The North America Wood Preservatives Market would witness market growth of 4.3% CAGR during the forecast period (2024-2031). In the year 2020, the North America market's volume surged to 1,327 hundred Tonnes, showcasing a growth of 18.8% (2020-2023).

Solvent-based wood preservatives typically consist of a carrier solvent, such as mineral spirits or petroleum distillates, which allows the active ingredients to penetrate deep into the wood substrate, providing long-lasting protection against decay, insects, and weathering. These formulations are favored for their ability to offer quick drying times and easy application methods, making them suitable for both outdoor and indoor wood protection applications. Therefore, Canada used 50.64 hundred Tonnes of solvent-based wood preservative in 2023.

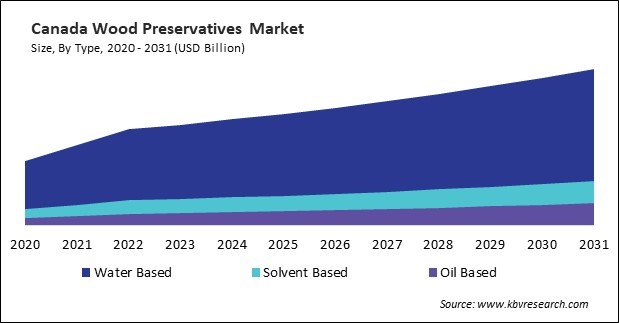

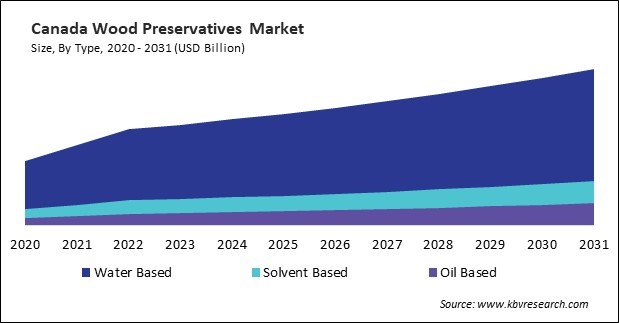

The US market dominated the North America Wood Preservatives Market by Country in 2023 and would continue to be a dominant market till 2031; thereby, achieving a market value of $497.3 million by 2031. The Canada market is experiencing a CAGR of 6% during (2024 - 2031). Additionally, The Mexico market would exhibit a CAGR of 5.8% during (2024 - 2031).

Leading segments for B2C e-commerce in order are consumer electronics, fashion, furniture, toys/hobby, health pharmaceuticals, media & entertainment, beverages, and food. As per the data from Statistics Canada, between February 2020 and July 2022, retail e-commerce sales surged by 67.9%, and from 2019 to 2022 (July year-to-date), e-commerce sales as a share of total retail sales increased noticeably. Retail e-commerce sales remained high in some industry subsectors in 2022. Still, in others, the return of in-store operations has caused consumers and businesses to move closer to pre-pandemic purchasing habits.

Additionally, integrating digital tools, data analytics, and machine learning algorithms in wood treatment processes facilitates real-time monitoring, predictive maintenance, and optimization of treatment parameters, enabling manufacturers to achieve higher throughput, lower energy consumption, and improved product performance.

Mexico is experiencing a boom in residential construction fueled by population growth, urbanization, and rising housing demand. As more homes are built to accommodate the growing population, there is an increased need for treated wood products such as structural framing, decking, fencing, and siding. Wood preservatives protect these wooden structures from decay, insect infestation, and weathering, ensuring their longevity and durability in Mexico's diverse climate conditions. Hence, the growing construction sector in North America will boost the demand for wood preservatives in the region.

Free Valuable Insights: The Wood Preservatives Market is Predict to reach USD 2 Billion by 2031, at a CAGR of 4.9%

Based on Type, the market is segmented into Water Based, Solvent Based, and Oil Based. Based on Application, the market is segmented into Residential, Commercial, and Industrial. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- Jubilant Industries Limited (Jubilant Bhartia Group)

- Rio Tinto PLC (Rio Tinto International Holdings Limited)

- Lanxess AG

- Nisus Corporation

- Groupe Berkem

- Arxada AG

- RÜTGERS Organics GmbH (International Chemical Investors GmbH)

- Wykamol Group Ltd.

- Koppers Performance Chemicals Inc. (Koppers Holdings Inc.)

- Viance, LLC

North America Wood Preservatives Market Report Segmentation

By Type (Volume, Hundred Tonnes, USD Billion, 2020-2031)

- Water Based

- Solvent Based

- Oil Based

By Application (Volume, Hundred Tonnes, USD Billion, 2020-2031)

- Residential

- Commercial

- Industrial

By Country (Volume, Hundred Tonnes, USD Billion, 2020-2031)

- US

- Canada

- Mexico

- Rest of North America

TABLE 1 North America Wood Preservatives Market, 2020 - 2023, USD Million

TABLE 2 North America Wood Preservatives Market, 2024 - 2031, USD Million

TABLE 3 North America Wood Preservatives Market, 2020 - 2023, Hundred Tonnes

TABLE 4 North America Wood Preservatives Market, 2024 - 2031, Hundred Tonnes

TABLE 5 North America Wood Preservatives Market by Type, 2020 - 2023, USD Million

TABLE 6 North America Wood Preservatives Market by Type, 2024 - 2031, USD Million

TABLE 7 North America Wood Preservatives Market by Type, 2020 - 2023, Hundred Tonnes

TABLE 8 North America Wood Preservatives Market by Type, 2024 - 2031, Hundred Tonnes

TABLE 9 North America Water Based Market by Country, 2020 - 2023, USD Million

TABLE 10 North America Water Based Market by Country, 2024 - 2031, USD Million

TABLE 11 North America Water Based Market by Country, 2020 - 2023, Hundred Tonnes

TABLE 12 North America Water Based Market by Country, 2024 - 2031, Hundred Tonnes

TABLE 13 North America Solvent Based Market by Country, 2020 - 2023, USD Million

TABLE 14 North America Solvent Based Market by Country, 2024 - 2031, USD Million

TABLE 15 North America Solvent Based Market by Country, 2020 - 2023, Hundred Tonnes

TABLE 16 North America Solvent Based Market by Country, 2024 - 2031, Hundred Tonnes

TABLE 17 North America Oil Based Market by Country, 2020 - 2023, USD Million

TABLE 18 North America Oil Based Market by Country, 2024 - 2031, USD Million

TABLE 19 North America Oil Based Market by Country, 2020 - 2023, Hundred Tonnes

TABLE 20 North America Oil Based Market by Country, 2024 - 2031, Hundred Tonnes

TABLE 21 North America Wood Preservatives Market by Application, 2020 - 2023, USD Million

TABLE 22 North America Wood Preservatives Market by Application, 2024 - 2031, USD Million

TABLE 23 North America Wood Preservatives Market by Application, 2020 - 2023, Hundred Tonnes

TABLE 24 North America Wood Preservatives Market by Application, 2024 - 2031, Hundred Tonnes

TABLE 25 North America Residential Market by Country, 2020 - 2023, USD Million

TABLE 26 North America Residential Market by Country, 2024 - 2031, USD Million

TABLE 27 North America Residential Market by Country, 2020 - 2023, Hundred Tonnes

TABLE 28 North America Residential Market by Country, 2024 - 2031, Hundred Tonnes

TABLE 29 North America Commercial Market by Country, 2020 - 2023, USD Million

TABLE 30 North America Commercial Market by Country, 2024 - 2031, USD Million

TABLE 31 North America Commercial Market by Country, 2020 - 2023, Hundred Tonnes

TABLE 32 North America Commercial Market by Country, 2024 - 2031, Hundred Tonnes

TABLE 33 North America Industrial Market by Country, 2020 - 2023, USD Million

TABLE 34 North America Industrial Market by Country, 2024 - 2031, USD Million

TABLE 35 North America Industrial Market by Country, 2020 - 2023, Hundred Tonnes

TABLE 36 North America Industrial Market by Country, 2024 - 2031, Hundred Tonnes

TABLE 37 North America Wood Preservatives Market by Country, 2020 - 2023, USD Million

TABLE 38 North America Wood Preservatives Market by Country, 2024 - 2031, USD Million

TABLE 39 North America Wood Preservatives Market by Country, 2020 - 2023, Hundred Tonnes

TABLE 40 North America Wood Preservatives Market by Country, 2024 - 2031, Hundred Tonnes

TABLE 41 US Wood Preservatives Market, 2020 - 2023, USD Million

TABLE 42 US Wood Preservatives Market, 2024 - 2031, USD Million

TABLE 43 US Wood Preservatives Market, 2020 - 2023, Hundred Tonnes

TABLE 44 US Wood Preservatives Market, 2024 - 2031, Hundred Tonnes

TABLE 45 US Wood Preservatives Market by Type, 2020 - 2023, USD Million

TABLE 46 US Wood Preservatives Market by Type, 2024 - 2031, USD Million

TABLE 47 US Wood Preservatives Market by Type, 2020 - 2023, Hundred Tonnes

TABLE 48 US Wood Preservatives Market by Type, 2024 - 2031, Hundred Tonnes

TABLE 49 US Wood Preservatives Market by Application, 2020 - 2023, USD Million

TABLE 50 US Wood Preservatives Market by Application, 2024 - 2031, USD Million

TABLE 51 US Wood Preservatives Market by Application, 2020 - 2023, Hundred Tonnes

TABLE 52 US Wood Preservatives Market by Application, 2024 - 2031, Hundred Tonnes

TABLE 53 Canada Wood Preservatives Market, 2020 - 2023, USD Million

TABLE 54 Canada Wood Preservatives Market, 2024 - 2031, USD Million

TABLE 55 Canada Wood Preservatives Market, 2020 - 2023, Hundred Tonnes

TABLE 56 Canada Wood Preservatives Market, 2024 - 2031, Hundred Tonnes

TABLE 57 Canada Wood Preservatives Market by Type, 2020 - 2023, USD Million

TABLE 58 Canada Wood Preservatives Market by Type, 2024 - 2031, USD Million

TABLE 59 Canada Wood Preservatives Market by Type, 2020 - 2023, Hundred Tonnes

TABLE 60 Canada Wood Preservatives Market by Type, 2024 - 2031, Hundred Tonnes

TABLE 61 Canada Wood Preservatives Market by Application, 2020 - 2023, USD Million

TABLE 62 Canada Wood Preservatives Market by Application, 2024 - 2031, USD Million

TABLE 63 Canada Wood Preservatives Market by Application, 2020 - 2023, Hundred Tonnes

TABLE 64 Canada Wood Preservatives Market by Application, 2024 - 2031, Hundred Tonnes

TABLE 65 Mexico Wood Preservatives Market, 2020 - 2023, USD Million

TABLE 66 Mexico Wood Preservatives Market, 2024 - 2031, USD Million

TABLE 67 Mexico Wood Preservatives Market, 2020 - 2023, Hundred Tonnes

TABLE 68 Mexico Wood Preservatives Market, 2024 - 2031, Hundred Tonnes

TABLE 69 Mexico Wood Preservatives Market by Type, 2020 - 2023, USD Million

TABLE 70 Mexico Wood Preservatives Market by Type, 2024 - 2031, USD Million

TABLE 71 Mexico Wood Preservatives Market by Type, 2020 - 2023, Hundred Tonnes

TABLE 72 Mexico Wood Preservatives Market by Type, 2024 - 2031, Hundred Tonnes

TABLE 73 Mexico Wood Preservatives Market by Application, 2020 - 2023, USD Million

TABLE 74 Mexico Wood Preservatives Market by Application, 2024 - 2031, USD Million

TABLE 75 Mexico Wood Preservatives Market by Application, 2020 - 2023, Hundred Tonnes

TABLE 76 Mexico Wood Preservatives Market by Application, 2024 - 2031, Hundred Tonnes

TABLE 77 Rest of North America Wood Preservatives Market, 2020 - 2023, USD Million

TABLE 78 Rest of North America Wood Preservatives Market, 2024 - 2031, USD Million

TABLE 79 Rest of North America Wood Preservatives Market, 2020 - 2023, Hundred Tonnes

TABLE 80 Rest of North America Wood Preservatives Market, 2024 - 2031, Hundred Tonnes

TABLE 81 Rest of North America Wood Preservatives Market by Type, 2020 - 2023, USD Million

TABLE 82 Rest of North America Wood Preservatives Market by Type, 2024 - 2031, USD Million

TABLE 83 Rest of North America Wood Preservatives Market by Type, 2020 - 2023, Hundred Tonnes

TABLE 84 Rest of North America Wood Preservatives Market by Type, 2024 - 2031, Hundred Tonnes

TABLE 85 Rest of North America Wood Preservatives Market by Application, 2020 - 2023, USD Million

TABLE 86 Rest of North America Wood Preservatives Market by Application, 2024 - 2031, USD Million

TABLE 87 Rest of North America Wood Preservatives Market by Application, 2020 - 2023, Hundred Tonnes

TABLE 88 Rest of North America Wood Preservatives Market by Application, 2024 - 2031, Hundred Tonnes

TABLE 89 Key Information – Jubilant Industries Limited

TABLE 90 key Information – Rio Tinto PLC

TABLE 91 Key Information – Lanxess AG

TABLE 92 Key Information – Nisus Corporation

TABLE 93 Key Information – Groupe Berkem

TABLE 94 Key Information – Arxada AG

TABLE 95 Key Information – RÜTGERS Organics GmbH

TABLE 96 Key Information – Wykamol Group Ltd.

TABLE 97 Key Information – Koppers Performance Chemicals Inc.

TABLE 98 Key Information – Viance, LLC

List of Figures

FIG 1 Methodology for the research

FIG 2 North America Wood Preservatives Market, 2020 - 2031, USD Million

FIG 3 Key Factors Impacting Wood Preservatives Market

FIG 4 Porter’s Five Forces Analysis – Wood Preservatives market

FIG 5 North America Wood Preservatives Market share by Type, 2023

FIG 6 North America Wood Preservatives Market share by Type, 2031

FIG 7 North America Wood Preservatives Market by Type, 2020 - 2031, USD Million

FIG 8 North America Wood Preservatives Market share by Application, 2023

FIG 9 North America Wood Preservatives Market share by Application, 2031

FIG 10 North America Wood Preservatives Market by Application, 2020 - 2031, USD Million

FIG 11 North America Wood Preservatives Market share by Country, 2023

FIG 12 North America Wood Preservatives Market share by Country, 2031

FIG 13 North America Wood Preservatives Market by Country, 2020 - 2031, USD Million

FIG 14 Swot Analysis: Jubilant Industries Limited

FIG 15 Swot Analysis: Rio Tinto PLC

FIG 16 Recent strategies and developments: Lanxess AG

FIG 17 Swot Analysis: Lanxess AG

FIG 18 Swot Analysis: Nisus Corporation

FIG 19 Swot Analysis: Groupe Berkem

FIG 20 Swot Analysis: Arxada AG

FIG 21 Swot Analysis: RÜTGERS Organics GmbH

FIG 22 Swot Analysis: Wykamol Group Ltd.

FIG 23 Swot Analysis: Koppers Performance Chemicals Inc.

FIG 24 Swot Analysis: Viance, LLC