The Global Omics Lab Services Market size is expected to reach $139.1 billion by 2028, rising at a market growth of 12.9% CAGR during the forecast period.

A biological science branch of study that ends in omics, like genomics, proteomics, transcriptomics, or metabolomics, is referred to as omics. Omics strives to characterize and quantify large groups of biological molecules that are relevant to an organism's or a group of organisms' structure, function, and dynamics.

The goal of functional genomics is to determine the functions of as many genes in a particular organism as feasible. Transcriptomics, proteomics, and saturated mutant collections are combined with other -omics approaches.

The market for omics lab services is expanding as a result of factors including rising customer demand and acceptance of the services as well as rising company involvement. For instance, to speed up therapeutic target identification utilizing AI-based genomic analysis, Illumina, Inc., and AstraZeneca engaged in a strategic alliance in October 2022.

Further study into the genetic susceptibility to certain illnesses has been made possible by the expansion of the genomic data pool as a result of research efforts. The clinical use of this data pool is anticipated to revolutionize the healthcare system by enabling the delivery of more precise, efficient, and dependable disease management solutions. The industrial and healthcare sectors are working to effectively integrate genetic data into clinical procedures, despite the fact that clinical usage of genomic data is still in its infancy.

The creation of diagnostic tools based on omics research is still in its infancy. The challenge for developers in the next years will be to provide outcomes that are reliable and timely enough to show the clinical value of such tests. Such examples will be necessary to convince healthcare professionals to use the tests and convince other parties to pay for their costs.

Due to the COVID-19 pandemic, 2020 experienced unheard-of growth. A variety of cancer immunotherapies have been evaluated using advanced omics technologies, including single-cell omics, multi-omics, and conventional omics techniques. Additionally, the industry is being driven by the increasing use of "multi-omics" in research and the use of sophisticated sequencing platforms in the context of precision medicine. COVID-19 has significantly disrupted the pharmaceutical industry's supply chain as a whole. In order to comprehend the COVID-19 virus, several small businesses have begun omics-based clinical studies.

Governments in a number of nations have made considerable investments in genomics in recent years. These government investments have aided the development of new technology significantly. For instance, The Department of Biotechnology (DBT) launched the "Genome India Project (GIP)" in January 2020. The goal of the initiative is to collect 10,000 genetic samples from Indian residents in order to create a reference genome. Precision health, rare genetic illnesses, the mutation spectrum of genetic and complex diseases in the Indian population, genetic epidemiology of multifactorial lifestyle diseases, and translational research are some of the areas of focus of this project.

Continuous technical breakthroughs in sequencing methods have made it possible to create effective, portable, and user-friendly NGS systems with a shorter turnaround time and the ability to offer rapid and accurate findings. Leading corporations are increasing their R&D spending in order to strengthen their market positions and share since the launch of such items and technologies gives them an instant competitive advantage. Technical advancements have led to the addition of several new bioinformatics tools to metagenomics, increasing market revenue.

Data from omics can be utilized for a wide number of purposes, such as pharmacogenomics, diagnostics, and toxicogenomics. In some circumstances, technical improvements have made it possible for the instruments in use to give an analysis; however, the reader's interpretation is still up to them. It is vital to recruiting skilled professionals to evaluate and interpret the outcomes of sequencing data due to the intricacies involved and the requirement for an in-depth understanding of omics.

Based on the business, the Omics Lab Services Market is divided into Hospitals, Research Institutes, and Diagnostic Labs. In 2021, Diagnostic Labs segment accounted for the largest revenue share in the market. The rise in testing and the accessibility of resources for conducting tests are responsible for the segment's expansion. Improved hospital dependence on diagnostic labs for testing and assessment is contributing to the segment's increased growth.

Based on End-Use, the omics lab services market is categorized into Cancer, Pharmaco, Reproductive, Other Genetic Tests, Forensics, Population Studies, Skincare, Nutrition, Vitamins and Supplements, Genealogy, and Others. The reproductive segment acquired the considerable revenue share in the market in 2021. The study of oocytes (or the somatic cells surrounding them) and embryos, where the low quantity of material significantly decreases the information accessible when compared with somatic tissues, is the first clear area to profit from the capacity to amplify DNA (using PCR-type reactions). The number of unidentified genes discovered to be expressed in oocytes or cumulus cells as opposed to granulosa cells nowadays still reflects this.

Based on type, the Omics Lab Services Market is classified into Genomics, Proteomics, Transcriptomic, Metabolomics, and Epigenetics. The epigenetics segment garnered the significant revenue share in the market during 2021. The future potential provided by the epigenetic analysis is responsible for the segment's expansion. Businesses in the omics lab services market are concentrating on expanding their product and service portfolios for this market segment. For instance, Eisbach Bio and MD Anderson collaborated strategically to create a drug that targets epigenetics in cancer in January 2022.

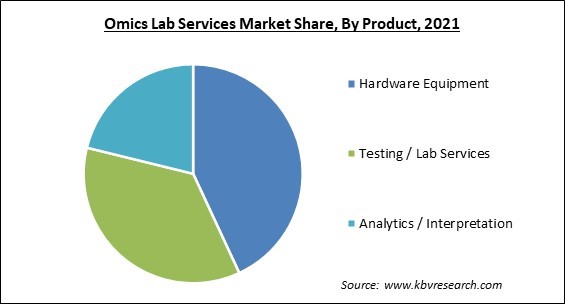

Based on product, the omics lab services market is classified into Hardware Equipment (Instrument, Kits, and Chips), Testing / Lab (Services), and Analytics / Interpretation (Personalization and Interpretation). The hardware equipment segment registered the highest share in the market in 2021. The instruments used in genomic applications are likely to get smaller, which will boost market expansion. Specificity, sensitivity, and automation are benefits provided by tiny devices in the development of point-of-care diagnostics.

Based on the frequency of service, the omics lab services market is classified into One-off, Repeat, and Continuous segments. In 2021, the continuous segment led the market for omics lab services. Genetic technologies are increasingly being used at all periods of life, including old age and the postmortem stage. The use of genetic technology in healthcare creates unique ethical issues that endanger existing therapeutic modalities. These challenges include the varying definitions of value for genetic information.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 59.9 Billion |

| Market size forecast in 2028 | USD 139.1 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 12.9% from 2022 to 2028 |

| Number of Pages | 326 |

| Number of Tables | 589 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Business, Type, Product, Frequency of Service, End-use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on geography, the Omics Lab Services Market is divided into North America, Europe, Asia Pacific, and LAMEA. Due to the high accuracy, specificity, and sensitivity of genetic testing, North America led the global omics lab services market in 2021, which may be ascribed to this region's growing use of genetic testing. Market expansion is predicted to be fueled by the growing demand for genetic testing in clinical studies, including customized healthcare for diseases like diabetes and cancer.

Free Valuable Insights: Global Omics Lab Services Market size to reach USD 139.1 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Thermo Fisher Scientific, Inc., Agilent Technologies, Inc., Qiagen N.V., Quest Diagnostics Incorporated, Illumina, Inc., BGI Group, Q2 Solutions (IQVIA), Flomics Biotech, PhenoSwitch Bioscience

By Business

By End-Use

By Type

By Product

By Frequency of Service

By Geography

The global Omics Lab Services Market size is expected to reach $139.1 billion by 2028.

The Massive Investment of the Government for Genomics Projects are driving the market in coming years, however, A Scarcity of Qualified Professionals restraints the growth of the market.

Thermo Fisher Scientific, Inc., Agilent Technologies, Inc., Qiagen N.V., Quest Diagnostics Incorporated, Illumina, Inc., BGI Group, Q2 Solutions (IQVIA), Flomics Biotech, PhenoSwitch Bioscience

The Proteomics market has acquired maximum revenue share in the Global Omics Lab Services Market by Type in 2021; thereby, achieving a market value of $46.5 billion by 2028.

The Cancer market is leading the Global Omics Lab Services Market by End-Use in 2021; thereby, achieving a market value of $31.7 billion by 2028.

The North America market dominated the Global Omics Lab Services Market by Region in 2021; thereby, achieving a market value of $52.0 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.