North America Glass Flake Coatings Market Size, Share & Trends Analysis Report By Material (Epoxy, Vinyl Ester, and Polyester), By End Use (Marine, Oil & Gas, Chemical, Industrial, Construction, and Others), By Country and Growth Forecast, 2023 - 2030

Published Date : 15-Mar-2024 |

Pages: 122 |

Formats: PDF |

COVID-19 Impact on the North America Glass Flake Coatings Market

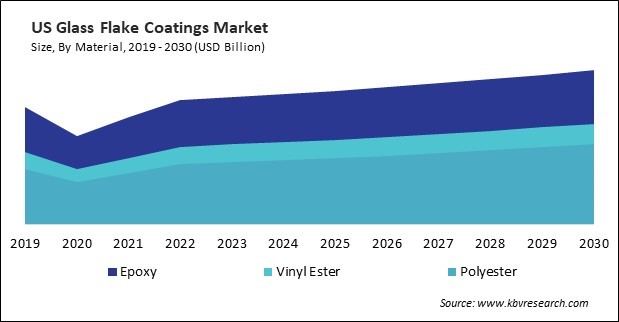

The North America Glass Flake Coatings Market would witness market growth of 3.9% CAGR during the forecast period (2023-2030). In the year 2019, the North America market's volume surged to 1050.63 hundred Tonnes, showcasing a growth of 3.2% (2019-2022).

This resin, derived from the reaction of epoxy resin with acrylic or methacrylic acid, offers a versatile solution for various coating applications, particularly in environments prone to harsh chemicals, corrosion, and abrasion. When combined with glass flakes, which serve as reinforcement, the resulting composite exhibits superior mechanical properties, including enhanced tensile strength and impact resistance. Therefore, the US market consumes 366.66 hundred tonnes of glass flake coatings in production of vinyl ester by 2030.

The US market dominated the North America Glass Flake Coatings Market by Country in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $349.4 Million by 2030. The Canada market is experiencing a CAGR of 6.2% during (2023 - 2030). Additionally, The Mexico market would exhibit a CAGR of 5.3% during (2023 - 2030).

Glass flake coatings are used in chemical processing plants to protect storage tanks, reactors, and vessels from corrosive chemicals. The coatings’ chemical resistance ensures the longevity and safety of equipment in environments where exposure to corrosive substances is common. Glass flake coatings are applied to the underbodies of vehicles to protect against corrosion caused by road salts, water, and environmental factors. These coatings contribute to the overall durability and longevity of automotive components.

Additionally, glass flake coatings protect steel and concrete structures like bridges and buildings from corrosion and environmental degradation. The coatings enhance the structural integrity of infrastructure, reducing maintenance needs over time. In water treatment plants, glass flake coatings are applied to pipelines and equipment to resist corrosion caused by water and chemical exposure, ensuring the longevity of critical infrastructure. Glass flake coatings find application in the mining industry to protect equipment exposed to abrasive materials.

In November 2023, Canadian manufacturing sales increased by 1.2% to $71.7 billion, as reported by Statistics Canada. The automotive manufacturing sector, a significant contributor to the Canadian economy, relies on coatings that provide corrosion protection for vehicles and manufacturing equipment. Hence, the factors mentioned above will drive the regional market growth.

Free Valuable Insights: The Glass Flake Coatings Market is Predict to reach USD 2.1 Billion by 2030, at a CAGR of 4.2%

Based on Material, the market is segmented into Epoxy, Vinyl Ester, and Polyester. Based on End Use, the market is segmented into Marine, Oil & Gas, Chemical, Industrial, Construction, and Others. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- Akzo Nobel N.V.

- Hempel A/S

- PPG Industries, Inc.

- KCC Corporation (Momentive Performance Materials Inc.,)

- Kansai Paint Co., Ltd.

- Berger Paints India Limited

- The Sherwin-Williams Company

- Jotun A/S

- Deccan Mechanical & Chemical Industries Pvt. Ltd

- Chugoku Marine Paints, Ltd.

North America Glass Flake Coatings Market Report Segmentation

By Material (Volume, Hundred Tonnes, USD Billion, 2019-2030)

- Epoxy

- Vinyl Ester

- Polyester

By End Use (Volume, Hundred Tonnes, USD Billion, 2019-2030)

- Marine

- Oil & Gas

- Chemical

- Industrial

- Construction

- Others

By Country (Volume, Hundred Tonnes, USD Billion, 2019-2030)

- US

- Canada

- Mexico

- Rest of North America

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 North America Glass Flake Coatings Market, by Material

1.4.2 North America Glass Flake Coatings Market, by End Use

1.4.3 North America Glass Flake Coatings Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

3.3 Porter’s Five Forces Analysis

Chapter 4. North America Glass Flake Coatings Market by Material

4.1 North America Epoxy Market by Country

4.2 North America Vinyl Ester Market by Country

4.3 North America Polyester Market by Country

Chapter 5. North America Glass Flake Coatings Market by End-use

5.1 North America Marine Market by Country

5.2 North America Oil & Gas Market by Country

5.3 North America Chemical Market by Country

5.4 North America Industrial Market by Country

5.5 North America Construction Market by Country

5.6 North America Others Market by Country

Chapter 6. North America Glass Flake Coatings Market by Country

6.1 US Glass Flake Coatings Market

6.1.1 US Glass Flake Coatings Market by Material

6.1.2 US Glass Flake Coatings Market by End-use

6.2 Canada Glass Flake Coatings Market

6.2.1 Canada Glass Flake Coatings Market by Material

6.2.2 Canada Glass Flake Coatings Market by End-use

6.3 Mexico Glass Flake Coatings Market

6.3.1 Mexico Glass Flake Coatings Market by Material

6.3.2 Mexico Glass Flake Coatings Market by End-use

6.4 Rest of North America Glass Flake Coatings Market

6.4.1 Rest of North America Glass Flake Coatings Market by Material

6.4.2 Rest of North America Glass Flake Coatings Market by End-use

Chapter 7. Company Profiles

7.1 Hempel A/S

7.1.1 Company Overview

7.1.2 Financial Analysis

7.1.3 Segmental and Regional Analysis

7.1.4 Research & Development Expenses

7.1.5 SWOT Analysis

7.2 KCC CORPORATION (Momentive Performance materials Inc.,)

7.2.1 Company Overview

7.2.2 SWOT Analysis

7.3 Kansai Paint Co., Ltd.

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Regional Analysis

7.3.4 SWOT Analysis

7.4 Berger Paints India Limited

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Regional Analysis

7.4.4 SWOT Analysis

7.5 The Sherwin-Williams Company

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Segmental

7.5.4 Research & Development Expenses

7.5.5 SWOT Analysis

7.6 Akzo Nobel N.V.

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Segmental and Regional Analysis

7.6.4 Recent strategies and developments:

7.6.4.1 Product Launches and Product Expansions:

7.6.5 SWOT Analysis

7.7 PPG Industries, Inc.

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Segmental and Regional Analysis

7.7.4 Research & Development Expense

7.7.5 Recent strategies and developments:

7.7.5.1 Acquisition and Mergers:

7.7.6 SWOT Analysis

7.8 Jotun A/S

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Segmental and Regional Analysis

7.8.4 Research & Development Expenses

7.8.5 Recent strategies and developments:

7.8.5.1 Product Launches and Product Expansions:

7.8.6 SWOT Analysis

7.9 Deccan Mechanical & Chemical Industries Pvt. Ltd

7.9.1 Company Overview

7.9.2 SWOT Analysis

7.10. Chugoku Marine Paints, Ltd.

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Regional Analysis

7.10.4 SWOT Analysis

TABLE 2 North America Glass Flake Coatings Market, 2023 - 2030, USD Million

TABLE 3 North America Glass Flake Coatings Market, 2019 - 2022, Hundred Tonnes

TABLE 4 North America Glass Flake Coatings Market, 2023 - 2030, Hundred Tonnes

TABLE 5 North America Glass Flake Coatings Market by Material, 2019 - 2022, USD Million

TABLE 6 North America Glass Flake Coatings Market by Material, 2023 - 2030, USD Million

TABLE 7 North America Glass Flake Coatings Market by Material, 2019 - 2022, Hundred Tonnes

TABLE 8 North America Glass Flake Coatings Market by Material, 2023 - 2030, Hundred Tonnes

TABLE 9 North America Epoxy Market by Country, 2019 - 2022, USD Million

TABLE 10 North America Epoxy Market by Country, 2023 - 2030, USD Million

TABLE 11 North America Epoxy Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 12 North America Epoxy Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 13 North America Vinyl Ester Market by Country, 2019 - 2022, USD Million

TABLE 14 North America Vinyl Ester Market by Country, 2023 - 2030, USD Million

TABLE 15 North America Vinyl Ester Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 16 North America Vinyl Ester Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 17 North America Polyester Market by Country, 2019 - 2022, USD Million

TABLE 18 North America Polyester Market by Country, 2023 - 2030, USD Million

TABLE 19 North America Polyester Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 20 North America Polyester Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 21 North America Glass Flake Coatings Market by End-use, 2019 - 2022, USD Million

TABLE 22 North America Glass Flake Coatings Market by End-use, 2023 - 2030, USD Million

TABLE 23 North America Glass Flake Coatings Market by End-use, 2019 - 2022, Hundred Tonnes

TABLE 24 North America Glass Flake Coatings Market by End-use, 2023 - 2030, Hundred Tonnes

TABLE 25 North America Marine Market by Country, 2019 - 2022, USD Million

TABLE 26 North America Marine Market by Country, 2023 - 2030, USD Million

TABLE 27 North America Marine Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 28 North America Marine Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 29 North America Oil & Gas Market by Country, 2019 - 2022, USD Million

TABLE 30 North America Oil & Gas Market by Country, 2023 - 2030, USD Million

TABLE 31 North America Oil & Gas Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 32 North America Oil & Gas Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 33 North America Chemical Market by Country, 2019 - 2022, USD Million

TABLE 34 North America Chemical Market by Country, 2023 - 2030, USD Million

TABLE 35 North America Chemical Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 36 North America Chemical Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 37 North America Industrial Market by Country, 2019 - 2022, USD Million

TABLE 38 North America Industrial Market by Country, 2023 - 2030, USD Million

TABLE 39 North America Industrial Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 40 North America Industrial Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 41 North America Construction Market by Country, 2019 - 2022, USD Million

TABLE 42 North America Construction Market by Country, 2023 - 2030, USD Million

TABLE 43 North America Construction Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 44 North America Construction Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 45 North America Others Market by Country, 2019 - 2022, USD Million

TABLE 46 North America Others Market by Country, 2023 - 2030, USD Million

TABLE 47 North America Others Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 48 North America Others Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 49 North America Glass Flake Coatings Market by Country, 2019 - 2022, USD Million

TABLE 50 North America Glass Flake Coatings Market by Country, 2023 - 2030, USD Million

TABLE 51 North America Glass Flake Coatings Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 52 North America Glass Flake Coatings Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 53 US Glass Flake Coatings Market, 2019 - 2022, USD Million

TABLE 54 US Glass Flake Coatings Market, 2023 - 2030, USD Million

TABLE 55 US Glass Flake Coatings Market, 2019 - 2022, Hundred Tonnes

TABLE 56 US Glass Flake Coatings Market, 2023 - 2030, Hundred Tonnes

TABLE 57 US Glass Flake Coatings Market by Material, 2019 - 2022, USD Million

TABLE 58 US Glass Flake Coatings Market by Material, 2023 - 2030, USD Million

TABLE 59 US Glass Flake Coatings Market by Material, 2019 - 2022, Hundred Tonnes

TABLE 60 US Glass Flake Coatings Market by Material, 2023 - 2030, Hundred Tonnes

TABLE 61 US Glass Flake Coatings Market by End-use, 2019 - 2022, USD Million

TABLE 62 US Glass Flake Coatings Market by End-use, 2023 - 2030, USD Million

TABLE 63 US Glass Flake Coatings Market by End-use, 2019 - 2022, Hundred Tonnes

TABLE 64 US Glass Flake Coatings Market by End-use, 2023 - 2030, Hundred Tonnes

TABLE 65 Canada Glass Flake Coatings Market, 2019 - 2022, USD Million

TABLE 66 Canada Glass Flake Coatings Market, 2023 - 2030, USD Million

TABLE 67 Canada Glass Flake Coatings Market, 2019 - 2022, Hundred Tonnes

TABLE 68 Canada Glass Flake Coatings Market, 2023 - 2030, Hundred Tonnes

TABLE 69 Canada Glass Flake Coatings Market by Material, 2019 - 2022, USD Million

TABLE 70 Canada Glass Flake Coatings Market by Material, 2023 - 2030, USD Million

TABLE 71 Canada Glass Flake Coatings Market by Material, 2019 - 2022, Hundred Tonnes

TABLE 72 Canada Glass Flake Coatings Market by Material, 2023 - 2030, Hundred Tonnes

TABLE 73 Canada Glass Flake Coatings Market by End-use, 2019 - 2022, USD Million

TABLE 74 Canada Glass Flake Coatings Market by End-use, 2023 - 2030, USD Million

TABLE 75 Canada Glass Flake Coatings Market by End-use, 2019 - 2022, Hundred Tonnes

TABLE 76 Canada Glass Flake Coatings Market by End-use, 2023 - 2030, Hundred Tonnes

TABLE 77 Mexico Glass Flake Coatings Market, 2019 - 2022, USD Million

TABLE 78 Mexico Glass Flake Coatings Market, 2023 - 2030, USD Million

TABLE 79 Mexico Glass Flake Coatings Market, 2019 - 2022, Hundred Tonnes

TABLE 80 Mexico Glass Flake Coatings Market, 2023 - 2030, Hundred Tonnes

TABLE 81 Mexico Glass Flake Coatings Market by Material, 2019 - 2022, USD Million

TABLE 82 Mexico Glass Flake Coatings Market by Material, 2023 - 2030, USD Million

TABLE 83 Mexico Glass Flake Coatings Market by Material, 2019 - 2022, Hundred Tonnes

TABLE 84 Mexico Glass Flake Coatings Market by Material, 2023 - 2030, Hundred Tonnes

TABLE 85 Mexico Glass Flake Coatings Market by End-use, 2019 - 2022, USD Million

TABLE 86 Mexico Glass Flake Coatings Market by End-use, 2023 - 2030, USD Million

TABLE 87 Mexico Glass Flake Coatings Market by End-use, 2019 - 2022, Hundred Tonnes

TABLE 88 Mexico Glass Flake Coatings Market by End-use, 2023 - 2030, Hundred Tonnes

TABLE 89 Rest of North America Glass Flake Coatings Market, 2019 - 2022, USD Million

TABLE 90 Rest of North America Glass Flake Coatings Market, 2023 - 2030, USD Million

TABLE 91 Rest of North America Glass Flake Coatings Market, 2019 - 2022, Hundred Tonnes

TABLE 92 Rest of North America Glass Flake Coatings Market, 2023 - 2030, Hundred Tonnes

TABLE 93 Rest of North America Glass Flake Coatings Market by Material, 2019 - 2022, USD Million

TABLE 94 Rest of North America Glass Flake Coatings Market by Material, 2023 - 2030, USD Million

TABLE 95 Rest of North America Glass Flake Coatings Market by Material, 2019 - 2022, Hundred Tonnes

TABLE 96 Rest of North America Glass Flake Coatings Market by Material, 2023 - 2030, Hundred Tonnes

TABLE 97 Rest of North America Glass Flake Coatings Market by End-use, 2019 - 2022, USD Million

TABLE 98 Rest of North America Glass Flake Coatings Market by End-use, 2023 - 2030, USD Million

TABLE 99 Rest of North America Glass Flake Coatings Market by End-use, 2019 - 2022, Hundred Tonnes

TABLE 100 Rest of North America Glass Flake Coatings Market by End-use, 2023 - 2030, Hundred Tonnes

TABLE 101 Key Information – Hempel A/S

TABLE 102 Key Information – KCC CORPORATION.

TABLE 103 Key Information – Kansai Paint CO., LTD.

TABLE 104 Key Information – Berger Paints India Limited

TABLE 105 Key Information – The Sherwin-Williams Company

TABLE 106 Key information – Akzo Nobel N.V.

TABLE 107 Key Information – PPG Industries, Inc.

TABLE 108 Key Information – JOTUN A/S

TABLE 109 Key Information – Deccan Mechanical & Chemical Industries Pvt. Ltd

TABLE 110 Key Information – Chugoku Marine Paints, Ltd.

List of Figures

FIG 1 Methodology for the research

FIG 2 North America Glass Flake Coatings Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Glass Flake Coatings Market Market

FIG 4 Porter’s Five Forces Analysis - Glass Flake Coatings Market

FIG 5 North America Glass Flake Coatings Market share by Material, 2022

FIG 6 North America Glass Flake Coatings Market share by Material, 2030

FIG 7 North America Glass Flake Coatings Market by Material, 2019 - 2030, USD Million

FIG 8 North America Glass Flake Coatings Market share by End-use, 2022

FIG 9 North America Glass Flake Coatings Market share by End-use, 2030

FIG 10 North America Glass Flake Coatings Market by End-use, 2019 - 2030, USD Million

FIG 11 North America Glass Flake Coatings Market share by Country, 2022

FIG 12 North America Glass Flake Coatings Market share by Country, 2030

FIG 13 North America Glass Flake Coatings Market by Country, 2019 - 2030, USD Million

FIG 14 SWOT Analysis: Hempel A/S

FIG 15 SWOT Analysis: KCC Corporation

FIG 16 SWOT Analysis: Kansai Paint Co., Ltd.

FIG 17 SWOT Analysis: Berger Paints India Limited

FIG 18 SWOT Analysis: The Sherwin-Williams Company

FIG 19 SWOT Analysis: Akzo Nobel N.V.

FIG 20 SWOT Analysis: PPG Industries, Inc.

FIG 21 SWOT Analysis: Jotun A/S

FIG 22 SWOT Analysis: Deccan Mechanical & Chemical Industries Pvt. Ltd

FIG 23 SWOT Analysis: Chugoku Marine Paints, Ltd.