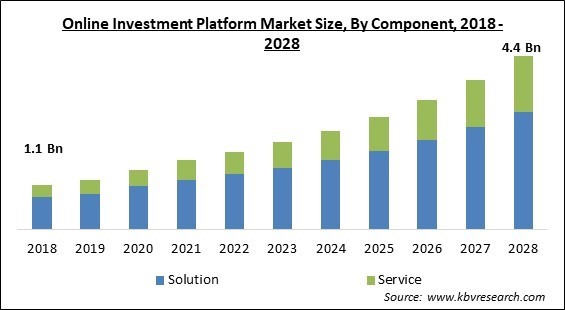

The Global Online Investment Platform Market size is expected to reach $4.4 billion by 2028, rising at a market growth of 14.4% CAGR during the forecast period.

Online investing is the process of making orders to purchase and sell stocks through the internet in place of placing orders by contacting directly with a broker over the phone. An online interface is provided by a trading platform to investors so they may access different markets, make trades, track their positions, and manage their accounts.

Over the forecast period, the online investment platform market is expected to be driven by the rising acceptance of cryptocurrencies as investments and assets. Additionally, it is anticipated that the number of online investors is increasing due to rising disposable income. Also, the inclusion of P2P transactions in online investing programs which provides safe and secure transactions.

The number of High Net Worth Individuals (HNWIs) across the world is rising and their interest in digital investments has been also increased. HNWIs are also well-liked by private equity firms because of the added effort needed to protect and retain their investment.

In addition, the use of blockchain technology is rising. The blockchain network's advantages in assisting with disputes & data discrepancies are increasing its significance in online investing platforms. Moreover, the blockchain-enabled trading and investing platforms worldwide, including CoinSwitch Kuber is being developed.

Furthermore, the lower latency of these platforms enables traders & investors to save time and money. Also, the trend of online investments is rising due to expanding initiatives taken by numerous governments around the world to promote digitalization. Likewise, the demands for personalized online investment platforms is being fueled.

An individual has a very difficult time spending money on internet investment sites as the COVID-19 outbreak persists. The creation of a console for managing the COVID-19 pandemic relies heavily on blockchain technology. Blockchain technology is being used by numerous hospitals to track the COVID-19 vaccine. Although, over the forecast period, the COVID-19 outbreak has been a significant factor in the market's growth. Internet investment platforms are becoming more and more popular as people all over the world become more aware of online investing.

The future of the investing platforms is predicted to change owing to AI. Through the use of robo-advisors, businesses are integrating AI into their trading platforms. The platform equipped with AI technology enables consumers to keep track of a large number of data pointers and carry out procedures at the best possible cost. The technology also enables analysts to do highly accurate market research and assists trading organizations in effectively reducing risks to provide better returns. These elements may result in market expansion during the forecast period.

Investments can be financed by borrowing or current savings. Interest rates have a significant impact on investment. Borrowing becomes more expensive at high-interest rates. Because investors forfeit the interest payments at higher interest rates, investing has a larger opportunity cost. Companies invest to satisfy future demand. If demand is declining, businesses will reduce their investment. Businesses will increase investment if the economy looks better because they anticipate increased demand in the future. Strong empirical data supports the cyclical nature of investing. Investment declines during a recession and rises with economic expansion.

Government regulations, international regulatory agencies, self-regulatory groups, and various exchanges all heavily regulate the online investment software industry. Vendors are required to adhere to regulatory and compliance requirements. Similar to that, these vendors must follow specific regulations imposed by key regulators in order to undertake client activities. Consequently, the vendor may be penalized if they are unable to comply. The development of the online investment platform market may be hampered by this factor as government regulations restrict businesses to enter the market.

By component, the online investment platform market is divided into solution and service. In 2021, the solution segment covered the highest revenue share in the online investment platform market. Because online solutions may have lower operating costs than traditional brokerages, online platform may charge lower commissions. Robo-advisory solutions are also anticipated to increase public access to investment advisory services.

The solution segment is segmented into portfolio management, order management, funds & trading management, risk management, compliance management, reporting and others. In 2021, the portfolio management segment dominated the online investment platform market by generating the maximum revenue share. It is projected that the increased use of Systematic Investment Plans (SIPs) will aid in the segment's expansion. Moreover, a number of portfolio & asset management organizations are making various efforts to improve their products, which is anticipated to increase demand for the services provided by online investing firms.

The service segment is fragmented into advisory services, system integration & deployment, technical support, and managed services. In 2021, the advisory services segment held the highest revenue share in the online investment platform market. The segment growth is predicted to be boosted by the rising usage of investment advice among SMEs and high-net-worth people. To increase overall effectiveness and enhance strategies for maximum returns, advisory services offer prevention along with risk reduction services to their clients. Consequently, the advantages provided by advisory service providers indicate that the segment will expand rapidly.

On the basis of end-use, the online investment platform market is classified into banks, investment management firms, trading & exchange firms, brokerage firms and others. In 2021, the trading & exchange market firms segment procured a significant revenue share in the online investment platform market. As the interest of people especially youngsters, in the stock market is increasing the online investment in trade & exchange is rising. Further, the availability of a large number of firms in this business is supporting the market expansion over the forecast period.

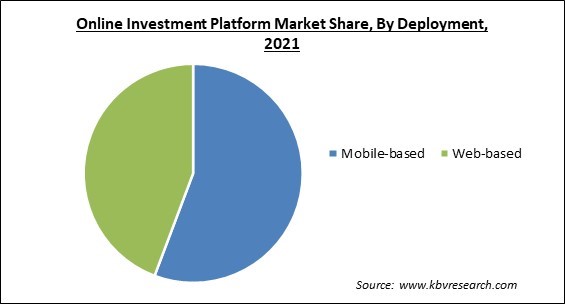

By deployment type, the online investment platform market is divided into web-based, and mobile-based. In 2021, the mobile-based segment witnessed the largest revenue share in the online investment platform market. The growth in this segment is predicted to be fueled by investors' increasing propensity to use mobile-based investment platforms. Mobile-based investment's simplicity and convenience are accelerating expansion. The expansion of the market is being driven by a rise in the number of providers of mobile-based investment platforms.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 1.7 Billion |

| Market size forecast in 2028 | USD 4.4 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 14.4% from 2022 to 2028 |

| Number of Pages | 343 |

| Number of Tables | 583 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, End-Use, Deployment, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the online investment platform market is analyzed across the North America, Europe, Asia Pacific and LAMEA. In 2021, the North America region accounted for the highest revenue share in the online investment platform market. It is projected that increased technology developments will fuel growth. The best online brokers and trading platforms are present in the United States, which is promoting regional growth at the same time. With more than half of the population owning stocks, the demand for improved online investment platforms is increasing in the North America region.

Free Valuable Insights: Global Online Investment Platform Market size to reach USD 4.4 Billion by 2028

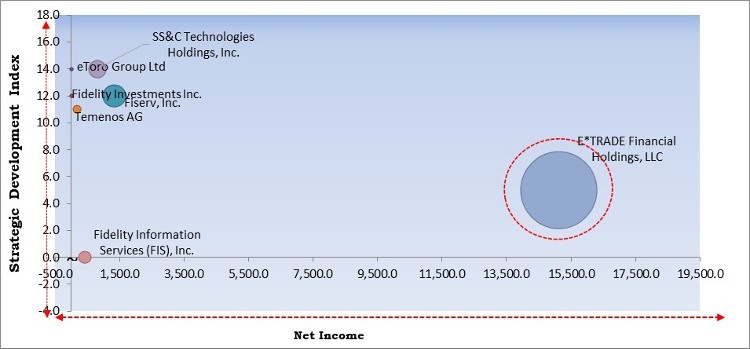

The matrix is designed considering the major strategic developments including Mergers & Acquisitions, product launches, partnership among others and the financial strength of the company in the considered years. The major strategies followed by the market participants are Product Launches. Companies such as eToro Group Ltd, Fidelity Investments Inc. and Temenos AG are some of the key innovators in Online Investment Platform Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Temenos AG, Fiserv, Inc., SS&C Technologies Holdings, Inc., E*Trade Financial Holdings, LLC, Fidelity Information Services (FIS), Inc., Profile Software S.A., eToro Group Ltd, Fidelity Investments Inc., InvestEdge, Inc., and Adenza Group, Inc.

By Component

By End User

By Deployment

By Geography

The Online Investment Platform Market size is projected to reach USD 4.4 billion by 2028.

Higher adoption of Artificial Intelligence across various industries are driving the market in coming years, however, Strict government rules & regulations restraints the growth of the market.

Temenos AG, Fiserv, Inc., SS&C Technologies Holdings, Inc., E*Trade Financial Holdings, LLC, Fidelity Information Services (FIS), Inc., Profile Software S.A., eToro Group Ltd, Fidelity Investments Inc., InvestEdge, Inc., and Adenza Group, Inc.

The expected CAGR of the Online Investment Platform Market is 14.4% from 2022 to 2028.

The Banks market acquired the highest share in the Global Online Investment Platform Market by End-Use in 2021, thereby, achieving a market value of $1.3 billion by 2028.

North America dominated the Global Online Investment Platform Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $1.5 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.