The North America Commercial Metal Plating Equipment Market would witness market growth of 3.4% CAGR during the forecast period (2024-2031).

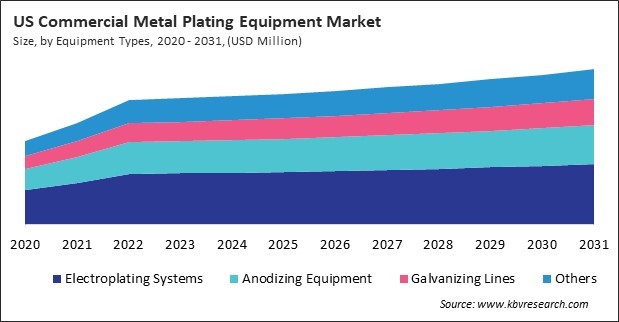

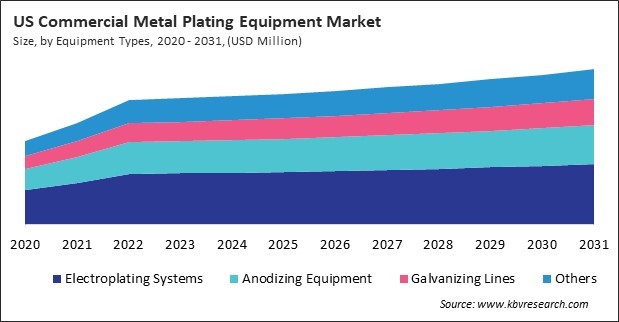

The US market dominated the North America Commercial Metal Plating Equipment Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $97,168.1 Thousands by 2031. The Canada market is experiencing a CAGR of 5.6% during (2024 - 2031). Additionally, The Mexico market would exhibit a CAGR of 4.8% during (2024 - 2031).

The automotive industry is one of the largest consumers of metal plating equipment. Metal plating is extensively used in the automotive sector to enhance various components' durability and aesthetic appeal. This includes everything from engine parts and transmission components to exterior trims and decorative elements.

Additionally, aesthetic considerations are paramount in the automotive industry. Consumers increasingly demand vehicles with high visual appeal, often achieved through decorative metal plating on parts like grilles, emblems, and interior accents.

The market in North America is experiencing significant growth, particularly due to the expansion of the aerospace sector. The demand for advanced metal plating equipment is driven by various factors specific to different nations within the region. According to the Federal Aviation Administration (FAA), the U.S. aerospace industry will grow significantly over the coming years. The FAA Aerospace Forecast for FY 2025-2044, annual growth for ASM and RPM are forecast to grow at 2.8 percent, while enplanements will grow at a rate of 3.1 percent, driven by economic fundamentals and increased demand for air travel.

Free Valuable Insights: The Commercial Metal Plating Equipment Market is Predict to reach USD 470.3 Million by 2031, at a CAGR of 4.1%

Based on Equipment Types, the market is segmented into Electroplating Systems, Anodizing Equipment, Galvanizing Lines, and Others. Based on End User, the market is segmented into Electronics, Automotive, Aerospace, and Others. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- Koch, LLC (Koch Enterprises, Inc.)

- Progalvano S.r.l.

- SIFCO ASC

- Chicago Plastic Systems

- Poliplast Ltd.

- Sharretts Plating Company

- Anoplate Corporation

- Lincoln Industries

- Arlington Plating Company

North America Commercial Metal Plating Equipment Market Report Segmentation

By Equipment Types

- Electroplating Systems

- Anodizing Equipment

- Galvanizing Lines

- Others

By End User

- Electronics

- Automotive

- Aerospace

- Others

By Country

- US

- Canada

- Mexico

- Rest of North America

Chapter 1. Market Scope & Methodology

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 North America Commercial Metal Plating Equipment Market, by Equipment Types

1.4.2 North America Commercial Metal Plating Equipment Market, by End User

1.4.3 North America Commercial Metal Plating Equipment Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

3.3 Porter Five Forces Analysis

Chapter 4. North America Commercial Metal Plating Equipment Market by Equipment Types

4.1 North America Electroplating Systems Market by Country

4.2 North America Anodizing Equipment Market by Country

4.3 North America Galvanizing Lines Market by Country

4.4 North America Others Market by Country

Chapter 5. North America Commercial Metal Plating Equipment Market by End User

5.1 North America Electronics Market by Country

5.2 North America Automotive Market by Country

5.3 North America Aerospace Market by Country

5.4 North America Others Market by Country

Chapter 6. North America Commercial Metal Plating Equipment Market by Country

6.1 US Commercial Metal Plating Equipment Market

6.1.1 US Commercial Metal Plating Equipment Market by Equipment Types

6.1.2 US Commercial Metal Plating Equipment Market by End User

6.2 Canada Commercial Metal Plating Equipment Market

6.2.1 Canada Commercial Metal Plating Equipment Market by Equipment Types

6.2.2 Canada Commercial Metal Plating Equipment Market by End User

6.3 Mexico Commercial Metal Plating Equipment Market

6.3.1 Mexico Commercial Metal Plating Equipment Market by Equipment Types

6.3.2 Mexico Commercial Metal Plating Equipment Market by End User

6.4 Rest of North America Commercial Metal Plating Equipment Market

6.4.1 Rest of North America Commercial Metal Plating Equipment Market by Equipment Types

6.4.2 Rest of North America Commercial Metal Plating Equipment Market by End User

Chapter 7. Company Profiles

7.1 Koch, LLC (Koch Enterprises, Inc.)

7.1.1 Company Overview

7.1.2 SWOT Analysis

7.2 Progalvano S.r.l.

7.2.1 Company Overview

7.2.2 SWOT Analysis

7.3 SIFCO ASC

7.3.1 Company Overview

7.3.2 SWOT Analysis

7.4 Chicago Plastic Systems, Inc.

7.4.1 Company Overview

7.4.2 SWOT Analysis

7.5 Poliplast Ltd.

7.5.1 Company Overview

7.5.2 SWOT Analysis

7.6 Sharretts Plating Company

7.6.1 Company Overview

7.6.2 SWOT Analysis

7.7 Anoplate Corporation

7.7.1 Company Overview

7.7.2 SWOT Analysis

7.8 Lincoln Industries

7.8.1 Company Overview

7.8.2 SWOT Analysis

7.9 Arlington Plating Company

7.9.1 Company Overview

7.9.2 SWOT Analysis

TABLE 1 North America Commercial Metal Plating Equipment Market, 2020 - 2023, USD Thousands

TABLE 2 North America Commercial Metal Plating Equipment Market, 2024 - 2031, USD Thousands

TABLE 3 North America Commercial Metal Plating Equipment Market by Equipment Types, 2020 - 2023, USD Thousands

TABLE 4 North America Commercial Metal Plating Equipment Market by Equipment Types, 2024 - 2031, USD Thousands

TABLE 5 North America Electroplating Systems Market by Country, 2020 - 2023, USD Thousands

TABLE 6 North America Electroplating Systems Market by Country, 2024 - 2031, USD Thousands

TABLE 7 North America Anodizing Equipment Market by Country, 2020 - 2023, USD Thousands

TABLE 8 North America Anodizing Equipment Market by Country, 2024 - 2031, USD Thousands

TABLE 9 North America Galvanizing Lines Market by Country, 2020 - 2023, USD Thousands

TABLE 10 North America Galvanizing Lines Market by Country, 2024 - 2031, USD Thousands

TABLE 11 North America Others Market by Country, 2020 - 2023, USD Thousands

TABLE 12 North America Others Market by Country, 2024 - 2031, USD Thousands

TABLE 13 North America Commercial Metal Plating Equipment Market by End User, 2020 - 2023, USD Thousands

TABLE 14 North America Commercial Metal Plating Equipment Market by End User, 2024 - 2031, USD Thousands

TABLE 15 North America Electronics Market by Country, 2020 - 2023, USD Thousands

TABLE 16 North America Electronics Market by Country, 2024 - 2031, USD Thousands

TABLE 17 North America Automotive Market by Country, 2020 - 2023, USD Thousands

TABLE 18 North America Automotive Market by Country, 2024 - 2031, USD Thousands

TABLE 19 North America Aerospace Market by Country, 2020 - 2023, USD Thousands

TABLE 20 North America Aerospace Market by Country, 2024 - 2031, USD Thousands

TABLE 21 North America Others Market by Country, 2020 - 2023, USD Thousands

TABLE 22 North America Others Market by Country, 2024 - 2031, USD Thousands

TABLE 23 North America Commercial Metal Plating Equipment Market by Country, 2020 - 2023, USD Thousands

TABLE 24 North America Commercial Metal Plating Equipment Market by Country, 2024 - 2031, USD Thousands

TABLE 25 US Commercial Metal Plating Equipment Market, 2020 - 2023, USD Thousands

TABLE 26 US Commercial Metal Plating Equipment Market, 2024 - 2031, USD Thousands

TABLE 27 US Commercial Metal Plating Equipment Market by Equipment Types, 2020 - 2023, USD Thousands

TABLE 28 US Commercial Metal Plating Equipment Market by Equipment Types, 2024 - 2031, USD Thousands

TABLE 29 US Commercial Metal Plating Equipment Market by End User, 2020 - 2023, USD Thousands

TABLE 30 US Commercial Metal Plating Equipment Market by End User, 2024 - 2031, USD Thousands

TABLE 31 Canada Commercial Metal Plating Equipment Market, 2020 - 2023, USD Thousands

TABLE 32 Canada Commercial Metal Plating Equipment Market, 2024 - 2031, USD Thousands

TABLE 33 Canada Commercial Metal Plating Equipment Market by Equipment Types, 2020 - 2023, USD Thousands

TABLE 34 Canada Commercial Metal Plating Equipment Market by Equipment Types, 2024 - 2031, USD Thousands

TABLE 35 Canada Commercial Metal Plating Equipment Market by End User, 2020 - 2023, USD Thousands

TABLE 36 Canada Commercial Metal Plating Equipment Market by End User, 2024 - 2031, USD Thousands

TABLE 37 Mexico Commercial Metal Plating Equipment Market, 2020 - 2023, USD Thousands

TABLE 38 Mexico Commercial Metal Plating Equipment Market, 2024 - 2031, USD Thousands

TABLE 39 Mexico Commercial Metal Plating Equipment Market by Equipment Types, 2020 - 2023, USD Thousands

TABLE 40 Mexico Commercial Metal Plating Equipment Market by Equipment Types, 2024 - 2031, USD Thousands

TABLE 41 Mexico Commercial Metal Plating Equipment Market by End User, 2020 - 2023, USD Thousands

TABLE 42 Mexico Commercial Metal Plating Equipment Market by End User, 2024 - 2031, USD Thousands

TABLE 43 Rest of North America Commercial Metal Plating Equipment Market, 2020 - 2023, USD Thousands

TABLE 44 Rest of North America Commercial Metal Plating Equipment Market, 2024 - 2031, USD Thousands

TABLE 45 Rest of North America Commercial Metal Plating Equipment Market by Equipment Types, 2020 - 2023, USD Thousands

TABLE 46 Rest of North America Commercial Metal Plating Equipment Market by Equipment Types, 2024 - 2031, USD Thousands

TABLE 47 Rest of North America Commercial Metal Plating Equipment Market by End User, 2020 - 2023, USD Thousands

TABLE 48 Rest of North America Commercial Metal Plating Equipment Market by End User, 2024 - 2031, USD Thousands

TABLE 49 Key Information – Koch, LLC

TABLE 50 Key Information – Progalvano S.r.l.

TABLE 51 Key Information – SIFCO ASC

TABLE 52 Key Information – Chicago Plastic Systems, Inc.

TABLE 53 Key Information – Poliplast Ltd.

TABLE 54 Key Information – Sharretts Plating Company

TABLE 55 Key Information – Anoplate Corporation

TABLE 56 Key Information – Lincoln Industries

TABLE 57 Key Information – Arlington Plating Company

List of Figures

FIG 1 Methodology for the research

FIG 2 North America Commercial Metal Plating Equipment Market, 2020 - 2031, USD Thousands

FIG 3 Key Factors Impacting Commercial Metal Plating Equipment Market

FIG 4 Porter’s Five Forces Analysis – Commercial Metal Plating Equipment Market

FIG 5 North America Commercial Metal Plating Equipment Market share by Equipment Types, 2023

FIG 6 North America Commercial Metal Plating Equipment Market share by Equipment Types, 2031

FIG 7 North America Commercial Metal Plating Equipment Market by Equipment Types, 2020 - 2031, USD Thousands

FIG 8 North America Commercial Metal Plating Equipment Market share by End User, 2023

FIG 9 North America Commercial Metal Plating Equipment Market share by End User, 2031

FIG 10 North America Commercial Metal Plating Equipment Market by End User, 2020 - 2031, USD Thousands

FIG 11 North America Commercial Metal Plating Equipment Market share by Country, 2023

FIG 12 North America Commercial Metal Plating Equipment Market share by Country, 2031

FIG 13 North America Commercial Metal Plating Equipment Market by Country, 2020 - 2031, USD Thousands

FIG 14 SWOT Analysis: Koch, LLC

FIG 15 SWOT Analysis: Progalvano S.r.l.

FIG 16 SWOT Analysis: SIFCO Applied Surface Concepts (SIFCO ASC)

FIG 17 SWOT Analysis: Chicago Plastic Systems, Inc.

FIG 18 SWOT Analysis: Poliplast Ltd.

FIG 19 SWOT Analysis: Sharretts Plating Company

FIG 20 SWOT Analysis: Anoplate Corporation

FIG 21 SWOT Analysis: Lincoln Industries

FIG 22 SWOT Analysis: Arlington Plating Company