North America Intraosseous Infusion Devices Market Size, Share & Trends Analysis Report By Devices Type (Manual IO Needles, Battery Powered Driver and Impact Driven Devices), By End User, By Country and Growth Forecast, 2024 - 2031

Published Date : 30-Apr-2024 |

Pages: 74 |

Formats: PDF |

COVID-19 Impact on the North America Intraosseous Infusion Devices Market

The North America Intraosseous Infusion Devices Market would witness market growth of 5.2% CAGR during the forecast period (2024-2031).

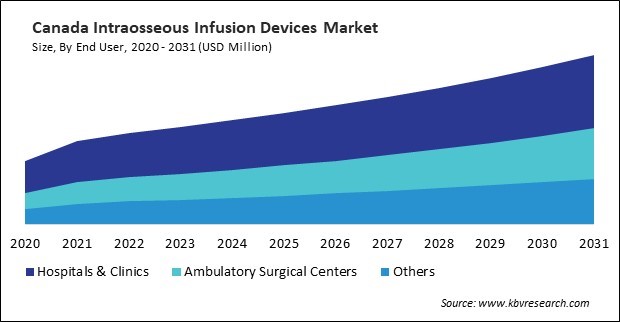

The US market dominated the North America Intraosseous Infusion Devices Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $397.7 Million by 2031. The Canada market is experiencing a CAGR of 7.6% during (2024 - 2031). Additionally, The Mexico market would exhibit a CAGR of 6.7% during (2024 - 2031).

The adoption of these devices has been propelled by their ability to provide rapid and reliable vascular access, particularly in life-threatening situations such as cardiac arrest, trauma, and pediatric emergencies. Intraosseous access offers several advantages over traditional vascular access methods, including bypassing collapsed veins, achieving rapid drug delivery, and maintaining vascular access in hypovolemic or hemodynamically unstable patients.

Moreover, the increasing expansion and development of healthcare facilities are expected to boost the demand for these devices significantly. As per the data provided in 2023 by the Government of Canada, to enhance health care services for Canadians, the government announced an investment of $196.1 billion over ten years, including $46.2 billion in new funding, for provinces and territories.

Mexico has been investing in expanding its hospital infrastructure to meet the growing healthcare needs of its population. With the construction of new hospitals and the expansion of existing facilities, there is a greater demand for essential medical equipment, including these devices, to support emergency and critical care services. As per the data from the Government of Mexico, in the fourth quarter of 2023, health care and social assistance recorded a gross domestic product of $577B MX. Moreover, with advancing age comes a higher prevalence of age-related health conditions, such as cardiovascular disease, sepsis, dehydration, and respiratory distress, among the elderly population in Canada. As per Statistics Canada, in 2022, there were 7,330,605 people aged 65 and older in Canada. The 2021 Census recorded a total of 861,000 individuals aged 85 and above, which is over twofold the figure reported in the 2001 Census. Hence, the rising healthcare sector and aging population in North America will assist in the expansion of the regional market.

Free Valuable Insights: The Intraosseous Infusion Devices Market is Predict to reach USD 1.4 Billion by 2031, at a CAGR of 5.9%

Based on Devices Type, the market is segmented into Manual IO Needles, Battery Powered Driver and Impact Driven Devices. Based on End User, the market is segmented into Hospitals & Clinics, Ambulatory Surgical Centers and Others. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- Aero Healthcare AU Pty Ltd

- Teleflex Incorporated

- Becton, Dickinson and Company

- BIOPSYBELL S.R.L.

- Cook Medical, Inc.(Cook Group)

- The Seaberg Company Inc. (SAM Medical)

- Argon Medical Devices, Inc. (SHANDONG WEIGAO GROUP MEDICAL POLYMER COMPANY LIMITED)

- Medax Srl

- PAVmed Inc.

North America Intraosseous Infusion Devices Market Report Segmentation

By Devices Type

- Manual IO Needles

- Battery Powered Driver

- Impact Driven Devices

By End User

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Others

By Country

- US

- Canada

- Mexico

- Rest of North America

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 North America Intraosseous Infusion Devices Market, by Devices Type

1.4.2 North America Intraosseous Infusion Devices Market, by End User

1.4.3 North America Intraosseous Infusion Devices Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

3.3 Porter Five Forces Analysis

Chapter 4. North America Intraosseous Infusion Devices Market by Devices Type

4.1 North America Manual IO Needles Market by Country

4.2 North America Battery Powered Driver Market by Country

4.3 North America Impact Driven Devices Market by Country

Chapter 5. North America Intraosseous Infusion Devices Market by End User

5.1 North America Hospitals & Clinics Market by Country

5.2 North America Ambulatory Surgical Centers Market by Country

5.3 North America Others Market by Country

Chapter 6. North America Intraosseous Infusion Devices Market by Country

6.1 US Intraosseous Infusion Devices Market

6.1.1 US Intraosseous Infusion Devices Market by Devices Type

6.1.2 US Intraosseous Infusion Devices Market by End User

6.2 Canada Intraosseous Infusion Devices Market

6.2.1 Canada Intraosseous Infusion Devices Market by Devices Type

6.2.2 Canada Intraosseous Infusion Devices Market by End User

6.3 Mexico Intraosseous Infusion Devices Market

6.3.1 Mexico Intraosseous Infusion Devices Market by Devices Type

6.3.2 Mexico Intraosseous Infusion Devices Market by End User

6.4 Rest of North America Intraosseous Infusion Devices Market

6.4.1 Rest of North America Intraosseous Infusion Devices Market by Devices Type

6.4.2 Rest of North America Intraosseous Infusion Devices Market by End User

Chapter 7. Company Profiles

7.1 Aero Healthcare AU Pty Ltd

7.1.1 Company Overview

7.2 The Seaberg Company Inc. (SAM Medical)

7.2.1 Company Overview

7.2.2 Recent strategies and developments:

7.2.2.1 Product Launches and Product Expansions:

7.3 Medax Srl

7.3.1 Company Overview

7.4 PAVmed Inc.

7.4.1 Company Overview

7.4.2 Financial Analysis

7.5 Teleflex Incorporated

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Segmental and Regional Analysis

7.5.4 Research & Development Expenses

7.5.5 Recent strategies and developments:

7.5.5.1 Trials and Approvals:

7.5.6 SWOT Analysis

7.6 Becton, Dickinson, and Company

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Segmental and Regional Analysis

7.6.4 Research & Development Expense

7.6.5 SWOT Analysis

7.7 Biopsybell S.R.L.

7.7.1 Company Overview

7.8 Cook Medical, Inc. (Cook Group)

7.8.1 Company Overview

7.8.2 SWOT Analysis

7.9 Argon Medical Devices, Inc. (Shandong Weigao Group Medical Polymer Company Limited)

7.9.1 Company Overview

7.9.2 Financial Analysis

TABLE 2 North America Intraosseous Infusion Devices Market, 2024 - 2031, USD Million

TABLE 3 North America Intraosseous Infusion Devices Market by Devices Type, 2020 - 2023, USD Million

TABLE 4 North America Intraosseous Infusion Devices Market by Devices Type, 2024 - 2031, USD Million

TABLE 5 North America Manual IO Needles Market by Country, 2020 - 2023, USD Million

TABLE 6 North America Manual IO Needles Market by Country, 2024 - 2031, USD Million

TABLE 7 North America Battery Powered Driver Market by Country, 2020 - 2023, USD Million

TABLE 8 North America Battery Powered Driver Market by Country, 2024 - 2031, USD Million

TABLE 9 North America Impact Driven Devices Market by Country, 2020 - 2023, USD Million

TABLE 10 North America Impact Driven Devices Market by Country, 2024 - 2031, USD Million

TABLE 11 North America Intraosseous Infusion Devices Market by End User, 2020 - 2023, USD Million

TABLE 12 North America Intraosseous Infusion Devices Market by End User, 2024 - 2031, USD Million

TABLE 13 North America Hospitals & Clinics Market by Country, 2020 - 2023, USD Million

TABLE 14 North America Hospitals & Clinics Market by Country, 2024 - 2031, USD Million

TABLE 15 North America Ambulatory Surgical Centers Market by Country, 2020 - 2023, USD Million

TABLE 16 North America Ambulatory Surgical Centers Market by Country, 2024 - 2031, USD Million

TABLE 17 North America Others Market by Country, 2020 - 2023, USD Million

TABLE 18 North America Others Market by Country, 2024 - 2031, USD Million

TABLE 19 North America Intraosseous Infusion Devices Market by Country, 2020 - 2023, USD Million

TABLE 20 North America Intraosseous Infusion Devices Market by Country, 2024 - 2031, USD Million

TABLE 21 US Intraosseous Infusion Devices Market, 2020 - 2023, USD Million

TABLE 22 US Intraosseous Infusion Devices Market, 2024 - 2031, USD Million

TABLE 23 US Intraosseous Infusion Devices Market by Devices Type, 2020 - 2023, USD Million

TABLE 24 US Intraosseous Infusion Devices Market by Devices Type, 2024 - 2031, USD Million

TABLE 25 US Intraosseous Infusion Devices Market by End User, 2020 - 2023, USD Million

TABLE 26 US Intraosseous Infusion Devices Market by End User, 2024 - 2031, USD Million

TABLE 27 Canada Intraosseous Infusion Devices Market, 2020 - 2023, USD Million

TABLE 28 Canada Intraosseous Infusion Devices Market, 2024 - 2031, USD Million

TABLE 29 Canada Intraosseous Infusion Devices Market by Devices Type, 2020 - 2023, USD Million

TABLE 30 Canada Intraosseous Infusion Devices Market by Devices Type, 2024 - 2031, USD Million

TABLE 31 Canada Intraosseous Infusion Devices Market by End User, 2020 - 2023, USD Million

TABLE 32 Canada Intraosseous Infusion Devices Market by End User, 2024 - 2031, USD Million

TABLE 33 Mexico Intraosseous Infusion Devices Market, 2020 - 2023, USD Million

TABLE 34 Mexico Intraosseous Infusion Devices Market, 2024 - 2031, USD Million

TABLE 35 Mexico Intraosseous Infusion Devices Market by Devices Type, 2020 - 2023, USD Million

TABLE 36 Mexico Intraosseous Infusion Devices Market by Devices Type, 2024 - 2031, USD Million

TABLE 37 Mexico Intraosseous Infusion Devices Market by End User, 2020 - 2023, USD Million

TABLE 38 Mexico Intraosseous Infusion Devices Market by End User, 2024 - 2031, USD Million

TABLE 39 Rest of North America Intraosseous Infusion Devices Market, 2020 - 2023, USD Million

TABLE 40 Rest of North America Intraosseous Infusion Devices Market, 2024 - 2031, USD Million

TABLE 41 Rest of North America Intraosseous Infusion Devices Market by Devices Type, 2020 - 2023, USD Million

TABLE 42 Rest of North America Intraosseous Infusion Devices Market by Devices Type, 2024 - 2031, USD Million

TABLE 43 Rest of North America Intraosseous Infusion Devices Market by End User, 2020 - 2023, USD Million

TABLE 44 Rest of North America Intraosseous Infusion Devices Market by End User, 2024 - 2031, USD Million

TABLE 45 Key Information – Aero Healthcare AU Pty Ltd

TABLE 46 Key Information – The Seaberg Company Inc.

TABLE 47 Key Information – Medax Srl

TABLE 48 Key Information – PAVmed Inc.

TABLE 49 Key Information – Teleflex Incorporated

TABLE 50 Key Information – Becton, Dickinson and Company

TABLE 51 Key Information – Biopsybell S.R.L.

TABLE 52 Key Information – Cook Medical, Inc.

TABLE 53 key Information – Argon Medical Devices, Inc.

List of Figures

FIG 1 Methodology for the research

FIG 2 North America Intraosseous Infusion Devices Market, 2020 - 2031, USD Million

FIG 3 Key Factors Impacting Intraosseous Infusion Devices Market

FIG 4 Porter’s Five Forces Analysis – Intraosseous Infusion Devices Market

FIG 5 North America Intraosseous Infusion Devices Market share by Devices Type, 2023

FIG 6 North America Intraosseous Infusion Devices Market share by Devices Type, 2031

FIG 7 North America Intraosseous Infusion Devices Market by Devices Type, 2020 - 2031, USD Million

FIG 8 North America Intraosseous Infusion Devices Market share by End User, 2023

FIG 9 North America Intraosseous Infusion Devices Market share by End User, 2031

FIG 10 North America Intraosseous Infusion Devices Market by End User, 2020 - 2031, USD Million

FIG 11 North America Intraosseous Infusion Devices Market share by Country, 2023

FIG 12 North America Intraosseous Infusion Devices Market share by Country, 2031

FIG 13 North America Intraosseous Infusion Devices Market by Country, 2020 - 2031, USD Million

FIG 14 SWOT Analysis: Teleflex INcorporated

FIG 15 SWOT Analysis: Becton, Dickinson and company

FIG 16 SWOT Analysis: Cook Medical, Inc