The North America Engineering Plastics Market would witness market growth of 5.2% CAGR during the forecast period (2023-2030). In the year 2019, the North America market's volume surged to 7,209.2 kilo tonnes, showcasing a growth of 2.5% (2019-2022).

The Automotive sector stands as a significant application area within the Engineering Plastics Market, where materials play a crucial role in enhancing vehicle performance, safety, and fuel efficiency. Engineering plastics offer a diverse range of properties that are well-suited for various automotive applications, including interior, exterior, under-the-hood, and structural components. Thus, the US market would utilize 2,254.0 kilo tonnes of Engineering Plastics material in Automotive sector by 2030.

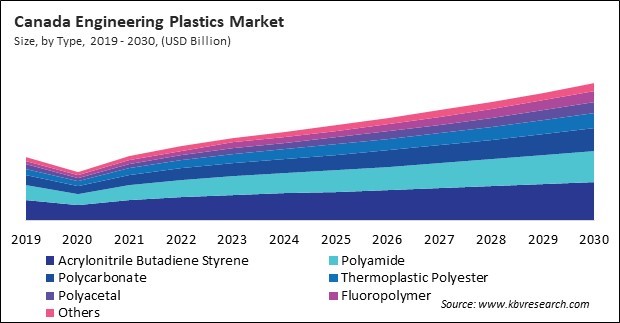

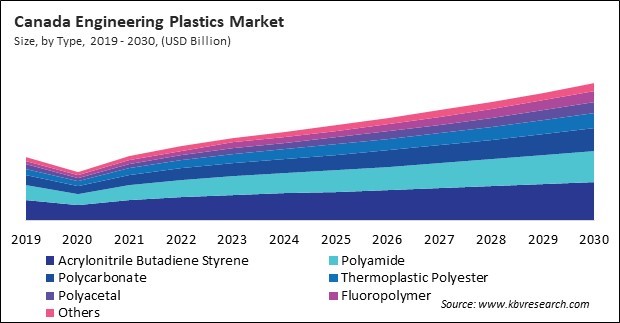

The US market dominated the North America Engineering Plastics Market by Country in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $28,199.9 million by 2030. The Canada market is registering a CAGR of 7.6% during (2023 - 2030). Additionally, The Mexico market would showcase a CAGR of 6.7% during (2023 - 2030).

Another important property of engineering plastics is their excellent chemical resistance. These materials can withstand various chemicals, making them suitable for corrosive environments. In the healthcare industry, it is used to manufacture medical devices and equipment that require sterilization, such as surgical instruments and medical implants.

It also offers superior thermal properties, including high heat resistance and low thermal conductivity. Elevated temperatures do not cause deformation or loss of properties in electronic devices or automotive engine components, rendering them well-suited for use in such environments. In addition to their mechanical, thermal, and chemical properties, it also offers excellent electrical insulation properties. These materials can be used in electrical and electronic applications where insulation is critical, such as wiring, connectors, and switchgear.

Additionally, according to the ITA, Mexico is the world’s seventh-largest passenger vehicle manufacturer, producing 3.5 million vehicles annually. 88% of vehicles produced in Mexico are exported. Additionally, the production of EVs and hybrids totaled 51,065 units in 2022, representing a growth of 8.5 percent compared to 2021. Mexico has seen increased vehicle sales due to a growing middle class, rising disposable incomes, and urbanization. The country's automotive industry has also benefited from trade agreements, like the USMCA (United States-Mexico-Canada Agreement), making it more attractive for automakers to invest in Mexico. Therefore, as these industries continue to grow and evolve, the demand for engineering plastics is expected to remain strong, driving further growth in the market.

Free Valuable Insights: The Engineering Plastics Market is Predict to reach USD 163.4 Billion by 2030, at a CAGR of 5.7%

Based on Type, the market is segmented into Acrylonitrile Butadiene Styrene, Polyamide, Polycarbonate, Thermoplastic Polyester, Polyacetal, Fluoropolymer, and Others. Based on End-User, the market is segmented into Automotive & Transportation, Electrical & Electronics, Consumer Appliances, Industrial & Machinery, Packaging, and Others. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- SABIC (Saudi Arabian Oil Co.)

- Lanxess AG

- Solvay SA

- Evonik Industries AG (RAG-Stiftung)

- Arkema S.A.

- LG Chem Ltd. (LG Corporation)

- Bayer AG

- BASF SE

- Celanese Corporation

- DuPont de Nemours, Inc.

North America Engineering Plastics Market Report Segmentation

By Type (Volume, Kilo Tonnes, USD Billion, 2019-2030)

- Acrylonitrile Butadiene Styrene

- Polyamide

- Polycarbonate

- Thermoplastic Polyester

- Polyacetal

- Fluoropolymer

- Others

By End-User (Volume, Kilo Tonnes, USD Billion, 2019-2030)

- Automotive & Transportation

- Electrical & Electronics

- Consumer Appliances

- Industrial & Machinery

- Packaging

- Others

By Country (Volume, Kilo Tonnes, USD Billion, 2019-2030)

- US

- Canada

- Mexico

- Rest of North America

TABLE 1 North America Engineering Plastics Market, 2019 - 2022, USD Million

TABLE 2 North America Engineering Plastics Market, 2023 - 2030, USD Million

TABLE 3 North America Engineering Plastics Market, 2019 - 2022, Kilo Tonnes

TABLE 4 North America Engineering Plastics Market, 2023 - 2030, Kilo Tonnes

TABLE 5 North America Engineering Plastics Market by Type, 2019 - 2022, USD Million

TABLE 6 North America Engineering Plastics Market by Type, 2023 - 2030, USD Million

TABLE 7 North America Engineering Plastics Market by Type, 2019 - 2022, Kilo Tonnes

TABLE 8 North America Engineering Plastics Market by Type, 2023 - 2030, Kilo Tonnes

TABLE 9 North America Acrylonitrile Butadiene Styrene Market by Country, 2019 - 2022, USD Million

TABLE 10 North America Acrylonitrile Butadiene Styrene Market by Country, 2023 - 2030, USD Million

TABLE 11 North America Acrylonitrile Butadiene Styrene Market by Country, 2019 - 2022, Kilo Tonnes

TABLE 12 North America Acrylonitrile Butadiene Styrene Market by Country, 2023 - 2030, Kilo Tonnes

TABLE 13 North America Polyamide Market by Country, 2019 - 2022, USD Million

TABLE 14 North America Polyamide Market by Country, 2023 - 2030, USD Million

TABLE 15 North America Polyamide Market by Country, 2019 - 2022, Kilo Tonnes

TABLE 16 North America Polyamide Market by Country, 2023 - 2030, Kilo Tonnes

TABLE 17 North America Polycarbonate Market by Country, 2019 - 2022, USD Million

TABLE 18 North America Polycarbonate Market by Country, 2023 - 2030, USD Million

TABLE 19 North America Polycarbonate Market by Country, 2019 - 2022, Kilo Tonnes

TABLE 20 North America Polycarbonate Market by Country, 2023 - 2030, Kilo Tonnes

TABLE 21 North America Thermoplastic Polyester Market by Country, 2019 - 2022, USD Million

TABLE 22 North America Thermoplastic Polyester Market by Country, 2023 - 2030, USD Million

TABLE 23 North America Thermoplastic Polyester Market by Country, 2019 - 2022, Kilo Tonnes

TABLE 24 North America Thermoplastic Polyester Market by Country, 2023 - 2030, Kilo Tonnes

TABLE 25 North America Polyacetal Market by Country, 2019 - 2022, USD Million

TABLE 26 North America Polyacetal Market by Country, 2023 - 2030, USD Million

TABLE 27 North America Polyacetal Market by Country, 2019 - 2022, Kilo Tonnes

TABLE 28 North America Polyacetal Market by Country, 2023 - 2030, Kilo Tonnes

TABLE 29 North America Fluoropolymer Market by Country, 2019 - 2022, USD Million

TABLE 30 North America Fluoropolymer Market by Country, 2023 - 2030, USD Million

TABLE 31 North America Fluoropolymer Market by Country, 2019 - 2022, Kilo Tonnes

TABLE 32 North America Fluoropolymer Market by Country, 2023 - 2030, Kilo Tonnes

TABLE 33 North America Others Market by Country, 2019 - 2022, USD Million

TABLE 34 North America Others Market by Country, 2023 - 2030, USD Million

TABLE 35 North America Others Market by Country, 2019 - 2022, Kilo Tonnes

TABLE 36 North America Others Market by Country, 2023 - 2030, Kilo Tonnes

TABLE 37 North America Engineering Plastics Market by End-User, 2019 - 2022, USD Million

TABLE 38 North America Engineering Plastics Market by End-User, 2023 - 2030, USD Million

TABLE 39 North America Engineering Plastics Market by End-User, 2019 - 2022, Kilo Tonnes

TABLE 40 North America Engineering Plastics Market by End-User, 2023 - 2030, Kilo Tonnes

TABLE 41 North America Automotive & Transportation Market by Country, 2019 - 2022, USD Million

TABLE 42 North America Automotive & Transportation Market by Country, 2023 - 2030, USD Million

TABLE 43 North America Automotive & Transportation Market by Country, 2019 - 2022, Kilo Tonnes

TABLE 44 North America Automotive & Transportation Market by Country, 2023 - 2030, Kilo Tonnes

TABLE 45 North America Electrical & Electronics Market by Country, 2019 - 2022, USD Million

TABLE 46 North America Electrical & Electronics Market by Country, 2023 - 2030, USD Million

TABLE 47 North America Electrical & Electronics Market by Country, 2019 - 2022, Kilo Tonnes

TABLE 48 North America Electrical & Electronics Market by Country, 2023 - 2030, Kilo Tonnes

TABLE 49 North America Consumer Appliances Market by Country, 2019 - 2022, USD Million

TABLE 50 North America Consumer Appliances Market by Country, 2023 - 2030, USD Million

TABLE 51 North America Consumer Appliances Market by Country, 2019 - 2022, Kilo Tonnes

TABLE 52 North America Consumer Appliances Market by Country, 2023 - 2030, Kilo Tonnes

TABLE 53 North America Industrial & Machinery Market by Country, 2019 - 2022, USD Million

TABLE 54 North America Industrial & Machinery Market by Country, 2023 - 2030, USD Million

TABLE 55 North America Industrial & Machinery Market by Country, 2019 - 2022, Kilo Tonnes

TABLE 56 North America Industrial & Machinery Market by Country, 2023 - 2030, Kilo Tonnes

TABLE 57 North America Packaging Market by Country, 2019 - 2022, USD Million

TABLE 58 North America Packaging Market by Country, 2023 - 2030, USD Million

TABLE 59 North America Packaging Market by Country, 2019 - 2022, Kilo Tonnes

TABLE 60 North America Packaging Market by Country, 2023 - 2030, Kilo Tonnes

TABLE 61 North America Others Market by Country, 2019 - 2022, USD Million

TABLE 62 North America Others Market by Country, 2023 - 2030, USD Million

TABLE 63 North America Others Market by Country, 2019 - 2022, Kilo Tonnes

TABLE 64 North America Others Market by Country, 2023 - 2030, Kilo Tonnes

TABLE 65 North America Engineering Plastics Market by Country, 2019 - 2022, USD Million

TABLE 66 North America Engineering Plastics Market by Country, 2023 - 2030, USD Million

TABLE 67 North America Engineering Plastics Market by Country, 2019 - 2022, Kilo Tonnes

TABLE 68 North America Engineering Plastics Market by Country, 2023 - 2030, Kilo Tonnes

TABLE 69 US Engineering Plastics Market, 2019 - 2022, USD Million

TABLE 70 US Engineering Plastics Market, 2023 - 2030, USD Million

TABLE 71 US Engineering Plastics Market, 2019 - 2022, Kilo Tonnes

TABLE 72 US Engineering Plastics Market, 2023 - 2030, Kilo Tonnes

TABLE 73 US Engineering Plastics Market by Type, 2019 - 2022, USD Million

TABLE 74 US Engineering Plastics Market by Type, 2023 - 2030, USD Million

TABLE 75 US Engineering Plastics Market by Type, 2019 - 2022, Kilo Tonnes

TABLE 76 US Engineering Plastics Market by Type, 2023 - 2030, Kilo Tonnes

TABLE 77 US Engineering Plastics Market by End-User, 2019 - 2022, USD Million

TABLE 78 US Engineering Plastics Market by End-User, 2023 - 2030, USD Million

TABLE 79 US Engineering Plastics Market by End-User, 2019 - 2022, Kilo Tonnes

TABLE 80 US Engineering Plastics Market by End-User, 2023 - 2030, Kilo Tonnes

TABLE 81 Canada Engineering Plastics Market, 2019 - 2022, USD Million

TABLE 82 Canada Engineering Plastics Market, 2023 - 2030, USD Million

TABLE 83 Canada Engineering Plastics Market, 2019 - 2022, Kilo Tonnes

TABLE 84 Canada Engineering Plastics Market, 2023 - 2030, Kilo Tonnes

TABLE 85 Canada Engineering Plastics Market by Type, 2019 - 2022, USD Million

TABLE 86 Canada Engineering Plastics Market by Type, 2023 - 2030, USD Million

TABLE 87 Canada Engineering Plastics Market by Type, 2019 - 2022, Kilo Tonnes

TABLE 88 Canada Engineering Plastics Market by Type, 2023 - 2030, Kilo Tonnes

TABLE 89 Canada Engineering Plastics Market by End-User, 2019 - 2022, USD Million

TABLE 90 Canada Engineering Plastics Market by End-User, 2023 - 2030, USD Million

TABLE 91 Canada Engineering Plastics Market by End-User, 2019 - 2022, Kilo Tonnes

TABLE 92 Canada Engineering Plastics Market by End-User, 2023 - 2030, Kilo Tonnes

TABLE 93 Mexico Engineering Plastics Market, 2019 - 2022, USD Million

TABLE 94 Mexico Engineering Plastics Market, 2023 - 2030, USD Million

TABLE 95 Mexico Engineering Plastics Market, 2019 - 2022, Kilo Tonnes

TABLE 96 Mexico Engineering Plastics Market, 2023 - 2030, Kilo Tonnes

TABLE 97 Mexico Engineering Plastics Market by Type, 2019 - 2022, USD Million

TABLE 98 Mexico Engineering Plastics Market by Type, 2023 - 2030, USD Million

TABLE 99 Mexico Engineering Plastics Market by Type, 2019 - 2022, Kilo Tonnes

TABLE 100 Mexico Engineering Plastics Market by Type, 2023 - 2030, Kilo Tonnes

TABLE 101 Mexico Engineering Plastics Market by End-User, 2019 - 2022, USD Million

TABLE 102 Mexico Engineering Plastics Market by End-User, 2023 - 2030, USD Million

TABLE 103 Mexico Engineering Plastics Market by End-User, 2019 - 2022, Kilo Tonnes

TABLE 104 Mexico Engineering Plastics Market by End-User, 2023 - 2030, Kilo Tonnes

TABLE 105 Rest of North America Engineering Plastics Market, 2019 - 2022, USD Million

TABLE 106 Rest of North America Engineering Plastics Market, 2023 - 2030, USD Million

TABLE 107 Rest of North America Engineering Plastics Market, 2019 - 2022, Kilo Tonnes

TABLE 108 Rest of North America Engineering Plastics Market, 2023 - 2030, Kilo Tonnes

TABLE 109 Rest of North America Engineering Plastics Market by Type, 2019 - 2022, USD Million

TABLE 110 Rest of North America Engineering Plastics Market by Type, 2023 - 2030, USD Million

TABLE 111 Rest of North America Engineering Plastics Market by Type, 2019 - 2022, Kilo Tonnes

TABLE 112 Rest of North America Engineering Plastics Market by Type, 2023 - 2030, Kilo Tonnes

TABLE 113 Rest of North America Engineering Plastics Market by End-User, 2019 - 2022, USD Million

TABLE 114 Rest of North America Engineering Plastics Market by End-User, 2023 - 2030, USD Million

TABLE 115 Rest of North America Engineering Plastics Market by End-User, 2019 - 2022, Kilo Tonnes

TABLE 116 Rest of North America Engineering Plastics Market by End-User, 2023 - 2030, Kilo Tonnes

TABLE 117 Key Information – SABIC

TABLE 118 Key Information – Lanxess AG

TABLE 119 Key Information – Solvay SA

TABLE 120 Key Information – Evonik Industries AG

TABLE 121 Key information – Arkema S.A.

TABLE 122 key information – LG Chem Ltd.

TABLE 123 Key Information – Bayer AG

TABLE 124 Key Information – BASF SE

TABLE 125 Key Information – Celanese Corporation

TABLE 126 Key Information –DuPont de Nemours, Inc.

List of Figures

FIG 1 Methodology for the research

FIG 2 North America Engineering Plastics Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Engineering Plastics Market

FIG 4 Porter’s Five Forces Analysis – Engineering Plastics Market

FIG 5 North America Engineering Plastics Market share by Type, 2022

FIG 6 North America Engineering Plastics Market share by Type, 2030

FIG 7 North America Engineering Plastics Market by Type, 2019 - 2030, USD Million

FIG 8 North America Engineering Plastics Market share by End-User, 2022

FIG 9 North America Engineering Plastics Market share by End-User, 2030

FIG 10 North America Engineering Plastics Market by End-User, 2019 - 2030, USD Million

FIG 11 North America Engineering Plastics Market share by Country, 2022

FIG 12 North America Engineering Plastics Market share by Country, 2030

FIG 13 North America Engineering Plastics Market by Country, 2019 - 2030, USD Million

FIG 14 SWOT Analysis: SABIC

FIG 15 Swot Analysis: Lanxess AG

FIG 16 SWOT Analysis: Solvay SA

FIG 17 SWOT Analysis: Evonik Industries AG

FIG 18 SWOT Analysis: Arkema S.A.

FIG 19 Swot Analysis: LG Chem Ltd.

FIG 20 Swot Analysis: Bayer AG

FIG 21 Recent strategies and developments: BASF SE

FIG 22 SWOT Analysis: BASF SE

FIG 23 SWOT Analysis: Celanese Corporation

FIG 24 Swot Analysis: DuPont de Nemours, Inc.