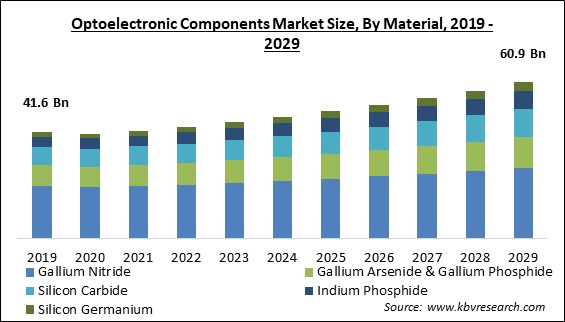

The Global Optoelectronic Components Market size is expected to reach $60.9 billion by 2029, rising at a market growth of 5.0% CAGR during the forecast period.

Electronic components known as optoelectronics are those that can detect and regulate light as well as convert electrical impulses into visible or infrared energy or the opposite. It is utilized in solar power supply, electric eyes, monitor and control circuits, as well as optical fiber communication systems. Optoelectronic components are used for stimulated emission in quantum cascade lasers and injection laser diodes. For safety, packaging, & digital imaging systems, optoelectronic components like image sensors and LEDs are employed. Optoelectronic components' low power consumption and the growing use of infrared electronics in cameras and autos are driving the demand for optoelectronic components.

The field of optoelectronics is sometimes also known as optronics. Imaging detectors, which use electronic image sensors as their basis, opto-isolators, which transfer analog or digital signals while retaining electrical isolation, and other similar devices are examples of optoelectronic devices. Laser technology, optical fiber communications, and other forms of optical metrology are just a few of the fields in which optoelectronic devices are used.

Semiconductor materials are a major component of optoelectronics. These have suitable bandgap energies for absorbing light, such as visible light and near-infrared, and their imperfect electric conductivity is also crucial for such applications. However, with the exception of some photodetectors that make use of the extrinsic photoelectric effect, dielectrics are difficult to use in both aspects, and metals are primarily used as conductors.

Indirect band gaps materials like silicon and germanium are frequently sufficient for taking advantage of absorption processes, for instance, in photodetectors, but are typically less suitable for generating light. Although there have been many different kinds of solutions found, this is a significant challenge for silicon photonics. Direct band gap components, particularly those of the III-V type, such as indium phosphide and gallium arsenide, are the foundation of a majority of emitting devices, such as laser diodes.

The fact that China was the center of the virus outbreak, and that Asia Pacific was the primary region for the production of semiconductors caused significant losses in the initial phases of the pandemic. However, the market is anticipated to pick up steam in the coming years as production facilities resume full-strength operations to fulfill the expanding demand for optoelectronic components throughout a range of industry verticals. In summation, the pandemic had an adverse impact on the market in the starting phases. Still, as the associated industries recover in the coming years, it will proliferate the growth of the market.

In laser generation, laser diodes are a common optoelectronic component with applications in anything from fiber Blu-ray/DVD recorders to printing, networking, and barcode readers. Additionally, the widespread use of electronic devices has led to the development of conventional display technology, with customers demanding displays with higher resolution and efficiency, which is fueling the growth of the optoelectronics sector and driving up demand for electronic gadgets. For a variety of applications, such as cutting, welding, and fabrication, high-power lasers are in high demand in the industrial sectors. Therefore, the growing advancements in laser diodes are anticipated to fuel market demand throughout the forecast period.

Along with the shift to a new way of life, rising disposable income has impacted consumer behavior. The demand for luxury cars has increased as a result of these reasons, particularly in developing nations. The optoelectronic system is necessary for high-end features like autonomous driving and the incorporation of AI and IoT for an enhanced end-user experience. Automobiles are increasingly using ambient lighting, OLED and LED screens, and LED lights to offer luxury performance to customers. The automotive optoelectronic industry is primarily driven by the increase in demand for luxury vehicles. The market for optoelectronic components is expected to increase as a result of this shift in consumer attitudes toward safety while purchasing automobiles.

Optoelectronics is integrated into the workings of LED lighting, OLED displays, as well as LED televisions. However, both the price and manufacturing of LEDs are more challenging. One of the things preventing industrial expansion is the price differential between optoelectronics-based products and conventional commodities. Since LCD displays are more affordable than LED displays, customers might prefer optoelectronics-based products instead of those alternatives. The price of replacing spare parts is also higher than that of normal goods. These key issues limit the demand for optoelectronic components globally.

Based on component, the optoelectronic components market is characterized into sensor, LED, and laser diode & infrared components. The laser diode and infrared components segment procured a considerable growth rate in the optoelectronic components market in 2022. The optoelectronic components used most frequently in laser generation are the laser diode and infrared components. Scaling down the dimensions of various devices and achieving high levels of integration in systems, including arrays of laser arrays, integrated systems, and light-emitting diodes with other electronic parts on the same chip, are the current market trends in optoelectronics.

On the basis of application, the optoelectronic components market is classified into measurement, lighting, communications, security & surveillance, and others. The measurement segment acquired the largest revenue share in the optoelectronic components market in 2022. Measurement systems are utilized for a variety of tasks, including machine vision, process and operation monitoring, control, and experimental engineering analysis. They transform light signals from optoelectronic sensors to electric currents. The precision needed in metrology tasks presently further increases the demand for optoelectronic components.

By material, the optoelectronic components market is divided into gallium nitride, gallium arsenide & gallium phosphide, silicon carbide, indium phosphide, and silicon germanium. The gallium arsenide and gallium phosphide segment garnered a remarkable growth rate in the optoelectronic components market in 2022. Fiber-optic communication and the rapid uptake of mobile phones are propelling the expansion of the segment. Gallium arsenide or GaAs is employed primarily for high-frequency as well as optoelectronic applications because it has electron motion processes that allow for quick and efficient light emission.

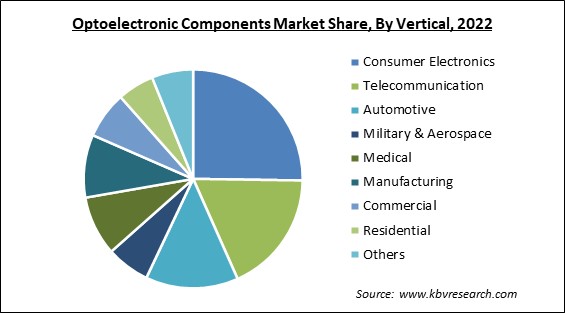

Based on vertical, the optoelectronic components market is segmented into automotive, consumer electronics, telecommunication, military & aerospace, medical, residential, commercial, manufacturing, and others. The consumer electronics segment acquired the highest revenue share in the optoelectronic components market in 2022. Due to technological developments and the rising popularity of consumer goods, including sophisticated high-end cameras, copier machines, cellphones, flat & flexible television screens, blue-ray storage devices, and more, optoelectronic components are now being used more frequently in consumer electronics. The rapid expansion of the consumer electronics industry is boosting the growth of the segment.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 43.5 Billion |

| Market size forecast in 2029 | USD 60.9 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 5% from 2023 to 2029 |

| Number of Pages | 331 |

| Number of Table | 540 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Material, Application, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the optoelectronic components market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment procured the largest revenue share in the optoelectronic components market in 2022. The countries that have contributed most to the market expansion in the Asia Pacific region are India, South Korea, China, and Japan. The market in this region is projected to be fueled by expanding automotive, medical, and industrial manufacturing businesses as well as by an increase in demand for optoelectronic components from other regions. Additionally, the region is a significant producer of semiconductors, and thus, major market participants are present in the region.

Free Valuable Insights: Global Optoelectronic Components Market size to reach USD 60.9 Billion by 2029

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Hamamatsu Photonics K.K., OSRAM GmbH (AMS AG), TT electronics PLC, Vishay Intertechnology, Inc., ON Semiconductor Corporation, Cree, Inc. (SMART Global Holdings, Inc.), TRUMPF GmbH + Co. KG, Sick AG, Broadcom, Inc. and Samsung Electronics Co., Ltd. (Samsung Group).

By Material

By Application

By Component

By Vertical

By Geography

The Market size is projected to reach USD 60.9 billion by 2029.

Rising demand for vehicle safety and luxury vehicles are driving the Market in coming years, however, High prices of some optoelectronic components like LED restraints the growth of the Market.

Hamamatsu Photonics K.K., OSRAM GmbH (AMS AG), TT electronics PLC, Vishay Intertechnology, Inc., ON Semiconductor Corporation, Cree, Inc. (SMART Global Holdings, Inc.), TRUMPF GmbH + Co. KG, Sick AG, Broadcom, Inc. and Samsung Electronics Co., Ltd. (Samsung Group).

The Gallium Nitride segment acquired maximum revenue share in the Global Optoelectronic Components Market by Material in 2022 thereby, achieving a market value of $27.5 billion by 2029.

The Sensor segment is leading the Market by Component in 2022 thereby, achieving a market value of $27.1 billion by 2029.

The Asia Pacific market dominated the Market by Region in 2022, and would continue to be a dominant market till 2029; thereby, achieving a market value of $23.9 billion by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.