“Global Oat-based Snacks Market to reach a market value of USD 56.72 Billion by 2031 growing at a CAGR of 13.6%”

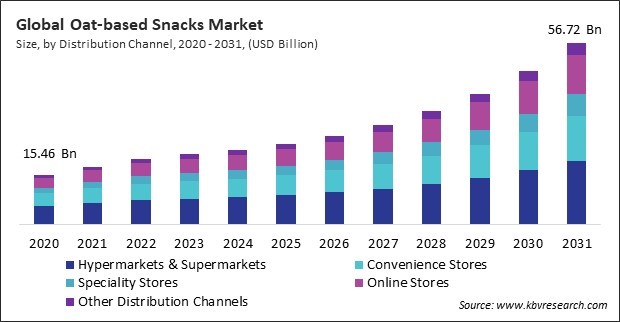

The Global Oat-based Snacks Market size is expected to reach $56.72 billion by 2031, rising at a market growth of 13.6% CAGR during the forecast period. In the year 2023, the market attained a volume of 8,244.39 million units (100g per unit), experiencing a growth of 10.1% (2020-2023).

The expanding retail sector in North America significantly drives the growing demand for oat-based snacks. As consumers in the region become increasingly health-conscious, there is a noticeable shift toward healthier snack options, including oat-based products. Mexico's supermarket sector also contributes to this rising demand. According to the Mexican Association of Nationwide Retailers (ANTAD, 2020), there were 31 supermarket chains with a combined 3,435 stores, many of which feature oat-based snacks prominently among their offerings. Thus, the North America segment garnered 31% revenue share in the market in 2023. In Terms of volume, 4,001.07 million units of oat-based snacks are expected to be utilized by the year 2031 in this region. A pronounced consumer emphasis on health and wellness propels the oat-based snacks market in North America. The rising demand for organic, gluten-free, and clean-label products has further bolstered market growth. Additionally, innovative marketing campaigns and a robust retail infrastructure, including supermarkets and online channels, contribute to the segment's significant revenue share.

The versatility of oat-based snacks caters to diverse dietary preferences and needs. Whether in the form of granola bars, cookies, or flavored crackers, oat-based products meet the growing desire for wholesome, guilt-free indulgences. Hence, this health-conscious trend is expected to continue driving the demand for oat-based snacks as more individuals adopt proactive nutrition and preventive healthcare approaches. Additionally, the rise of e-commerce has also empowered small and local oat-based snack producers to compete with established brands by providing them with direct-to-consumer (DTC) opportunities. Social media integration with e-commerce platforms further boosts visibility and drives impulse purchases. For instance, links embedded in Instagram or Facebook posts direct users to product pages, facilitating seamless transactions. UNCTAD's findings show that cross-border e-commerce accounted for nearly 25% of total e-commerce sales, reflecting the growing consumer interest in sourcing specialty snacks, such as organic oat-based products, from other countries. Therefore, the rise of e-commerce has revolutionized the oat-based snacks market.

However, Elevated production costs translate into higher retail prices, making oat-based snacks less competitive in markets dominated by cheaper, mass-produced snack options. This pricing disparity can deter cost-sensitive consumers, especially in regions where affordability is crucial in purchasing decisions. Hence, these factors may hamper the market's growth.

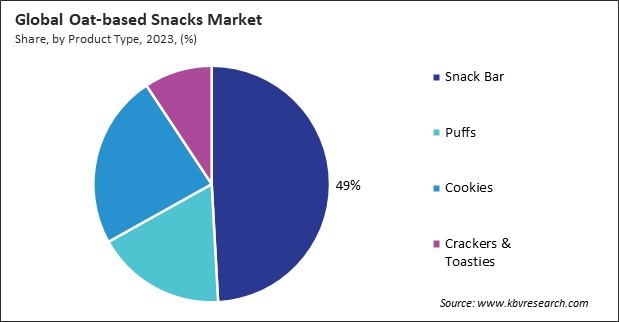

Based on product type, the market is classified into snack bars, puffs, cookies, and crackers & toasties. The puffs segment procured 18% revenue share in the market in 2023. In terms of volume, 5,001.56 million units of puffs are expected to be utilized by the year 2031. The puffs segment is driven by its appeal to health-conscious consumers and those seeking indulgent yet nutritious snacking options. Oat-based puffs provide a crisp texture and are frequently promoted as a more healthful substitute for conventional fried treats. Innovations in flavors, such as spicy, cheesy, or tangy variants, cater to diverse taste preferences, enhancing their market appeal. The rise in demand for baked snacks and clean-label products has further fueled growth in this segment.

On the basis of distribution channel, the market is divided into hypermarkets & supermarkets, convenience stores, specialist stores, online stores, and others. The hypermarkets & supermarkets segment acquired 37% revenue share in the market in 2023. In terms of volume, 6,423.75 million units of oat-based snacks are expected to be sold through hypermarkets & supermarkets by the year 2031. Hypermarkets and supermarkets drive the oat-based snacks market due to their wide reach, extensive product variety, and convenient one-stop shopping experience. These stores provide significant shelf space for oat-based snacks, allowing brands to showcase their offerings to a broad consumer base. Promotions, discounts, and in-store marketing campaigns enhance visibility and drive impulse purchases.

Free Valuable Insights: Global Oat-based Snacks Market size to reach USD 56.72 Billion by 2031

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe segment witnessed 37% revenue share in the market in 2023. In Terms of volume, 3,949.53 million units of oat-based snacks are expected to be utilized by the year 2031 in this region. Companies in the region actively launch new products and expand their retail presence, leveraging the growing consumer preference for sustainable and health-conscious food choices. The growing prevalence of plant-based diets, coupled with the rising demand for functional foods, propels the market, as oat-based munchies are in harmony with these dietary trends. Strong government regulations supporting producing healthy and eco-friendly products further support market growth in this region.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 21.88 Billion |

| Market size forecast in 2031 | USD 56.72 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 13.6% from 2024 to 2031 |

| Quantitative Data | Volume in Million Units (100g per unit), Revenue in USD Billion, and CAGR from 2020 to 2031 |

| Number of Pages | 295 |

| Number of Tables | 569 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Product Type, Distribution Channel, Region |

| Country scope |

|

| Companies Included | General Mills Inc., Kellogg Company, PepsiCo, Inc. (The Quaker Oats Company), Mondelez International, Inc., Abbott Laboratories, Clif Bar & Company, Simply Delicious Inc., Nairn's Oatcakes Limited, The Hain Celestial Group, Inc. |

By Product Type (Volume, Million Units, USD Billion, 2020-2031)

By Distribution Channel (Volume, Million Units, USD Billion, 2020-2031)

By Geography (Volume, Million Units, USD Billion, 2020-2031)

This Market size is expected to reach $56.72 billion by 2031.

Increasing Health Consciousness Among People are driving the Market in coming years, however, High Costs of Production restraints the growth of the Market.

General Mills Inc., Kellogg Company, PepsiCo, Inc. (The Quaker Oats Company), Mondelez International, Inc., Abbott Laboratories, Clif Bar & Company, Simply Delicious Inc., Nairn's Oatcakes Limited, The Hain Celestial Group, Inc.

In the year 2023, the market attained a volume of 8,244.39 million units (100g per unit), experiencing a growth of 10.1% (2020-2023).

The Snack Bar segment is leading the Market by Product Type in 2023; thereby, achieving a market value of $26.77 billion by 2031.

The Europe region dominated the Market by Region in 2023; thereby, achieving a market value of $20.26 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges