North America Millimeter Wave Sensors and Modules Market Size, Share & Trends Analysis Report By Frequency Band (E-Band, V-Band, and Other Frequency Band), By Application, By Country and Growth Forecast, 2024 - 2031

Published Date : 19-Dec-2024 |

Pages: 105 |

Formats: PDF |

COVID-19 Impact on the North America Millimeter Wave Sensors and Modules Market

The North America Millimeter Wave Sensors and Modules Market would witness market growth of 29.0% CAGR during the forecast period (2024-2031).

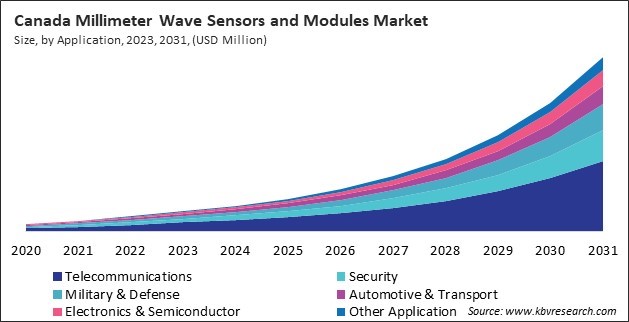

The US market dominated the North America Millimeter Wave Sensors and Modules Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $138,709.9 Thousands by 2031. The Canada market is experiencing a CAGR of 31.6% during (2024 - 2031). Additionally, The Mexico market would exhibit a CAGR of 30.6% during (2024 - 2031).

This market is booming because of the growing need for precise sensing, high-speed communication, and sophisticated imaging technologies. Millimeter wave (mmWave) technology operates within the frequency range of 30 GHz to 300 GHz, offering unparalleled bandwidth and minimal interference compared to traditional communication systems. mmWave technology is essential in many sectors, including healthcare, defense, automotive, and telecommunications, owing to these characteristics.

The telecommunications industry has been a significant market driver, particularly with the rollout of 5G networks. These sensors and modules enable high-speed, low-latency communication, which defines 5G. The growing need for advanced driver assistance systems (ADAS) and driverless cars has also made the automobile industry a major adopter of mmWave sensors.

The growing integration of mmWave sensors in defense and infrastructure applications is also noteworthy. The United States, as the largest military spender globally, allocated $877 billion to defense in 2022, representing 39% of the world's total military expenditure. Initiatives like the National Defense Authorization Act (NDAA) directed over $138 billion in 2023 toward the research and development of advanced defense technologies. A portion of this funding supports critical infrastructure, including mmWave sensors, integral to applications such as enhanced surveillance systems, AI-powered defense platforms, and real-time data transmission in military vehicles and aircraft. These sensors ensure robust performance in extreme conditions, providing reliable data access where conventional systems may fail, thereby solidifying their importance in military modernization efforts. Hence, these factors create a promising outlook for the region's millimeter wave sensors and modules market over the forecast period.

Free Valuable Insights: The Millimeter Wave Sensors and Modules Market is Predict to reach USD 677.49 Million by 2031, at a CAGR of 29.8%

Based on Frequency Band, the market is segmented into E-Band, V-Band, and Other Frequency Band. Based on Application, the market is segmented into Telecommunications, Security, Military & Defense, Automotive & Transport, Electronics & Semiconductor, and Other Application. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- Texas Instruments, Inc.

- NEC Corporation

- Keysight Technologies, Inc.

- Qualcomm Incorporated (Qualcomm Technologies, Inc.)

- MediaTek, Inc.

- Infineon Technologies AG

- Smiths Group PLC

- Eravant, Inc.

- Mistral Solutions Pvt. Ltd. (Axicades Technologies)

- QuinStar Technology, Inc.

North America Millimeter Wave Sensors and Modules Market Report Segmentation

By Frequency Band

- E-Band

- V-Band

- Other Frequency Band

By Application

- Telecommunications

- Security

- Military & Defense

- Automotive & Transport

- Electronics & Semiconductor

- Other Application

By Country

- US

- Canada

- Mexico

- Rest of North America

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 North America Millimeter Wave Sensors and Modules Market, by Frequency Band

1.4.2 North America Millimeter Wave Sensors and Modules Market, by Application

1.4.3 North America Millimeter Wave Sensors and Modules Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Competition Analysis – Global

4.1 Market Share Analysis, 2023

4.2 Porter Five Forces Analysis

Chapter 5. North America Millimeter Wave Sensors and Modules Market by Frequency Band

5.1 North America E-Band Market by Country

5.2 North America V-Band Market by Country

5.3 North America Other Frequency Band Market by Country

Chapter 6. North America Millimeter Wave Sensors and Modules Market by Application

6.1 North America Telecommunications Market by Country

6.2 North America Security Market by Country

6.3 North America Military & Defense Market by Country

6.4 North America Automotive & Transport Market by Country

6.5 North America Electronics & Semiconductor Market by Country

6.6 North America Other Application Market by Country

Chapter 7. North America Millimeter Wave Sensors and Modules Market by Country

7.1 US Millimeter Wave Sensors and Modules Market

7.1.1 US Millimeter Wave Sensors and Modules Market by Frequency Band

7.1.2 US Millimeter Wave Sensors and Modules Market by Application

7.2 Canada Millimeter Wave Sensors and Modules Market

7.2.1 Canada Millimeter Wave Sensors and Modules Market by Frequency Band

7.2.2 Canada Millimeter Wave Sensors and Modules Market by Application

7.3 Mexico Millimeter Wave Sensors and Modules Market

7.3.1 Mexico Millimeter Wave Sensors and Modules Market by Frequency Band

7.3.2 Mexico Millimeter Wave Sensors and Modules Market by Application

7.4 Rest of North America Millimeter Wave Sensors and Modules Market

7.4.1 Rest of North America Millimeter Wave Sensors and Modules Market by Frequency Band

7.4.2 Rest of North America Millimeter Wave Sensors and Modules Market by Application

Chapter 8. Company Profiles

8.1 Texas Instruments, Inc.

8.1.1 Company Overview

8.1.2 Financial Analysis

8.1.3 Segmental and Regional Analysis

8.1.4 Research & Development Expense

8.1.5 Recent strategies and developments:

8.1.5.1 Product Launches and Product Expansions:

8.1.6 SWOT Analysis

8.2 NEC Corporation

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Segmental and Regional Analysis

8.2.4 Research & Development Expenses

8.2.5 SWOT Analysis

8.3 Keysight Technologies, Inc.

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Segmental and Regional Analysis

8.3.4 Research & Development Expenses

8.3.5 Recent strategies and developments:

8.3.5.1 Product Launches and Product Expansions:

8.3.6 SWOT Analysis

8.4 Qualcomm Incorporated (Qualcomm Technologies, Inc.)

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Segmental and Regional Analysis

8.4.4 Research & Development Expense

8.4.5 Recent strategies and developments:

8.4.5.1 Product Launches and Product Expansions:

8.4.6 SWOT Analysis

8.5 MediaTek, Inc.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Regional Analysis

8.5.4 Research & Development Expenses

8.5.5 SWOT Analysis

8.6 Infineon Technologies AG

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Segmental and Regional Analysis

8.6.4 Research & Development Expense

8.6.5 SWOT Analysis

8.7 Smiths Group PLC

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Segmental and Regional Analysis

8.7.4 Research & Development Expenses

8.7.5 SWOT Analysis

8.8 Eravant, Inc.

8.8.1 Company Overview

8.9 Mistral Solutions Pvt. Ltd. (Axicades Technologies)

8.9.1 Company Overview

8.10. QuinStar Technology, Inc.

8.10.1 Company Overview

TABLE 2 North America Millimeter Wave Sensors and Modules Market, 2024 - 2031, USD Thousands

TABLE 3 North America Millimeter Wave Sensors and Modules Market by Frequency Band, 2020 - 2023, USD Thousands

TABLE 4 North America Millimeter Wave Sensors and Modules Market by Frequency Band, 2024 - 2031, USD Thousands

TABLE 5 North America E-Band Market by Country, 2020 - 2023, USD Thousands

TABLE 6 North America E-Band Market by Country, 2024 - 2031, USD Thousands

TABLE 7 North America V-Band Market by Country, 2020 - 2023, USD Thousands

TABLE 8 North America V-Band Market by Country, 2024 - 2031, USD Thousands

TABLE 9 North America Other Frequency Band Market by Country, 2020 - 2023, USD Thousands

TABLE 10 North America Other Frequency Band Market by Country, 2024 - 2031, USD Thousands

TABLE 11 North America Millimeter Wave Sensors and Modules Market by Application, 2020 - 2023, USD Thousands

TABLE 12 North America Millimeter Wave Sensors and Modules Market by Application, 2024 - 2031, USD Thousands

TABLE 13 North America Telecommunications Market by Country, 2020 - 2023, USD Thousands

TABLE 14 North America Telecommunications Market by Country, 2024 - 2031, USD Thousands

TABLE 15 North America Security Market by Country, 2020 - 2023, USD Thousands

TABLE 16 North America Security Market by Country, 2024 - 2031, USD Thousands

TABLE 17 North America Military & Defense Market by Country, 2020 - 2023, USD Thousands

TABLE 18 North America Military & Defense Market by Country, 2024 - 2031, USD Thousands

TABLE 19 North America Automotive & Transport Market by Country, 2020 - 2023, USD Thousands

TABLE 20 North America Automotive & Transport Market by Country, 2024 - 2031, USD Thousands

TABLE 21 North America Electronics & Semiconductor Market by Country, 2020 - 2023, USD Thousands

TABLE 22 North America Electronics & Semiconductor Market by Country, 2024 - 2031, USD Thousands

TABLE 23 North America Other Application Market by Country, 2020 - 2023, USD Thousands

TABLE 24 North America Other Application Market by Country, 2024 - 2031, USD Thousands

TABLE 25 North America Millimeter Wave Sensors and Modules Market by Country, 2020 - 2023, USD Thousands

TABLE 26 North America Millimeter Wave Sensors and Modules Market by Country, 2024 - 2031, USD Thousands

TABLE 27 US Millimeter Wave Sensors and Modules Market, 2020 - 2023, USD Thousands

TABLE 28 US Millimeter Wave Sensors and Modules Market, 2024 - 2031, USD Thousands

TABLE 29 US Millimeter Wave Sensors and Modules Market by Frequency Band, 2020 - 2023, USD Thousands

TABLE 30 US Millimeter Wave Sensors and Modules Market by Frequency Band, 2024 - 2031, USD Thousands

TABLE 31 US Millimeter Wave Sensors and Modules Market by Application, 2020 - 2023, USD Thousands

TABLE 32 US Millimeter Wave Sensors and Modules Market by Application, 2024 - 2031, USD Thousands

TABLE 33 Canada Millimeter Wave Sensors and Modules Market, 2020 - 2023, USD Thousands

TABLE 34 Canada Millimeter Wave Sensors and Modules Market, 2024 - 2031, USD Thousands

TABLE 35 Canada Millimeter Wave Sensors and Modules Market by Frequency Band, 2020 - 2023, USD Thousands

TABLE 36 Canada Millimeter Wave Sensors and Modules Market by Frequency Band, 2024 - 2031, USD Thousands

TABLE 37 Canada Millimeter Wave Sensors and Modules Market by Application, 2020 - 2023, USD Thousands

TABLE 38 Canada Millimeter Wave Sensors and Modules Market by Application, 2024 - 2031, USD Thousands

TABLE 39 Mexico Millimeter Wave Sensors and Modules Market, 2020 - 2023, USD Thousands

TABLE 40 Mexico Millimeter Wave Sensors and Modules Market, 2024 - 2031, USD Thousands

TABLE 41 Mexico Millimeter Wave Sensors and Modules Market by Frequency Band, 2020 - 2023, USD Thousands

TABLE 42 Mexico Millimeter Wave Sensors and Modules Market by Frequency Band, 2024 - 2031, USD Thousands

TABLE 43 Mexico Millimeter Wave Sensors and Modules Market by Application, 2020 - 2023, USD Thousands

TABLE 44 Mexico Millimeter Wave Sensors and Modules Market by Application, 2024 - 2031, USD Thousands

TABLE 45 Rest of North America Millimeter Wave Sensors and Modules Market, 2020 - 2023, USD Thousands

TABLE 46 Rest of North America Millimeter Wave Sensors and Modules Market, 2024 - 2031, USD Thousands

TABLE 47 Rest of North America Millimeter Wave Sensors and Modules Market by Frequency Band, 2020 - 2023, USD Thousands

TABLE 48 Rest of North America Millimeter Wave Sensors and Modules Market by Frequency Band, 2024 - 2031, USD Thousands

TABLE 49 Rest of North America Millimeter Wave Sensors and Modules Market by Application, 2020 - 2023, USD Thousands

TABLE 50 Rest of North America Millimeter Wave Sensors and Modules Market by Application, 2024 - 2031, USD Thousands

TABLE 51 Key Information – Texas Instruments, Inc.

TABLE 52 KEY INFORMATION – NEC Corporation

TABLE 53 Key Information – Keysight Technologies, Inc.

TABLE 54 Key Information – Qualcomm Incorporated

TABLE 55 Key Information – MediaTek, Inc.

TABLE 56 Key Information – Infineon Technologies AG

TABLE 57 Key Information – Smiths Group PLC

TABLE 58 Key Information – Eravant, Inc.

TABLE 59 Key Information – Mistral Solutions Pvt. Ltd. (Axicades Technologies)

TABLE 60 Key Information – QuinStar Technology, Inc.

List of Figures

FIG 1 Methodology for the research

FIG 2 North America Millimeter Wave Sensors and Modules Market, 2020 - 2031, USD Thousands

FIG 3 Key Factors Impacting Millimeter Wave Sensors and Modules Market

FIG 4 Market Share Analysis, 2023

FIG 5 Porter’s Five Forces Analysis – Millimeter Wave Sensors and Modules Market

FIG 6 North America Millimeter Wave Sensors and Modules Market share by Frequency Band, 2023

FIG 7 North America Millimeter Wave Sensors and Modules Market share by Frequency Band, 2031

FIG 8 North America Millimeter Wave Sensors and Modules Market by Frequency Band, 2020 - 2031, USD Thousands

FIG 9 North America Millimeter Wave Sensors and Modules Market share by Application, 2023

FIG 10 North America Millimeter Wave Sensors and Modules Market share by Application, 2031

FIG 11 North America Millimeter Wave Sensors and Modules Market by Application, 2020 - 2031, USD Thousands

FIG 12 North America Millimeter Wave Sensors and Modules Market share by Country, 2023

FIG 13 North America Millimeter Wave Sensors and Modules Market share by Country, 2031

FIG 14 North America Millimeter Wave Sensors and Modules Market by Country, 2020 - 2031, USD Thousands

FIG 15 SWOT Analysis: Texas Instruments, Inc.

FIG 16 SWOT Analysis: NEC Corporation

FIG 17 SWOT Analysis: Keysight Technologies, Inc.

FIG 18 SWOT Analysis: QUALCOMM Incorporated

FIG 19 SWOT Analysis: MediaTek, Inc.

FIG 20 SWOT Analysis: Infineon Technologies AG

FIG 21 SWOT Analysis: Smiths Group plc