The North America Immersive Simulation Market would witness market growth of 30.0% CAGR during the forecast period (2024-2031).

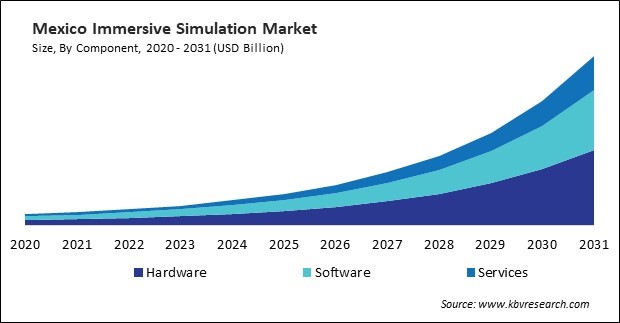

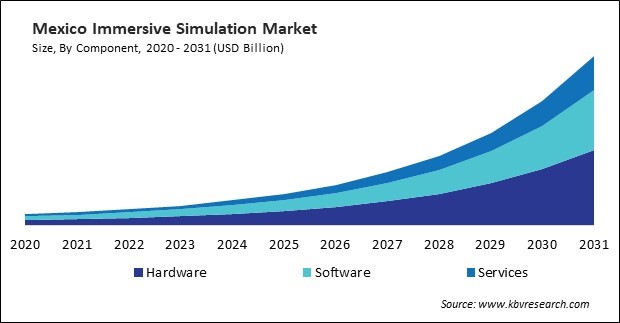

The US market dominated the North America Immersive Simulation Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $16,595.3 million by 2031. The Canada market is experiencing a CAGR of 32.8% during (2024 - 2031). Additionally, The Mexico market would exhibit a CAGR of 31.7% during (2024 - 2031).

This market is an innovative and rapidly growing sector within the broader technology industry. With advancements in virtual reality (VR), augmented reality (AR), and mixed reality (MR), these simulations are gaining traction across various industries, revolutionizing how people experience, interact, and train in digital environments.

These simulations are being adopted across a wide range of industries and applications. These simulations are particularly popular in sectors that require high levels of training and skill acquisition. Traditional training methods can be costly, time-consuming, and sometimes dangerous, particularly in fields like healthcare, defense, and aviation.

In Canada, the aerospace industry’s recovery efforts are creating new opportunities for these simulation technologies, while Mexico’s booming e-commerce industry is driving demand for enhanced digital experiences. Canada’s aerospace industry plays a significant role in adopting these simulation technologies for training, design, and maintenance. The Aerospace Regional Recovery Initiative (ARRI), launched by the Government of Canada with a total budget of $250 million, aims to strengthen the sector’s resilience and innovation. Mexico’s e-commerce sector has seen extraordinary growth, making the country one of the top five globally in terms of retail e-commerce growth rate. According to the International Trade Administration (ITA), the market reached USD 26.2 billion in 2022, a 23% increase from 2021. The number of Mexicans using e-commerce grew to 63 million in 2022, an increase of 5.5 million over the previous year. This rapid expansion is boosting demand for immersive simulation technologies to enhance customer experiences and improve retail operations. Thus, the market in Canada and Mexico is gaining momentum, driven by advancements in the aerospace and e-commerce sectors.

Free Valuable Insights: The Immersive Simulation Market is Predict to reach USD 58.00 Billion by 2031, at a CAGR of 30.6%

Based on Application, the market is segmented into Training & Learning, Product Development, Emergency Services, Sales & Marketing, and Other Application. Based on Component, the market is segmented into Hardware, Software, and Services. Based on Technology Type, the market is segmented into Virtual Reality (VR), Augmented Reality (AR), Mixed Reality (MR), and Other Technology Type. Based on Industry, the market is segmented into Media & Entertainment, Aerospace & Defense, Education, Gaming, Manufacturing, Automotive, Healthcare, Retail & E-commerce, and Other Industry. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- Microsoft Corporation

- Meta Platforms, Inc.

- Magic Leap, Inc.

- IBM Corporation

- NVIDIA Corporation

- Autodesk, Inc.

- Lockheed Martin Corporation

- Siemens AG

- EON Reality, Inc.

- Sony Corporation

North America Immersive Simulation Market Report Segmentation

By Application

- Training & Learning

- Product Development

- Emergency Services

- Sales & Marketing

- Other Application

By Component

- Hardware

- Software

- Services

By Technology Type

- Virtual Reality (VR)

- Augmented Reality (AR)

- Mixed Reality (MR)

- Other Technology Type

By Industry

- Media & Entertainment

- Aerospace & Defense

- Education

- Gaming

- Manufacturing

- Automotive

- Healthcare

- Retail & E-commerce

- Other Industry

By Country

- US

- Canada

- Mexico

- Rest of North America

Chapter 1. Market Scope & Methodology

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 North America Immersive Simulation Market, by Application

1.4.2 North America Immersive Simulation Market, by Component

1.4.3 North America Immersive Simulation Market, by Technology Type

1.4.4 North America Immersive Simulation Market, by Industry

1.4.5 North America Immersive Simulation Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Competition Analysis - Global

4.1 KBV Cardinal Matrix

4.2 Recent Industry Wide Strategic Developments

4.2.1 Partnerships, Collaborations and Agreements

4.2.2 Product Launches and Product Expansions

4.2.3 Acquisition and Mergers

4.3 Market Share Analysis, 2023

4.4 Top Winning Strategies

4.4.1 Key Leading Strategies: Percentage Distribution (2020-2024)

4.4.2 Key Strategic Move: (Partnerships, Collaborations & Agreements: 2022, Jun – 2024, Dec) Leading Players

4.5 Porter Five Forces Analysis

Chapter 5. North America Immersive Simulation Market by Application

5.1 North America Training & Learning Market by Country

5.2 North America Product Development Market by Country

5.3 North America Emergency Services Market by Country

5.4 North America Sales & Marketing Market by Country

5.5 North America Other Application Market by Country

Chapter 6. North America Immersive Simulation Market by Component

6.1 North America Hardware Market by Country

6.2 North America Software Market by Country

6.3 North America Services Market by Country

Chapter 7. North America Immersive Simulation Market by Technology Type

7.1 North America Virtual Reality (VR) Market by Country

7.2 North America Augmented Reality (AR) Market by Country

7.3 North America Mixed Reality (MR) Market by Country

7.4 North America Other Technology Type Market by Country

Chapter 8. North America Immersive Simulation Market by Industry

8.1 North America Media & Entertainment Market by Country

8.2 North America Aerospace & Defense Market by Country

8.3 North America Education Market by Country

8.4 North America Gaming Market by Country

8.5 North America Manufacturing Market by Country

8.6 North America Automotive Market by Country

8.7 North America Healthcare Market by Country

8.8 North America Retail & E-commerce Market by Country

8.9 North America Other Industry Market by Country

Chapter 9. North America Immersive Simulation Market by Country

9.1 US Immersive Simulation Market

9.1.1 US Immersive Simulation Market by Application

9.1.2 US Immersive Simulation Market by Component

9.1.3 US Immersive Simulation Market by Technology Type

9.1.4 US Immersive Simulation Market by Industry

9.2 Canada Immersive Simulation Market

9.2.1 Canada Immersive Simulation Market by Application

9.2.2 Canada Immersive Simulation Market by Component

9.2.3 Canada Immersive Simulation Market by Technology Type

9.2.4 Canada Immersive Simulation Market by Industry

9.3 Mexico Immersive Simulation Market

9.3.1 Mexico Immersive Simulation Market by Application

9.3.2 Mexico Immersive Simulation Market by Component

9.3.3 Mexico Immersive Simulation Market by Technology Type

9.3.4 Mexico Immersive Simulation Market by Industry

9.4 Rest of North America Immersive Simulation Market

9.4.1 Rest of North America Immersive Simulation Market by Application

9.4.2 Rest of North America Immersive Simulation Market by Component

9.4.3 Rest of North America Immersive Simulation Market by Technology Type

9.4.4 Rest of North America Immersive Simulation Market by Industry

Chapter 10. Company Profiles

10.1 Microsoft Corporation

10.1.1 Company Overview

10.1.2 Financial Analysis

10.1.3 Segmental and Regional Analysis

10.1.4 Research & Development Expenses

10.1.5 Recent strategies and developments:

10.1.5.1 Partnerships, Collaborations, and Agreements:

10.1.5.2 Acquisition and Mergers:

10.1.6 SWOT Analysis

10.2 Meta Platforms, Inc.

10.2.1 Company Overview

10.2.2 Financial Analysis

10.2.3 Segment and Regional Analysis

10.2.4 Research & Development Expense

10.2.5 Recent strategies and developments:

10.2.5.1 Partnerships, Collaborations, and Agreements:

10.2.5.2 Product Launches and Product Expansions:

10.2.6 SWOT Analysis

10.3 Magic Leap, Inc.

10.3.1 Company Overview

10.3.2 Recent strategies and developments:

10.3.2.1 Partnerships, Collaborations, and Agreements:

10.3.2.2 Product Launches and Product Expansions:

10.3.3 SWOT Analysis

10.4 IBM Corporation

10.4.1 Company Overview

10.4.2 Financial Analysis

10.4.3 Regional & Segmental Analysis

10.4.4 Research & Development Expenses

10.4.5 SWOT Analysis

10.5 NVIDIA Corporation

10.5.1 Company Overview

10.5.2 Financial Analysis

10.5.3 Segmental and Regional Analysis

10.5.4 Research & Development Expenses

10.5.5 Recent strategies and developments:

10.5.5.1 Partnerships, Collaborations, and Agreements:

10.5.6 SWOT Analysis

10.6 Autodesk, Inc.

10.6.1 Company Overview

10.6.2 Financial Analysis

10.6.3 Regional Analysis

10.6.4 Research & Development Expenses

10.6.5 Recent strategies and developments:

10.6.5.1 Acquisition and Mergers:

10.6.6 SWOT Analysis

10.7 Lockheed Martin Corporation

10.7.1 Company Overview

10.7.2 Financial Analysis

10.7.3 Segmental and Regional Analysis

10.7.4 Research & Development Expense

10.7.5 Recent strategies and developments:

10.7.5.1 Partnerships, Collaborations, and Agreements:

10.7.5.2 Product Launches and Product Expansions:

10.7.6 SWOT Analysis

10.8 Siemens AG

10.8.1 Company Overview

10.8.2 Financial Analysis

10.8.3 Segmental and Regional Analysis

10.8.4 Research & Development Expense

10.8.5 Recent strategies and developments:

10.8.5.1 Partnerships, Collaborations, and Agreements:

10.8.6 SWOT Analysis

10.9 EON Reality, Inc.

10.9.1 Company Overview

10.9.2 Recent strategies and developments:

10.9.2.1 Partnerships, Collaborations, and Agreements:

10.10. Sony Corporation

10.10.1 Company Overview

10.10.2 Financial Analysis

10.10.3 Segmental and Regional Analysis

10.10.4 Research & Development Expenses

10.10.5 SWOT Analysis

TABLE 1 North America Immersive Simulation Market, 2020 - 2023, USD Million

TABLE 2 North America Immersive Simulation Market, 2024 - 2031, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– Immersive Simulation Market

TABLE 4 Product Launches And Product Expansions– Immersive Simulation Market

TABLE 5 Acquisition and Mergers– Immersive Simulation Market

TABLE 6 North America Immersive Simulation Market by Application, 2020 - 2023, USD Million

TABLE 7 North America Immersive Simulation Market by Application, 2024 - 2031, USD Million

TABLE 8 North America Training & Learning Market by Country, 2020 - 2023, USD Million

TABLE 9 North America Training & Learning Market by Country, 2024 - 2031, USD Million

TABLE 10 North America Product Development Market by Country, 2020 - 2023, USD Million

TABLE 11 North America Product Development Market by Country, 2024 - 2031, USD Million

TABLE 12 North America Emergency Services Market by Country, 2020 - 2023, USD Million

TABLE 13 North America Emergency Services Market by Country, 2024 - 2031, USD Million

TABLE 14 North America Sales & Marketing Market by Country, 2020 - 2023, USD Million

TABLE 15 North America Sales & Marketing Market by Country, 2024 - 2031, USD Million

TABLE 16 North America Other Application Market by Country, 2020 - 2023, USD Million

TABLE 17 North America Other Application Market by Country, 2024 - 2031, USD Million

TABLE 18 North America Immersive Simulation Market by Component, 2020 - 2023, USD Million

TABLE 19 North America Immersive Simulation Market by Component, 2024 - 2031, USD Million

TABLE 20 North America Hardware Market by Country, 2020 - 2023, USD Million

TABLE 21 North America Hardware Market by Country, 2024 - 2031, USD Million

TABLE 22 North America Software Market by Country, 2020 - 2023, USD Million

TABLE 23 North America Software Market by Country, 2024 - 2031, USD Million

TABLE 24 North America Services Market by Country, 2020 - 2023, USD Million

TABLE 25 North America Services Market by Country, 2024 - 2031, USD Million

TABLE 26 North America Immersive Simulation Market by Technology Type, 2020 - 2023, USD Million

TABLE 27 North America Immersive Simulation Market by Technology Type, 2024 - 2031, USD Million

TABLE 28 North America Virtual Reality (VR) Market by Country, 2020 - 2023, USD Million

TABLE 29 North America Virtual Reality (VR) Market by Country, 2024 - 2031, USD Million

TABLE 30 North America Augmented Reality (AR) Market by Country, 2020 - 2023, USD Million

TABLE 31 North America Augmented Reality (AR) Market by Country, 2024 - 2031, USD Million

TABLE 32 North America Mixed Reality (MR) Market by Country, 2020 - 2023, USD Million

TABLE 33 North America Mixed Reality (MR) Market by Country, 2024 - 2031, USD Million

TABLE 34 North America Other Technology Type Market by Country, 2020 - 2023, USD Million

TABLE 35 North America Other Technology Type Market by Country, 2024 - 2031, USD Million

TABLE 36 North America Immersive Simulation Market by Industry, 2020 - 2023, USD Million

TABLE 37 North America Immersive Simulation Market by Industry, 2024 - 2031, USD Million

TABLE 38 North America Media & Entertainment Market by Country, 2020 - 2023, USD Million

TABLE 39 North America Media & Entertainment Market by Country, 2024 - 2031, USD Million

TABLE 40 North America Aerospace & Defense Market by Country, 2020 - 2023, USD Million

TABLE 41 North America Aerospace & Defense Market by Country, 2024 - 2031, USD Million

TABLE 42 North America Education Market by Country, 2020 - 2023, USD Million

TABLE 43 North America Education Market by Country, 2024 - 2031, USD Million

TABLE 44 North America Gaming Market by Country, 2020 - 2023, USD Million

TABLE 45 North America Gaming Market by Country, 2024 - 2031, USD Million

TABLE 46 North America Manufacturing Market by Country, 2020 - 2023, USD Million

TABLE 47 North America Manufacturing Market by Country, 2024 - 2031, USD Million

TABLE 48 North America Automotive Market by Country, 2020 - 2023, USD Million

TABLE 49 North America Automotive Market by Country, 2024 - 2031, USD Million

TABLE 50 North America Healthcare Market by Country, 2020 - 2023, USD Million

TABLE 51 North America Healthcare Market by Country, 2024 - 2031, USD Million

TABLE 52 North America Retail & E-commerce Market by Country, 2020 - 2023, USD Million

TABLE 53 North America Retail & E-commerce Market by Country, 2024 - 2031, USD Million

TABLE 54 North America Other Industry Market by Country, 2020 - 2023, USD Million

TABLE 55 North America Other Industry Market by Country, 2024 - 2031, USD Million

TABLE 56 North America Immersive Simulation Market by Country, 2020 - 2023, USD Million

TABLE 57 North America Immersive Simulation Market by Country, 2024 - 2031, USD Million

TABLE 58 US Immersive Simulation Market, 2020 - 2023, USD Million

TABLE 59 US Immersive Simulation Market, 2024 - 2031, USD Million

TABLE 60 US Immersive Simulation Market by Application, 2020 - 2023, USD Million

TABLE 61 US Immersive Simulation Market by Application, 2024 - 2031, USD Million

TABLE 62 US Immersive Simulation Market by Component, 2020 - 2023, USD Million

TABLE 63 US Immersive Simulation Market by Component, 2024 - 2031, USD Million

TABLE 64 US Immersive Simulation Market by Technology Type, 2020 - 2023, USD Million

TABLE 65 US Immersive Simulation Market by Technology Type, 2024 - 2031, USD Million

TABLE 66 US Immersive Simulation Market by Industry, 2020 - 2023, USD Million

TABLE 67 US Immersive Simulation Market by Industry, 2024 - 2031, USD Million

TABLE 68 Canada Immersive Simulation Market, 2020 - 2023, USD Million

TABLE 69 Canada Immersive Simulation Market, 2024 - 2031, USD Million

TABLE 70 Canada Immersive Simulation Market by Application, 2020 - 2023, USD Million

TABLE 71 Canada Immersive Simulation Market by Application, 2024 - 2031, USD Million

TABLE 72 Canada Immersive Simulation Market by Component, 2020 - 2023, USD Million

TABLE 73 Canada Immersive Simulation Market by Component, 2024 - 2031, USD Million

TABLE 74 Canada Immersive Simulation Market by Technology Type, 2020 - 2023, USD Million

TABLE 75 Canada Immersive Simulation Market by Technology Type, 2024 - 2031, USD Million

TABLE 76 Canada Immersive Simulation Market by Industry, 2020 - 2023, USD Million

TABLE 77 Canada Immersive Simulation Market by Industry, 2024 - 2031, USD Million

TABLE 78 Mexico Immersive Simulation Market, 2020 - 2023, USD Million

TABLE 79 Mexico Immersive Simulation Market, 2024 - 2031, USD Million

TABLE 80 Mexico Immersive Simulation Market by Application, 2020 - 2023, USD Million

TABLE 81 Mexico Immersive Simulation Market by Application, 2024 - 2031, USD Million

TABLE 82 Mexico Immersive Simulation Market by Component, 2020 - 2023, USD Million

TABLE 83 Mexico Immersive Simulation Market by Component, 2024 - 2031, USD Million

TABLE 84 Mexico Immersive Simulation Market by Technology Type, 2020 - 2023, USD Million

TABLE 85 Mexico Immersive Simulation Market by Technology Type, 2024 - 2031, USD Million

TABLE 86 Mexico Immersive Simulation Market by Industry, 2020 - 2023, USD Million

TABLE 87 Mexico Immersive Simulation Market by Industry, 2024 - 2031, USD Million

TABLE 88 Rest of North America Immersive Simulation Market, 2020 - 2023, USD Million

TABLE 89 Rest of North America Immersive Simulation Market, 2024 - 2031, USD Million

TABLE 90 Rest of North America Immersive Simulation Market by Application, 2020 - 2023, USD Million

TABLE 91 Rest of North America Immersive Simulation Market by Application, 2024 - 2031, USD Million

TABLE 92 Rest of North America Immersive Simulation Market by Component, 2020 - 2023, USD Million

TABLE 93 Rest of North America Immersive Simulation Market by Component, 2024 - 2031, USD Million

TABLE 94 Rest of North America Immersive Simulation Market by Technology Type, 2020 - 2023, USD Million

TABLE 95 Rest of North America Immersive Simulation Market by Technology Type, 2024 - 2031, USD Million

TABLE 96 Rest of North America Immersive Simulation Market by Industry, 2020 - 2023, USD Million

TABLE 97 Rest of North America Immersive Simulation Market by Industry, 2024 - 2031, USD Million

TABLE 98 Key Information – Microsoft Corporation

TABLE 99 Key Information – Meta Platforms, Inc.

TABLE 100 Key Information – Magic Leap, Inc.

TABLE 101 Key Information – IBM Corporation

TABLE 102 Key Information – NVIDIA Corporation

TABLE 103 Key Information – Autodesk, Inc.

TABLE 104 Key Information – Lockheed Martin Corporation

TABLE 105 Key Information – Siemens AG

TABLE 106 Key Information – EON Reality, Inc.

TABLE 107 Key Information – Sony Corporation

List of Figures

FIG 1 Methodology for the research

FIG 2 North America Immersive Simulation Market, 2020 - 2031, USD Million

FIG 3 Key Factors Impacting Immersive Simulation Market

FIG 4 KBV Cardinal Matrix

FIG 5 Market Share Analysis, 2023

FIG 6 Key Leading Strategies: Percentage Distribution (2020-2024)

FIG 7 Key Strategic Move: (Partnerships, Collaborations & Agreements: 2022, Jun – 2024, Dec) Leading Players

FIG 8 Porter’s Five Forces Analysis – Immersive Simulation Market

FIG 9 North America Immersive Simulation Market share by Application, 2023

FIG 10 North America Immersive Simulation Market share by Application, 2031

FIG 11 North America Immersive Simulation Market by Application, 2020 - 2031, USD Million

FIG 12 North America Immersive Simulation Market share by Component, 2023

FIG 13 North America Immersive Simulation Market share by Component, 2031

FIG 14 North America Immersive Simulation Market by Component, 2020 - 2031, USD Million

FIG 15 North America Immersive Simulation Market share by Technology Type, 2023

FIG 16 North America Immersive Simulation Market share by Technology Type, 2031

FIG 17 North America Immersive Simulation Market by Technology Type, 2020 - 2031, USD Million

FIG 18 North America Immersive Simulation Market share by Industry, 2023

FIG 19 North America Immersive Simulation Market share by Industry, 2031

FIG 20 North America Immersive Simulation Market by Industry, 2020 - 2031, USD Million

FIG 21 North America Immersive Simulation Market share by Country, 2023

FIG 22 North America Immersive Simulation Market share by Country, 2031

FIG 23 North America Immersive Simulation Market by Country, 2020 - 2031, USD Million

FIG 24 Recent strategies and developments: Microsoft Corporation

FIG 25 SWOT Analysis: Microsoft Corporation

FIG 26 Recent strategies and developments: Meta Platforms, Inc.

FIG 27 SWOT Analysis: Meta Platforms, Inc.

FIG 28 Recent strategies and developments: Magic Leap, Inc.

FIG 29 SWOT Analysis: Magic Leap, Inc.

FIG 30 SWOT Analysis: IBM Corporation

FIG 31 SWOT Analysis: NVIDIA Corporation

FIG 32 SWOT Analysis: Autodesk, Inc.

FIG 33 Recent strategies and developments: Lockheed Martin Corporation

FIG 34 SWOT Analysis: Lockheed Martin Corporation

FIG 35 SWOT Analysis: Siemens AG

FIG 36 SWOT Analysis: Sony Corporation