North America Natural Dog Treats Market Size, Share & Trends Analysis Report By Product, By Distribution Channel (Specialty Pet Stores, Supermarkets & Hypermarkets, Online, and Others), By Country and Growth Forecast, 2024 - 2031

Published Date : 10-Sep-2024 |

Pages: 82 |

Formats: PDF |

COVID-19 Impact on the North America Natural Dog Treats Market

The North America Natural Dog Treats Market would witness market growth of 11.5% CAGR during the forecast period (2024-2031).

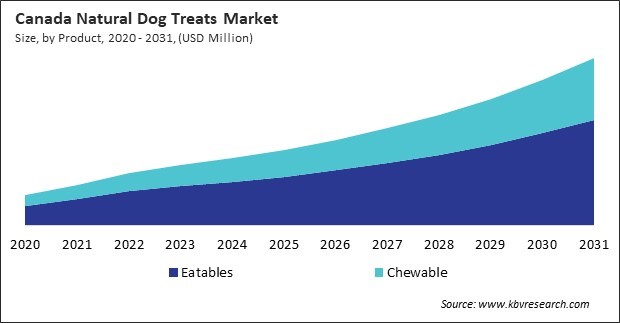

The US market dominated the North America Natural Dog Treats Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $4,372.9 Million by 2031. The Canada market is experiencing a CAGR of 13.9% during (2024 - 2031). Additionally, The Mexico market would register a CAGR of 12.9% during (2024 - 2031).

Natural dog treats serve various purposes beyond their basic role as snacks or rewards. Their applications are diverse and reflect their multifunctional benefits. Natural dog treats are often formulated to provide specific nutritional benefits, such as improved coat health, enhanced immune function, or better digestive health. Ingredients like omega fatty acids, probiotics, and antioxidants are commonly included to address these needs.

Some treats are designed to complement or enhance a dog's diet, offering additional nutrients that may not be in their regular food. For example, treats with added vitamins or minerals support overall health and fill dietary gaps. Natural dog treats are used as rewards during training sessions to reinforce desired behaviors. Their high palatability and appealing flavors effectively motivate and reward dogs, facilitating successful training outcomes. Many natural treats address behavioral issues, such as excessive howling or anxiety. Ingredients like calming herbs or adaptogens can help manage stress and promote relaxation.

Natural dog treats, often free from artificial additives and preservatives, align with this shift towards healthier options in the USA and contribute to the growth of this market segment. As pet owners in the USA spend more on their pets, there's a growing preference for premium and natural products. This trend drives the demand for natural dog treats in the USA, which are perceived as healthier and more nutritious compared to conventional treats. Companies in the USA are investing more in marketing and branding to capture the attention of affluent pet owners. Effective branding of natural dog treats as premium, high-quality products helps drive consumer preference and loyalty within the USA. Thus, rising pet ownership and increasing spending in pet industry is driving the growth of the market.

Free Valuable Insights: The Natural Dog Treats Market is Predict to reach USD 14.1 Billion by 2031, at a CAGR of 12.0%

Based on Product, the market is segmented into Eatables and Chewable. Based on Distribution Channel, the market is segmented into Specialty Pet Stores, Supermarkets & Hypermarkets, Online, and Others. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- Mars, Inc.

- Nestlé S.A.

- The J.M. Smucker Company

- General Mills, Inc.

- The Colgate Palmolive Company

- Off Leash Pet Treats

- The Wellness Pet Company (Clearlake Capital Group, L.P.)

- Spectrum Brands Holdings, Inc.

- The Dog Chew Company

North America Natural Dog Treats Market Report Segmentation

By Product

- Eatables

- Chewable

By Distribution Channel

- Specialty Pet Stores

- Supermarkets & Hypermarkets

- Online

- Others

By Country

- US

- Canada

- Mexico

- Rest of North America

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 North America Natural Dog Treats Market, by Product

1.4.2 North America Natural Dog Treats Market, by Distribution Channel

1.4.3 North America Natural Dog Treats Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

3.3 Porter Five Forces Analysis

Chapter 4. North America Natural Dog Treats Market by Product

4.1 North America Eatables Market by Country

4.2 North America Chewable Market by Country

Chapter 5. North America Natural Dog Treats Market by Distribution Channel

5.1 North America Specialty Pet Stores Market by Country

5.2 North America Supermarkets & Hypermarkets Market by Country

5.3 North America Online Market by Country

5.4 North America Others Market by Country

Chapter 6. North America Natural Dog Treats Market by Country

6.1 US Natural Dog Treats Market

6.1.1 US Natural Dog Treats Market by Product

6.1.2 US Natural Dog Treats Market by Distribution Channel

6.2 Canada Natural Dog Treats Market

6.2.1 Canada Natural Dog Treats Market by Product

6.2.2 Canada Natural Dog Treats Market by Distribution Channel

6.3 Mexico Natural Dog Treats Market

6.3.1 Mexico Natural Dog Treats Market by Product

6.3.2 Mexico Natural Dog Treats Market by Distribution Channel

6.4 Rest of North America Natural Dog Treats Market

6.4.1 Rest of North America Natural Dog Treats Market by Product

6.4.2 Rest of North America Natural Dog Treats Market by Distribution Channel

Chapter 7. Company Profiles

7.1 The J.M. Smucker Company

7.1.1 Company Overview

7.1.2 Financial Analysis

7.1.3 Segmental and Regional Analysis

7.2 Off Leash Pet Treats

7.2.1 Company Overview

7.3 The Dog Chew Company

7.3.1 Company Overview

7.4 Mars, Inc.

7.4.1 Company Overview

7.4.2 SWOT Analysis

7.5 Nestle S.A.

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Segmental and Regional Analysis

7.5.4 Research & Development Expenses

7.5.5 SWOT Analysis

7.6 General Mills, Inc.

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Segmental and Regional Analysis

7.6.4 Research & Development Expense

7.6.5 SWOT Analysis

7.7 The Wellness Pet Company (Clearlake Capital Group, L.P.)

7.7.1 Company Overview

7.7.2 SWOT Analysis

7.8 Spectrum Brands Holdings, Inc.

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Segmental and Regional Analysis

7.8.4 Research & Development Expenses

7.8.5 SWOT Analysis

7.9 The Colgate Palmolive Company

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Segmental and Regional Analysis

7.9.4 Research & Development Expenses

7.9.5 SWOT Analysis

TABLE 2 North America Natural Dog Treats Market, 2024 - 2031, USD Million

TABLE 3 North America Natural Dog Treats Market by Product, 2020 - 2023, USD Million

TABLE 4 North America Natural Dog Treats Market by Product, 2024 - 2031, USD Million

TABLE 5 North America Eatables Market by Country, 2020 - 2023, USD Million

TABLE 6 North America Eatables Market by Country, 2024 - 2031, USD Million

TABLE 7 North America Chewable Market by Country, 2020 - 2023, USD Million

TABLE 8 North America Chewable Market by Country, 2024 - 2031, USD Million

TABLE 9 North America Natural Dog Treats Market by Distribution Channel, 2020 - 2023, USD Million

TABLE 10 North America Natural Dog Treats Market by Distribution Channel, 2024 - 2031, USD Million

TABLE 11 North America Specialty Pet Stores Market by Country, 2020 - 2023, USD Million

TABLE 12 North America Specialty Pet Stores Market by Country, 2024 - 2031, USD Million

TABLE 13 North America Supermarkets & Hypermarkets Market by Country, 2020 - 2023, USD Million

TABLE 14 North America Supermarkets & Hypermarkets Market by Country, 2024 - 2031, USD Million

TABLE 15 North America Online Market by Country, 2020 - 2023, USD Million

TABLE 16 North America Online Market by Country, 2024 - 2031, USD Million

TABLE 17 North America Others Market by Country, 2020 - 2023, USD Million

TABLE 18 North America Others Market by Country, 2024 - 2031, USD Million

TABLE 19 North America Natural Dog Treats Market by Country, 2020 - 2023, USD Million

TABLE 20 North America Natural Dog Treats Market by Country, 2024 - 2031, USD Million

TABLE 21 US Natural Dog Treats Market, 2020 - 2023, USD Million

TABLE 22 US Natural Dog Treats Market, 2024 - 2031, USD Million

TABLE 23 US Natural Dog Treats Market by Product, 2020 - 2023, USD Million

TABLE 24 US Natural Dog Treats Market by Product, 2024 - 2031, USD Million

TABLE 25 US Natural Dog Treats Market by Distribution Channel, 2020 - 2023, USD Million

TABLE 26 US Natural Dog Treats Market by Distribution Channel, 2024 - 2031, USD Million

TABLE 27 Canada Natural Dog Treats Market, 2020 - 2023, USD Million

TABLE 28 Canada Natural Dog Treats Market, 2024 - 2031, USD Million

TABLE 29 Canada Natural Dog Treats Market by Product, 2020 - 2023, USD Million

TABLE 30 Canada Natural Dog Treats Market by Product, 2024 - 2031, USD Million

TABLE 31 Canada Natural Dog Treats Market by Distribution Channel, 2020 - 2023, USD Million

TABLE 32 Canada Natural Dog Treats Market by Distribution Channel, 2024 - 2031, USD Million

TABLE 33 Mexico Natural Dog Treats Market, 2020 - 2023, USD Million

TABLE 34 Mexico Natural Dog Treats Market, 2024 - 2031, USD Million

TABLE 35 Mexico Natural Dog Treats Market by Product, 2020 - 2023, USD Million

TABLE 36 Mexico Natural Dog Treats Market by Product, 2024 - 2031, USD Million

TABLE 37 Mexico Natural Dog Treats Market by Distribution Channel, 2020 - 2023, USD Million

TABLE 38 Mexico Natural Dog Treats Market by Distribution Channel, 2024 - 2031, USD Million

TABLE 39 Rest of North America Natural Dog Treats Market, 2020 - 2023, USD Million

TABLE 40 Rest of North America Natural Dog Treats Market, 2024 - 2031, USD Million

TABLE 41 Rest of North America Natural Dog Treats Market by Product, 2020 - 2023, USD Million

TABLE 42 Rest of North America Natural Dog Treats Market by Product, 2024 - 2031, USD Million

TABLE 43 Rest of North America Natural Dog Treats Market by Distribution Channel, 2020 - 2023, USD Million

TABLE 44 Rest of North America Natural Dog Treats Market by Distribution Channel, 2024 - 2031, USD Million

TABLE 45 Key Information – The J.M. Smucker Company

TABLE 46 Key Information – Off Leash Pet Treats

TABLE 47 Key Information – The Dog Chew Company

TABLE 48 key information – Mars, Inc.

TABLE 49 Key Information – Nestle S.A.

TABLE 50 Key Information – General Mills, Inc.

TABLE 51 Key Information – The Wellness Pet Company

TABLE 52 Key Information – Spectrum Brands Holdings, Inc.

TABLE 53 Key Information – The Colgate Palmolive Company

List of Figures

FIG 1 Methodology for the research

FIG 2 North America Natural Dog Treats Market, 2020 - 2031, USD Million

FIG 3 Key Factors Impacting Natural Dog Treats Market

FIG 4 Porter’s Five Forces Analysis – Natural Dog Treats Market

FIG 5 North America Natural Dog Treats Market share by Product, 2023

FIG 6 North America Natural Dog Treats Market share by Product, 2031

FIG 7 North America Natural Dog Treats Market by Product, 2020 - 2031, USD Million

FIG 8 North America Natural Dog Treats Market share by Distribution Channel, 2023

FIG 9 North America Natural Dog Treats Market share by Distribution Channel, 2031

FIG 10 North America Natural Dog Treats Market by Distribution Channel, 2020 - 2031, USD Million

FIG 11 North America Natural Dog Treats Market share by Country, 2023

FIG 12 North America Natural Dog Treats Market share by Country, 2031

FIG 13 North America Natural Dog Treats Market by Country, 2020 - 2031, USD Million

FIG 14 Swot Analysis: Mars, Inc.

FIG 15 SWOT Analysis: Nestle S.A.

FIG 16 Swot Analysis: General Mills, Inc.

FIG 17 SWOT Analysis: The Wellness Pet Company

FIG 18 SWOT Analysis: Spectrum Brands Holdings, Inc.

FIG 19 Swot Analysis: The Colgate-Palmolive Company