North America Ready to Drink Shakes Market Size, Share & Trends Analysis Report By Type (Bottles, Cans, and Tetra Packs), By Distribution Channel (Supermarkets, & Hypermarkets, Convenience Stores and Online), By Country and Growth Forecast, 2023 - 2030

Published Date : 18-Mar-2024 |

Pages: 123 |

Formats: PDF |

COVID-19 Impact on the North America Ready to Drink Shakes Market

The North America Ready to Drink Shakes Market would witness market growth of 5.5% CAGR during the forecast period (2023-2030). In the year 2019, the North America market's volume surged to 407.1 million units (200ml-pack of 6), showcasing a growth of 6.2% (2019-2022).

Bottles offer ample surface area for branding and product information, enabling effective marketing communication and brand differentiation on crowded retail shelves. As a result, bottles are positioned as a preferred packaging type in the ready-to-drink shakes market, driving convenience, sustainability, and consumer engagement simultaneously. Therefore, the Mexico market consumed 16.6 million units (200 ml – pack of 6) bottles in 2022.

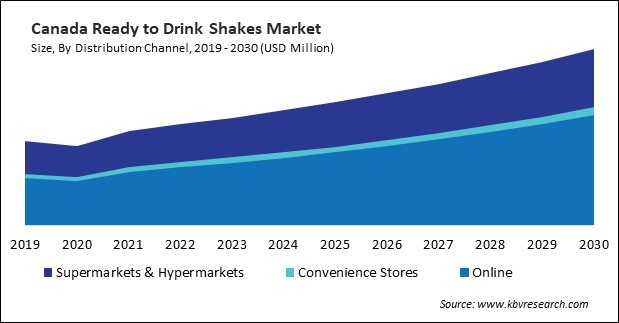

The US market dominated the North America Ready to Drink Shakes Market by Country in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $3,624.9 Million by 2030. The Canada market is experiencing a CAGR of 7.9% during (2023 - 2030). Additionally, The Mexico market would exhibit a CAGR of 6.9% during (2023 - 2030).

The healthcare sector has embraced the application of RTD Shakes as medical nutrition. These shakes find utility when individuals face challenges in traditional food consumption due to medical conditions or recovery from surgeries or as supplements for nutritional support. They cater to the demand for quick, convenient, and nutritious options for those who may skip traditional breakfast or need a mid-morning pick-me-up.

Furthermore, the applications of RTD Shakes are further diversified by exploring flavor profiles and culinary innovation. Companies in the market continually introduce new and exotic flavors, drawing inspiration from different cuisines. This culinary exploration enhances the sensory experience, making RTD Shakes not just a functional beverage but a delightful treat.

The U.S. has seen a significant rise in the fitness and wellness culture, with more individuals engaging in regular exercise and adopting healthier lifestyles. As fitness becomes a mainstream focus, there is a growing demand for convenient and nutritious solutions to support workout routines. Thus, the rising fitness trends and e-commerce sector in North America will boost the demand for ready to drink shakes in the region.

Free Valuable Insights: The Ready to Drink Shakes Market is Predict to reach USD 15.9 Billion by 2030, at a CAGR of 6.1%

Based on Type, the market is segmented into Bottles, Cans, and Tetra Packs. Based on Distribution Channel, the market is segmented into Supermarkets, & Hypermarkets, Convenience Stores and Online. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- Abbott Laboratories

- Kellogg Company

- The Coca Cola Company

- PepsiCo, Inc.

- Nestle S.A.

- Hormel Foods Corporation (MegaMex Foods, LLC)

- Danone S.A.

- Campbell Soup Company

- KeHE Distributors, LLC

- Huel GmbH

North America Ready to Drink Shakes Market Report Segmentation

By Type (Volume, Million Units (200ml-pack of 6), USD Billion, 2019-2030)

- Bottles

- Cans

- Tetra Packs

By Distribution Channel (Volume, Million Units (200ml-pack of 6), USD Billion, 2019-2030)

- Supermarkets & Hypermarkets

- Convenience Stores

- Online

By Country (Volume, Million Units (200ml-pack of 6), USD Billion, 2019-2030)

- US

- Canada

- Mexico

- Rest of North America

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 North America Ready to Drink Shakes Market, by Type

1.4.2 North America Ready to Drink Shakes Market, by Distribution Channel

1.4.3 North America Ready to Drink Shakes Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Competition Analysis - Global

4.1 KBV Cardinal Matrix

4.2 Recent Industry Wide Strategic Developments

4.2.1 Partnerships, Collaborations and Agreements

4.2.2 Product Launches and Product Expansions

4.2.3 Acquisition and Mergers

4.3 Top Winning Strategies

4.3.1 Key Leading Strategies: Percentage Distribution (2019-2023)

4.3.2 Key Strategic Move: (Product Launches and Product Expansions : 2019, Jan – 2024, Jan) Leading Players

4.4 Porter’s Five Forces Analysis

Chapter 5. North America Ready to Drink Shakes Market by Type

5.1 North America Bottles Market by Country

5.2 North America Cans Market by Country

5.3 North America Tetra Packs Market by Country

Chapter 6. North America Ready to Drink Shakes Market by Distribution Channel

6.1 North America Supermarkets & Hypermarkets Market by Country

6.2 North America Convenience Stores Market by Country

6.3 North America Online Market by Country

Chapter 7. North America Ready to Drink Shakes Market by Country

7.1 US Ready to Drink Shakes Market

7.1.1 US Ready to Drink Shakes Market by Type

7.1.2 US Ready to Drink Shakes Market by Distribution Channel

7.2 Canada Ready to Drink Shakes Market

7.2.1 Canada Ready to Drink Shakes Market by Type

7.2.2 Canada Ready to Drink Shakes Market by Distribution Channel

7.3 Mexico Ready to Drink Shakes Market

7.3.1 Mexico Ready to Drink Shakes Market by Type

7.3.2 Mexico Ready to Drink Shakes Market by Distribution Channel

7.4 Rest of North America Ready to Drink Shakes Market

7.4.1 Rest of North America Ready to Drink Shakes Market by Type

7.4.2 Rest of North America Ready to Drink Shakes Market by Distribution Channel

Chapter 8. Company Profiles

8.1 Abbott Laboratories

8.1.1 Company Overview

8.1.2 Financial Analysis

8.1.3 Segmental and Regional Analysis

8.1.4 Research & Development Expense

8.1.5 Recent strategies and developments:

8.1.5.1 Product Launches and Product Expansions:

8.1.6 SWOT Analysis

8.2 Kellogg Company

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Segmental and Regional Analysis

8.2.4 Research & Development Expense

8.2.5 Recent strategies and developments:

8.2.5.1 Partnerships, Collaborations, and Agreements:

8.2.6 SWOT Analysis

8.3 The Coca Cola Company

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Segmental and Regional Analysis

8.3.4 Recent strategies and developments:

8.3.4.1 Partnerships, Collaborations, and Agreements:

8.3.4.2 Product Launches and Product Expansions:

8.3.4.3 Acquisition and Mergers:

8.3.5 SWOT Analysis

8.4 PepsiCo, Inc.

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Segmental and Regional Analysis

8.4.4 Research & Development Expense

8.4.5 Recent strategies and developments:

8.4.5.1 Product Launches and Product Expansions:

8.4.5.2 Acquisition and Mergers:

8.4.6 SWOT Analysis

8.5 Nestle S.A

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Segmental and Regional Analysis

8.5.4 Research & Development Expenses

8.5.5 Recent strategies and developments:

8.5.5.1 Partnerships, Collaborations, and Agreements:

8.5.6 SWOT Analysis

8.6 Hormel Foods Corporation (MegaMex Foods, LLC)

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Segmental and Regional Analysis

8.6.4 Research & Development Expenses

8.6.5 SWOT Analysis

8.7 Danone S.A.

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Category and Regional Analysis

8.7.4 Recent strategies and developments:

8.7.4.1 Product Launches and Product Expansions:

8.7.5 SWOT Analysis

8.8 Campbell Soup Company

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Segmental Analysis

8.8.4 Research & Development Expenses

8.8.5 SWOT Analysis

8.9 KeHE Distributors, LLC

8.9.1 Company Overview

8.9.2 SWOT Analysis

8.10. Huel Limited

8.10.1 Company Overview

8.10.2 Recent strategies and developments:

8.10.2.1 Product Launches and Product Expansions:

8.10.3 SWOT Analysis

TABLE 2 North America Ready to Drink Shakes Market, 2023 - 2030, USD Million

TABLE 3 North America Ready to Drink Shakes Market, 2019 - 2022, Million Units (200 ml - pack of 6)

TABLE 4 North America Ready to Drink Shakes Market, 2023 - 2030, Million Units (200 ml - pack of 6)

TABLE 5 Partnerships, Collaborations and Agreements– Ready to Drink Shakes Market

TABLE 6 Product Launches And Product Expansions– Ready to Drink Shakes Market

TABLE 7 Acquisition and Mergers– Ready to Drink Shakes Market

TABLE 8 North America Ready to Drink Shakes Market by Type, 2019 - 2022, USD Million

TABLE 9 North America Ready to Drink Shakes Market by Type, 2023 - 2030, USD Million

TABLE 10 North America Ready to Drink Shakes Market by Type, 2019 - 2022, Million Units (200 ml - pack of 6)

TABLE 11 North America Ready to Drink Shakes Market by Type, 2023 - 2030, Million Units (200 ml - pack of 6)

TABLE 12 North America Bottles Market by Country, 2019 - 2022, USD Million

TABLE 13 North America Bottles Market by Country, 2023 - 2030, USD Million

TABLE 14 North America Bottles (200 ml - pack of 6) Market by Country, 2019 - 2022, Million Units (200 ml - pack of 6)

TABLE 15 North America Bottles (200 ml - pack of 6) Market by Country, 2023 - 2030, Million Units (200 ml - pack of 6)

TABLE 16 North America Cans Market by Country, 2019 - 2022, USD Million

TABLE 17 North America Cans Market by Country, 2023 - 2030, USD Million

TABLE 18 North America Cans (200 ml - pack of 6) Market by Country, 2019 - 2022, Million Units (200 ml - pack of 6)

TABLE 19 North America Cans (200 ml - pack of 6) Market by Country, 2023 - 2030, Million Units (200 ml - pack of 6)

TABLE 20 North America Tetra Packs Market by Country, 2019 - 2022, USD Million

TABLE 21 North America Tetra Packs Market by Country, 2023 - 2030, USD Million

TABLE 22 North America Tetra Packs (200 ml - pack of 6) Market by Country, 2019 - 2022, Million Units (200 ml - pack of 6)

TABLE 23 North America Tetra Packs (200 ml - pack of 6) Market by Country, 2023 - 2030, Million Units (200 ml - pack of 6)

TABLE 24 North America Ready to Drink Shakes Market by Distribution Channel, 2019 - 2022, USD Million

TABLE 25 North America Ready to Drink Shakes Market by Distribution Channel, 2023 - 2030, USD Million

TABLE 26 North America Ready to Drink Shakes Market by Distribution Channel, 2019 - 2022, Million Units (200 ml - pack of 6)

TABLE 27 North America Ready to Drink Shakes Market by Distribution Channel, 2023 - 2030, Million Units (200 ml - pack of 6)

TABLE 28 North America Supermarkets & Hypermarkets Market by Country, 2019 - 2022, USD Million

TABLE 29 North America Supermarkets & Hypermarkets Market by Country, 2023 - 2030, USD Million

TABLE 30 North America Supermarkets & Hypermarkets Market by Country, 2019 - 2022, Million Units (200 ml - pack of 6)

TABLE 31 North America Supermarkets & Hypermarkets Market by Country, 2023 - 2030, Million Units (200 ml - pack of 6)

TABLE 32 North America Convenience Stores Market by Country, 2019 - 2022, USD Million

TABLE 33 North America Convenience Stores Market by Country, 2023 - 2030, USD Million

TABLE 34 North America Convenience Stores Market by Country, 2019 - 2022, Million Units (200 ml - pack of 6)

TABLE 35 North America Convenience Stores Market by Country, 2023 - 2030, Million Units (200 ml - pack of 6)

TABLE 36 North America Online Market by Country, 2019 - 2022, USD Million

TABLE 37 North America Online Market by Country, 2023 - 2030, USD Million

TABLE 38 North America Online Market by Country, 2019 - 2022, Million Units (200 ml - pack of 6)

TABLE 39 North America Online Market by Country, 2023 - 2030, Million Units (200 ml - pack of 6)

TABLE 40 North America Ready to Drink Shakes Market by Country, 2019 - 2022, USD Million

TABLE 41 North America Ready to Drink Shakes Market by Country, 2023 - 2030, USD Million

TABLE 42 North America Ready to Drink Shakes Market by Country, 2019 - 2022, Million Units (200 ml - pack of 6)

TABLE 43 North America Ready to Drink Shakes Market by Country, 2023 - 2030, Million Units (200 ml - pack of 6)

TABLE 44 US Ready to Drink Shakes Market, 2019 - 2022, USD Million

TABLE 45 US Ready to Drink Shakes Market, 2023 - 2030, USD Million

TABLE 46 US Ready to Drink Shakes Market, 2019 - 2022, Million Units (200 ml - pack of 6)

TABLE 47 US Ready to Drink Shakes Market, 2023 - 2030, Million Units (200 ml - pack of 6)

TABLE 48 US Ready to Drink Shakes Market by Type, 2019 - 2022, USD Million

TABLE 49 US Ready to Drink Shakes Market by Type, 2023 - 2030, USD Million

TABLE 50 US Ready to Drink Shakes Market by Type, 2019 - 2022, Million Units (200 ml - pack of 6)

TABLE 51 US Ready to Drink Shakes Market by Type, 2023 - 2030, Million Units (200 ml - pack of 6)

TABLE 52 US Ready to Drink Shakes Market by Distribution Channel, 2019 - 2022, USD Million

TABLE 53 US Ready to Drink Shakes Market by Distribution Channel, 2023 - 2030, USD Million

TABLE 54 US Ready to Drink Shakes Market by Distribution Channel, 2019 - 2022, Million Units (200 ml - pack of 6)

TABLE 55 US Ready to Drink Shakes Market by Distribution Channel, 2023 - 2030, Million Units (200 ml - pack of 6)

TABLE 56 Canada Ready to Drink Shakes Market, 2019 - 2022, USD Million

TABLE 57 Canada Ready to Drink Shakes Market, 2023 - 2030, USD Million

TABLE 58 Canada Ready to Drink Shakes Market, 2019 - 2022, Million Units (200 ml - pack of 6)

TABLE 59 Canada Ready to Drink Shakes Market, 2023 - 2030, Million Units (200 ml - pack of 6)

TABLE 60 Canada Ready to Drink Shakes Market by Type, 2019 - 2022, USD Million

TABLE 61 Canada Ready to Drink Shakes Market by Type, 2023 - 2030, USD Million

TABLE 62 Canada Ready to Drink Shakes Market by Type, 2019 - 2022, Million Units (200 ml - pack of 6)

TABLE 63 Canada Ready to Drink Shakes Market by Type, 2023 - 2030, Million Units (200 ml - pack of 6)

TABLE 64 Canada Ready to Drink Shakes Market by Distribution Channel, 2019 - 2022, USD Million

TABLE 65 Canada Ready to Drink Shakes Market by Distribution Channel, 2023 - 2030, USD Million

TABLE 66 Canada Ready to Drink Shakes Market by Distribution Channel, 2019 - 2022, Million Units (200 ml - pack of 6)

TABLE 67 Canada Ready to Drink Shakes Market by Distribution Channel, 2023 - 2030, Million Units (200 ml - pack of 6)

TABLE 68 Mexico Ready to Drink Shakes Market, 2019 - 2022, USD Million

TABLE 69 Mexico Ready to Drink Shakes Market, 2023 - 2030, USD Million

TABLE 70 Mexico Ready to Drink Shakes Market, 2019 - 2022, Million Units (200 ml - pack of 6)

TABLE 71 Mexico Ready to Drink Shakes Market, 2023 - 2030, Million Units (200 ml - pack of 6)

TABLE 72 Mexico Ready to Drink Shakes Market by Type, 2019 - 2022, USD Million

TABLE 73 Mexico Ready to Drink Shakes Market by Type, 2023 - 2030, USD Million

TABLE 74 Mexico Ready to Drink Shakes Market by Type, 2019 - 2022, Million Units (200 ml - pack of 6)

TABLE 75 Mexico Ready to Drink Shakes Market by Type, 2023 - 2030, Million Units (200 ml - pack of 6)

TABLE 76 Mexico Ready to Drink Shakes Market by Distribution Channel, 2019 - 2022, USD Million

TABLE 77 Mexico Ready to Drink Shakes Market by Distribution Channel, 2023 - 2030, USD Million

TABLE 78 Mexico Ready to Drink Shakes Market by Distribution Channel, 2019 - 2022, Million Units (200 ml - pack of 6)

TABLE 79 Mexico Ready to Drink Shakes Market by Distribution Channel, 2023 - 2030, Million Units (200 ml - pack of 6)

TABLE 80 Rest of North America Ready to Drink Shakes Market, 2019 - 2022, USD Million

TABLE 81 Rest of North America Ready to Drink Shakes Market, 2023 - 2030, USD Million

TABLE 82 Rest of North America Ready to Drink Shakes Market, 2019 - 2022, Million Units (200 ml - pack of 6)

TABLE 83 Rest of North America Ready to Drink Shakes Market, 2023 - 2030, Million Units (200 ml - pack of 6)

TABLE 84 Rest of North America Ready to Drink Shakes Market by Type, 2019 - 2022, USD Million

TABLE 85 Rest of North America Ready to Drink Shakes Market by Type, 2023 - 2030, USD Million

TABLE 86 Rest of North America Ready to Drink Shakes Market by Type, 2019 - 2022, Million Units (200 ml - pack of 6)

TABLE 87 Rest of North America Ready to Drink Shakes Market by Type, 2023 - 2030, Million Units (200 ml - pack of 6)

TABLE 88 Rest of North America Ready to Drink Shakes Market by Distribution Channel, 2019 - 2022, USD Million

TABLE 89 Rest of North America Ready to Drink Shakes Market by Distribution Channel, 2023 - 2030, USD Million

TABLE 90 Rest of North America Ready to Drink Shakes Market by Distribution Channel, 2019 - 2022, Million Units (200 ml - pack of 6)

TABLE 91 Rest of North America Ready to Drink Shakes Market by Distribution Channel, 2023 - 2030, Million Units (200 ml - pack of 6)

TABLE 92 Key Information – Abbott Laboratories

TABLE 93 Key information – Kellogg Company

TABLE 94 Key Information – The Coca Cola Company

TABLE 95 Key Information – PepsiCo, Inc.

TABLE 96 Key Information – Nestle S.A

TABLE 97 Key Information – Hormel Foods Corporation

TABLE 98 Key information – Danone S.A.

TABLE 99 Key Information – Campbell Soup Company

TABLE 100 Key Information – KeHE Distributors, LLC

TABLE 101 Key Information – Huel Limited

List of Figures

FIG 1 Methodology for the research

FIG 2 North America Ready to Drink Shakes Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Ready to Drink Shakes Market

FIG 4 KBV Cardinal Matrix

FIG 5 Key Leading Strategies: Percentage Distribution (2019-2023)

FIG 6 Key Strategic Move: (Product Launches and Product Expansions : 2019, Jan – 2024, Jan) Leading Players

FIG 7 Porter’s Five Forces Analysis - Ready to Drink Shakes Market

FIG 8 North America Ready to Drink Shakes Market share by Type, 2022

FIG 9 North America Ready to Drink Shakes Market share by Type, 2030

FIG 10 North America Ready to Drink Shakes Market by Type, 2019 - 2030, USD Million

FIG 11 North America Ready to Drink Shakes Market share by Distribution Channel, 2022

FIG 12 North America Ready to Drink Shakes Market share by Distribution Channel, 2030

FIG 13 North America Ready to Drink Shakes Market by Distribution Channel, 2019 - 2030, USD Million

FIG 14 North America Ready to Drink Shakes Market share by Country, 2022

FIG 15 North America Ready to Drink Shakes Market share by Country, 2030

FIG 16 North America Ready to Drink Shakes Market by Country, 2019 - 2030, USD Million

FIG 17 SWOT Analysis: Abbott Laboratories

FIG 18 Swot Analysis: Kellogg Company

FIG 19 Recent strategies and developments: The Coca-Cola Company

FIG 20 SWOT Analysis: The Coca Cola Company

FIG 21 Recent strategies and developments: PepsiCo, Inc.

FIG 22 Swot Analysis: PepsiCo, Inc.

FIG 23 SWOT Analysis: Nestle S.A

FIG 24 SWOT Analysis: Hormel Foods Corporation

FIG 25 SWOT Analysis: Danone, S.A.

FIG 26 SWOT Analysis: Campbell Soup Company

FIG 27 SWOT Analysis: KeHE Distributors, LLC

FIG 28 SWOT Analysis: Huel Limited