The North America Persulfates Market would witness market growth of 3.3% CAGR during the forecast period (2024-2031). In the year 2020, the North America market's volume surged to 366.06 hundred tonnes, showcasing a growth of 17.6% (2020-2023).

Ammonium persulfate is a powerful oxidizing agent commonly used in various industrial and scientific applications. It is a white, crystalline salt with the chemical formula (NH4)2S2O8. One of its primary uses is as an initiator for polymerization reactions, particularly in the production of acrylics, vinyl polymers, and elastomers. In the electronics industry, ammonium persulfate is utilized for etching copper-clad printed circuit boards (PCBs) as it effectively removes copper during the manufacturing process. Thus, the US market consumed 248.52 hundred tonnes of ammonium persulfate in 2023.

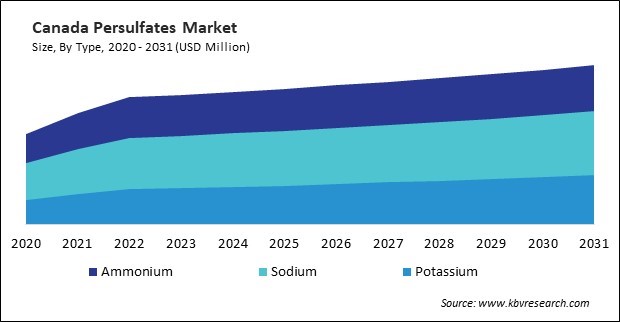

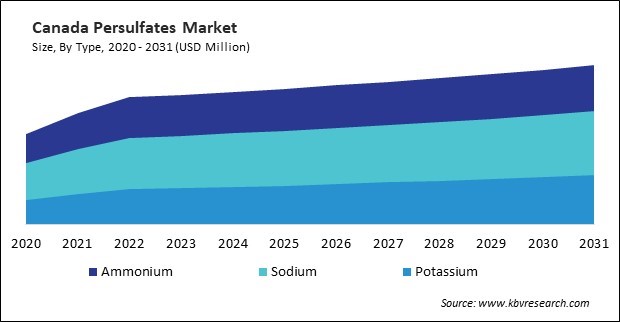

The US market dominated the North America Persulfates Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $167.7 million by 2031. The Canada market is experiencing a CAGR of 3.6% during (2024 - 2031). Additionally, The Mexico market would exhibit a CAGR of 4.3% during (2024 - 2031).

These chemicals are extensively used in water treatment processes to oxidize and degrade organic contaminants. These contaminants include volatile organic compounds (VOCs), chlorinated solvents, pesticides, and pharmaceuticals in industrial wastewater, groundwater, and surface water sources. These chemicals offer an effective solution for the remediation of contaminated sites and ensuring the safety and quality of water resources.

In the electronics industry, these chemicals are utilized as etchants to produce printed circuit boards (PCBs). Persulfate-based etchants effectively remove unwanted copper from PCB substrates, thereby defining circuit patterns and facilitating the manufacturing of electronic components with high precision and reliability.

According to the International Trade Administration (ITA), Mexico is one of the largest oil producers in the world (with 1.6 million barrels produced daily in 2022) and the fourth largest in the Americas after the United States, Canada, and Brazil. In 2022, Mexico ranked 13th globally in crude oil production, 21st in crude oil reserves, 16th in refined capacity, and fifth in logistics infrastructure. Moreover, according to the Government of Sri Lanka’s Apparel Industry in Canada & Market Opportunities report, in 2020, the apparel industry in Canada was valued at 23.85 billion Canadian dollars. Projections in this report indicate a growth to 28.53 billion Canadian dollars by the conclusion of 2024. Additionally, the revenue generated by the Canadian apparel industry reached 37.5 billion USD in 2022. Thus, the growing oil sector and increasing apparel industry in the region drive the market’s growth.

Free Valuable Insights: The Persulfates Market is Predict to reach USD 1.1 Billion by 2031, at a CAGR of 3.6%

Based on Type, the market is segmented into Ammonium, Sodium and Potassium. Based on End-use, the market is segmented into Polymers, Electronics, Oil & Gas, Pulp, Paper, & Textile, Water Treatment, and Others. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

`

List of Key Companies Profiled

- Evonik Industries AG (RAG-Stiftung)

- Calibre Chemicals Pvt. Ltd. (Everstone Capital Asia Pte. Ltd.)

- United Initiators GmbH (EQUISTONE PARTNERS EUROPE)

- Mitsubishi Gas Chemical Company, Inc.

- Fujian ZhanHua Chemical Co., Ltd

- Ak-kim Kimya Sanayi ve Ticaret A.Ş (Akkök Holding A.Ş)

- Yatai Electrochemistry Co., Ltd.

- ABC Chemicals(Shanghai)Co., Ltd.

- San Yuan Chemical Co., Ltd.

- Adeka Corporation

North America Persulfates Market Report Segmentation

By Type (Volume, Hundred Tonnes, USD Billion, 2020-31)

- Ammonium

- Sodium

- Potassium

By End-use (Volume, Hundred Tonnes, USD Billion, 2020-31)

- Polymers

- Electronics

- Oil & Gas

- Pulp, Paper, & Textile

- Water Treatment

- Others

By Country (Volume, Hundred Tonnes, USD Billion, 2020-31)

- US

- Canada

- Mexico

- Rest of North America

TABLE 1 North America Persulfates Market, 2020 - 2023, USD Million

TABLE 2 North America Persulfates Market, 2024 - 2031, USD Million

TABLE 3 North America Persulfates Market, 2020 - 2023, Hundred Tonnes

TABLE 4 North America Persulfates Market, 2024 - 2031, Hundred Tonnes

TABLE 5 North America Persulfates Market by Type, 2020 - 2023, USD Million

TABLE 6 North America Persulfates Market by Type, 2024 - 2031, USD Million

TABLE 7 North America Persulfates Market by Type, 2020 - 2023, Hundred Tonnes

TABLE 8 North America Persulfates Market by Type, 2024 - 2031, Hundred Tonnes

TABLE 9 North America Ammonium Market by Country, 2020 - 2023, USD Million

TABLE 10 North America Ammonium Market by Country, 2024 - 2031, USD Million

TABLE 11 North America Ammonium Market by Country, 2020 - 2023, Hundred Tonnes

TABLE 12 North America Ammonium Market by Country, 2024 - 2031, Hundred Tonnes

TABLE 13 North America Sodium Market by Country, 2020 - 2023, USD Million

TABLE 14 North America Sodium Market by Country, 2024 - 2031, USD Million

TABLE 15 North America Sodium Market by Country, 2020 - 2023, Hundred Tonnes

TABLE 16 North America Sodium Market by Country, 2024 - 2031, Hundred Tonnes

TABLE 17 North America Potassium Market by Country, 2020 - 2023, USD Million

TABLE 18 North America Potassium Market by Country, 2024 - 2031, USD Million

TABLE 19 North America Potassium Market by Country, 2020 - 2023, Hundred Tonnes

TABLE 20 North America Potassium Market by Country, 2024 - 2031, Hundred Tonnes

TABLE 21 North America Persulfates Market by End-use, 2020 - 2023, USD Million

TABLE 22 North America Persulfates Market by End-use, 2024 - 2031, USD Million

TABLE 23 North America Persulfates Market by End-use, 2020 - 2023, Hundred Tonnes

TABLE 24 North America Persulfates Market by End-use, 2024 - 2031, Hundred Tonnes

TABLE 25 North America Polymers Market by Country, 2020 - 2023, USD Million

TABLE 26 North America Polymers Market by Country, 2024 - 2031, USD Million

TABLE 27 North America Polymers Market by Country, 2020 - 2023, Hundred Tonnes

TABLE 28 North America Polymers Market by Country, 2024 - 2031, Hundred Tonnes

TABLE 29 North America Electronics Market by Country, 2020 - 2023, USD Million

TABLE 30 North America Electronics Market by Country, 2024 - 2031, USD Million

TABLE 31 North America Electronics Market by Country, 2020 - 2023, Hundred Tonnes

TABLE 32 North America Electronics Market by Country, 2024 - 2031, Hundred Tonnes

TABLE 33 North America Oil & Gas Market by Country, 2020 - 2023, USD Million

TABLE 34 North America Oil & Gas Market by Country, 2024 - 2031, USD Million

TABLE 35 North America Oil & Gas Market by Country, 2020 - 2023, Hundred Tonnes

TABLE 36 North America Oil & Gas Market by Country, 2024 - 2031, Hundred Tonnes

TABLE 37 North America Pulp, Paper, & Textile Market by Country, 2020 - 2023, USD Million

TABLE 38 North America Pulp, Paper, & Textile Market by Country, 2024 - 2031, USD Million

TABLE 39 North America Pulp, Paper, & Textile Market by Country, 2020 - 2023, Hundred Tonnes

TABLE 40 North America Pulp, Paper, & Textile Market by Country, 2024 - 2031, Hundred Tonnes

TABLE 41 North America Water Treatment Market by Country, 2020 - 2023, USD Million

TABLE 42 North America Water Treatment Market by Country, 2024 - 2031, USD Million

TABLE 43 North America Water Treatment Market by Country, 2020 - 2023, Hundred Tonnes

TABLE 44 North America Water Treatment Market by Country, 2024 - 2031, Hundred Tonnes

TABLE 45 North America Others Market by Country, 2020 - 2023, USD Million

TABLE 46 North America Others Market by Country, 2024 - 2031, USD Million

TABLE 47 North America Others Market by Country, 2020 - 2023, Hundred Tonnes

TABLE 48 North America Others Market by Country, 2024 - 2031, Hundred Tonnes

TABLE 49 North America Persulfates Market by Country, 2020 - 2023, USD Million

TABLE 50 North America Persulfates Market by Country, 2024 - 2031, USD Million

TABLE 51 North America Persulfates Market by Country, 2020 - 2023, Hundred Tonnes

TABLE 52 North America Persulfates Market by Country, 2024 - 2031, Hundred Tonnes

TABLE 53 US Persulfates Market, 2020 - 2023, USD Million

TABLE 54 US Persulfates Market, 2024 - 2031, USD Million

TABLE 55 US Persulfates Market, 2020 - 2023, Hundred Tonnes

TABLE 56 US Persulfates Market, 2024 - 2031, Hundred Tonnes

TABLE 57 US Persulfates Market by Type, 2020 - 2023, USD Million

TABLE 58 US Persulfates Market by Type, 2024 - 2031, USD Million

TABLE 59 US Persulfates Market by Type, 2020 - 2023, Hundred Tonnes

TABLE 60 US Persulfates Market by Type, 2024 - 2031, Hundred Tonnes

TABLE 61 US Persulfates Market by End-use, 2020 - 2023, USD Million

TABLE 62 US Persulfates Market by End-use, 2024 - 2031, USD Million

TABLE 63 US Persulfates Market by End-use, 2020 - 2023, Hundred Tonnes

TABLE 64 US Persulfates Market by End-use, 2024 - 2031, Hundred Tonnes

TABLE 65 Canada Persulfates Market, 2020 - 2023, USD Million

TABLE 66 Canada Persulfates Market, 2024 - 2031, USD Million

TABLE 67 Canada Persulfates Market, 2020 - 2023, Hundred Tonnes

TABLE 68 Canada Persulfates Market, 2024 - 2031, Hundred Tonnes

TABLE 69 Canada Persulfates Market by Type, 2020 - 2023, USD Million

TABLE 70 Canada Persulfates Market by Type, 2024 - 2031, USD Million

TABLE 71 Canada Persulfates Market by Type, 2020 - 2023, Hundred Tonnes

TABLE 72 Canada Persulfates Market by Type, 2024 - 2031, Hundred Tonnes

TABLE 73 Canada Persulfates Market by End-use, 2020 - 2023, USD Million

TABLE 74 Canada Persulfates Market by End-use, 2024 - 2031, USD Million

TABLE 75 Canada Persulfates Market by End-use, 2020 - 2023, Hundred Tonnes

TABLE 76 Canada Persulfates Market by End-use, 2024 - 2031, Hundred Tonnes

TABLE 77 Mexico Persulfates Market, 2020 - 2023, USD Million

TABLE 78 Mexico Persulfates Market, 2024 - 2031, USD Million

TABLE 79 Mexico Persulfates Market, 2020 - 2023, Hundred Tonnes

TABLE 80 Mexico Persulfates Market, 2024 - 2031, Hundred Tonnes

TABLE 81 Mexico Persulfates Market by Type, 2020 - 2023, USD Million

TABLE 82 Mexico Persulfates Market by Type, 2024 - 2031, USD Million

TABLE 83 Mexico Persulfates Market by Type, 2020 - 2023, Hundred Tonnes

TABLE 84 Mexico Persulfates Market by Type, 2024 - 2031, Hundred Tonnes

TABLE 85 Mexico Persulfates Market by End-use, 2020 - 2023, USD Million

TABLE 86 Mexico Persulfates Market by End-use, 2024 - 2031, USD Million

TABLE 87 Mexico Persulfates Market by End-use, 2020 - 2023, Hundred Tonnes

TABLE 88 Mexico Persulfates Market by End-use, 2024 - 2031, Hundred Tonnes

TABLE 89 Rest of North America Persulfates Market, 2020 - 2023, USD Million

TABLE 90 Rest of North America Persulfates Market, 2024 - 2031, USD Million

TABLE 91 Rest of North America Persulfates Market, 2020 - 2023, Hundred Tonnes

TABLE 92 Rest of North America Persulfates Market, 2024 - 2031, Hundred Tonnes

TABLE 93 Rest of North America Persulfates Market by Type, 2020 - 2023, USD Million

TABLE 94 Rest of North America Persulfates Market by Type, 2024 - 2031, USD Million

TABLE 95 Rest of North America Persulfates Market by Type, 2020 - 2023, Hundred Tonnes

TABLE 96 Rest of North America Persulfates Market by Type, 2024 - 2031, Hundred Tonnes

TABLE 97 Rest of North America Persulfates Market by End-use, 2020 - 2023, USD Million

TABLE 98 Rest of North America Persulfates Market by End-use, 2024 - 2031, USD Million

TABLE 99 Rest of North America Persulfates Market by End-use, 2020 - 2023, Hundred Tonnes

TABLE 100 Rest of North America Persulfates Market by End-use, 2024 - 2031, Hundred Tonnes

TABLE 101 Key Information – Calibre Chemicals Pvt. Ltd.

TABLE 102 Key Information – United Initiators GmbH

TABLE 103 Key Information – Fujian ZhanHua Chemical Co., Ltd

TABLE 104 Key Information – Ak-kim Kimya Sanayi ve Ticaret A.Ş

TABLE 105 Key Information – Yatai Electrochemistry Co., Ltd.

TABLE 106 Key Information – ABC Chemicals (Shanghai)Co., Ltd.

TABLE 107 Key Information – ADEKA Corporation

TABLE 108 Key Information – San Yuan Chemical Co., Ltd.

TABLE 109 Key Information – Evonik Industries AG

TABLE 110 Key Information – Mitsubishi Gas Chemical Company, Inc.

List of Figures

FIG 1 Methodology for the research

FIG 2 North America Persulfates Market, 2020 - 2031, USD Million

FIG 3 Key Factors Impacting Persulfates Market

FIG 4 Porter’s Five Forces Analysis – Persulfates Market

FIG 5 North America Persulfates Market share by Type, 2023

FIG 6 North America Persulfates Market share by Type, 2031

FIG 7 North America Persulfates Market by Type, 2020 - 2031, USD Million

FIG 8 North America Persulfates Market share by End-use, 2023

FIG 9 North America Persulfates Market share by End-use, 2031

FIG 10 North America Persulfates Market by End-use, 2020 - 2031, USD Million

FIG 11 North America Persulfates Market share by Country, 2023

FIG 12 North America Persulfates Market share by Country, 2031

FIG 13 North America Persulfates Market by Country, 2020 - 2031, USD Million

FIG 14 SWOT Analysis: Evonik Industries AG

FIG 15 SWOT Analysis: MITSUBISHI GAS CHEMICAL COMPANY, INC.