North America Pour Point Depressant Market Size, Share & Trends Analysis Report By Product (Ethylene Co Vinyl Acetate, Poly Alkyl Methacrylates, Styrene Esters, and Poly Alpha Olefin), By End-use, By Country and Growth Forecast, 2024 - 2031

Published Date : 25-Apr-2024 |

Pages: 121 |

Formats: PDF |

COVID-19 Impact on the North America Pour Point Depressant Market

The North America Pour Point Depressant Market would witness market growth of 3.8% CAGR during the forecast period (2024-2031). In the year 2020, the North America market's volume surged to 1,328.08 hundred tonnes, showcasing a growth of 18.7% (2020-2023).

Ethylene-co-vinyl acetate (EVA) is a significant by-product in the pour point depressant market, playing a crucial role in enhancing the functionality and performance of various industrial fluids, particularly in cold weather conditions. As a copolymer of ethylene and vinyl acetate, EVA exhibits exceptional compatibility with a wide range of base fluids, including lubricants, hydraulic fluids, and diesel fuels. Its incorporation as a pour point depressant effectively lowers the crystallization temperature of these fluids, preventing wax or paraffin buildup and ensuring fluidity at lower temperatures. Therefore, the USA market consumed 794.72 hundred tonnes of Ethylene-co-vinyl acetate in 2023.

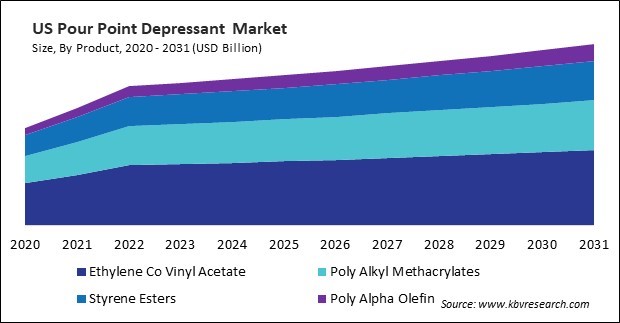

The US market dominated the North America Pour Point Depressant Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $565.5 Million by 2031. The Canada market is experiencing a CAGR of 5.8% during (2024 - 2031). Additionally, The Mexico market would exhibit a CAGR of 5.3% during (2024 - 2031).

PPD find widespread applications across various sectors of the petroleum industry due to their ability to improve the flow properties of petroleum fluids in cold weather conditions. For example, these depressants are used in oil production operations to prevent wax deposition and flow restrictions in wellbores, production tubing, and surface facilities. By maintaining the fluidity of crude oil at low temperatures, these depressants enable uninterrupted production and transportation of crude oil from reservoirs to processing facilities.

These depressants are added to gasoline, diesel, and aviation fuel to improve their cold flow properties and prevent wax buildup in fuel lines, filters, and fuel injectors. By ensuring the smooth flow of transportation fuels in cold weather conditions, these depressants enhance engine performance, reduce fuel consumption, and minimize the risk of fuel system failures in automotive, marine, and aerospace applications.

With the expansion of the aerospace industry, there will be a rise in the number of aircraft in Canada's fleet, including commercial airliners, cargo planes, helicopters, and military aircraft. As per the data from the Government of Canada, with a total budget of $250 million over three years (until March 31, 2024), the Aerospace Regional Recovery Initiative (ARRI) was delivered by Canada's regional development agencies (RDAs). It complemented support for the aerospace industry provided through Canada's COVID-19 Economic Response Plan and by Industry, Science and Economic Development (ISED) through the Strategic Innovation Fund. Likewise, with increasing oil production comes a higher demand for oilfield chemicals, including these depressants. As Mexico ramps up its oil production, there is a corresponding increase in the demand for these depressants to ensure the efficient extraction, transportation, and processing of crude oil. According to the International Trade Administration (ITA), Mexico ranked 13th in the world in 2022 for crude oil output, 21st in reserves, 16th in terms of capacity for refined oil, and sixth in logistics infrastructure. Hence, increasing investments in the aerospace sector and high oil production in the region are propelling the market's growth.

Free Valuable Insights: The Pour Point Depressant Market is Predict to reach USD 2.8 Billion by 2031, at a CAGR of 4.3%

Based on Product, the market is segmented into Ethylene Co Vinyl Acetate, Poly Alkyl Methacrylates, Styrene Esters, and Poly Alpha Olefin. Based on End-use, the market is segmented into Oil & Gas, Automotive, Aerospace, Marine, and Others. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- Clariant AG

- Lubrizol Corporation (Berkshire Hathaway, Inc.)

- Evonik Industries AG (RAG-Stiftung)

- Ecolab, Inc

- Sanyo Chemical Industries, Ltd

- Infineum International Limited.

- Shenyang Great Wall Lubricant Manufacturing Co., Ltd

- Puyang Jiahua Chemical Co., Ltd

- Innospec Inc

- Akzo Nobel N.V.

North America Pour Point Depressant Market Report Segmentation

By Product (Volume, Hundred Tonnes, USD Billion, 2020-31)

- Ethylene Co Vinyl Acetate

- Poly Alkyl Methacrylates

- Styrene Esters

- Poly Alpha Olefin

By End-use (Volume, Hundred Tonnes, USD Billion, 2020-31)

- Oil & Gas

- Automotive

- Aerospace

- Marine

- Others

By Country (Volume, Hundred Tonnes, USD Billion, 2020-31)

- US

- Canada

- Mexico

- Rest of North America

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 North America Pour Point Depressant Market, by Product

1.4.2 North America Pour Point Depressant Market, by End-use

1.4.3 North America Pour Point Depressant Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

3.3 Porter’s Five Forces Analysis

Chapter 4. North America Pour Point Depressant Market by Product

4.1 North America Ethylene Co Vinyl Acetate Market by Country

4.2 North America Poly Alkyl Methacrylates Market by Country

4.3 North America Styrene Esters Market by Country

4.4 North America Poly Alpha Olefin Market by Country

Chapter 5. North America Pour Point Depressant Market by End-use

5.1 North America Oil & Gas Market by Country

5.2 North America Automotive Market by Country

5.3 North America Aerospace Market by Country

5.4 North America Marine Market by Country

5.5 North America Others Market by Country

Chapter 6. North America Pour Point Depressant Market by Country

6.1 US Pour Point Depressant Market

6.1.1 US Pour Point Depressant Market by Product

6.1.2 US Pour Point Depressant Market by End-use

6.2 Canada Pour Point Depressant Market

6.2.1 Canada Pour Point Depressant Market by Product

6.2.2 Canada Pour Point Depressant Market by End-use

6.3 Mexico Pour Point Depressant Market

6.3.1 Mexico Pour Point Depressant Market by Product

6.3.2 Mexico Pour Point Depressant Market by End-use

6.4 Rest of North America Pour Point Depressant Market

6.4.1 Rest of North America Pour Point Depressant Market by Product

6.4.2 Rest of North America Pour Point Depressant Market by End-use

Chapter 7. Company Profiles

7.1 Clariant AG

7.1.1 Company Overview

7.1.2 Financial Analysis

7.1.3 Segmental and Regional Analysis

7.1.4 Research & Development Expenses

7.1.5 SWOT Analysis

7.2 Lubrizol Corporation (Berkshire Hathaway, Inc.)

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Segmental and Regional Analysis

7.2.4 SWOT Analysis

7.3 Evonik Industries AG (RAG-Stiftung)

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Segmental and Regional Analysis

7.3.4 Research & Development Expenses

7.3.5 SWOT Analysis

7.4 Ecolab, Inc.

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Segmental and Regional Analysis

7.4.4 Research & Development Expenses

7.4.5 SWOT Analysis

7.5 Sanyo Chemical Industries, Ltd.

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Segmental and Regional Analysis

7.5.4 Research & Development Expenses

7.5.5 SWOT Analysis

7.6 Infineum International Limited.

7.6.1 Company Overview

7.6.2 Recent strategies and developments:

7.6.2.1 Partnerships, Collaborations, and Agreements:

7.6.2.2 Product Launches and Product Expansions:

7.6.3 SWOT Analysis

7.7 Shenyang Great Wall Lubricant Manufacturing Co., Ltd.

7.7.1 Company Overview

7.7.2 SWOT Analysis

7.8 Puyang Jiahua Chemical Co., Ltd

7.8.1 Company Overview

7.8.2 SWOT Analysis

7.9 Innospec Inc.

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Segmental and Regional Analysis

7.9.4 Research & Development Expenses

7.9.5 SWOT Analysis

7.10. Akzo Nobel N.V.

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Segmental and Regional Analysis

7.10.4 Research & Development Expenses

7.10.5 SWOT Analysis

TABLE 2 North America Pour Point Depressant Market, 2024 - 2031, USD Million

TABLE 3 North America Pour Point Depressant Market, 2020 - 2023, Hundred Tonnes

TABLE 4 North America Pour Point Depressant Market, 2024 - 2031, Hundred Tonnes

TABLE 5 North America Pour Point Depressant Market by Product, 2020 - 2023, USD Million

TABLE 6 North America Pour Point Depressant Market by Product, 2024 - 2031, USD Million

TABLE 7 North America Pour Point Depressant Market by Product, 2020 - 2023, Hundred Tonnes

TABLE 8 North America Pour Point Depressant Market by Product, 2024 - 2031, Hundred Tonnes

TABLE 9 North America Ethylene Co Vinyl Acetate Market by Country, 2020 - 2023, USD Million

TABLE 10 North America Ethylene Co Vinyl Acetate Market by Country, 2024 - 2031, USD Million

TABLE 11 North America Ethylene Co Vinyl Acetate Market by Country, 2020 - 2023, Hundred Tonnes

TABLE 12 North America Ethylene Co Vinyl Acetate Market by Country, 2024 - 2031, Hundred Tonnes

TABLE 13 North America Poly Alkyl Methacrylates Market by Country, 2020 - 2023, USD Million

TABLE 14 North America Poly Alkyl Methacrylates Market by Country, 2024 - 2031, USD Million

TABLE 15 North America Poly Alkyl Methacrylates Market by Country, 2020 - 2023, Hundred Tonnes

TABLE 16 North America Poly Alkyl Methacrylates Market by Country, 2024 - 2031, Hundred Tonnes

TABLE 17 North America Styrene Esters Market by Country, 2020 - 2023, USD Million

TABLE 18 North America Styrene Esters Market by Country, 2024 - 2031, USD Million

TABLE 19 North America Styrene Esters Market by Country, 2020 - 2023, Hundred Tonnes

TABLE 20 North America Styrene Esters Market by Country, 2024 - 2031, Hundred Tonnes

TABLE 21 North America Poly Alpha Olefin Market by Country, 2020 - 2023, USD Million

TABLE 22 North America Poly Alpha Olefin Market by Country, 2024 - 2031, USD Million

TABLE 23 North America Poly Alpha Olefin Market by Country, 2020 - 2023, Hundred Tonnes

TABLE 24 North America Poly Alpha Olefin Market by Country, 2024 - 2031, Hundred Tonnes

TABLE 25 North America Pour Point Depressant Market by End-use, 2020 - 2023, USD Million

TABLE 26 North America Pour Point Depressant Market by End-use, 2024 - 2031, USD Million

TABLE 27 North America Pour Point Depressant Market by End-use, 2020 - 2023, Hundred Tonnes

TABLE 28 North America Pour Point Depressant Market by End-use, 2024 - 2031, Hundred Tonnes

TABLE 29 North America Oil & Gas Market by Country, 2020 - 2023, USD Million

TABLE 30 North America Oil & Gas Market by Country, 2024 - 2031, USD Million

TABLE 31 North America Oil & Gas Market by Country, 2020 - 2023, Hundred Tonnes

TABLE 32 North America Oil & Gas Market by Country, 2024 - 2031, Hundred Tonnes

TABLE 33 North America Automotive Market by Country, 2020 - 2023, USD Million

TABLE 34 North America Automotive Market by Country, 2024 - 2031, USD Million

TABLE 35 North America Automotive Market by Country, 2020 - 2023, Hundred Tonnes

TABLE 36 North America Automotive Market by Country, 2024 - 2031, Hundred Tonnes

TABLE 37 North America Aerospace Market by Country, 2020 - 2023, USD Million

TABLE 38 North America Aerospace Market by Country, 2024 - 2031, USD Million

TABLE 39 North America Aerospace Market by Country, 2020 - 2023, Hundred Tonnes

TABLE 40 North America Aerospace Market by Country, 2024 - 2031, Hundred Tonnes

TABLE 41 North America Marine Market by Country, 2020 - 2023, USD Million

TABLE 42 North America Marine Market by Country, 2024 - 2031, USD Million

TABLE 43 North America Marine Market by Country, 2020 - 2023, Hundred Tonnes

TABLE 44 North America Marine Market by Country, 2024 - 2031, Hundred Tonnes

TABLE 45 North America Others Market by Country, 2020 - 2023, USD Million

TABLE 46 North America Others Market by Country, 2024 - 2031, USD Million

TABLE 47 North America Others Market by Country, 2020 - 2023, Hundred Tonnes

TABLE 48 North America Others Market by Country, 2024 - 2031, Hundred Tonnes

TABLE 49 North America Pour Point Depressant Market by Country, 2020 - 2023, USD Million

TABLE 50 North America Pour Point Depressant Market by Country, 2024 - 2031, USD Million

TABLE 51 North America Pour Point Depressant Market by Country, 2020 - 2023, Hundred Tonnes

TABLE 52 North America Pour Point Depressant Market by Country, 2024 - 2031, Hundred Tonnes

TABLE 53 US Pour Point Depressant Market, 2020 - 2023, USD Million

TABLE 54 US Pour Point Depressant Market, 2024 - 2031, USD Million

TABLE 55 US Pour Point Depressant Market, 2020 - 2023, Hundred Tonnes

TABLE 56 US Pour Point Depressant Market, 2024 - 2031, Hundred Tonnes

TABLE 57 US Pour Point Depressant Market by Product, 2020 - 2023, USD Million

TABLE 58 US Pour Point Depressant Market by Product, 2024 - 2031, USD Million

TABLE 59 US Pour Point Depressant Market by Product, 2020 - 2023, Hundred Tonnes

TABLE 60 US Pour Point Depressant Market by Product, 2024 - 2031, Hundred Tonnes

TABLE 61 US Pour Point Depressant Market by End-use, 2020 - 2023, USD Million

TABLE 62 US Pour Point Depressant Market by End-use, 2024 - 2031, USD Million

TABLE 63 US Pour Point Depressant Market by End-use, 2020 - 2023, Hundred Tonnes

TABLE 64 US Pour Point Depressant Market by End-use, 2024 - 2031, Hundred Tonnes

TABLE 65 Canada Pour Point Depressant Market, 2020 - 2023, USD Million

TABLE 66 Canada Pour Point Depressant Market, 2024 - 2031, USD Million

TABLE 67 Canada Pour Point Depressant Market, 2020 - 2023, Hundred Tonnes

TABLE 68 Canada Pour Point Depressant Market, 2024 - 2031, Hundred Tonnes

TABLE 69 Canada Pour Point Depressant Market by Product, 2020 - 2023, USD Million

TABLE 70 Canada Pour Point Depressant Market by Product, 2024 - 2031, USD Million

TABLE 71 Canada Pour Point Depressant Market by Product, 2020 - 2023, Hundred Tonnes

TABLE 72 Canada Pour Point Depressant Market by Product, 2024 - 2031, Hundred Tonnes

TABLE 73 Canada Pour Point Depressant Market by End-use, 2020 - 2023, USD Million

TABLE 74 Canada Pour Point Depressant Market by End-use, 2024 - 2031, USD Million

TABLE 75 Canada Pour Point Depressant Market by End-use, 2020 - 2023, Hundred Tonnes

TABLE 76 Canada Pour Point Depressant Market by End-use, 2024 - 2031, Hundred Tonnes

TABLE 77 Mexico Pour Point Depressant Market, 2020 - 2023, USD Million

TABLE 78 Mexico Pour Point Depressant Market, 2024 - 2031, USD Million

TABLE 79 Mexico Pour Point Depressant Market, 2020 - 2023, Hundred Tonnes

TABLE 80 Mexico Pour Point Depressant Market, 2024 - 2031, Hundred Tonnes

TABLE 81 Mexico Pour Point Depressant Market by Product, 2020 - 2023, USD Million

TABLE 82 Mexico Pour Point Depressant Market by Product, 2024 - 2031, USD Million

TABLE 83 Mexico Pour Point Depressant Market by Product, 2020 - 2023, Hundred Tonnes

TABLE 84 Mexico Pour Point Depressant Market by Product, 2024 - 2031, Hundred Tonnes

TABLE 85 Mexico Pour Point Depressant Market by End-use, 2020 - 2023, USD Million

TABLE 86 Mexico Pour Point Depressant Market by End-use, 2024 - 2031, USD Million

TABLE 87 Mexico Pour Point Depressant Market by End-use, 2020 - 2023, Hundred Tonnes

TABLE 88 Mexico Pour Point Depressant Market by End-use, 2024 - 2031, Hundred Tonnes

TABLE 89 Rest of North America Pour Point Depressant Market, 2020 - 2023, USD Million

TABLE 90 Rest of North America Pour Point Depressant Market, 2024 - 2031, USD Million

TABLE 91 Rest of North America Pour Point Depressant Market, 2020 - 2023, Hundred Tonnes

TABLE 92 Rest of North America Pour Point Depressant Market, 2024 - 2031, Hundred Tonnes

TABLE 93 Rest of North America Pour Point Depressant Market by Product, 2020 - 2023, USD Million

TABLE 94 Rest of North America Pour Point Depressant Market by Product, 2024 - 2031, USD Million

TABLE 95 Rest of North America Pour Point Depressant Market by Product, 2020 - 2023, Hundred Tonnes

TABLE 96 Rest of North America Pour Point Depressant Market by Product, 2024 - 2031, Hundred Tonnes

TABLE 97 Rest of North America Pour Point Depressant Market by End-use, 2020 - 2023, USD Million

TABLE 98 Rest of North America Pour Point Depressant Market by End-use, 2024 - 2031, USD Million

TABLE 99 Rest of North America Pour Point Depressant Market by End-use, 2020 - 2023, Hundred Tonnes

TABLE 100 Rest of North America Pour Point Depressant Market by End-use, 2024 - 2031, Hundred Tonnes

TABLE 101 Key Information – Clariant AG

TABLE 102 Key Information – Lubrizol Corporation

TABLE 103 Key Information – Evonik Industries AG

TABLE 104 Key Information – Ecolab, Inc.

TABLE 105 Key Information – Sanyo Chemical Industries, Ltd.

TABLE 106 Key Information – Infineum International Limited.

TABLE 107 Key Information – Shenyang Great Wall Lubricant Manufacturing Co., Ltd.

TABLE 108 Key Information – Puyang Jiahua Chemical Co., Ltd

TABLE 109 Key Information – Innospec Inc.

TABLE 110 Key Information – Akzo Nobel N.V.

List of Figures

FIG 1 Methodology for the research

FIG 2 North America Pour Point Depressant Market, 2020 - 2031, USD Million

FIG 3 Key Factors Impacting Pour Point Depressant Market

FIG 4 Porter’s Five Forces Analysis - Pour Point Depressant Market

FIG 5 North America Pour Point Depressant Market share by Product, 2023

FIG 6 North America Pour Point Depressant Market share by Product, 2031

FIG 7 North America Pour Point Depressant Market by Product, 2020 - 2031, USD Million

FIG 8 North America Pour Point Depressant Market share by End-use, 2023

FIG 9 North America Pour Point Depressant Market share by End-use, 2031

FIG 10 North America Pour Point Depressant Market by End-use, 2020 - 2031, USD Million

FIG 11 North America Pour Point Depressant Market share by Country, 2023

FIG 12 North America Pour Point Depressant Market share by Country, 2031

FIG 13 North America Pour Point Depressant Market by Country, 2020 - 2031, USD Million

FIG 14 SWOT Analysis: Clariant AG

FIG 15 SWOT Analysis: Lubrizol Corporation

FIG 16 SWOT Analysis: Evonik Industries AG

FIG 17 SWOT Analysis: Ecolab, Inc.

FIG 18 SWOT Analysis: Sanyo Chemical Industries, Ltd.

FIG 19 Recent strategies and developments: Infineum International Limited

FIG 20 SWOT Analysis: Infineum International Limited

FIG 21 SWOT Analysis: Shenyang Great Wall Lubricant Manufacturing Co., Ltd.

FIG 22 SWOT Analysis: Puyang Jiahua Chemical Co., Ltd

FIG 23 SWOT Analysis: Innospec Inc.

FIG 24 SWOT Analysis: Akzo Nobel N.V.