The North America Digital Audio Workstation Market would witness market growth of 7.5% CAGR during the forecast period (2024-2031).

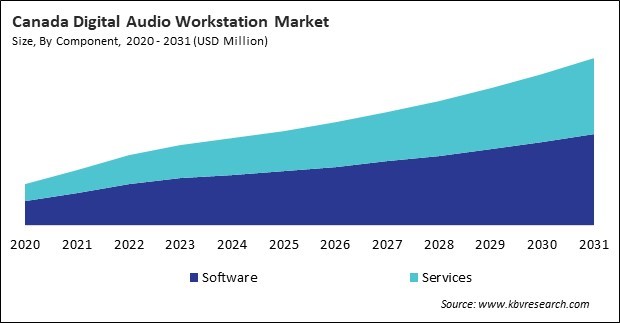

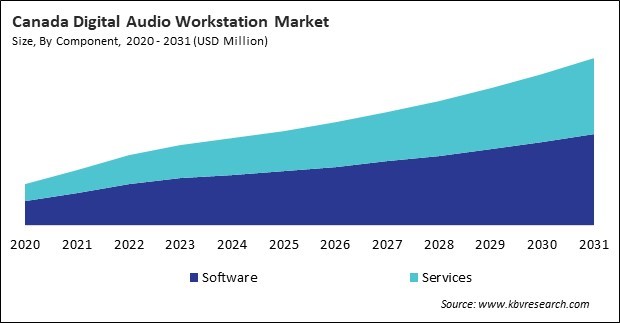

The US market dominated the North America Digital Audio Workstation Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $1,535.8 million by 2031. The Canada market is exhibiting a CAGR of 9.8% during (2024 - 2031). Additionally, The Mexico market would experience a CAGR of 8.9% during (2024 - 2031).

Digital audio workstations (DAWs) serve many applications across various industries and creative fields. The most recognized application of DAWs is in music production. Musicians use these platforms to compose, arrange, mix, and master tracks. Features such as MIDI support, virtual instruments, and various audio effects enable artists to create intricate compositions precisely. DAWs are increasingly used in sound therapy, where practitioners create calming soundscapes and therapeutic music. This application emphasizes the role of audio in mental well-being and relaxation, allowing therapists to design personalized audio experiences for clients.

DAWs produce instructional materials in educational settings, including voiceovers, educational videos, and interactive audio lessons. Educators can create engaging audio content that enhances students' learning experiences. The growing fields of VR and AR rely heavily on immersive audio experiences. DAWs are used to create spatial audio that enhances the realism of virtual environments, allowing users to perceive sound directionally, which is crucial for gaming and simulations.

The proliferation of independent artists and the rise of home studios have further fuelled the DAW market in Canada and the U.S. With accessible online platforms for distribution and promotion, many musicians are opting to produce music independently. This trend has led to a heightened demand for user-friendly DAW software that offers powerful features without the need for extensive technical knowledge. As a result, software developers are focusing on creating intuitive interfaces and comprehensive toolsets that cater to novice and professional users.

In addition, the collaboration between artists across geographical boundaries has been facilitated by digital platforms, allowing for greater synergy between the Canadian and American music scenes. This cross-pollination of ideas and styles necessitates using DAWs that support collaborative features, such as cloud-based storage and real-time editing. These tools enable musicians to work together seamlessly, regardless of physical location, fostering a more interconnected music industry. Therefore, the increasing music industry in Canada and the United States is significantly driving the growth of the digital audio workstation market. With a substantial share of global music revenues, a rise in independent artists, and advancements in audio technology, the digital audio workstation market is poised for continued expansion.

Free Valuable Insights: The Digital Audio Workstation Market is Predict to reach USD 6.3 Billion by 2031, at a CAGR of 8.1%

Based on Component, the market is segmented into Software, and Services. Based on End Use, the market is segmented into Professional Audio Engineers & Mixers, Electronic Musicians, Music Studios, Music Schools, Broadcasting & Media Companies, Game developers, and Other End Use. Based on Operating System, the market is segmented into Windows, MAC, Android, and Other Operating System. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- Apple, Inc.

- Adobe, Inc.

- Avid Technology, Inc. (STG Partners, LLC)

- Image-Line Software NV (FL Studio)

- Steinberg Media Technologies GmbH (Yamaha Corporation)

- Native Instruments GmbH

- Magix Software GmbH

- PreSonus Audio Electronics, Inc. (Fender Musical Instruments Corporation)

- Cockos Incorporated

- Ableton AG

North America Digital Audio Workstation Market Report Segmentation

By Component

By End Use

- Professional Audio Engineers & Mixers

- Electronic Musicians

- Music Studios

- Music Schools

- Broadcasting & Media Companies

- Game developers

- Other End Use

By Operating System

- Windows

- MAC

- Android

- Other Operating System

By Country

- US

- Canada

- Mexico

- Rest of North America

Chapter 1. Market Scope & Methodology

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 North America Digital Audio Workstation Market, by Component

1.4.2 North America Digital Audio Workstation Market, by End Use

1.4.3 North America Digital Audio Workstation Market, by Operating System

1.4.4 North America Digital Audio Workstation Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Competition Analysis - Global

4.1 KBV Cardinal Matrix

4.2 Recent Industry Wide Strategic Developments

4.2.1 Partnerships, Collaborations and Agreements

4.2.2 Product Launches and Product Expansions

4.2.3 Acquisition and Mergers

4.3 Market Share Analysis, 2023

4.4 Top Winning Strategies

4.4.1 Key Leading Strategies: Percentage Distribution (2020-2024)

4.4.2 Key Strategic Move: (Product Launches and Product Expansions: 2020, May – 2024, Sep) Leading Players

4.5 Porter Five Forces Analysis

Chapter 5. North America Digital Audio Workstation Market by Component

5.1 North America Software Market by Region

5.2 North America Services Market by Region

Chapter 6. North America Digital Audio Workstation Market by End Use

6.1 North America Professional Audio Engineers & Mixers Market by Country

6.2 North America Electronic Musicians Market by Country

6.3 North America Music Studios Market by Country

6.4 North America Music Schools Market by Country

6.5 North America Broadcasting & Media Companies Market by Country

6.6 North America Game developers Market by Country

6.7 North America Other End Use Market by Country

Chapter 7. North America Digital Audio Workstation Market by Operating System

7.1 North America Windows Market by Country

7.2 North America MAC Market by Country

7.3 North America Android Market by Country

7.4 North America Other Operating System Market by Country

Chapter 8. North America Digital Audio Workstation Market by Country

8.1 US Digital Audio Workstation Market

8.1.1 US Digital Audio Workstation Market by Component

8.1.2 US Digital Audio Workstation Market by End Use

8.1.3 US Digital Audio Workstation Market by Operating System

8.2 Canada Digital Audio Workstation Market

8.2.1 Canada Digital Audio Workstation Market by Component

8.2.2 Canada Digital Audio Workstation Market by End Use

8.2.3 Canada Digital Audio Workstation Market by Operating System

8.3 Mexico Digital Audio Workstation Market

8.3.1 Mexico Digital Audio Workstation Market by Component

8.3.2 Mexico Digital Audio Workstation Market by End Use

8.3.3 Mexico Digital Audio Workstation Market by Operating System

8.4 Rest of North America Digital Audio Workstation Market

8.4.1 Rest of North America Digital Audio Workstation Market by Component

8.4.2 Rest of North America Digital Audio Workstation Market by End Use

8.4.3 Rest of North America Digital Audio Workstation Market by Operating System

Chapter 9. Company Profiles

9.1 Apple, Inc.

9.1.1 Company Overview

9.1.2 Financial Analysis

9.1.3 Regional Analysis

9.1.4 Research & Development Expense

9.1.5 Recent strategies and developments:

9.1.5.1 Product Launches and Product Expansions:

9.1.6 SWOT Analysis

9.2 Adobe, Inc.

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Segmental and Regional Analysis

9.2.4 Research & Development Expense

9.2.5 SWOT Analysis

9.3 Avid Technology, Inc. (STG Partners, LLC)

9.3.1 Company Overview

9.3.2 Recent strategies and developments:

9.3.2.1 Product Launches and Product Expansions:

9.3.3 SWOT Analysis

9.4 Image-Line Software NV (FL Studio)

9.4.1 Company Overview

9.4.2 Recent strategies and developments:

9.4.2.1 Partnerships, Collaborations, and Agreements:

9.4.2.2 Product Launches and Product Expansions:

9.4.2.3 Acquisition and Mergers:

9.4.3 SWOT Analysis

9.5 Steinberg Media Technologies GmbH (Yamaha Corporation)

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Segmental & Regional Analysis

9.5.4 Research & Development Expenses

9.5.5 Recent strategies and developments:

9.5.5.1 Partnerships, Collaborations, and Agreements:

9.5.5.2 Product Launches and Product Expansions:

9.5.6 SWOT Analysis

9.6 Native Instruments GmbH

9.6.1 Company Overview

9.6.2 SWOT Analysis

9.7 Magix Software GmbH

9.7.1 Company Overview

9.7.2 Recent strategies and developments:

9.7.2.1 Product Launches and Product Expansions:

9.8 PreSonus Audio Electronics, Inc. (Fender Musical Instruments Corporation)

9.8.1 Company Overview

9.8.2 Recent strategies and developments:

9.8.2.1 Partnerships, Collaborations, and Agreements:

9.8.2.2 Product Launches and Product Expansions:

9.9 Cockos Incorporated

9.9.1 Company Overview

9.9.2 Recent strategies and developments:

9.9.2.1 Product Launches and Product Expansions:

9.10. Ableton AG

9.10.1 Company Overview

9.10.2 Recent strategies and developments:

9.10.2.1 Product Launches and Product Expansions:

TABLE 1 North America Digital Audio Workstation Market, 2020 - 2023, USD Million

TABLE 2 North America Digital Audio Workstation Market, 2024 - 2031, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– Digital Audio Workstation Market

TABLE 4 Product Launches And Product Expansions– Digital Audio Workstation Market

TABLE 5 Acquisition and Mergers– Digital Audio Workstation Market

TABLE 6 North America Digital Audio Workstation Market by Component, 2020 - 2023, USD Million

TABLE 7 North America Digital Audio Workstation Market by Component, 2024 - 2031, USD Million

TABLE 8 North America Software Market by Region, 2020 - 2023, USD Million

TABLE 9 North America Software Market by Region, 2024 - 2031, USD Million

TABLE 10 North America Services Market by Region, 2020 - 2023, USD Million

TABLE 11 North America Services Market by Region, 2024 - 2031, USD Million

TABLE 12 North America Digital Audio Workstation Market by End Use, 2020 - 2023, USD Million

TABLE 13 North America Digital Audio Workstation Market by End Use, 2024 - 2031, USD Million

TABLE 14 North America Professional Audio Engineers & Mixers Market by Country, 2020 - 2023, USD Million

TABLE 15 North America Professional Audio Engineers & Mixers Market by Country, 2024 - 2031, USD Million

TABLE 16 North America Electronic Musicians Market by Country, 2020 - 2023, USD Million

TABLE 17 North America Electronic Musicians Market by Country, 2024 - 2031, USD Million

TABLE 18 North America Music Studios Market by Country, 2020 - 2023, USD Million

TABLE 19 North America Music Studios Market by Country, 2024 - 2031, USD Million

TABLE 20 North America Music Schools Market by Country, 2020 - 2023, USD Million

TABLE 21 North America Music Schools Market by Country, 2024 - 2031, USD Million

TABLE 22 North America Broadcasting & Media Companies Market by Country, 2020 - 2023, USD Million

TABLE 23 North America Broadcasting & Media Companies Market by Country, 2024 - 2031, USD Million

TABLE 24 North America Game developers Market by Country, 2020 - 2023, USD Million

TABLE 25 North America Game developers Market by Country, 2024 - 2031, USD Million

TABLE 26 North America Other End Use Market by Country, 2020 - 2023, USD Million

TABLE 27 North America Other End Use Market by Country, 2024 - 2031, USD Million

TABLE 28 North America Digital Audio Workstation Market by Operating System, 2020 - 2023, USD Million

TABLE 29 North America Digital Audio Workstation Market by Operating System, 2024 - 2031, USD Million

TABLE 30 North America Windows Market by Country, 2020 - 2023, USD Million

TABLE 31 North America Windows Market by Country, 2024 - 2031, USD Million

TABLE 32 North America MAC Market by Country, 2020 - 2023, USD Million

TABLE 33 North America MAC Market by Country, 2024 - 2031, USD Million

TABLE 34 North America Android Market by Country, 2020 - 2023, USD Million

TABLE 35 North America Android Market by Country, 2024 - 2031, USD Million

TABLE 36 North America Other Operating System Market by Country, 2020 - 2023, USD Million

TABLE 37 North America Other Operating System Market by Country, 2024 - 2031, USD Million

TABLE 38 North America Digital Audio Workstation Market by Country, 2020 - 2023, USD Million

TABLE 39 North America Digital Audio Workstation Market by Country, 2024 - 2031, USD Million

TABLE 40 US Digital Audio Workstation Market, 2020 - 2023, USD Million

TABLE 41 US Digital Audio Workstation Market, 2024 - 2031, USD Million

TABLE 42 US Digital Audio Workstation Market by Component, 2020 - 2023, USD Million

TABLE 43 US Digital Audio Workstation Market by Component, 2024 - 2031, USD Million

TABLE 44 US Digital Audio Workstation Market by End Use, 2020 - 2023, USD Million

TABLE 45 US Digital Audio Workstation Market by End Use, 2024 - 2031, USD Million

TABLE 46 US Digital Audio Workstation Market by Operating System, 2020 - 2023, USD Million

TABLE 47 US Digital Audio Workstation Market by Operating System, 2024 - 2031, USD Million

TABLE 48 Canada Digital Audio Workstation Market, 2020 - 2023, USD Million

TABLE 49 Canada Digital Audio Workstation Market, 2024 - 2031, USD Million

TABLE 50 Canada Digital Audio Workstation Market by Component, 2020 - 2023, USD Million

TABLE 51 Canada Digital Audio Workstation Market by Component, 2024 - 2031, USD Million

TABLE 52 Canada Digital Audio Workstation Market by End Use, 2020 - 2023, USD Million

TABLE 53 Canada Digital Audio Workstation Market by End Use, 2024 - 2031, USD Million

TABLE 54 Canada Digital Audio Workstation Market by Operating System, 2020 - 2023, USD Million

TABLE 55 Canada Digital Audio Workstation Market by Operating System, 2024 - 2031, USD Million

TABLE 56 Mexico Digital Audio Workstation Market, 2020 - 2023, USD Million

TABLE 57 Mexico Digital Audio Workstation Market, 2024 - 2031, USD Million

TABLE 58 Mexico Digital Audio Workstation Market by Component, 2020 - 2023, USD Million

TABLE 59 Mexico Digital Audio Workstation Market by Component, 2024 - 2031, USD Million

TABLE 60 Mexico Digital Audio Workstation Market by End Use, 2020 - 2023, USD Million

TABLE 61 Mexico Digital Audio Workstation Market by End Use, 2024 - 2031, USD Million

TABLE 62 Mexico Digital Audio Workstation Market by Operating System, 2020 - 2023, USD Million

TABLE 63 Mexico Digital Audio Workstation Market by Operating System, 2024 - 2031, USD Million

TABLE 64 Rest of North America Digital Audio Workstation Market, 2020 - 2023, USD Million

TABLE 65 Rest of North America Digital Audio Workstation Market, 2024 - 2031, USD Million

TABLE 66 Rest of North America Digital Audio Workstation Market by Component, 2020 - 2023, USD Million

TABLE 67 Rest of North America Digital Audio Workstation Market by Component, 2024 - 2031, USD Million

TABLE 68 Rest of North America Digital Audio Workstation Market by End Use, 2020 - 2023, USD Million

TABLE 69 Rest of North America Digital Audio Workstation Market by End Use, 2024 - 2031, USD Million

TABLE 70 Rest of North America Digital Audio Workstation Market by Operating System, 2020 - 2023, USD Million

TABLE 71 Rest of North America Digital Audio Workstation Market by Operating System, 2024 - 2031, USD Million

TABLE 72 Key Information – Apple, Inc.

TABLE 73 Key Information – Adobe, Inc.

TABLE 74 Key Information – Avid Technology, Inc.

TABLE 75 Key Information – Image-Line Software NV

TABLE 76 Key Information – Steinberg Media Technologies GmbH

TABLE 77 Key Information – Native Instruments GmbH

TABLE 78 Key information – Magix Software GmbH

TABLE 79 Key Information – PreSonus Audio Electronics, Inc.

TABLE 80 Key Information – Cockos Incorporated

TABLE 81 Key Information – Ableton AG

List of Figures

FIG 1 Methodology for the research

FIG 2 North America Digital Audio Workstation Market, 2020 - 2031, USD Million

FIG 3 Key Factors Impacting Digital Audio Workstation Market

FIG 4 KBV Cardinal Matrix

FIG 5 Market Share Analysis, 2023

FIG 6 Key Leading Strategies: Percentage Distribution (2020-2024)

FIG 7 Key Strategic Move: (Product Launches and Product Expansions: 2020, May – 2024, Sep) Leading Players

FIG 8 Porter’s Five Forces Analysis – Digital Audio Workstation Market

FIG 9 North America Digital Audio Workstation Market share by Component, 2023

FIG 10 North America Digital Audio Workstation Market share by Component, 2031

FIG 11 North America Digital Audio Workstation Market by Component, 2020 - 2031, USD Million

FIG 12 North America Digital Audio Workstation Market share by End Use, 2023

FIG 13 North America Digital Audio Workstation Market share by End Use, 2031

FIG 14 North America Digital Audio Workstation Market by End Use, 2020 - 2031, USD Million

FIG 15 North America Digital Audio Workstation Market share by Operating System, 2023

FIG 16 North America Digital Audio Workstation Market share by Operating System, 2031

FIG 17 North America Digital Audio Workstation Market by Operating System, 2020 - 2031, USD Million

FIG 18 North America Digital Audio Workstation Market share by Country, 2023

FIG 19 North America Digital Audio Workstation Market share by Country, 2031

FIG 20 North America Digital Audio Workstation Market by Country, 2020 - 2031, USD Million

FIG 21 SWOT Analysis: Apple, Inc.

FIG 22 SWOT Analysis: Adobe, Inc.

FIG 23 SWOT Analysis: Avid Technology, Inc.

FIG 24 Recent strategies and developments: Image-Line Software NV

FIG 25 SWOT Analysis: Image-Line Software NV

FIG 26 Recent strategies and developments: Steinberg Media Technologies GmbH

FIG 27 SWOT Analysis: Steinberg Media Technologies GmbH

FIG 28 SWOT Analysis: Native Instruments GmbH

FIG 29 Recent strategies and developments: PreSonus Audio Electronics, Inc.