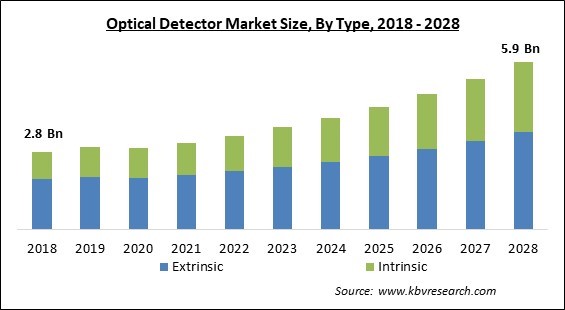

The Global Optical Detector Market size is expected to reach $5.9 billion by 2028, rising at a market growth of 10.1% CAGR during the forecast period.

An optical detector, also called a photodetector, is a device that turns light impulses into electrical signals, which can be amplified and processed. The optical detector is as important as the optical fiber and the light source in any fiber optic system. The performance of a fiber optic communication connection can be determined via an optical detector. Semiconductor photodiodes are the most frequent detectors in optical fiber systems because they have outstanding performance, are compact, and are inexpensive. Silicon, germanium, GaAs, InGaAs, and other semiconductor photodiodes are used.

A detector in a standard photo-research system measures the radiant intensity utilized to elicit photo-response in a sample, as well as the radiant intensity generated by the sample in response to the light or other simulation. After the beam has been divided into its component wavelengths, the measurement is frequently performed. Light signals are transformed into electrical impulses, which are subsequently amplified, processed using signal-to-noise-reduction devices, and displayed. Computers are commonly used to provide measurements in a user-friendly format and in connection to other parameters like wavelength and time.

These are then subdivided into different types of response-generating processes. Some systems use wavelength and temporal response altering phosphorescent accessories to adjust them to a specific UV measurement environment. Optical detector systems are normally made up of actual detector elements bundled with the necessary cooling, bias, and signal processing circuitry. Numerous software alternatives for this process are available. Various figures of merit are used to describe several detectors.

Multiple factors are responsible for the downfall of the optical detector market, including supply chain interruptions, international trade barriers, falling consumer demand, and restricted market potential. Furthermore, the semiconductor industry's collapse has reduced demand for sensing devices dramatically. In addition, several manufacturing plants went out of operation during the pandemic, including those in the automotive, packaging, and logistics industries. Sensor production has been significantly affected by the COVID-19 infection, which has caused manufacturing plants all around the world to temporarily shut down in order to prevent the infection from spreading.

The utilization of optical detectors is significantly increasing across several sectors in the industry. Different industries are currently showcasing a significant demand for optical detectors or sensors that provide precise output. These sensors are capable of detecting things of various sizes as well as sensing a variety of materials. They also have a wide sensing range. The demand for these photodetectors is constantly growing as businesses strive to improve their production efficiency without sacrificing product quality. Optical detectors are cost-effective as well as highly durable, due to which, the various manufacturers are incorporating these sensors into their manufacturing or assembly lines.

Food safety, quality, and provenance have all become subject of major concern due to recent food crises. The advent of a low-cost, reliable, and portable chemical detection technology, like an optical detector, can aid in addressing these concerns. Various researchers have shifted their focus to building optical chemical sensors to help them achieve this goal. Because of its low sensitivity to electromagnetic noise, interoperability with optical fibers, and multiplexing capability, OCS technology is a potential alternative to electrodes as well as other chemical-sensing devices.

Magnetic rotary sensors are a viable option if dirt, dust, oil, humidity, and other impurities that typically degrade the performance of optical detectors are a concern. The new generation of advanced and high-end magnetic rotational position sensors provides consumers with an extra incentive, as the total system cost is typically much lower than that of an equivalent optical detector or resolver. Magnetic rotatory sensors offer enhanced angle measurement accuracy even at very high rotation rates due to their DAEC (dynamic angle error compensation) technology. The maximum resolution of the ABI output is significantly higher in magnetic rotatory sensors to above 4,000 steps/1,000 pulses per revolution in decimal mode as well as 4,096 steps/1,024 pulses per revolution in binary mode, allowing a larger range of optical detectors to be substituted.

Based on Type, the market is segmented into Extrinsic and Intrinsic. In 2021, the extrinsic segment acquired the largest revenue share of the optical detector market. The increasing demand for this segment is attributed to the increasing adoption in the manufacturing of healthcare devices. Full bio-sensing solutions for constant heart-rate tracking, heart variability, and oxygen saturation are available in optical health sensor ICs for body-wearable applications, which measure health and wellbeing along with full bio-sensing solutions for consistent heart-rate tracking, heart rate fluctuation, and oxygen saturation

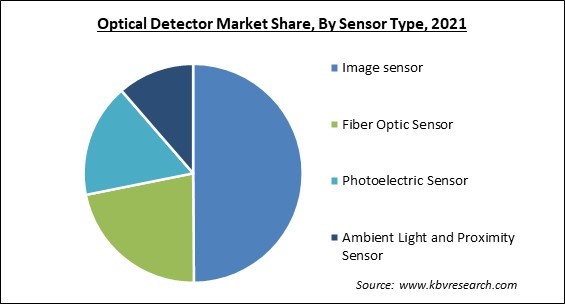

Based on Sensor Type, the market is segmented into Image sensor, Fiber Optic Sensor, Photoelectric Sensor, and Ambient Light and Proximity Sensor. In 2021, the fiber optic sensor segment garnered a substantial revenue share of the optical detector market. The increasing growth of this segment is owing to the high sensitivity along with increased immunity to electromagnetic interference of fiber optic sensors.

Based on End Use, the market is segmented into Consumer Electronics, Medical, Automotive, Industrial, and Others. In 2021, the consumer electronics segment procured the largest revenue share of the optical detector market. The growth of this segment is rapidly rising due to the increasing utilization of photodetectors in various industries. Consumer interest in technology-integrated items is likely to grow in the coming year.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 3 Billion |

| Market size forecast in 2028 | USD 5.9 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 10.1% from 2022 to 2028 |

| Number of Pages | 212 |

| Number of Tables | 369 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Sensor Type, End-use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2021, North America accounted for the largest revenue share of the optical detector market, Numerous regional enterprises are already producing future sensors and inventing solutions to address the expanding market for light management extrinsic.

Free Valuable Insights: Global Optical Detector Market size to reach USD 5.9 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Analog Devices, Inc., STMicroelectronics N.V., ams-OSRAM AG, Rohm Semiconductors Co., Ltd., Hamamatsu Photonics K.K., Vishay Intertechnology, Inc., Excelitas Technologies Corp., Leuze electronic GmbH + Co. KG, and Fotech Group Limited.

By Type

By Sensor Type

By End Use

By Geography

The optical detector market size is projected to reach USD 5.9 billion by 2028.

Increasing applications of optical detectors are driving the market in coming years, however, Prevalence of alternatives across the market limited the growth of the market.

Analog Devices, Inc., STMicroelectronics N.V., ams-OSRAM AG, Rohm Semiconductors Co., Ltd., Hamamatsu Photonics K.K., Vishay Intertechnology, Inc., Excelitas Technologies Corp., Leuze electronic GmbH + Co. KG, and Fotech Group Limited.

The expected CAGR of the optical detector market is 10.1% from 2022 to 2028.

The Image sensor segment is leading the Global Optical Detector Market by Sensor Type in 2021, thereby, achieving a market value of $2.84 billion by 2028.

The North America market dominated the Global Optical Detector Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $2.02 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.