North America Cold Rolled Steel Coil Market Size, Share & Trends Analysis Report By Hardness (Half-hard, Full Hard, Quarter Hard, and Others), By End User (Automotive, Construction, Aerospace, Oil & Gas, and Others), By Country and Growth Forecast, 2024 - 2031

Published Date : 18-Jul-2024 |

Pages: 129 |

Formats: PDF |

COVID-19 Impact on the North America Cold Rolled Steel Coil Market

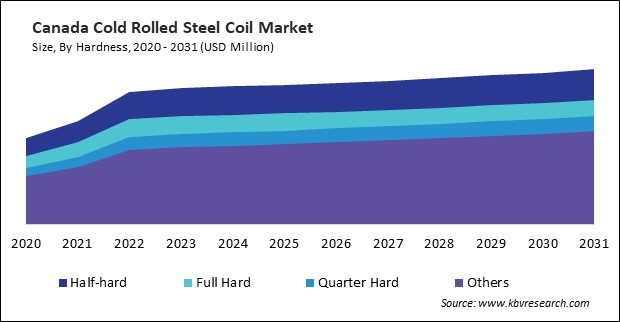

The North America Cold Rolled Steel Coil Market would witness market growth of 2.7% CAGR during the forecast period (2024-2031). In the year 2020, the North America market's volume surged to 18,494.62 tonnes, showcasing a growth of 22% (2020-2023). Half-Hard cold rolled steel coils exhibit moderate hardness, typically achieved through partial annealing, making them less malleable than fully annealed (soft) steel but more workable than full-hard steel. Thus, the Canada market would utilize 1,410.97 tonnes of Half-Hard cold rolled steel coils by 2031.

The US market dominated the North America Cold Rolled Steel Coil Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $30,122.9 Thousands by 2031. The Canada market is exhibiting a CAGR of 5% during (2024 - 2031). Additionally, The Mexico market would experience a CAGR of 4.1% during (2024 - 2031).

This offers high tensile strength and excellent durability, making them ideal for structural applications. Buildings and infrastructure constructed using cold-rolled steel coils are strong, sturdy, and able to withstand various environmental conditions, including high winds, earthquakes, and heavy snow loads.

Moreover, buildings and infrastructure constructed using cold-rolled steel coils are less corrosion-resistant, resulting in lower maintenance costs and longer service life. These are lighter than other construction materials, such as concrete and masonry, making them ideal for lightweight construction projects.

Cold-rolled steel coils are used in manufacturing various aircraft components, including structural parts, fuselage frames, wing ribs, and landing gear, contributing to the expansion of the aerospace industry in Canada. The increased emphasis in the aerospace industry on employing lightweight materials to improve aircraft performance, lower emissions, and increase fuel efficiency is driving up demand for cold-rolled steel coil in Canada. The Canadian aerospace industry serves commercial and military markets, with a growing demand for defense and security applications.

Free Valuable Insights: The Cold Rolled Steel Coil Market is Predict to reach USD 192.8 Million by 2031, at a CAGR of 3.3%

Based on Hardness, the market is segmented into Half-hard, Full Hard, Quarter Hard, and Others. Based on End User, the market is segmented into Automotive, Construction, Aerospace, Oil & Gas, and Others. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- Tata Steel Limited (TATA Group) (Tata Sons Pvt. Ltd.)

- ArcelorMittal S.A.

- JFE Steel Corporation (JFE Holdings, Inc.)

- Nippon Steel Corporation

- China Steel Corporation

- AK Steel International B.V. (Cleveland-Cliffs Inc.)

- Nucor Corporation

- Hyundai Steel Company (Hyundai Motor Company)

- SSAB AB

- Voestalpine AG

North America Cold Rolled Steel Coil Market Report Segmentation

By Hardness (Volume, Tonnes, USD Million, 2020-2031)

- Half-hard

- Full Hard

- Quarter Hard

- Others

By End User (Volume, Tonnes, USD Million, 2020-2031)

- Automotive

- Construction

- Aerospace

- Oil & Gas

- Others

By Country (Volume, Tonnes, USD Million, 2020-2031)

- US

- Canada

- Mexico

- Rest of North America

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 North America Cold Rolled Steel Coil Market, by Hardness

1.4.2 North America Cold Rolled Steel Coil Market, by End User

1.4.3 North America Cold Rolled Steel Coil Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

3.3 Porter’s Five Forces Analysis

Chapter 4. North America Cold Rolled Steel Coil Market by Hardness

4.1 North America Half-hard Market by Country

4.2 North America Full Hard Market by Country

4.3 North America Quarter Hard Market by Country

4.4 North America Others Market by Country

Chapter 5. North America Cold Rolled Steel Coil Market by End-User

5.1 North America Automotive Market by Country

5.2 North America Construction Market by Country

5.3 North America Aerospace Market by Country

5.4 North America Oil & Gas Market by Country

5.5 North America Others Market by Country

Chapter 6. North America Cold Rolled Steel Coil Market by Country

6.1 US Cold Rolled Steel Coil Market

6.1.1 US Cold Rolled Steel Coil Market by Hardness

6.1.2 US Cold Rolled Steel Coil Market by End-User

6.2 Canada Cold Rolled Steel Coil Market

6.2.1 Canada Cold Rolled Steel Coil Market by Hardness

6.2.2 Canada Cold Rolled Steel Coil Market by End-User

6.3 Mexico Cold Rolled Steel Coil Market

6.3.1 Mexico Cold Rolled Steel Coil Market by Hardness

6.3.2 Mexico Cold Rolled Steel Coil Market by End-User

6.4 Rest of North America Cold Rolled Steel Coil Market

6.4.1 Rest of North America Cold Rolled Steel Coil Market by Hardness

6.4.2 Rest of North America Cold Rolled Steel Coil Market by End-User

Chapter 7. Company Profiles

7.1 Tata Steel Limited (TATA Group) (Tata Sons Pvt. Ltd.)

7.1.1 Company Overview

7.1.2 Financial Analysis

7.1.3 Segmental and Regional Analysis

7.1.4 Research & Development Expenses

7.1.5 Recent strategies and developments:

7.1.5.1 Partnerships, Collaborations, and Agreements:

7.1.5.2 Product Launches and Product Expansions:

7.1.6 SWOT Analysis

7.2 ArcelorMittal S.A.

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Segmental and Regional Analysis

7.2.4 Research & Development Expenses

7.2.5 SWOT Analysis

7.3 JFE Steel Corporation (JFE Holdings, Inc.)

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Segmental Analysis

7.3.4 SWOT Analysis

7.4 Nippon Steel Corporation

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Segmental and Regional Analysis

7.4.4 Research & Development Expenses

7.4.5 Recent strategies and developments:

7.4.5.1 Acquisition and Mergers:

7.4.6 SWOT Analysis

7.5 China Steel Corporation

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Segmental and Regional Analysis

7.5.4 Research & Development Expenses

7.5.5 SWOT Analysis

7.6 AK Steel International B.V. (Cleveland-Cliffs Inc.)

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Segmental and Regional Analysis

7.6.4 SWOT Analysis

7.7 Nucor Corporation

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Segmental Analysis

7.7.4 Research & Development Expenses

7.7.5 SWOT Analysis

7.8 Hyundai Steel Company (Hyundai Motor Company)

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Regional Analysis

7.8.4 Research & Development Expenses

7.8.5 SWOT Analysis

7.9 SSAB AB

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Segmental and Regional Analysis

7.9.4 Research & Development Expenses

7.9.5 SWOT Analysis

7.10. Voestalpine AG

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Segmental and Regional Analysis

7.10.4 Research & Development Expenses

7.10.5 SWOT Analysis

TABLE 2 North America Cold Rolled Steel Coil Market, 2024 - 2031, USD Thousands

TABLE 3 North America Cold Rolled Steel Coil Market, 2020 - 2023, Tonnes

TABLE 4 North America Cold Rolled Steel Coil Market, 2024 - 2031, Tonnes

TABLE 5 North America Cold Rolled Steel Coil Market by Hardness, 2020 - 2023, USD Thousands

TABLE 6 North America Cold Rolled Steel Coil Market by Hardness, 2024 - 2031, USD Thousands

TABLE 7 North America Cold Rolled Steel Coil Market by Hardness, 2020 - 2023, Tonnes

TABLE 8 North America Cold Rolled Steel Coil Market by Hardness, 2024 - 2031, Tonnes

TABLE 9 North America Half-hard Market by Country, 2020 - 2023, USD Thousands

TABLE 10 North America Half-hard Market by Country, 2024 - 2031, USD Thousands

TABLE 11 North America Half-hard Market by Country, 2020 - 2023, Tonnes

TABLE 12 North America Half-hard Market by Country, 2024 - 2031, Tonnes

TABLE 13 North America Full Hard Market by Country, 2020 - 2023, USD Thousands

TABLE 14 North America Full Hard Market by Country, 2024 - 2031, USD Thousands

TABLE 15 North America Full Hard Market by Country, 2020 - 2023, Tonnes

TABLE 16 North America Full Hard Market by Country, 2024 - 2031, Tonnes

TABLE 17 North America Quarter Hard Market by Country, 2020 - 2023, USD Thousands

TABLE 18 North America Quarter Hard Market by Country, 2024 - 2031, USD Thousands

TABLE 19 North America Quarter Hard Market by Country, 2020 - 2023, Tonnes

TABLE 20 North America Quarter Hard Market by Country, 2024 - 2031, Tonnes

TABLE 21 North America Others Market by Country, 2020 - 2023, USD Thousands

TABLE 22 North America Others Market by Country, 2024 - 2031, USD Thousands

TABLE 23 North America Others Market by Country, 2020 - 2023, Tonnes

TABLE 24 North America Others Market by Country, 2024 - 2031, Tonnes

TABLE 25 North America Cold Rolled Steel Coil Market by End-User, 2020 - 2023, USD Thousands

TABLE 26 North America Cold Rolled Steel Coil Market by End-User, 2024 - 2031, USD Thousands

TABLE 27 North America Cold Rolled Steel Coil Market by End-User, 2020 - 2023, Tonnes

TABLE 28 North America Cold Rolled Steel Coil Market by End-User, 2024 - 2031, Tonnes

TABLE 29 North America Automotive Market by Country, 2020 - 2023, USD Thousands

TABLE 30 North America Automotive Market by Country, 2024 - 2031, USD Thousands

TABLE 31 North America Automotive Market by Country, 2020 - 2023, Tonnes

TABLE 32 North America Automotive Market by Country, 2024 - 2031, Tonnes

TABLE 33 North America Construction Market by Country, 2020 - 2023, USD Thousands

TABLE 34 North America Construction Market by Country, 2024 - 2031, USD Thousands

TABLE 35 North America Construction Market by Country, 2020 - 2023, Tonnes

TABLE 36 North America Construction Market by Country, 2024 - 2031, Tonnes

TABLE 37 North America Aerospace Market by Country, 2020 - 2023, USD Thousands

TABLE 38 North America Aerospace Market by Country, 2024 - 2031, USD Thousands

TABLE 39 North America Aerospace Market by Country, 2020 - 2023, Tonnes

TABLE 40 North America Aerospace Market by Country, 2024 - 2031, Tonnes

TABLE 41 North America Oil & Gas Market by Country, 2020 - 2023, USD Thousands

TABLE 42 North America Oil & Gas Market by Country, 2024 - 2031, USD Thousands

TABLE 43 North America Oil & Gas Market by Country, 2020 - 2023, Tonnes

TABLE 44 North America Oil & Gas Market by Country, 2024 - 2031, Tonnes

TABLE 45 North America Others Market by Country, 2020 - 2023, USD Thousands

TABLE 46 North America Others Market by Country, 2024 - 2031, USD Thousands

TABLE 47 North America Others Market by Country, 2020 - 2023, Tonnes

TABLE 48 North America Others Market by Country, 2024 - 2031, Tonnes

TABLE 49 North America Cold Rolled Steel Coil Market by Country, 2020 - 2023, USD Thousands

TABLE 50 North America Cold Rolled Steel Coil Market by Country, 2024 - 2031, USD Thousands

TABLE 51 North America Cold Rolled Steel Coil Market by Country, 2020 - 2023, Tonnes

TABLE 52 North America Cold Rolled Steel Coil Market by Country, 2024 - 2031, Tonnes

TABLE 53 US Cold Rolled Steel Coil Market, 2020 - 2023, USD Thousands

TABLE 54 US Cold Rolled Steel Coil Market, 2024 - 2031, USD Thousands

TABLE 55 US Cold Rolled Steel Coil Market, 2020 - 2023, Tonnes

TABLE 56 US Cold Rolled Steel Coil Market, 2024 - 2031, Tonnes

TABLE 57 US Cold Rolled Steel Coil Market by Hardness, 2020 - 2023, USD Thousands

TABLE 58 US Cold Rolled Steel Coil Market by Hardness, 2024 - 2031, USD Thousands

TABLE 59 US Cold Rolled Steel Coil Market by Hardness, 2020 - 2023, Tonnes

TABLE 60 US Cold Rolled Steel Coil Market by Hardness, 2024 - 2031, Tonnes

TABLE 61 US Cold Rolled Steel Coil Market by End-User, 2020 - 2023, USD Thousands

TABLE 62 US Cold Rolled Steel Coil Market by End-User, 2024 - 2031, USD Thousands

TABLE 63 US Cold Rolled Steel Coil Market by End-User, 2020 - 2023, Tonnes

TABLE 64 US Cold Rolled Steel Coil Market by End-User, 2024 - 2031, Tonnes

TABLE 65 Canada Cold Rolled Steel Coil Market, 2020 - 2023, USD Thousands

TABLE 66 Canada Cold Rolled Steel Coil Market, 2024 - 2031, USD Thousands

TABLE 67 Canada Cold Rolled Steel Coil Market, 2020 - 2023, Tonnes

TABLE 68 Canada Cold Rolled Steel Coil Market, 2024 - 2031, Tonnes

TABLE 69 Canada Cold Rolled Steel Coil Market by Hardness, 2020 - 2023, USD Thousands

TABLE 70 Canada Cold Rolled Steel Coil Market by Hardness, 2024 - 2031, USD Thousands

TABLE 71 Canada Cold Rolled Steel Coil Market by Hardness, 2020 - 2023, Tonnes

TABLE 72 Canada Cold Rolled Steel Coil Market by Hardness, 2024 - 2031, Tonnes

TABLE 73 Canada Cold Rolled Steel Coil Market by End-User, 2020 - 2023, USD Thousands

TABLE 74 Canada Cold Rolled Steel Coil Market by End-User, 2024 - 2031, USD Thousands

TABLE 75 Canada Cold Rolled Steel Coil Market by End-User, 2020 - 2023, Tonnes

TABLE 76 Canada Cold Rolled Steel Coil Market by End-User, 2024 - 2031, Tonnes

TABLE 77 Mexico Cold Rolled Steel Coil Market, 2020 - 2023, USD Thousands

TABLE 78 Mexico Cold Rolled Steel Coil Market, 2024 - 2031, USD Thousands

TABLE 79 Mexico Cold Rolled Steel Coil Market, 2020 - 2023, Tonnes

TABLE 80 Mexico Cold Rolled Steel Coil Market, 2024 - 2031, Tonnes

TABLE 81 Mexico Cold Rolled Steel Coil Market by Hardness, 2020 - 2023, USD Thousands

TABLE 82 Mexico Cold Rolled Steel Coil Market by Hardness, 2024 - 2031, USD Thousands

TABLE 83 Mexico Cold Rolled Steel Coil Market by Hardness, 2020 - 2023, Tonnes

TABLE 84 Mexico Cold Rolled Steel Coil Market by Hardness, 2024 - 2031, Tonnes

TABLE 85 Mexico Cold Rolled Steel Coil Market by End-User, 2020 - 2023, USD Thousands

TABLE 86 Mexico Cold Rolled Steel Coil Market by End-User, 2024 - 2031, USD Thousands

TABLE 87 Mexico Cold Rolled Steel Coil Market by End-User, 2020 - 2023, Tonnes

TABLE 88 Mexico Cold Rolled Steel Coil Market by End-User, 2024 - 2031, Tonnes

TABLE 89 Rest of North America Cold Rolled Steel Coil Market, 2020 - 2023, USD Thousands

TABLE 90 Rest of North America Cold Rolled Steel Coil Market, 2024 - 2031, USD Thousands

TABLE 91 Rest of North America Cold Rolled Steel Coil Market, 2020 - 2023, Tonnes

TABLE 92 Rest of North America Cold Rolled Steel Coil Market, 2024 - 2031, Tonnes

TABLE 93 Rest of North America Cold Rolled Steel Coil Market by Hardness, 2020 - 2023, USD Thousands

TABLE 94 Rest of North America Cold Rolled Steel Coil Market by Hardness, 2024 - 2031, USD Thousands

TABLE 95 Rest of North America Cold Rolled Steel Coil Market by Hardness, 2020 - 2023, Tonnes

TABLE 96 Rest of North America Cold Rolled Steel Coil Market by Hardness, 2024 - 2031, Tonnes

TABLE 97 Rest of North America Cold Rolled Steel Coil Market by End-User, 2020 - 2023, USD Thousands

TABLE 98 Rest of North America Cold Rolled Steel Coil Market by End-User, 2024 - 2031, USD Thousands

TABLE 99 Rest of North America Cold Rolled Steel Coil Market by End-User, 2020 - 2023, Tonnes

TABLE 100 Rest of North America Cold Rolled Steel Coil Market by End-User, 2024 - 2031, Tonnes

TABLE 101 Key Information – Tata Steel Limited

TABLE 102 key Information – ArcelorMittal S.A.

TABLE 103 Key Information – JFE Steel Corporation

TABLE 104 Key Information – Nippon Steel Corporation

TABLE 105 Key Information – China Steel Corporation

TABLE 106 Key Information – AK Steel International B.V.

TABLE 107 Key Information – Nucor Corporation

TABLE 108 Key Information – Hyundai Steel Company

TABLE 109 Key Information – SSAB AB

TABLE 110 Key Information – Voestalpine AG

List of Figures

FIG 1 Methodology for the research

FIG 2 North America Cold Rolled Steel Coil Market, 2020 - 2031, USD Thousands

FIG 3 Key Factors Impacting Cold Rolled Steel Coil Market

FIG 4 Porter’s Five Forces Analysis - Cold Rolled Steel Coil Market

FIG 5 North America Cold Rolled Steel Coil Market share by Hardness, 2023

FIG 6 North America Cold Rolled Steel Coil Market share by Hardness, 2031

FIG 7 North America Cold Rolled Steel Coil Market by Hardness, 2020 - 2031, USD Thousands

FIG 8 North America Cold Rolled Steel Coil Market share by End-User, 2023

FIG 9 North America Cold Rolled Steel Coil Market share by End-User, 2031

FIG 10 North America Cold Rolled Steel Coil Market by End-User, 2020 - 2031, USD Thousands

FIG 11 North America Cold Rolled Steel Coil Market share by Country, 2023

FIG 12 North America Cold Rolled Steel Coil Market share by Country, 2031

FIG 13 North America Cold Rolled Steel Coil Market by Country, 2020 - 2031, USD Thousands

FIG 14 Recent strategies and developments: TATA Steel Limited

FIG 15 SWOT Analysis: TATA Steel Limited

FIG 16 SWOT Analysis: ArcelorMittal S.A.

FIG 17 Swot Analysis: JFE Steel Corporation

FIG 18 Swot Analysis: Nippon Steel Corporation

FIG 19 Swot Analysis: China Steel Corporation

FIG 20 Swot Analysis: AK Steel International B.V.

FIG 21 Swot Analysis: Nucor Corporation

FIG 22 Swot Analysis: Hyundai Steel Company

FIG 23 Swot Analysis: SSAB AB

FIG 24 Swot Analysis: Voestalpine AG