North America Medical Isotope Market Size, Share & Trends Analysis Report By Type, By End User (Hospitals, Diagnostic Centers, and Research Institutes), By Application (Diagonostic, and Nuclear Therapy), By Country and Growth Forecast, 2023 - 2030

Published Date : 18-Mar-2024 |

Pages: 103 |

Formats: PDF |

COVID-19 Impact on the North America Medical Isotope Market

The North America Medical Isotope Market would witness market growth of 7.8% CAGR during the forecast period (2023-2030).

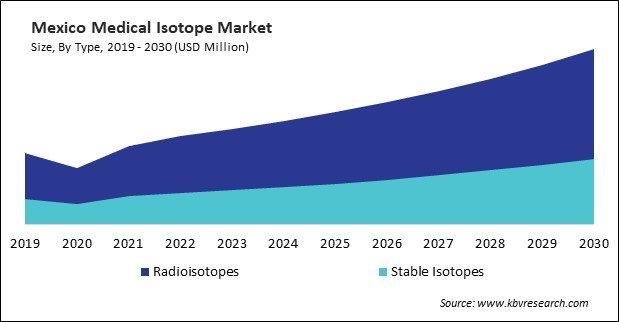

The US market dominated the North America Medical Isotope Market by Country in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $2,322.1 million by 2030. The Canada market is experiencing a CAGR of 10.3% during (2023 - 2030). Additionally, The Mexico market would exhibit a CAGR of 9.3% during (2023 - 2030).

The medical isotope market is crucial in modern healthcare, providing essential tools for diagnostic imaging, treatments, and medical research. Medical isotopes, or radiopharmaceuticals, are radioactive substances used in nuclear medicine procedures to diagnose and treat various medical conditions. Medical isotopes play a vital role in diagnostic imaging, allowing healthcare professionals to visualize and assess physiological processes within the body. From identifying tumors, assessing organ function, detecting abnormalities, and monitoring treatment response, medical isotopes provide valuable diagnostic information that helps guide patient care.

Furthermore, the development of clinical guidelines and protocols for using medical isotopes has standardized practices and increased confidence among healthcare providers. Evidence-based recommendations help guide the appropriate selection, administration, and interpretation of isotopic imaging studies and therapeutic interventions. Increased awareness among healthcare professionals and patients about the benefits and applications of medical isotopes has contributed to their adoption. Educational initiatives, professional development programs, and patient advocacy efforts have helped disseminate information about the role of medical isotopes in healthcare.

The expansion of the healthcare sector in Canada creates growth opportunities for companies involved in the production, distribution, and utilization of medical isotopes. According to data released by the Canadian government in 2023, provinces and territories will receive an additional $46.2 billion in financing as part of a $196.1 billion ten-year government investment to enhance health care services for all Canadians. Hence, the growing healthcare sector and pharmaceutical industry in the region is propelling the market’s growth.

Free Valuable Insights: The Medical Isotope Market is Predict to reach USD 9.1 Billion by 2030, at a CAGR of 8.6%

Based on Type, the market is segmented into Radioisotopes, and Stable Isotopes. Based on End User, the market is segmented into Hospitals, Diagnostic Centers, and Research Institutes. Based on Application, the market is segmented into Diagnostic, and Nuclear Therapy. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- Mallinckrodt PLC

- Bayer AG

- GE HealthCare Technologies, Inc.

- Canadian Nuclear Laboratories (Atomic Energy Of Canada Limited)

- ITM Isotope Technologies Munich SE

- Siemens Healthineers AG

- Eczacibasi-Monrol

- NorthStar Medical Radioisotopes, LLC

- Nordion Inc. (Sotera Health LLC)

- Iba SA

North America Medical Isotope Market Report Segmentation

By Type

- Radioisotopes

- Stable Isotopes

By End User

- Hospitals

- Diagnostic Centers

- Research Institutes

By Application

- Diagnostic

- Nuclear Therapy

By Country

- US

- Canada

- Mexico

- Rest of North America

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 North America Medical Isotope Market, by Type

1.4.2 North America Medical Isotope Market, by End User

1.4.3 North America Medical Isotope Market, by Application

1.4.4 North America Medical Isotope Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Opportunities

3.2.3 Market Restraints

3.2.4 Market Challenges

3.3 Porter’s Five Forces Analysis

Chapter 4. Recent Strategies Deployed in Medical Isotopes Market

Chapter 5. North America Medical Isotope Market by Type

5.1 North America Radioisotopes Market by Region

5.2 North America Stable Isotopes Market by Region

Chapter 6. North America Medical Isotope Market by End User

6.1 North America Hospitals Market by Country

6.2 North America Diagnostic Centers Market by Country

6.3 North America Research Institutes Market by Country

Chapter 7. North America Medical Isotope Market by Application

7.1 North America Diagonostic Market by Country

7.2 North America Nuclear Therapy Market by Country

Chapter 8. North America Medical Isotope Market by Country

8.1 US Medical Isotope Market

8.1.1 US Medical Isotope Market by Type

8.1.2 US Medical Isotope Market by End User

8.1.3 US Medical Isotope Market by Application

8.2 Canada Medical Isotope Market

8.2.1 Canada Medical Isotope Market by Type

8.2.2 Canada Medical Isotope Market by End User

8.2.3 Canada Medical Isotope Market by Application

8.3 Mexico Medical Isotope Market

8.3.1 Mexico Medical Isotope Market by Type

8.3.2 Mexico Medical Isotope Market by End User

8.3.3 Mexico Medical Isotope Market by Application

8.4 Rest of North America Medical Isotope Market

8.4.1 Rest of North America Medical Isotope Market by Type

8.4.2 Rest of North America Medical Isotope Market by End User

8.4.3 Rest of North America Medical Isotope Market by Application

Chapter 9. Company Profiles

9.1 Canadian Nuclear Laboratories (Atomic Energy of Canada Limited)

9.1.1 Company Overview

9.1.2 Recent strategies and developments:

9.1.2.1 Partnerships, Collaborations, and Agreements:

9.1.3 SWOT Analysis

9.2 ITM Isotope Technologies Munich SE

9.2.1 Company Overview

9.2.2 Recent strategies and developments:

9.2.2.1 Partnerships, Collaborations, and Agreements:

9.2.3 SWOT Analysis

9.3 ECZACIBAŞI-MONROL

9.3.1 Company Overview

9.3.2 Recent strategies and developments:

9.3.2.1 Partnerships, Collaborations, and Agreements:

9.3.3 SWOT Analysis

9.4 NorthStar Medical Radioisotopes, LLC

9.4.1 Company Overview

9.4.2 Recent strategies and developments:

9.4.2.1 Partnerships, Collaborations, and Agreements:

9.4.3 SWOT Analysis

9.5 Iba SA

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Segmental and Regional Analysis

9.5.4 Research & Development Expenses

9.5.5 SWOT Analysis

9.6 Mallinckrodt PLC

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Segmental and Regional Analysis

9.6.4 Research & Development Expense

9.6.5 SWOT Analysis

9.7 GE HealthCare Technologies, Inc.

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Segmental and Regional Analysis

9.7.4 Research & Development Expenses

9.7.5 Recent strategies and developments:

9.7.5.1 Partnerships, Collaborations, and Agreements:

9.7.6 SWOT Analysis

9.8 Nordion Inc. (Sotera Health LLC)

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Segmental and Regional Analysis

9.9 Bayer AG

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Segmental and Regional Analysis

9.9.4 Research & Development Expense

9.9.5 Recent strategies and developments:

9.9.5.1 Partnerships, Collaborations, and Agreements:

9.9.6 SWOT Analysis

9.10. Siemens Healthineers AG (Siemens AG)

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Segmental and Regional Analysis

9.10.4 Research & Development Expense

9.10.5 SWOT Analysis

TABLE 2 North America Medical Isotope Market, 2023 - 2030, USD Million

TABLE 3 North America Medical Isotope Market by Type, 2019 - 2022, USD Million

TABLE 4 North America Medical Isotope Market by Type, 2023 - 2030, USD Million

TABLE 5 North America Radioisotopes Market by Region, 2019 - 2022, USD Million

TABLE 6 North America Radioisotopes Market by Region, 2023 - 2030, USD Million

TABLE 7 North America Stable Isotopes Market by Region, 2019 - 2022, USD Million

TABLE 8 North America Stable Isotopes Market by Region, 2023 - 2030, USD Million

TABLE 9 North America Medical Isotope Market by End User, 2019 - 2022, USD Million

TABLE 10 North America Medical Isotope Market by End User, 2023 - 2030, USD Million

TABLE 11 North America Hospitals Market by Country, 2019 - 2022, USD Million

TABLE 12 North America Hospitals Market by Country, 2023 - 2030, USD Million

TABLE 13 North America Diagnostic Centers Market by Country, 2019 - 2022, USD Million

TABLE 14 North America Diagnostic Centers Market by Country, 2023 - 2030, USD Million

TABLE 15 North America Research Institutes Market by Country, 2019 - 2022, USD Million

TABLE 16 North America Research Institutes Market by Country, 2023 - 2030, USD Million

TABLE 17 North America Medical Isotope Market by Application, 2019 - 2022, USD Million

TABLE 18 North America Medical Isotope Market by Application, 2023 - 2030, USD Million

TABLE 19 North America Diagonostic Market by Country, 2019 - 2022, USD Million

TABLE 20 North America Diagonostic Market by Country, 2023 - 2030, USD Million

TABLE 21 North America Nuclear Therapy Market by Country, 2019 - 2022, USD Million

TABLE 22 North America Nuclear Therapy Market by Country, 2023 - 2030, USD Million

TABLE 23 North America Medical Isotope Market by Country, 2019 - 2022, USD Million

TABLE 24 North America Medical Isotope Market by Country, 2023 - 2030, USD Million

TABLE 25 US Medical Isotope Market, 2019 - 2022, USD Million

TABLE 26 US Medical Isotope Market, 2023 - 2030, USD Million

TABLE 27 US Medical Isotope Market by Type, 2019 - 2022, USD Million

TABLE 28 US Medical Isotope Market by Type, 2023 - 2030, USD Million

TABLE 29 US Medical Isotope Market by End User, 2019 - 2022, USD Million

TABLE 30 US Medical Isotope Market by End User, 2023 - 2030, USD Million

TABLE 31 US Medical Isotope Market by Application, 2019 - 2022, USD Million

TABLE 32 US Medical Isotope Market by Application, 2023 - 2030, USD Million

TABLE 33 Canada Medical Isotope Market, 2019 - 2022, USD Million

TABLE 34 Canada Medical Isotope Market, 2023 - 2030, USD Million

TABLE 35 Canada Medical Isotope Market by Type, 2019 - 2022, USD Million

TABLE 36 Canada Medical Isotope Market by Type, 2023 - 2030, USD Million

TABLE 37 Canada Medical Isotope Market by End User, 2019 - 2022, USD Million

TABLE 38 Canada Medical Isotope Market by End User, 2023 - 2030, USD Million

TABLE 39 Canada Medical Isotope Market by Application, 2019 - 2022, USD Million

TABLE 40 Canada Medical Isotope Market by Application, 2023 - 2030, USD Million

TABLE 41 Mexico Medical Isotope Market, 2019 - 2022, USD Million

TABLE 42 Mexico Medical Isotope Market, 2023 - 2030, USD Million

TABLE 43 Mexico Medical Isotope Market by Type, 2019 - 2022, USD Million

TABLE 44 Mexico Medical Isotope Market by Type, 2023 - 2030, USD Million

TABLE 45 Mexico Medical Isotope Market by End User, 2019 - 2022, USD Million

TABLE 46 Mexico Medical Isotope Market by End User, 2023 - 2030, USD Million

TABLE 47 Mexico Medical Isotope Market by Application, 2019 - 2022, USD Million

TABLE 48 Mexico Medical Isotope Market by Application, 2023 - 2030, USD Million

TABLE 49 Rest of North America Medical Isotope Market, 2019 - 2022, USD Million

TABLE 50 Rest of North America Medical Isotope Market, 2023 - 2030, USD Million

TABLE 51 Rest of North America Medical Isotope Market by Type, 2019 - 2022, USD Million

TABLE 52 Rest of North America Medical Isotope Market by Type, 2023 - 2030, USD Million

TABLE 53 Rest of North America Medical Isotope Market by End User, 2019 - 2022, USD Million

TABLE 54 Rest of North America Medical Isotope Market by End User, 2023 - 2030, USD Million

TABLE 55 Rest of North America Medical Isotope Market by Application, 2019 - 2022, USD Million

TABLE 56 Rest of North America Medical Isotope Market by Application, 2023 - 2030, USD Million

TABLE 57 Key Information – Canadian nuclear Laboratories

TABLE 58 Key Information – ITM Isotope Technologies Munich SE

TABLE 59 Key Information – ECZACIBAŞI-MONROL

TABLE 60 Key Information – NorthStar Medical Radioisotopes, LLC

TABLE 61 Key Information – iba sa

TABLE 62 Key information – Mallinckrodt PLC

TABLE 63 Key Information – GE HealthCare Technologies, Inc.

TABLE 64 Key Information – Nordion Inc.

TABLE 65 Key Information – Bayer AG

TABLE 66 Key Information – Siemens Healthineers AG

List of Figures

FIG 1 Methodology for the research

FIG 2 North America Medical Isotope Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Medical Isotope Market

FIG 4 Porter’s Five Forces Analysis - Medical Isotopes Market

FIG 5 North America Medical Isotope Market share by Type, 2022

FIG 6 North America Medical Isotope Market share by Type, 2030

FIG 7 North America Medical Isotope Market by Type, 2019 - 2030, USD Million

FIG 8 North America Medical Isotope Market share by End User, 2022

FIG 9 North America Medical Isotope Market share by End User, 2030

FIG 10 North America Medical Isotope Market by End User, 2019 - 2030, USD Million

FIG 11 North America Medical Isotope Market share by Application, 2022

FIG 12 North America Medical Isotope Market share by Application, 2030

FIG 13 North America Medical Isotope Market by Application, 2019 - 2030, USD Million

FIG 14 North America Medical Isotope Market share by Country, 2022

FIG 15 North America Medical Isotope Market share by Country, 2030

FIG 16 North America Medical Isotope Market by Country, 2019 - 2030, USD Million

FIG 17 SWOT Analysis: Canadian Nuclear Laboratories

FIG 18 SWOT Analysis: ITM Isotope Technologies Munich SE

FIG 19 SWOT Analysis: Eczacibasi-Monrol

FIG 20 SWOT Analysis: NorthStar Medical Radioisotopes, LLC

FIG 21 SWOT Analysis: Iba SA

FIG 22 SWOT Analysis: Mallinckrodt PLC

FIG 23 SWOT Analysis: GE HealthCare Technologies, Inc.

FIG 24 Swot Analysis: Bayer AG

FIG 25 SWOT Analysis: Siemens Healthineers AG