North America Ultra Wideband Market Size, Share & Trends Analysis Report By Positioning System (Indoor, and Outdoor), By Application, By End Use, By Country and Growth Forecast, 2024 - 2031

Published Date : 06-Sep-2024 |

Pages: 122 |

Formats: PDF |

COVID-19 Impact on the North America Ultra Wideband Market

The North America Ultra Wideband Market would witness market growth of 17.5% CAGR during the forecast period (2024-2031).

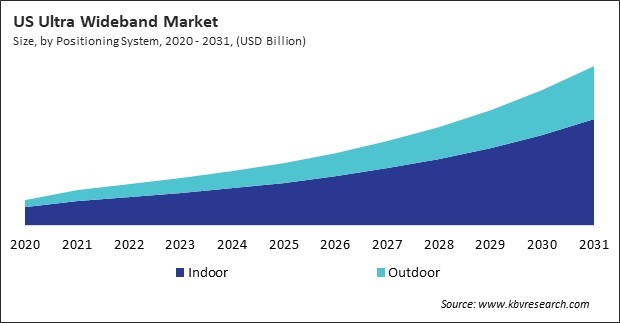

The US market dominated the North America Ultra Wideband Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $1,163.6 million by 2031. The Canada market is experiencing a CAGR of 20% during (2024 - 2031). Additionally, The Mexico market would exhibit a CAGR of 19% during (2024 - 2031).

the adoption of UWB technology has been driven by several factors, including the increasing demand for precise location-based services, the growth of IoT devices, and the need for more secure and reliable communication protocols in various applications.

Additionally, UWB technology is increasingly adopted in smart building infrastructure for precise indoor positioning and navigation. It optimizes space utilization, enhances energy management, and provides location-based services such as automated lighting and HVAC control, improving overall building efficiency and user experience.

As internet access becomes more widespread in Mexico, there is a growing demand for IoT devices that rely on UWB technology for precise location tracking and secure communication. This trend supports the growth of UWB applications in smart homes, industrial automation, and connected devices across the country. According to the International Trade Administration (ITA), the Mexican telecommunications sector has consistently outpaced the overall economy’s growth, largely driven by mobile telephones, broadband services, and broadcasting. In 2022, Mexico had over 130 million active wireless lines, and over 113 million had Internet access.

Free Valuable Insights: The Ultra Wideband Market is Predict to reach USD 4.9 Billion by 2031, at a CAGR of 18.2%

Based on Positioning System, the market is segmented into Indoor, and Outdoor. Based on Application, the market is segmented into Real-time Location System (RTLS), Imaging, and Communication. Based on End Use, the market is segmented into Consumer Electronics, Automotive & Transportation, Manufacturing, Residential, and Others. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- Qorvo, Inc.

- NXP Semiconductors N.V.

- Texas Instruments, Inc.

- Apple, Inc.

- Samsung Electronics Co. Ltd

- Johanson Technology, Inc.

- Sony Corporation

- Qualcomm Incorporated (Qualcomm Technologies, Inc.)

- STMicroelectronics N.V.

- Intel Corporation

North America Ultra Wideband Market Report Segmentation

By Positioning System

- Indoor

- Outdoor

By Application

- Real-time Location System (RTLS)

- Imaging

- Communication

By End Use

- Consumer Electronics

- Automotive & Transportation

- Manufacturing

- Residential

- Others

By Country

- US

- Canada

- Mexico

- Rest of North America

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 North America Ultra Wideband Market, by Positioning System

1.4.2 North America Ultra Wideband Market, by Application

1.4.3 North America Ultra Wideband Market, by End Use

1.4.4 North America Ultra Wideband Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Competition Analysis - Global

4.1 KBV Cardinal Matrix

4.2 Recent Industry Wide Strategic Developments

4.2.1 Partnerships, Collaborations and Agreements

4.2.2 Product Launches and Product Expansions

4.2.3 Acquisition and Mergers

4.3 Market Share Analysis, 2023

4.4 Top Winning Strategies

4.4.1 Key Leading Strategies: Percentage Distribution (2020-2024)

4.4.2 Key Strategic Move: (Product Launches and Product Expansions: 2020, Jul – 2024, Feb) Leading Players

4.5 Porter Five Forces Analysis

Chapter 5. North America Ultra Wideband Market by Positioning System

5.1 North America Indoor Market by Region

5.2 North America Outdoor Market by Region

Chapter 6. North America Ultra Wideband Market by Application

6.1 North America Real-time Location System (RTLS) Market by Country

6.2 North America Imaging Market by Country

6.3 North America Communication Market by Country

Chapter 7. North America Ultra Wideband Market by End Use

7.1 North America Consumer Electronics Market by Country

7.2 North America Automotive & Transportation Market by Country

7.3 North America Manufacturing Market by Country

7.4 North America Residential Market by Country

7.5 North America Others Market by Country

Chapter 8. North America Ultra Wideband Market by Country

8.1 US Ultra Wideband Market

8.1.1 US Ultra Wideband Market by Positioning System

8.1.2 US Ultra Wideband Market by Application

8.1.3 US Ultra Wideband Market by End Use

8.2 Canada Ultra Wideband Market

8.2.1 Canada Ultra Wideband Market by Positioning System

8.2.2 Canada Ultra Wideband Market by Application

8.2.3 Canada Ultra Wideband Market by End Use

8.3 Mexico Ultra Wideband Market

8.3.1 Mexico Ultra Wideband Market by Positioning System

8.3.2 Mexico Ultra Wideband Market by Application

8.3.3 Mexico Ultra Wideband Market by End Use

8.4 Rest of North America Ultra Wideband Market

8.4.1 Rest of North America Ultra Wideband Market by Positioning System

8.4.2 Rest of North America Ultra Wideband Market by Application

8.4.3 Rest of North America Ultra Wideband Market by End Use

Chapter 9. Company Profiles

9.1 Qorvo, Inc.

9.1.1 Company Overview

9.1.2 Financial Analysis

9.1.3 Segmental and Regional Analysis

9.1.4 Research & Development Expenses

9.1.5 Recent strategies and developments:

9.1.5.1 Partnerships, Collaborations, and Agreements:

9.1.5.2 Product Launches and Product Expansions:

9.1.5.3 Acquisition and Mergers:

9.1.6 SWOT Analysis

9.2 Texas Instruments, Inc.

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Segmental and Regional Analysis

9.2.4 Research & Development Expense

9.2.5 Recent strategies and developments:

9.2.5.1 Product Launches and Product Expansions:

9.2.6 SWOT Analysis

9.3 NXP Semiconductors N.V.

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Regional Analysis

9.3.4 Research & Development Expenses

9.3.5 Recent strategies and developments:

9.3.5.1 Partnerships, Collaborations, and Agreements:

9.3.5.2 Product Launches and Product Expansions:

9.3.6 SWOT Analysis

9.4 Apple, Inc.

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Regional Analysis

9.4.4 Research & Development Expense

9.4.5 Recent strategies and developments:

9.4.5.1 Product Launches and Product Expansions:

9.4.6 SWOT Analysis

9.5 Samsung Electronics Co., Ltd. (Samsung Group)

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Segmental and Regional Analysis

9.5.4 Research & Development Expenses

9.5.5 Recent strategies and developments:

9.5.5.1 Partnerships, Collaborations, and Agreements:

9.5.5.2 Product Launches and Product Expansions:

9.5.6 SWOT Analysis

9.6 Johanson Technology, Inc.

9.6.1 Company Overview

9.7 Sony Corporation

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Segmental and Regional Analysis

9.7.4 Research & Development Expenses

9.7.5 SWOT Analysis

9.8 Qualcomm Incorporated (Qualcomm Technologies, Inc.)

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Segmental and Regional Analysis

9.8.4 Research & Development Expense

9.8.5 Recent strategies and developments:

9.8.5.1 Product Launches and Product Expansions:

9.8.6 SWOT Analysis

9.9 STMicroelectronics N.V.

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Segmental and Regional Analysis

9.9.4 Research & Development Expenses

9.9.5 Recent strategies and developments:

9.9.5.1 Product Launches and Product Expansions:

9.9.6 SWOT Analysis

9.10. Intel Corporation

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Segmental and Regional Analysis

9.10.4 Research & Development Expenses

9.10.5 SWOT Analysis

TABLE 2 North America Ultra Wideband Market, 2024 - 2031, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– Ultra Wideband Market

TABLE 4 Product Launches And Product Expansions– Ultra Wideband Market

TABLE 5 Acquisition and Mergers– Ultra Wideband Market

TABLE 6 North America Ultra Wideband Market by Positioning System, 2020 - 2023, USD Million

TABLE 7 North America Ultra Wideband Market by Positioning System, 2024 - 2031, USD Million

TABLE 8 North America Indoor Market by Region, 2020 - 2023, USD Million

TABLE 9 North America Indoor Market by Region, 2024 - 2031, USD Million

TABLE 10 North America Outdoor Market by Region, 2020 - 2023, USD Million

TABLE 11 North America Outdoor Market by Region, 2024 - 2031, USD Million

TABLE 12 North America Ultra Wideband Market by Application, 2020 - 2023, USD Million

TABLE 13 North America Ultra Wideband Market by Application, 2024 - 2031, USD Million

TABLE 14 North America Real-time Location System (RTLS) Market by Country, 2020 - 2023, USD Million

TABLE 15 North America Real-time Location System (RTLS) Market by Country, 2024 - 2031, USD Million

TABLE 16 North America Imaging Market by Country, 2020 - 2023, USD Million

TABLE 17 North America Imaging Market by Country, 2024 - 2031, USD Million

TABLE 18 North America Communication Market by Country, 2020 - 2023, USD Million

TABLE 19 North America Communication Market by Country, 2024 - 2031, USD Million

TABLE 20 North America Ultra Wideband Market by End Use, 2020 - 2023, USD Million

TABLE 21 North America Ultra Wideband Market by End Use, 2024 - 2031, USD Million

TABLE 22 North America Consumer Electronics Market by Country, 2020 - 2023, USD Million

TABLE 23 North America Consumer Electronics Market by Country, 2024 - 2031, USD Million

TABLE 24 North America Automotive & Transportation Market by Country, 2020 - 2023, USD Million

TABLE 25 North America Automotive & Transportation Market by Country, 2024 - 2031, USD Million

TABLE 26 North America Manufacturing Market by Country, 2020 - 2023, USD Million

TABLE 27 North America Manufacturing Market by Country, 2024 - 2031, USD Million

TABLE 28 North America Residential Market by Country, 2020 - 2023, USD Million

TABLE 29 North America Residential Market by Country, 2024 - 2031, USD Million

TABLE 30 North America Others Market by Country, 2020 - 2023, USD Million

TABLE 31 North America Others Market by Country, 2024 - 2031, USD Million

TABLE 32 North America Ultra Wideband Market by Country, 2020 - 2023, USD Million

TABLE 33 North America Ultra Wideband Market by Country, 2024 - 2031, USD Million

TABLE 34 US Ultra Wideband Market, 2020 - 2023, USD Million

TABLE 35 US Ultra Wideband Market, 2024 - 2031, USD Million

TABLE 36 US Ultra Wideband Market by Positioning System, 2020 - 2023, USD Million

TABLE 37 US Ultra Wideband Market by Positioning System, 2024 - 2031, USD Million

TABLE 38 US Ultra Wideband Market by Application, 2020 - 2023, USD Million

TABLE 39 US Ultra Wideband Market by Application, 2024 - 2031, USD Million

TABLE 40 US Ultra Wideband Market by End Use, 2020 - 2023, USD Million

TABLE 41 US Ultra Wideband Market by End Use, 2024 - 2031, USD Million

TABLE 42 Canada Ultra Wideband Market, 2020 - 2023, USD Million

TABLE 43 Canada Ultra Wideband Market, 2024 - 2031, USD Million

TABLE 44 Canada Ultra Wideband Market by Positioning System, 2020 - 2023, USD Million

TABLE 45 Canada Ultra Wideband Market by Positioning System, 2024 - 2031, USD Million

TABLE 46 Canada Ultra Wideband Market by Application, 2020 - 2023, USD Million

TABLE 47 Canada Ultra Wideband Market by Application, 2024 - 2031, USD Million

TABLE 48 Canada Ultra Wideband Market by End Use, 2020 - 2023, USD Million

TABLE 49 Canada Ultra Wideband Market by End Use, 2024 - 2031, USD Million

TABLE 50 Mexico Ultra Wideband Market, 2020 - 2023, USD Million

TABLE 51 Mexico Ultra Wideband Market, 2024 - 2031, USD Million

TABLE 52 Mexico Ultra Wideband Market by Positioning System, 2020 - 2023, USD Million

TABLE 53 Mexico Ultra Wideband Market by Positioning System, 2024 - 2031, USD Million

TABLE 54 Mexico Ultra Wideband Market by Application, 2020 - 2023, USD Million

TABLE 55 Mexico Ultra Wideband Market by Application, 2024 - 2031, USD Million

TABLE 56 Mexico Ultra Wideband Market by End Use, 2020 - 2023, USD Million

TABLE 57 Mexico Ultra Wideband Market by End Use, 2024 - 2031, USD Million

TABLE 58 Rest of North America Ultra Wideband Market, 2020 - 2023, USD Million

TABLE 59 Rest of North America Ultra Wideband Market, 2024 - 2031, USD Million

TABLE 60 Rest of North America Ultra Wideband Market by Positioning System, 2020 - 2023, USD Million

TABLE 61 Rest of North America Ultra Wideband Market by Positioning System, 2024 - 2031, USD Million

TABLE 62 Rest of North America Ultra Wideband Market by Application, 2020 - 2023, USD Million

TABLE 63 Rest of North America Ultra Wideband Market by Application, 2024 - 2031, USD Million

TABLE 64 Rest of North America Ultra Wideband Market by End Use, 2020 - 2023, USD Million

TABLE 65 Rest of North America Ultra Wideband Market by End Use, 2024 - 2031, USD Million

TABLE 66 Key Information – Qorvo, Inc

TABLE 67 Key Information – Texas Instruments, Inc.

TABLE 68 Key Information – NXP Semiconductors N.V.

TABLE 69 Key Information – Apple, Inc.

TABLE 70 Key Information – Samsung Electronics Co., Ltd.

TABLE 71 Key Information – Johanson Technology, Inc.

TABLE 72 Key Information – Sony Corporation

TABLE 73 Key Information – Qualcomm Incorporated

TABLE 74 Key Information – STMicroelectronics N.V.

TABLE 75 Key Information – Intel Corporation

List of Figures

FIG 1 Methodology for the research

FIG 2 North America Ultra Wideband Market, 2020 - 2031, USD Million

FIG 3 Key Factors Impacting Ultra Wideband Market

FIG 4 KBV Cardinal Matrix

FIG 5 Market Share Analysis, 2023

FIG 6 Key Leading Strategies: Percentage Distribution (2020-2024)

FIG 7 Key Strategic Move: (Product Launches and Product Expansions : 2020, Jul – 2024, Feb) Leading Players

FIG 8 Porter’s Five Forces Analysis – Ultra Wideband Market

FIG 9 North America Ultra Wideband Market share by Positioning System, 2023

FIG 10 North America Ultra Wideband Market share by Positioning System, 2031

FIG 11 North America Ultra Wideband Market by Positioning System, 2020 - 2031, USD Million

FIG 12 North America Ultra Wideband Market share by Application, 2023

FIG 13 North America Ultra Wideband Market share by Application, 2031

FIG 14 North America Ultra Wideband Market by Application, 2020 - 2031, USD Million

FIG 15 North America Ultra Wideband Market share by End Use, 2023

FIG 16 North America Ultra Wideband Market share by End Use, 2031

FIG 17 North America Ultra Wideband Market by End Use, 2020 - 2031, USD Million

FIG 18 North America Ultra Wideband Market share by Country, 2023

FIG 19 North America Ultra Wideband Market share by Country, 2031

FIG 20 North America Ultra Wideband Market by Country, 2020 - 2031, USD Million

FIG 21 Recent strategies and developments: Qorvo, Inc.

FIG 22 SWOT Analysis: Qorvo, Inc.

FIG 23 SWOT Analysis: Texas Instruments, Inc.

FIG 24 Recent strategies and developments: NXP Semiconductors N.V.

FIG 25 SWOT Analysis: NXP Semiconductors N.V.

FIG 26 SWOT Analysis: Apple, Inc.

FIG 27 Recent strategies and developments: Samsung Electronics Co., Ltd

FIG 28 SWOT Analysis: Samsung Electronics Co., Ltd

FIG 29 SWOT Analysis: Sony Corporation

FIG 30 SWOT Analysis: QUALCOMM Incorporated

FIG 31 SWOT Analysis: STMicroelectronics N.V.

FIG 32 SWOT Analysis: Intel corporation