North America High-tech Logistics Market Size, Share & Trends Analysis Report By Service (Transportation, Warehousing & Storage, Inventory Management, and Distribution & Fulfillment), By Industry, By Country and Growth Forecast, 2024 - 2031

Published Date : 07-Oct-2024 |

Pages: 106 |

Formats: PDF |

COVID-19 Impact on the North America High-tech Logistics Market

The North America High-tech Logistics Market would witness market growth of 11.0% CAGR during the forecast period (2024-2031).

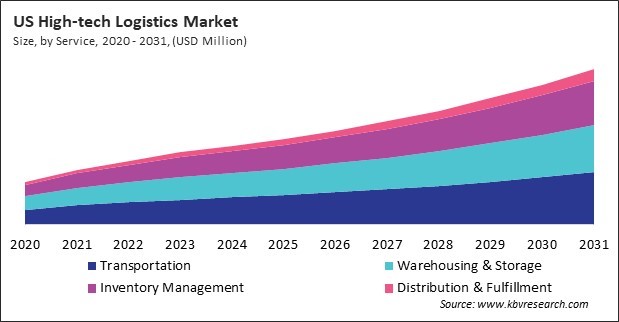

The US market dominated the North America High-tech Logistics Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $24,399.8 Million by 2031. The Canada market is experiencing a CAGR of 13.5% during (2024 - 2031). Additionally, The Mexico market would exhibit a CAGR of 12.6% during (2024 - 2031).

This refers to using advanced technologies to improve the efficiency, accuracy, and automation of logistics processes such as transportation, storage, and distribution. It integrates cutting-edge technologies like artificial intelligence (AI), the Internet of Things (IoT), automation, big data analytics, blockchain, and robotics to streamline supply chain operations. These logistics endeavors to optimize the movement of products from manufacturers to consumers, reduce costs, improve supply chain visibility, and enhance decision-making by utilizing these innovations.

This market represents a rapidly evolving sector integrating advanced technologies to enhance logistics operations' efficiency, accuracy, and overall performance. The transportation, storage, and delivery of products on time and at a reasonable cost are all dependent on logistics, which serves as the foundation of trade and commerce. In recent years, the logistics industry has undertaken a substantial transformation as a result of the necessity to address the complexities of the supply chain, meet the increasing expectations of consumers, and capitalize on cutting-edge innovations.

Protecting sensitive logistical and manufacturing data is paramount as Mexico emerges as a manufacturing powerhouse, especially in sectors like automotive and electronics. The government’s implementation of stricter data protection laws, such as the Federal Law on the Protection of Personal Data (LFPDPPP), has pushed logistics companies to adopt blockchain technology and other secure systems to safeguard information. This growing emphasis on data security is leading to increased investment in logistics solutions that prioritize both the safe transport of goods and the protection of sensitive data. Thus, these combined factors ensure that North America remains a critical player in the global high-tech logistics landscape.

Free Valuable Insights: The High-tech Logistics Market is Predict to reach USD 95.2 Billion by 2031, at a CAGR of 11.6%

Based on Service, the market is segmented into Transportation, Warehousing & Storage, Inventory Management, and Distribution & Fulfillment. Based on Industry, the market is segmented into Semiconductor Industry, Consumer Electronics, Medical Devices, Telecommunications Equipment, and Aerospace & Defense Technologies. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- C.H. Robinson Worldwide, Inc.

- FedEx Corporation

- DP World Logistics FZE (SeaRates)

- Deutsche Post DHL Group (The Deutsche Post AG)

- Deutsche Bahn AG (DB Schenker)

- P. Moller - Maersk A/S

- Burris Logistics

- Wings Logistics Canada, Inc.

- Cosco Shipping Lines Co. Ltd.

- Broekman Logistics

North America High-tech Logistics Market Report Segmentation

By Service

- Transportation

- Warehousing & Storage

- Inventory Management

- Distribution & Fulfillment

By Industry

- Semiconductor Industry

- Consumer Electronics

- Medical Devices

- Telecommunications Equipment

- Aerospace & Defense Technologies

By Country

- US

- Canada

- Mexico

- Rest of North America

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 North America High-tech Logistics Market, by Service

1.4.2 North America High-tech Logistics Market, by Industry

1.4.3 North America High-tech Logistics Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Competition Analysis - Global

4.1 KBV Cardinal Matrix

4.2 Recent Industry Wide Strategic Developments

4.2.1 Partnerships, Collaborations and Agreements

4.2.2 Product Launches and Product Expansions

4.2.3 Acquisition and Mergers

4.2.4 Geographical Expansion

4.3 Market Share Analysis, 2023

4.4 Top Winning Strategies

4.4.1 Key Leading Strategies: Percentage Distribution (2020-2024)

4.4.2 Key Strategic Move: (Product Launches and Product Expansions: 2020, Apr – 2024, Aug) Leading Players

4.5 Porter Five Forces Analysis

Chapter 5. North America High-tech Logistics Market by Service

5.1 North America Transportation Market by Country

5.2 North America Warehousing & Storage Market by Country

5.3 North America Inventory Management Market by Country

5.4 North America Distribution & Fulfillment Market by Country

Chapter 6. North America High-tech Logistics Market by Industry

6.1 North America Semiconductor Industry Market by Country

6.2 North America Consumer Electronics Market by Country

6.3 North America Medical Devices Market by Country

6.4 North America Telecommunications Equipment Market by Country

6.5 North America Aerospace & Defense Technologies Market by Country

Chapter 7. North America High-tech Logistics Market by Country

7.1 US High-tech Logistics Market

7.1.1 US High-tech Logistics Market by Service

7.1.2 US High-tech Logistics Market by Industry

7.2 Canada High-tech Logistics Market

7.2.1 Canada High-tech Logistics Market by Service

7.2.2 Canada High-tech Logistics Market by Industry

7.3 Mexico High-tech Logistics Market

7.3.1 Mexico High-tech Logistics Market by Service

7.3.2 Mexico High-tech Logistics Market by Industry

7.4 Rest of North America High-tech Logistics Market

7.4.1 Rest of North America High-tech Logistics Market by Service

7.4.2 Rest of North America High-tech Logistics Market by Industry

Chapter 8. Company Profiles

8.1 C.H. Robinson Worldwide, Inc.

8.1.1 Company Overview

8.1.2 Financial Analysis

8.1.3 Regional & Segmental Analysis

8.1.4 Recent strategies and developments:

8.1.4.1 Partnerships, Collaborations, and Agreements:

8.1.4.2 Product Launches and Product Expansions:

8.1.4.3 Geographical Expansions:

8.1.5 SWOT Analysis

8.2 FedEx Corporation

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Segmental and Regional Analysis

8.2.4 Recent strategies and developments:

8.2.4.1 Partnerships, Collaborations, and Agreements:

8.2.4.2 Product Launches and Product Expansions:

8.3 DP World Logistics FZE (SeaRates)

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Regional Analysis

8.3.4 Recent strategies and developments:

8.3.4.1 Partnerships, Collaborations, and Agreements:

8.3.4.2 Product Launches and Product Expansions:

8.3.4.3 Geographical Expansions:

8.4 Deutsche Post DHL Group (The Deutsche Post AG)

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Segmental and Regional Analysis

8.4.4 Recent strategies and developments:

8.4.4.1 Product Launches and Product Expansions:

8.5 Deutsche Bahn AG (DB Schenker)

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Segmental and Regional Analysis

8.5.4 Recent strategies and developments:

8.5.4.1 Partnerships, Collaborations, and Agreements:

8.5.4.2 Acquisition and Mergers:

8.6 A.P. Moller - Maersk A/S

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Segmental and Regional Analysis

8.6.4 Recent strategies and developments:

8.6.4.1 Product Launches and Product Expansions:

8.6.4.2 Acquisition and Mergers:

8.7 Burris Logistics

8.7.1 Company Overview

8.7.2 SWOT Analysis

8.8 Wings Logistics Canada, Inc.

8.8.1 Company Overview

8.9 Cosco Shipping Lines Co. Ltd.

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Regional Analysis

8.9.4 Recent strategies and developments:

8.9.4.1 Product Launches and Product Expansions:

8.10. Broekman Logistics

8.10.1 Company Overview

8.10.2 Recent strategies and developments:

8.10.2.1 Geographical Expansions:

8.10.3 SWOT Analysis

TABLE 2 North America High-tech Logistics Market, 2024 - 2031, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– High-tech Logistics Market

TABLE 4 Product Launches And Product Expansions– High-tech Logistics Market

TABLE 5 Acquisition and Mergers– High-tech Logistics Market

TABLE 6 Geographical Expansion– High-tech Logistics Market

TABLE 7 North America High-tech Logistics Market by Service, 2020 - 2023, USD Million

TABLE 8 North America High-tech Logistics Market by Service, 2024 - 2031, USD Million

TABLE 9 North America Transportation Market by Country, 2020 - 2023, USD Million

TABLE 10 North America Transportation Market by Country, 2024 - 2031, USD Million

TABLE 11 North America Warehousing & Storage Market by Country, 2020 - 2023, USD Million

TABLE 12 North America Warehousing & Storage Market by Country, 2024 - 2031, USD Million

TABLE 13 North America Inventory Management Market by Country, 2020 - 2023, USD Million

TABLE 14 North America Inventory Management Market by Country, 2024 - 2031, USD Million

TABLE 15 North America Distribution & Fulfillment Market by Country, 2020 - 2023, USD Million

TABLE 16 North America Distribution & Fulfillment Market by Country, 2024 - 2031, USD Million

TABLE 17 North America High-tech Logistics Market by Industry, 2020 - 2023, USD Million

TABLE 18 North America High-tech Logistics Market by Industry, 2024 - 2031, USD Million

TABLE 19 North America Semiconductor Industry Market by Country, 2020 - 2023, USD Million

TABLE 20 North America Semiconductor Industry Market by Country, 2024 - 2031, USD Million

TABLE 21 North America Consumer Electronics Market by Country, 2020 - 2023, USD Million

TABLE 22 North America Consumer Electronics Market by Country, 2024 - 2031, USD Million

TABLE 23 North America Medical Devices Market by Country, 2020 - 2023, USD Million

TABLE 24 North America Medical Devices Market by Country, 2024 - 2031, USD Million

TABLE 25 North America Telecommunications Equipment Market by Country, 2020 - 2023, USD Million

TABLE 26 North America Telecommunications Equipment Market by Country, 2024 - 2031, USD Million

TABLE 27 North America Aerospace & Defense Technologies Market by Country, 2020 - 2023, USD Million

TABLE 28 North America Aerospace & Defense Technologies Market by Country, 2024 - 2031, USD Million

TABLE 29 North America High-tech Logistics Market by Country, 2020 - 2023, USD Million

TABLE 30 North America High-tech Logistics Market by Country, 2024 - 2031, USD Million

TABLE 31 US High-tech Logistics Market, 2020 - 2023, USD Million

TABLE 32 US High-tech Logistics Market, 2024 - 2031, USD Million

TABLE 33 US High-tech Logistics Market by Service, 2020 - 2023, USD Million

TABLE 34 US High-tech Logistics Market by Service, 2024 - 2031, USD Million

TABLE 35 US High-tech Logistics Market by Industry, 2020 - 2023, USD Million

TABLE 36 US High-tech Logistics Market by Industry, 2024 - 2031, USD Million

TABLE 37 Canada High-tech Logistics Market, 2020 - 2023, USD Million

TABLE 38 Canada High-tech Logistics Market, 2024 - 2031, USD Million

TABLE 39 Canada High-tech Logistics Market by Service, 2020 - 2023, USD Million

TABLE 40 Canada High-tech Logistics Market by Service, 2024 - 2031, USD Million

TABLE 41 Canada High-tech Logistics Market by Industry, 2020 - 2023, USD Million

TABLE 42 Canada High-tech Logistics Market by Industry, 2024 - 2031, USD Million

TABLE 43 Mexico High-tech Logistics Market, 2020 - 2023, USD Million

TABLE 44 Mexico High-tech Logistics Market, 2024 - 2031, USD Million

TABLE 45 Mexico High-tech Logistics Market by Service, 2020 - 2023, USD Million

TABLE 46 Mexico High-tech Logistics Market by Service, 2024 - 2031, USD Million

TABLE 47 Mexico High-tech Logistics Market by Industry, 2020 - 2023, USD Million

TABLE 48 Mexico High-tech Logistics Market by Industry, 2024 - 2031, USD Million

TABLE 49 Rest of North America High-tech Logistics Market, 2020 - 2023, USD Million

TABLE 50 Rest of North America High-tech Logistics Market, 2024 - 2031, USD Million

TABLE 51 Rest of North America High-tech Logistics Market by Service, 2020 - 2023, USD Million

TABLE 52 Rest of North America High-tech Logistics Market by Service, 2024 - 2031, USD Million

TABLE 53 Rest of North America High-tech Logistics Market by Industry, 2020 - 2023, USD Million

TABLE 54 Rest of North America High-tech Logistics Market by Industry, 2024 - 2031, USD Million

TABLE 55 Key information – C.H. Robinson Worldwide, Inc.

TABLE 56 Key Information – FedEx Corporation

TABLE 57 Key Information – DP World Logistics FZE

TABLE 58 Key Information – Deutsche Post DHL Group

TABLE 59 Key Information – Deutsche Bahn AG

TABLE 60 Key Information – A.P. Moller - Maersk A/S

TABLE 61 Key Information – Burris Logistics

TABLE 62 Key Information – Wings Logistics Canada, Inc.

TABLE 63 Key Information – Cosco Shipping Lines Co. Ltd.

TABLE 64 Key Information – Broekman Logistics

List of Figures

FIG 1 Methodology for the research

FIG 2 North America High-tech Logistics Market, 2020 - 2031, USD Million

FIG 3 Key Factors Impacting High-tech Logistics Market

FIG 4 KBV Cardinal Matrix

FIG 5 Market Share Analysis, 2023

FIG 6 Key Leading Strategies: Percentage Distribution (2020-2024)

FIG 7 Key Strategic Move: (Product Launches and Product Expansions : 2020, Apr – 2024, Aug) Leading Players

FIG 8 Porter’s Five Forces Analysis – High-tech Logistics Market

FIG 9 North America High-tech Logistics Market share by Service, 2023

FIG 10 North America High-tech Logistics Market share by Service, 2031

FIG 11 North America High-tech Logistics Market by Service, 2020 - 2031, USD Million

FIG 12 North America High-tech Logistics Market share by Industry, 2023

FIG 13 North America High-tech Logistics Market share by Industry, 2031

FIG 14 North America High-tech Logistics Market by Industry, 2020 - 2031, USD Million

FIG 15 North America High-tech Logistics Market share by Country, 2023

FIG 16 North America High-tech Logistics Market share by Country, 2031

FIG 17 North America High-tech Logistics Market by Country, 2020 - 2031, USD Million

FIG 18 Recent strategies and developments: C.H. Robinson Worldwide, Inc.

FIG 19 SWOT Analysis: C.H. Robinson Worldwide, Inc.

FIG 20 Recent strategies and developments: FedEx Corporation

FIG 21 Recent strategies and developments: DP World Logistics FZE

FIG 22 Recent strategies and developments: Deutsche Bahn AG

FIG 23 Recent strategies and developments: A.P. Moller - Maersk A/S

FIG 24 SWOT Analysis: Burris Logistics

FIG 25 Swot Analysis: Broekman Logistics