The North America Generative Design Market would witness market growth of 19.3% CAGR during the forecast period (2024-2031).

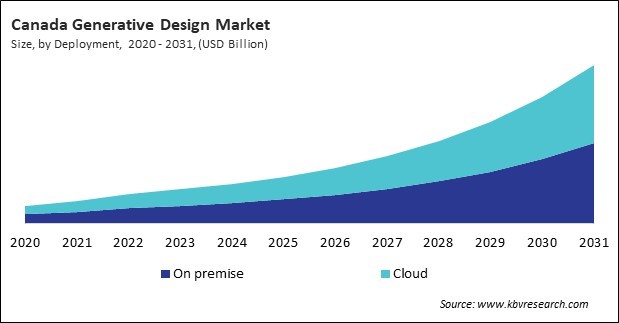

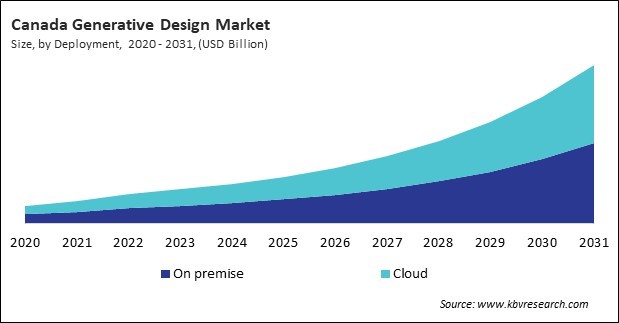

The US market dominated the North America Generative Design Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $251,974.5 Thousands by 2031. The Canada market is exhibiting a CAGR of 21.8% during (2024 - 2031). Additionally, The Mexico market would experience a CAGR of 20.8% during (2024 - 2031).

Generative design is an advanced methodology that leverages computational algorithms and artificial intelligence to explore various design solutions and generate optimized structures and components. In addition, generative design finds applications across a broad spectrum of industries, each benefiting from its unique capabilities to optimize and innovate designs. Generative design is used to create optimized components for spacecraft, including satellite structures and space rovers. The technology helps design lightweight yet robust components that withstand harsh space conditions. In aerospace applications, generative design aids in developing advanced thermal management systems. This includes optimized heat sinks and cooling channels for spacecraft and aircraft, ensuring efficient heat dissipation in extreme environments.

In addition, generative design enables the development of ergonomically optimized consumer products, such as office chairs and wearable devices. The technology helps create products that fit the human body more comfortably, enhancing user experience and reducing strain. Generative design is used to develop innovative and functional packaging solutions for consumer goods. This includes packaging that minimizes material usage while maximizing protection and aesthetic appeal.

As per the International Trade Administration (ITA), Mexico is the world’s seventh-largest passenger vehicle manufacturer, producing 3.5 million vehicles annually. 88% percent of vehicles produced in Mexico are exported. Mexico is the world’s fifth-largest manufacturer of heavy-duty vehicles for cargo, hosting 14 manufacturers and assemblers of buses, trucks, and tractor trucks, as well as two manufacturers of engines.

The surge in vehicle production in Mexico drives the need for efficient manufacturing processes. Generative design contributes to streamlining production by optimizing component designs for manufacturability, reducing material waste, and improving overall production efficiency. The high volume of vehicle manufacturing in Mexico encourages the adoption of generative design to achieve these production efficiencies. Hence, the market is experiencing development due to the increased production of vehicles and construction activities in the region.

Free Valuable Insights: The Generative Design Market is Predict to reach USD 938.9 Million by 2031, at a CAGR of 19.8%

Based on Deployment, the market is segmented into On premise and Cloud. Based on Industry, the market is segmented into Automotive, Industrial Manufacturing, Aerospace & Defense, Architecture & Construction, and Others. Based on Application, the market is segmented into Topology Optimization & 3D Printing, Lightweighting, Thermal Management, and Others. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- PTC, Inc.

- Dassault Systemes SE

- Autodesk, Inc.

- Siemens AG

- ANSYS, Inc.

- nTopology Inc.

- Hexagon AB

- Altair Engineering, Inc. (IMG Companies, LLC)

- Carbon, Inc.

- Synera GmbH

North America Generative Design Market Report Segmentation

By Deployment

By Industry

- Automotive

- Industrial Manufacturing

- Aerospace & Defense

- Architecture & Construction

- Others

By Application

- Topology Optimization & 3D Printing

- Lightweighting

- Thermal Management

- Others

By Country

- US

- Canada

- Mexico

- Rest of North America

Chapter 1. Market Scope & Methodology

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 North America Generative Design Market, by Deployment

1.4.2 North America Generative Design Market, by Industry

1.4.3 North America Generative Design Market, by Application

1.4.4 North America Generative Design Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Competition Analysis - Global

4.1 KBV Cardinal Matrix

4.2 Recent Industry Wide Strategic Developments

4.2.1 Product Launches and Product Expansions

4.2.2 Partnerships, Collaborations and Agreements

4.2.3 Acquisition and Mergers

4.3 Market Share Analysis, 2023

4.4 Top Winning Strategies

4.4.1 Key Leading Strategies: Percentage Distribution (2020-2024)

4.4.2 Key Strategic Move: (Product Launches and Product Expansions : 2020, April – 2024, May) Leading Players

4.5 Porter Five Forces Analysis

Chapter 5. North America Generative Design Market by Deployment

5.1 North America On premise Market by Country

5.2 North America Cloud Market by Country

Chapter 6. North America Generative Design Market by Industry

6.1 North America Automotive Market by Country

6.2 North America Industrial Manufacturing Market by Country

6.3 North America Aerospace & Defense Market by Country

6.4 North America Architecture & Construction Market by Country

6.5 North America Others Market by Country

Chapter 7. North America Generative Design Market by Application

7.1 North America Topology Optimization & 3D Printing Market by Country

7.2 North America Lightweighting Market by Country

7.3 North America Thermal Management Market by Country

7.4 North America Others Market by Country

Chapter 8. North America Generative Design Market by Country

8.1 US Generative Design Market

8.1.1 US Generative Design Market by Deployment

8.1.2 US Generative Design Market by Industry

8.1.3 US Generative Design Market by Application

8.2 Canada Generative Design Market

8.2.1 Canada Generative Design Market by Deployment

8.2.2 Canada Generative Design Market by Industry

8.2.3 Canada Generative Design Market by Application

8.3 Mexico Generative Design Market

8.3.1 Mexico Generative Design Market by Deployment

8.3.2 Mexico Generative Design Market by Industry

8.3.3 Mexico Generative Design Market by Application

8.4 Rest of North America Generative Design Market

8.4.1 Rest of North America Generative Design Market by Deployment

8.4.2 Rest of North America Generative Design Market by Industry

8.4.3 Rest of North America Generative Design Market by Application

Chapter 9. Company Profiles

9.1 PTC, Inc.

9.1.1 Company Overview

9.1.2 Financial Analysis

9.1.3 Regional Analysis

9.1.4 Research & Development Expenses

9.1.5 Recent strategies and developments:

9.1.5.1 Product Launches and Product Expansions:

9.1.6 SWOT Analysis

9.2 Dassault Systemes SE

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Regional Analysis

9.2.4 Research & Development Expense

9.2.5 Recent strategies and developments:

9.2.5.1 Partnerships, Collaborations, and Agreements:

9.2.5.2 Product Launches and Product Expansions:

9.2.6 SWOT Analysis

9.3 Autodesk, Inc.

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Regional Analysis

9.3.4 Research & Development Expenses

9.3.5 Recent strategies and developments:

9.3.5.1 Partnerships, Collaborations, and Agreements:

9.3.5.2 Product Launches and Product Expansions:

9.3.5.3 Acquisition and Mergers:

9.3.6 SWOT Analysis

9.4 Siemens AG

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Segmental and Regional Analysis

9.4.4 Research & Development Expense

9.4.5 Recent strategies and developments:

9.4.5.1 Partnerships, Collaborations, and Agreements:

9.4.5.2 Product Launches and Product Expansions:

9.4.6 SWOT Analysis

9.5 ANSYS, Inc.

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Regional Analysis

9.5.4 Research & Development Expenses

9.5.5 Recent strategies and developments:

9.5.5.1 Product Launches and Product Expansions:

9.5.6 SWOT Analysis

9.6 nTopology Inc.

9.6.1 Company Overview

9.6.2 Recent strategies and developments:

9.6.2.1 Product Launches and Product Expansions:

9.6.3 SWOT Analysis

9.7 Hexagon AB

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Regional & Segmental Analysis

9.7.4 Research & Development Expenses

9.7.5 Recent strategies and developments:

9.7.5.1 Partnerships, Collaborations, and Agreements:

9.7.5.2 Product Launches and Product Expansions:

9.7.5.3 Acquisition and Mergers:

9.7.6 SWOT Analysis

9.8 Altair Engineering, Inc. (IMG Companies, LLC)

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Segmental and Regional Analysis

9.8.4 Research & Development Expenses

9.8.5 Recent strategies and developments:

9.8.5.1 Partnerships, Collaborations, and Agreements:

9.8.5.2 Product Launches and Product Expansions:

9.8.6 SWOT Analysis

9.9 Carbon, Inc.

9.9.1 Company Overview

9.9.2 Recent strategies and developments:

9.9.2.1 Product Launches and Product Expansions:

9.9.2.2 Acquisition and Mergers:

9.9.3 SWOT Analysis

9.10. Synera GmbH

9.10.1 Company Overview

9.10.2 Recent strategies and developments:

9.10.2.1 Product Launches and Product Expansions:

9.10.3 SWOT Analysis

TABLE 1 North America Generative Design Market, 2020 - 2023, USD Thousands

TABLE 2 North America Generative Design Market, 2024 - 2031, USD Thousands

TABLE 3 Product Launches And Product Expansions– Generative Design Market

TABLE 4 Partnerships, Collaborations and Agreements– Generative Design Market

TABLE 5 Acquisition and Mergers– Generative Design Market

TABLE 6 North America Generative Design Market by Deployment, 2020 - 2023, USD Thousands

TABLE 7 North America Generative Design Market by Deployment, 2024 - 2031, USD Thousands

TABLE 8 North America On premise Market by Country, 2020 - 2023, USD Thousands

TABLE 9 North America On premise Market by Country, 2024 - 2031, USD Thousands

TABLE 10 North America Cloud Market by Country, 2020 - 2023, USD Thousands

TABLE 11 North America Cloud Market by Country, 2024 - 2031, USD Thousands

TABLE 12 North America Generative Design Market by Industry, 2020 - 2023, USD Thousands

TABLE 13 North America Generative Design Market by Industry, 2024 - 2031, USD Thousands

TABLE 14 North America Automotive Market by Country, 2020 - 2023, USD Thousands

TABLE 15 North America Automotive Market by Country, 2024 - 2031, USD Thousands

TABLE 16 North America Industrial Manufacturing Market by Country, 2020 - 2023, USD Thousands

TABLE 17 North America Industrial Manufacturing Market by Country, 2024 - 2031, USD Thousands

TABLE 18 North America Aerospace & Defense Market by Country, 2020 - 2023, USD Thousands

TABLE 19 North America Aerospace & Defense Market by Country, 2024 - 2031, USD Thousands

TABLE 20 North America Architecture & Construction Market by Country, 2020 - 2023, USD Thousands

TABLE 21 North America Architecture & Construction Market by Country, 2024 - 2031, USD Thousands

TABLE 22 North America Others Market by Country, 2020 - 2023, USD Thousands

TABLE 23 North America Others Market by Country, 2024 - 2031, USD Thousands

TABLE 24 North America Generative Design Market by Application, 2020 - 2023, USD Thousands

TABLE 25 North America Generative Design Market by Application, 2024 - 2031, USD Thousands

TABLE 26 North America Topology Optimization & 3D Printing Market by Country, 2020 - 2023, USD Thousands

TABLE 27 North America Topology Optimization & 3D Printing Market by Country, 2024 - 2031, USD Thousands

TABLE 28 North America Lightweighting Market by Country, 2020 - 2023, USD Thousands

TABLE 29 North America Lightweighting Market by Country, 2024 - 2031, USD Thousands

TABLE 30 North America Thermal Management Market by Country, 2020 - 2023, USD Thousands

TABLE 31 North America Thermal Management Market by Country, 2024 - 2031, USD Thousands

TABLE 32 North America Others Market by Country, 2020 - 2023, USD Thousands

TABLE 33 North America Others Market by Country, 2024 - 2031, USD Thousands

TABLE 34 North America Generative Design Market by Country, 2020 - 2023, USD Thousands

TABLE 35 North America Generative Design Market by Country, 2024 - 2031, USD Thousands

TABLE 36 US Generative Design Market, 2020 - 2023, USD Thousands

TABLE 37 US Generative Design Market, 2024 - 2031, USD Thousands

TABLE 38 US Generative Design Market by Deployment, 2020 - 2023, USD Thousands

TABLE 39 US Generative Design Market by Deployment, 2024 - 2031, USD Thousands

TABLE 40 US Generative Design Market by Industry, 2020 - 2023, USD Thousands

TABLE 41 US Generative Design Market by Industry, 2024 - 2031, USD Thousands

TABLE 42 US Generative Design Market by Application, 2020 - 2023, USD Thousands

TABLE 43 US Generative Design Market by Application, 2024 - 2031, USD Thousands

TABLE 44 Canada Generative Design Market, 2020 - 2023, USD Thousands

TABLE 45 Canada Generative Design Market, 2024 - 2031, USD Thousands

TABLE 46 Canada Generative Design Market by Deployment, 2020 - 2023, USD Thousands

TABLE 47 Canada Generative Design Market by Deployment, 2024 - 2031, USD Thousands

TABLE 48 Canada Generative Design Market by Industry, 2020 - 2023, USD Thousands

TABLE 49 Canada Generative Design Market by Industry, 2024 - 2031, USD Thousands

TABLE 50 Canada Generative Design Market by Application, 2020 - 2023, USD Thousands

TABLE 51 Canada Generative Design Market by Application, 2024 - 2031, USD Thousands

TABLE 52 Mexico Generative Design Market, 2020 - 2023, USD Thousands

TABLE 53 Mexico Generative Design Market, 2024 - 2031, USD Thousands

TABLE 54 Mexico Generative Design Market by Deployment, 2020 - 2023, USD Thousands

TABLE 55 Mexico Generative Design Market by Deployment, 2024 - 2031, USD Thousands

TABLE 56 Mexico Generative Design Market by Industry, 2020 - 2023, USD Thousands

TABLE 57 Mexico Generative Design Market by Industry, 2024 - 2031, USD Thousands

TABLE 58 Mexico Generative Design Market by Application, 2020 - 2023, USD Thousands

TABLE 59 Mexico Generative Design Market by Application, 2024 - 2031, USD Thousands

TABLE 60 Rest of North America Generative Design Market, 2020 - 2023, USD Thousands

TABLE 61 Rest of North America Generative Design Market, 2024 - 2031, USD Thousands

TABLE 62 Rest of North America Generative Design Market by Deployment, 2020 - 2023, USD Thousands

TABLE 63 Rest of North America Generative Design Market by Deployment, 2024 - 2031, USD Thousands

TABLE 64 Rest of North America Generative Design Market by Industry, 2020 - 2023, USD Thousands

TABLE 65 Rest of North America Generative Design Market by Industry, 2024 - 2031, USD Thousands

TABLE 66 Rest of North America Generative Design Market by Application, 2020 - 2023, USD Thousands

TABLE 67 Rest of North America Generative Design Market by Application, 2024 - 2031, USD Thousands

TABLE 68 key Information – PTC, Inc.

TABLE 69 Key Information – Dassault Systemes SE

TABLE 70 Key Information – Autodesk, Inc.

TABLE 71 Key Information – Siemens AG

TABLE 72 Key Information – ANSYS, Inc.

TABLE 73 Key Information – nTopology Inc.

TABLE 74 Key Information – Hexagon AB

TABLE 75 Key Information – Altair Engineering, Inc.

TABLE 76 Key Information – Carbon, Inc.

TABLE 77 Key Information – Synera GmbH

List of Figures

FIG 1 Methodology for the research

FIG 2 North America Generative Design Market, 2020 - 2031, USD Thousands

FIG 3 Key Factors Impacting Generative Design Market

FIG 4 KBV Cardinal Matrix

FIG 5 Market Share Analysis, 2023

FIG 6 Key Leading Strategies: Percentage Distribution (2020-2024)

FIG 7 Key Strategic Move: (Product Launches and Product Expansions : 2020, apr – 2024, May) Leading Players

FIG 8 Porter’s Five Forces Analysis – Generative Design Market

FIG 9 North America Generative Design Market share by Deployment, 2023

FIG 10 North America Generative Design Market share by Deployment, 2031

FIG 11 North America Generative Design Market by Deployment, 2020 - 2031, USD Thousands

FIG 12 North America Generative Design Market share by Industry, 2023

FIG 13 North America Generative Design Market share by Industry, 2031

FIG 14 North America Generative Design Market by Industry, 2020 - 2031, USD Thousands

FIG 15 North America Generative Design Market share by Application, 2023

FIG 16 North America Generative Design Market share by Application, 2031

FIG 17 North America Generative Design Market by Application, 2020 - 2031, USD Thousands

FIG 18 North America Generative Design Market share by Country, 2023

FIG 19 North America Generative Design Market share by Country, 2031

FIG 20 North America Generative Design Market by Country, 2020 - 2031, USD Thousands

FIG 21 Swot Analysis: PTC, Inc.

FIG 22 Recent strategies and developments: Dassault Systemes SE

FIG 23 SWOT Analysis: Dassault Systemes SE

FIG 24 Recent strategies and developments: Autodesk, Inc.

FIG 25 SWOT Analysis: Autodesk, Inc.

FIG 26 Recent strategies and developments: Siemens AG

FIG 27 SWOT Analysis: Siemens AG

FIG 28 SWOT analysis: ANSYS, Inc.

FIG 29 SWOT analysis: nTopology Inc.

FIG 30 Recent strategies and developments: Hexagon AB

FIG 31 SWOT Analysis: Hexagon AB

FIG 32 Recent strategies and developments: Altair Engineering, Inc.

FIG 33 SWOT Analysis: Altair Engineering, Inc.

FIG 34 Recent strategies and developments: Carbon, Inc.

FIG 35 SWOT analysis: Carbon, Inc.

FIG 36 SWOT analysis: Synera GmbH