The North America IoT Sensors Market would witness market growth of 27.2% CAGR during the forecast period (2024-2031).

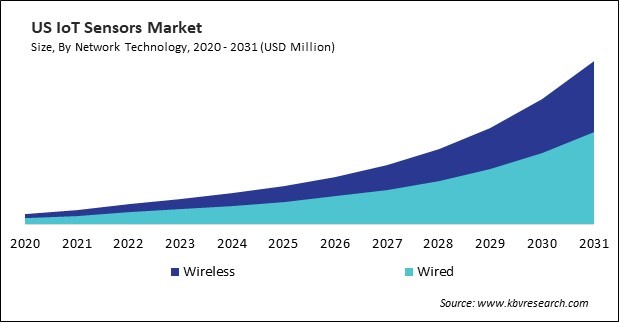

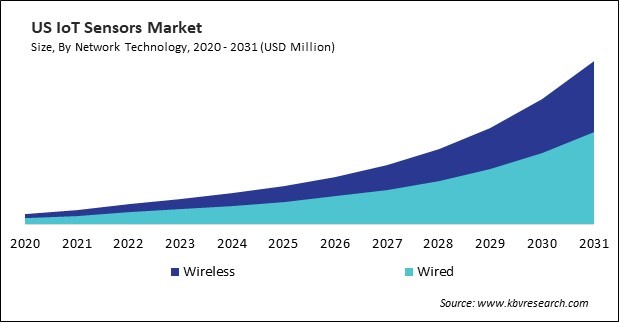

The US market dominated the North America IoT Sensors Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $46,602.8 million by 2031. The Canada market is experiencing a CAGR of 29.6% during (2024 - 2031). Additionally, The Mexico market would exhibit a CAGR of 28.8% during (2024 - 2031).

These sensors detect and measure various physical properties, such as temperature, humidity, pressure, light, motion, etc. These sensors are integral to the Internet of Things (IoT) ecosystem, enabling devices to collect, process, and transmit data about their environment. By converting physical phenomena into digital signals, these sensors allow machines, systems, and objects to "sense" their surroundings and interact with each other in an intelligent, automated manner.

In recent times, IoT has revolutionized how people interact, transforming everyday objects into intelligent, interconnected devices. Sensors have emerged as a critical driver of innovation in a variety of industries, including manufacturing, healthcare, agriculture, and smart communities, as the foundation of IoT technology. As a result of the growing use of Internet of Things solutions across a variety of industries, the market has undergone spectacular growth in recent years. The demand for more connected and intelligent devices has surged, pushing the boundaries of what these sensors can achieve. These sensors are embedded in everything from consumer electronics and industrial machinery to vehicles and medical devices, enabling a new era of data-driven decision-making and automation.

In Mexico, the automotive sector is a key driver of the increasing demand for these sensors. Mexico has witnessed an increasing integration of IoT technologies into its automotive production processes, as it is one of the world's greatest automotive manufacturing hubs. These sensors are used extensively to monitor vehicle assembly lines, ensure quality control, and optimize supply chain management. According to the International Trade Administration (ITA), Mexico is the world’s seventh-largest passenger vehicle manufacturer, producing 3.5 million vehicles annually. The production of EVs and hybrids totaled 51,065 units in 2022, representing a growth of 8.5 percent compared to 2021. It is anticipated that the automotive industry in Mexico will continue to increase the adoption of IoT sensors as manufacturers strive to enhance efficiency and reduce costs by implementing automation and real-time data analysis. Hence, the region will present lucrative growth opportunities for the market throughout the forecast period.

Free Valuable Insights: The IoT Sensors Market is Predict to reach USD 177.7 Billion by 2031, at a CAGR of 27.9%

Based on Network Technology, the market is segmented into Wireless (Bluetooth, Wi-Fi, Zigbee, Z-Wave, NFC, RFID, and Others), and Wired. Based on Bluetooth Type, the market is segmented into Bluetooth Smart, Bluetooth Smart/Ant+, and Bluetooth 5. Based on End Use, the market is segmented into Consumer Electronics, Automotive, Industrial, Healthcare, Food & Beverage, Aerospace & Defense, and Others. Based on Type, the market is segmented into Pressure Sensor, Temperature Sensor, Proximity Sensor, Image Sensor, Optical Sensor, Gyroscope Sensor, Humidity Sensor, Accelerometer Sensor, and Others. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- STMicroelectronics N.V.

- NXP Semiconductors N.V.

- Honeywell International, Inc.

- Siemens AG

- Robert Bosch GmbH

- Infineon Technologies AG

- ABB Group

- General Electric Company

- Texas Instruments, Inc.

- Sensirion AG

North America IoT Sensors Market Report Segmentation

By Network Technology

- Wireless

- Bluetooth

- Bluetooth Smart

- Bluetooth Smart/Ant+

- Bluetooth 5

- Wi-Fi

- Zigbee

- Z-Wave

- NFC

- RFID

- Others

- Wired

By End Use

- Consumer Electronics

- Automotive

- Industrial

- Healthcare

- Food & Beverage

- Aerospace & Defense

- Others

By Type

- Pressure Sensor

- Temperature Sensor

- Proximity Sensor

- Image Sensor

- Optical Sensor

- Gyroscope Sensor

- Humidity Sensor

- Accelerometer Sensor

- Others

By Country

- US

- Canada

- Mexico

- Rest of North America

Chapter 1. Market Scope & Methodology

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 North America IoT Sensors Market, by Network Technology

1.4.2 North America IoT Sensors Market, by End Use

1.4.3 North America IoT Sensors Market, by Type

1.4.4 North America IoT Sensors Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Competition Analysis - Global

4.1 KBV Cardinal Matrix

4.2 Recent Industry Wide Strategic Developments

4.2.1 Partnerships, Collaborations and Agreements

4.2.2 Product Launches and Product Expansions

4.2.3 Acquisition and Mergers

4.3 Market Share Analysis, 2023

4.4 Top Winning Strategies

4.4.1 Key Leading Strategies: Percentage Distribution (2020-2024)

4.4.2 Key Strategic Move: (Partnerships, Collaborations & Agreements: 2020, Nov – 2024, Feb) Leading Players

4.5 Porter Five Forces Analysis

Chapter 5. North America IoT Sensors Market by Network Technology

5.1 North America Wireless Market by Region

5.2 North America IoT Sensors Market by Wireless Type

5.2.1 North America Bluetooth Market by Country

5.2.2 North America IoT Sensors Market by Bluetooth Type

5.2.2.1 North America Bluetooth Smart Market by Country

5.2.2.2 North America Bluetooth Smart/Ant+ Market by Country

5.2.2.3 North America Bluetooth 5 Market by Country

5.2.3 North America Wi-Fi Market by Country

5.2.4 North America Zigbee Market by Country

5.2.5 North America Z-Wave Market by Region

5.2.6 North America NFC Market by Region

5.2.7 North America RFID Market by Country

5.2.8 North America Others Market by Country

5.3 North America Wired Market by Region

Chapter 6. North America IoT Sensors Market by End Use

6.1 North America Consumer Electronics Market by Country

6.2 North America Automotive Market by Country

6.3 North America Industrial Market by Country

6.4 North America Healthcare Market by Country

6.5 North America Food & Beverage Market by Country

6.6 North America Aerospace & Defense Market by Country

6.7 North America Others Market by Country

Chapter 7. North America IoT Sensors Market by Type

7.1 North America Pressure Sensor Market by Country

7.2 North America Temperature Sensor Market by Country

7.3 North America Proximity Sensor Market by Country

7.4 North America Image Sensor Market by Country

7.5 North America Optical Sensor Market by Country

7.6 North America Gyroscope Sensor Market by Country

7.7 North America Humidity Sensor Market by Country

7.8 North America Accelerometer Sensor Market by Country

7.9 North America Others Market by Country

Chapter 8. North America IoT Sensors Market by Country

8.1 US IoT Sensors Market

8.1.1 US IoT Sensors Market by Network Technology

8.1.1.1 US IoT Sensors Market by Wireless Type

8.1.1.1.1 US IoT Sensors Market by Bluetooth Type

8.1.2 US IoT Sensors Market by End Use

8.1.3 US IoT Sensors Market by Type

8.2 Canada IoT Sensors Market

8.2.1 Canada IoT Sensors Market by Network Technology

8.2.1.1 Canada IoT Sensors Market by Wireless Type

8.2.1.1.1 Canada IoT Sensors Market by Bluetooth Type

8.2.2 Canada IoT Sensors Market by End Use

8.2.3 Canada IoT Sensors Market by Type

8.3 Mexico IoT Sensors Market

8.3.1 Mexico IoT Sensors Market by Network Technology

8.3.1.1 Mexico IoT Sensors Market by Wireless Type

8.3.1.1.1 Mexico IoT Sensors Market by Bluetooth Type

8.3.2 Mexico IoT Sensors Market by End Use

8.3.3 Mexico IoT Sensors Market by Type

8.4 Rest of North America IoT Sensors Market

8.4.1 Rest of North America IoT Sensors Market by Network Technology

8.4.1.1 Rest of North America IoT Sensors Market by Wireless Type

8.4.1.1.1 Rest of North America IoT Sensors Market by Bluetooth Type

8.4.2 Rest of North America IoT Sensors Market by End Use

8.4.3 Rest of North America IoT Sensors Market by Type

Chapter 9. Company Profiles

9.1 STMicroelectronics N.V.

9.1.1 Company Overview

9.1.2 Financial Analysis

9.1.3 Segmental and Regional Analysis

9.1.4 Research & Development Expenses

9.1.5 Recent strategies and developments:

9.1.5.1 Partnerships, Collaborations, and Agreements:

9.1.5.2 Product Launches and Product Expansions:

9.1.6 SWOT Analysis

9.2 Texas Instruments, Inc.

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Segmental and Regional Analysis

9.2.4 Research & Development Expense

9.2.5 Recent strategies and developments:

9.2.5.1 Partnerships, Collaborations, and Agreements:

9.2.6 SWOT Analysis

9.3 NXP Semiconductors N.V.

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Regional Analysis

9.3.4 Research & Development Expenses

9.3.5 Recent strategies and developments:

9.3.5.1 Partnerships, Collaborations, and Agreements:

9.3.6 SWOT Analysis

9.4 Infineon Technologies AG

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Segmental and Regional Analysis

9.4.4 Research & Development Expense

9.4.5 Recent strategies and developments:

9.4.5.1 Partnerships, Collaborations, and Agreements:

9.4.5.2 Product Launches and Product Expansions:

9.4.5.3 Acquisition and Mergers:

9.4.6 SWOT Analysis

9.5 Honeywell International, Inc.

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Segmental and Regional Analysis

9.5.4 Research & Development Expenses

9.5.5 Recent strategies and developments:

9.5.5.1 Product Launches and Product Expansions:

9.5.6 SWOT Analysis

9.6 Siemens AG

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Segmental and Regional Analysis

9.6.4 Research & Development Expense

9.6.5 Recent strategies and developments:

9.6.5.1 Acquisition and Mergers:

9.6.6 SWOT Analysis

9.7 Robert Bosch GmbH

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Segmental and Regional Analysis

9.7.4 Research & Development Expense

9.7.5 Recent strategies and developments:

9.7.5.1 Partnerships, Collaborations, and Agreements:

9.7.5.2 Acquisition and Mergers:

9.7.6 SWOT Analysis

9.8 ABB Group

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Segmental and Regional Analysis

9.8.4 Research & Development Expense

9.8.5 Recent strategies and developments:

9.8.5.1 Partnerships, Collaborations, and Agreements:

9.8.5.2 Acquisition and Mergers:

9.8.6 SWOT Analysis

9.9 General Electric Company

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Segmental and Regional Analysis

9.9.4 Research & Development Expense

9.9.5 SWOT Analysis

9.10. Sensirion AG

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Regional Analysis

9.10.4 Research & Development Expenses

9.10.5 Recent strategies and developments:

9.10.5.1 Partnerships, Collaborations, and Agreements:

9.10.6 SWOT Analysis

TABLE 1 North America IoT Sensors Market, 2020 - 2023, USD Million

TABLE 2 North America IoT Sensors Market, 2024 - 2031, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– IoT Sensors Market

TABLE 4 Product Launches And Product Expansions– IoT Sensors Market

TABLE 5 Acquisition and Mergers– IoT Sensors Market

TABLE 6 North America IoT Sensors Market by Network Technology, 2020 - 2023, USD Million

TABLE 7 North America IoT Sensors Market by Network Technology, 2024 - 2031, USD Million

TABLE 8 North America Wireless Market by Region, 2020 - 2023, USD Million

TABLE 9 North America Wireless Market by Region, 2024 - 2031, USD Million

TABLE 10 North America IoT Sensors Market by Wireless Type, 2020 - 2023, USD Million

TABLE 11 North America IoT Sensors Market by Wireless Type, 2024 - 2031, USD Million

TABLE 12 North America Bluetooth Market by Country, 2020 - 2023, USD Million

TABLE 13 North America Bluetooth Market by Country, 2024 - 2031, USD Million

TABLE 14 North America IoT Sensors Market by Bluetooth Type, 2020 - 2023, USD Million

TABLE 15 North America IoT Sensors Market by Bluetooth Type, 2024 - 2031, USD Million

TABLE 16 North America Bluetooth Smart Market by Country, 2020 - 2023, USD Million

TABLE 17 North America Bluetooth Smart Market by Country, 2024 - 2031, USD Million

TABLE 18 North America Bluetooth Smart/Ant+ Market by Country, 2020 - 2023, USD Million

TABLE 19 North America Bluetooth Smart/Ant+ Market by Country, 2024 - 2031, USD Million

TABLE 20 North America Bluetooth 5 Market by Country, 2020 - 2023, USD Million

TABLE 21 North America Bluetooth 5 Market by Country, 2024 - 2031, USD Million

TABLE 22 North America Wi-Fi Market by Country, 2020 - 2023, USD Million

TABLE 23 North America Wi-Fi Market by Country, 2024 - 2031, USD Million

TABLE 24 North America Zigbee Market by Country, 2020 - 2023, USD Million

TABLE 25 North America Zigbee Market by Country, 2024 - 2031, USD Million

TABLE 26 North America Z-Wave Market by Region, 2020 - 2023, USD Million

TABLE 27 North America Z-Wave Market by Region, 2024 - 2031, USD Million

TABLE 28 North America NFC Market by Region, 2020 - 2023, USD Million

TABLE 29 North America NFC Market by Region, 2024 - 2031, USD Million

TABLE 30 North America RFID Market by Country, 2020 - 2023, USD Million

TABLE 31 North America RFID Market by Country, 2024 - 2031, USD Million

TABLE 32 North America Others Market by Country, 2020 - 2023, USD Million

TABLE 33 North America Others Market by Country, 2024 - 2031, USD Million

TABLE 34 North America Wired Market by Region, 2020 - 2023, USD Million

TABLE 35 North America Wired Market by Region, 2024 - 2031, USD Million

TABLE 36 North America IoT Sensors Market by End Use, 2020 - 2023, USD Million

TABLE 37 North America IoT Sensors Market by End Use, 2024 - 2031, USD Million

TABLE 38 North America Consumer Electronics Market by Country, 2020 - 2023, USD Million

TABLE 39 North America Consumer Electronics Market by Country, 2024 - 2031, USD Million

TABLE 40 North America Automotive Market by Country, 2020 - 2023, USD Million

TABLE 41 North America Automotive Market by Country, 2024 - 2031, USD Million

TABLE 42 North America Industrial Market by Country, 2020 - 2023, USD Million

TABLE 43 North America Industrial Market by Country, 2024 - 2031, USD Million

TABLE 44 North America Healthcare Market by Country, 2020 - 2023, USD Million

TABLE 45 North America Healthcare Market by Country, 2024 - 2031, USD Million

TABLE 46 North America Food & Beverage Market by Country, 2020 - 2023, USD Million

TABLE 47 North America Food & Beverage Market by Country, 2024 - 2031, USD Million

TABLE 48 North America Aerospace & Defense Market by Country, 2020 - 2023, USD Million

TABLE 49 North America Aerospace & Defense Market by Country, 2024 - 2031, USD Million

TABLE 50 North America Others Market by Country, 2020 - 2023, USD Million

TABLE 51 North America Others Market by Country, 2024 - 2031, USD Million

TABLE 52 North America IoT Sensors Market by Type, 2020 - 2023, USD Million

TABLE 53 North America IoT Sensors Market by Type, 2024 - 2031, USD Million

TABLE 54 North America Pressure Sensor Market by Country, 2020 - 2023, USD Million

TABLE 55 North America Pressure Sensor Market by Country, 2024 - 2031, USD Million

TABLE 56 North America Temperature Sensor Market by Country, 2020 - 2023, USD Million

TABLE 57 North America Temperature Sensor Market by Country, 2024 - 2031, USD Million

TABLE 58 North America Proximity Sensor Market by Country, 2020 - 2023, USD Million

TABLE 59 North America Proximity Sensor Market by Country, 2024 - 2031, USD Million

TABLE 60 North America Image Sensor Market by Country, 2020 - 2023, USD Million

TABLE 61 North America Image Sensor Market by Country, 2024 - 2031, USD Million

TABLE 62 North America Optical Sensor Market by Country, 2020 - 2023, USD Million

TABLE 63 North America Optical Sensor Market by Country, 2024 - 2031, USD Million

TABLE 64 North America Gyroscope Sensor Market by Country, 2020 - 2023, USD Million

TABLE 65 North America Gyroscope Sensor Market by Country, 2024 - 2031, USD Million

TABLE 66 North America Humidity Sensor Market by Country, 2020 - 2023, USD Million

TABLE 67 North America Humidity Sensor Market by Country, 2024 - 2031, USD Million

TABLE 68 North America Accelerometer Sensor Market by Country, 2020 - 2023, USD Million

TABLE 69 North America Accelerometer Sensor Market by Country, 2024 - 2031, USD Million

TABLE 70 North America Others Market by Country, 2020 - 2023, USD Million

TABLE 71 North America Others Market by Country, 2024 - 2031, USD Million

TABLE 72 North America IoT Sensors Market by Country, 2020 - 2023, USD Million

TABLE 73 North America IoT Sensors Market by Country, 2024 - 2031, USD Million

TABLE 74 US IoT Sensors Market, 2020 - 2023, USD Million

TABLE 75 US IoT Sensors Market, 2024 - 2031, USD Million

TABLE 76 US IoT Sensors Market by Network Technology, 2020 - 2023, USD Million

TABLE 77 US IoT Sensors Market by Network Technology, 2024 - 2031, USD Million

TABLE 78 US IoT Sensors Market by Wireless Type, 2020 - 2023, USD Million

TABLE 79 US IoT Sensors Market by Wireless Type, 2024 - 2031, USD Million

TABLE 80 US IoT Sensors Market by Bluetooth Type, 2020 - 2023, USD Million

TABLE 81 US IoT Sensors Market by Bluetooth Type, 2024 - 2031, USD Million

TABLE 82 US IoT Sensors Market by End Use, 2020 - 2023, USD Million

TABLE 83 US IoT Sensors Market by End Use, 2024 - 2031, USD Million

TABLE 84 US IoT Sensors Market by Type, 2020 - 2023, USD Million

TABLE 85 US IoT Sensors Market by Type, 2024 - 2031, USD Million

TABLE 86 Canada IoT Sensors Market, 2020 - 2023, USD Million

TABLE 87 Canada IoT Sensors Market, 2024 - 2031, USD Million

TABLE 88 Canada IoT Sensors Market by Network Technology, 2020 - 2023, USD Million

TABLE 89 Canada IoT Sensors Market by Network Technology, 2024 - 2031, USD Million

TABLE 90 Canada IoT Sensors Market by Wireless Type, 2020 - 2023, USD Million

TABLE 91 Canada IoT Sensors Market by Wireless Type, 2024 - 2031, USD Million

TABLE 92 Canada IoT Sensors Market by Bluetooth Type, 2020 - 2023, USD Million

TABLE 93 Canada IoT Sensors Market by Bluetooth Type, 2024 - 2031, USD Million

TABLE 94 Canada IoT Sensors Market by End Use, 2020 - 2023, USD Million

TABLE 95 Canada IoT Sensors Market by End Use, 2024 - 2031, USD Million

TABLE 96 Canada IoT Sensors Market by Type, 2020 - 2023, USD Million

TABLE 97 Canada IoT Sensors Market by Type, 2024 - 2031, USD Million

TABLE 98 Mexico IoT Sensors Market, 2020 - 2023, USD Million

TABLE 99 Mexico IoT Sensors Market, 2024 - 2031, USD Million

TABLE 100 Mexico IoT Sensors Market by Network Technology, 2020 - 2023, USD Million

TABLE 101 Mexico IoT Sensors Market by Network Technology, 2024 - 2031, USD Million

TABLE 102 Mexico IoT Sensors Market by Wireless Type, 2020 - 2023, USD Million

TABLE 103 Mexico IoT Sensors Market by Wireless Type, 2024 - 2031, USD Million

TABLE 104 Mexico IoT Sensors Market by Bluetooth Type, 2020 - 2023, USD Million

TABLE 105 Mexico IoT Sensors Market by Bluetooth Type, 2024 - 2031, USD Million

TABLE 106 Mexico IoT Sensors Market by End Use, 2020 - 2023, USD Million

TABLE 107 Mexico IoT Sensors Market by End Use, 2024 - 2031, USD Million

TABLE 108 Mexico IoT Sensors Market by Type, 2020 - 2023, USD Million

TABLE 109 Mexico IoT Sensors Market by Type, 2024 - 2031, USD Million

TABLE 110 Rest of North America IoT Sensors Market, 2020 - 2023, USD Million

TABLE 111 Rest of North America IoT Sensors Market, 2024 - 2031, USD Million

TABLE 112 Rest of North America IoT Sensors Market by Network Technology, 2020 - 2023, USD Million

TABLE 113 Rest of North America IoT Sensors Market by Network Technology, 2024 - 2031, USD Million

TABLE 114 Rest of North America IoT Sensors Market by Wireless Type, 2020 - 2023, USD Million

TABLE 115 Rest of North America IoT Sensors Market by Wireless Type, 2024 - 2031, USD Million

TABLE 116 Rest of North America IoT Sensors Market by Bluetooth Type, 2020 - 2023, USD Million

TABLE 117 Rest of North America IoT Sensors Market by Bluetooth Type, 2024 - 2031, USD Million

TABLE 118 Rest of North America IoT Sensors Market by End Use, 2020 - 2023, USD Million

TABLE 119 Rest of North America IoT Sensors Market by End Use, 2024 - 2031, USD Million

TABLE 120 Rest of North America IoT Sensors Market by Type, 2020 - 2023, USD Million

TABLE 121 Rest of North America IoT Sensors Market by Type, 2024 - 2031, USD Million

TABLE 122 Key Information – STMicroelectronics N.V.

TABLE 123 Key Information – Texas Instruments, Inc.

TABLE 124 Key Information – NXP Semiconductors N.V.

TABLE 125 Key Information – Infineon Technologies AG

TABLE 126 Key Information – Honeywell International, Inc.

TABLE 127 Key Information – Siemens AG

TABLE 128 Key Information – Robert Bosch GmbH

TABLE 129 Key Information – ABB Group

TABLE 130 Key Information – General Electric Company

TABLE 131 Key Information – Sensirion AG

List of Figures

FIG 1 Methodology for the research

FIG 2 North America IoT Sensors Market, 2020 - 2031, USD Million

FIG 3 Key Factors Impacting IoT Sensors Market

FIG 4 KBV Cardinal Matrix

FIG 5 Market Share Analysis, 2023

FIG 6 Key Leading Strategies: Percentage Distribution (2020-2024)

FIG 7 Key Strategic Move: (Partnerships, Collaborations & Agreements: 2020, Nov – 2024, Feb) Leading Players

FIG 8 Porter’s Five Forces Analysis – IoT Sensors Market

FIG 9 North America IoT Sensors Market share by Network Technology, 2023

FIG 10 North America IoT Sensors Market share by Network Technology, 2031

FIG 11 North America IoT Sensors Market by Network Technology, 2020 - 2031, USD Million

FIG 12 North America IoT Sensors Market share by End Use, 2023

FIG 13 North America IoT Sensors Market share by End Use, 2031

FIG 14 North America IoT Sensors Market by End Use, 2020 - 2031, USD Million

FIG 15 North America IoT Sensors Market share by Type, 2023

FIG 16 North America IoT Sensors Market share by Type, 2031

FIG 17 North America IoT Sensors Market by Type, 2020 - 2031, USD Million

FIG 18 North America IoT Sensors Market share by Country, 2023

FIG 19 North America IoT Sensors Market share by Country, 2031

FIG 20 North America IoT Sensors Market by Country, 2020 - 2031, USD Million

FIG 21 Recent strategies and developments: STMicroelectronics N.V.

FIG 22 SWOT Analysis: STMicroelectronics N.V.

FIG 23 SWOT Analysis: Texas Instruments, Inc.

FIG 24 SWOT Analysis: NXP Semiconductors N.V.

FIG 25 Recent strategies and developments: Infineon Technologies AG

FIG 26 SWOT Analysis: Infineon Technologies AG

FIG 27 Swot analysis: Honeywell international, inc.

FIG 28 SWOT Analysis: Siemens AG

FIG 29 Recent strategies and developments: Robert Bosch GmbH

FIG 30 SWOT Analysis: Robert Bosch GmbH

FIG 31 Recent strategies and developments: ABB Group

FIG 32 SWOT Analysis: ABB GROUP

FIG 33 SWOT Analysis: General electric Company

FIG 34 SWOT Analysis: SENSIRION AG