 2019 - 2022, Tonnes

TABLE 4 North America Ceramide Market, 2023 - 2030, Tonnes

TABLE 5 North America Ceramide Market, By Application, 2019 - 2022, USD Thousands

TABLE 6 North America Ceramide Market, By Application, 2023 - 2030, USD Thousands

TABLE 7 North America Ceramide Market, By Application, 2019 - 2022, Tonnes

TABLE 8 North America Ceramide Market, By Application, 2023 - 2030, Tonnes

TABLE 9 North America Cosmetics Market, By Country, 2019 - 2022, USD Thousands

TABLE 10 North America Cosmetics Market, By Country, 2023 - 2030, USD Thousands

TABLE 11 North America Cosmetics Market, By Country, 2019 - 2022, Tonnes

TABLE 12 North America Cosmetics Market, By Country, 2023 - 2030, Tonnes

TABLE 13 North America Food Market, By Country, 2019 - 2022, USD Thousands

TABLE 14 North America Food Market, By Country, 2023 - 2030, USD Thousands

TABLE 15 North America Food Market, By Country, 2019 - 2022, Tonnes

TABLE 16 North America Food Market, By Country, 2023 - 2030, Tonnes

TABLE 17 North America Others Market, By Country, 2019 - 2022, USD Thousands

TABLE 18 North America Others Market, By Country, 2023 - 2030, USD Thousands

TABLE 19 North America Others Market, By Country, 2019 - 2022, Tonnes

TABLE 20 North America Others Market, By Country, 2023 - 2030, Tonnes

TABLE 21 North America Ceramide Market, By Process, 2019 - 2022, USD Thousands

TABLE 22 North America Ceramide Market, By Process, 2023 - 2030, USD Thousands

TABLE 23 North America Plant Extract Market, By Country, 2019 - 2022, USD Thousands

TABLE 24 North America Plant Extract Market, By Country, 2023 - 2030, USD Thousands

TABLE 25 North America Fermentation Market, By Country, 2019 - 2022, USD Thousands

TABLE 26 North America Fermentation Market, By Country, 2023 - 2030, USD Thousands

TABLE 27 North America Ceramide Market, By Type, 2019 - 2022, USD Thousands

TABLE 28 North America Ceramide Market, By Type, 2023 - 2030, USD Thousands

TABLE 29 North America Ceramide Market, By Type, 2019 - 2022, Tonnes

TABLE 30 North America Ceramide Market, By Type, 2023 - 2030, Tonnes

TABLE 31 North America Natural Market, By Country, 2019 - 2022, USD Thousands

TABLE 32 North America Natural Market, By Country, 2023 - 2030, USD Thousands

TABLE 33 North America Natural Market, By Country, 2019 - 2022, Tonnes

TABLE 34 North America Natural Market, By Country, 2023 - 2030, Tonnes

TABLE 35 North America Synthetic Market, By Country, 2019 - 2022, USD Thousands

TABLE 36 North America Synthetic Market, By Country, 2023 - 2030, USD Thousands

TABLE 37 North America Synthetic Market, By Country, 2019 - 2022, Tonnes

TABLE 38 North America Synthetic Market, By Country, 2023 - 2030, Tonnes

TABLE 39 North America Ceramide Market, By Country, 2019 - 2022, USD Thousands

TABLE 40 North America Ceramide Market, By Country, 2023 - 2030, USD Thousands

TABLE 41 North America Ceramide Market, By Country, 2019 - 2022, Tonnes

TABLE 42 North America Ceramide Market, By Country, 2023 - 2030, Tonnes

TABLE 43 US Ceramide Market, 2019 - 2022, USD Thousands

TABLE 44 US Ceramide Market, 2023 - 2030, USD Thousands

TABLE 45 US Ceramide Market, 2019 - 2022, Tonnes

TABLE 46 US Ceramide Market, 2023 - 2030, Tonnes

TABLE 47 US Ceramide Market, By Application, 2019 - 2022, USD Thousands

TABLE 48 US Ceramide Market, By Application, 2023 - 2030, USD Thousands

TABLE 49 US Ceramide Market, By Application, 2019 - 2022, Tonnes

TABLE 50 US Ceramide Market, By Application, 2023 - 2030, Tonnes

TABLE 51 US Ceramide Market, By Process, 2019 - 2022, USD Thousands

TABLE 52 US Ceramide Market, By Process, 2023 - 2030, USD Thousands

TABLE 53 US Ceramide Market, By Type, 2019 - 2022, USD Thousands

TABLE 54 US Ceramide Market, By Type, 2023 - 2030, USD Thousands

TABLE 55 US Ceramide Market, By Type, 2019 - 2022, Tonnes

TABLE 56 US Ceramide Market, By Type, 2023 - 2030, Tonnes

TABLE 57 Canada Ceramide Market, 2019 - 2022, USD Thousands

TABLE 58 Canada Ceramide Market, 2023 - 2030, USD Thousands

TABLE 59 Canada Ceramide Market, 2019 - 2022, Tonnes

TABLE 60 Canada Ceramide Market, 2023 - 2030, Tonnes

TABLE 61 Canada Ceramide Market, By Application, 2019 - 2022, USD Thousands

TABLE 62 Canada Ceramide Market, By Application, 2023 - 2030, USD Thousands

TABLE 63 Canada Ceramide Market, By Application, 2019 - 2022, Tonnes

TABLE 64 Canada Ceramide Market, By Application, 2023 - 2030, Tonnes

TABLE 65 Canada Ceramide Market, By Process, 2019 - 2022, USD Thousands

TABLE 66 Canada Ceramide Market, By Process, 2023 - 2030, USD Thousands

TABLE 67 Canada Ceramide Market, By Type, 2019 - 2022, USD Thousands

TABLE 68 Canada Ceramide Market, By Type, 2023 - 2030, USD Thousands

TABLE 69 Canada Ceramide Market, By Type, 2019 - 2022, Tonnes

TABLE 70 Canada Ceramide Market, By Type, 2023 - 2030, Tonnes

TABLE 71 Mexico Ceramide Market, 2019 - 2022, USD Thousands

TABLE 72 Mexico Ceramide Market, 2023 - 2030, USD Thousands

TABLE 73 Mexico Ceramide Market, 2019 - 2022, Tonnes

TABLE 74 Mexico Ceramide Market, 2023 - 2030, Tonnes

TABLE 75 Mexico Ceramide Market, By Application, 2019 - 2022, USD Thousands

TABLE 76 Mexico Ceramide Market, By Application, 2023 - 2030, USD Thousands

TABLE 77 Mexico Ceramide Market, By Application, 2019 - 2022, Tonnes

TABLE 78 Mexico Ceramide Market, By Application, 2023 - 2030, Tonnes

TABLE 79 Mexico Ceramide Market, By Process, 2019 - 2022, USD Thousands

TABLE 80 Mexico Ceramide Market, By Process, 2023 - 2030, USD Thousands

TABLE 81 Mexico Ceramide Market, By Type, 2019 - 2022, USD Thousands

TABLE 82 Mexico Ceramide Market, By Type, 2023 - 2030, USD Thousands

TABLE 83 Mexico Ceramide Market, By Type, 2019 - 2022, Tonnes

TABLE 84 Mexico Ceramide Market, By Type, 2023 - 2030, Tonnes

TABLE 85 Rest of North America Ceramide Market, 2019 - 2022, USD Thousands

TABLE 86 Rest of North America Ceramide Market, 2023 - 2030, USD Thousands

TABLE 87 Rest of North America Ceramide Market, 2019 - 2022, Tonnes

TABLE 88 Rest of North America Ceramide Market, 2023 - 2030, Tonnes

TABLE 89 Rest of North America Ceramide Market, By Application, 2019 - 2022, USD Thousands

TABLE 90 Rest of North America Ceramide Market, By Application, 2023 - 2030, USD Thousands

TABLE 91 Rest of North America Ceramide Market, By Application, 2019 - 2022, Tonnes

TABLE 92 Rest of North America Ceramide Market, By Application, 2023 - 2030, Tonnes

TABLE 93 Rest of North America Ceramide Market, By Process, 2019 - 2022, USD Thousands

TABLE 94 Rest of North America Ceramide Market, By Process, 2023 - 2030, USD Thousands

TABLE 95 Rest of North America Ceramide Market, By Type, 2019 - 2022, USD Thousands

TABLE 96 Rest of North America Ceramide Market, By Type, 2023 - 2030, USD Thousands

TABLE 97 Rest of North America Ceramide Market, By Type, 2019 - 2022, Tonnes

TABLE 98 Rest of North America Ceramide Market, By Type, 2023 - 2030, Tonnes

TABLE 99 Key Information – Ashland Inc.

TABLE 100 Key Information – TOYOBO CO., LTD.

TABLE 101 Key Information – Doosan Corporation

TABLE 102 Key information – Arkema S.A.

TABLE 103 Key Information – Evonik Industries AG

TABLE 104 Key Information – Cayman Chmeical Company, Inc.

TABLE 105 Key Information – Kao Corporation

TABLE 106 Key Information – Croda International PLC

TABLE 107 Key Information – Vantage Specialty Chemicals

TABLE 108 Key Information – Incospam Co., Ltd.

List of Figures

FIG 1 Methodology for the research

FIG 2 North America Ceramide Market, 2019 - 2030, USD Thousands

FIG 3 Key Factors Impacting Ceramide Market

FIG 4 Porter’s Five Forces Analysis - Ceramide Market

FIG 5 North America Ceramide Market share, By Application, 2022

FIG 6 North America Ceramide Market share, By Application, 2030

FIG 7 North America Ceramide Market, By Application, 2019 - 2030, USD Thousands

FIG 8 North America Ceramide Market share, By Process, 2022

FIG 9 North America Ceramide Market share, By Process, 2030

FIG 10 North America Ceramide Market, By Process, 2019 - 2030, USD Thousands

FIG 11 North America Ceramide Market share, By Type, 2022

FIG 12 North America Ceramide Market share, By Type, 2030

FIG 13 North America Ceramide Market, By Type, 2019 - 2030, USD Thousands

FIG 14 North America Ceramide Market share, By Country, 2022

FIG 15 North America Ceramide Market share, By Country, 2030

FIG 16 North America Ceramide Market, By Country, 2019 - 2030, USD Thousands

FIG 17 Swot Analysis: Ashland Inc.

FIG 18 SWOT Analysis: Toyobo Co., Ltd.

FIG 19 SWOT Analysis: Doosan Corporation

FIG 20 SWOT Analysis: Arkema S.A.

FIG 21 SWOT Analysis: Evonik Industries AG

FIG 22 Swot Analysis: Cayman Chemical Company, Inc.

FIG 23 SWOT Analysis: Kao Corporation

FIG 24 SWOT Analysis: Croda International PLC

FIG 25 SWOT Analysis: Vantage Specialty Chemicals

FIG 26 SWOT Analysis: Incospam Co., Ltd.