The Global Orthopedic Braces & Supports Market size is expected to reach $5.1 billion by 2028, rising at a market growth of 6.3% CAGR during the forecast period.

Orthopedic braces and supports are commonly found in orthopedic supplies, although they are frequently misinterpreted as a form of recuperative treatment. These are typically composed of rigid materials like hard plastics and soft materials like spandex, and are primarily used to immobilize joints so that they can heal in an effective position.

The use of orthopedic braces and support devices to increase the immobilization of the patient's broken area is common after any type of bone fracture. Fractures, such as osteoporotic vertebral fracture, one of the most severe types of osteoporotic fractures, result in the widespread use of braces like the TLSO (Thoracic Lumbar Sacral Orthosis). Early diagnosis and demand for orthopedic braces and support systems are becoming one of the key driving drivers for this market in developed economies, due to rising disposable income and a higher acceptance rate of new technologies in hospitals and orthopedic clinics.

According to an article published in December 2020 titled "Vertebral Compression Fractures," around 1 to 1.5 million Vertebral Compression Fractures (VCF) happen each year in the United States alone. As per the age and sex-adjusted incidence, it's predicted that 25% of women 50 and older have at least one VCF. Furthermore, the lifetime risk of hip, forearm, and vertebral fractures is approaching clinical attention in around 40% of the world, which is comparable to the risk of cardiovascular disease.

One of the main growth drivers is the rising incidence of osteoarthritis. It's the most prevalent type of arthritis, and it affects people of all ages. By 2040, the Centers for Disease Control and Prevention (CDC) predicts that over 78 million adults in the United States over the age of 18 would have been diagnosed with arthritis. As a result, the orthopedic brace industry's major customer base is persons with arthritis. Rheumatoid arthritis is another type of arthritis that affects the joints and causes muscle pain.

COVID-19 has had an impact on all aspects of different industries, including the orthopedic braces and supports market. The demand for orthopedic braces and supports varies greatly from one region to the next, owing to the pandemic's massive influence on the economy and consumers’ purchasing power. COVID-19's global spread has resulted in unprecedented limitations and interruptions in business and personal life. Many governments, for example, have issued "stay-at-home" directives for local business and personal activities. In addition, COVID-19's direct impact, as well as the preventive and precautionary measures implemented as a result, have had a negative impact on, and are expected to continue to have an impact on, certain industry elements, such as operations, commercial organizations, supply chains, and distribution systems, and are expected to continue to have an impact.

With the increased incidence of obesity and accompanying lifestyle problems, the frequency of orthopedic diseases and disorders is predicted to rise even more in the coming years, as obese people are at a higher risk of orthopedic and musculoskeletal injuries, as well as diabetes. Orthopedic braces and supports provide various advantages over traditional goods, including lower cost, improved efficacy, more patient comfort, and ease of use. Key companies are rapidly creating customized solutions for the treatment of various orthopedic ailments as well as to meet unmet market needs as a result of these benefits.

The rising number of leg and knee injuries has resulted in a jump in sales of knee braces and supports. These injuries have risen due to the active participation of people in sports and other adventurous activities. Knee braces and supports are used to treat ailments such as sprained medial knee ligaments, anterior cruciate ligament (ACL) rupture, and posterior cruciate ligament (PCL) rupture after surgery. Knee braces relieve pressure on knee joints that have been impacted by arthritis. Knee braces and supports are most commonly used by those with arthritis and other joint-related ailments, athletes, and those who have had knee surgery.

To effectively manage pain associated with musculoskeletal illnesses such as tendinitis, carpal tunnel syndrome, and osteoarthritis, topical, oral, and parenteral pain medicines are extensively used. Despite the fact that orthopedic braces are used as part of a noninvasive approach to pain management during compression therapy, the acceptance of pain medication for such applications is high due to a lack of awareness about the benefits of orthopedic braces and an unfavorable reimbursement scenario for these products, posing a challenge to this market. Wearing a brace can lead to the wearer treating the braced knee as injured and favoring the other, which can lead to joint stiffness. At first, a knee brace may feel heavy, bulky, and heated. It may slip due to a poor fit.

Based on Type, the market is segmented into Soft & Elastic, Hard, and Hinged. The soft and elastic segment acquired the largest revenue share in the orthopedic braces and supports market in 2021. The expanding availability of improved goods, increasing adoption and patient choice for orthopedic braces in post-operative and preventative care, and the supportive reimbursement scenario for target products across mature countries are all contributing to the market growth of this segment.

Based on Product, the market is segmented into Knee, Ankle, Foot Walkers & Orthoses, Elbow, Hand & Wrist, Shoulder, Hip, Back, & Spine, and Others. The ankle segment garnered a substantial revenue share in the orthopedic braces and supports market in 2021. Ankle fractures are among the most common types of trauma treated by orthopedic teams around the world. Pain and disability, as well as physical, psychological, and social variables, have a crucial role in the long-term repercussions. Overuse and repetitive action in the ankles produce stress fractures, which are especially frequent among sportsmen. As a result, the use of these ankle braces increases, supporting the segment's growth and positively impacting the market's growth.

Based on Distribution Channel, the market is segmented into Hospitals & Surgical Centres, Orthopedic Clinics, Pharmacies & Retailers, E-commerce platforms, and Others. The e-commerce platforms segment registered a significant revenue share in the orthopedic braces and supports market. Sales of soft & elastic and hinged orthopedic braces & supports have risen in demand due the popularity of e-commerce websites like Amazon. Users can order these braces and supports from the comfort of their home. The use of e-commerce as a distribution channel has also increased due to the government mandated lockdowns to tackle the pandemic.

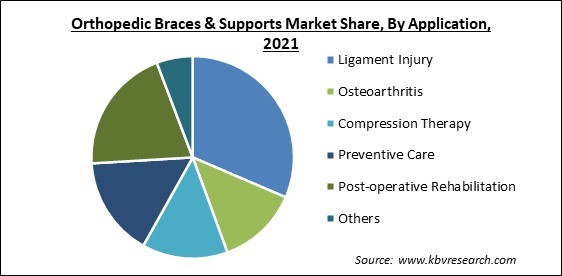

Based on Application, the market is segmented into Ligament Injury, Osteoarthritis, Compression Therapy, Preventive Care, Post-operative Rehabilitation, and Others. The ligament injury segment acquired the maximum revenue share in the orthopedic braces and supports market in 2021. The expanding public engagement in sports and athletic activities (combined with the rising frequency of sports-related injuries), the rising number of accidents globally, and the increasing availability of medical reimbursement for ligament injuries all contribute to this segment's growth.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 3.4 Billion |

| Market size forecast in 2028 | USD 5.1 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 6.3% from 2022 to 2028 |

| Number of Pages | 333 |

| Number of Tables | 542 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Product, Application, Distribution Channel, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. North America acquired the largest revenue share in the orthopedic braces and supports market in 2021. The market for orthopedic braces and supports in North America is driven by factors such as the ongoing development and commercialization of novel orthopedic braces and support products, as well as favorable reimbursements and insurance coverage of major orthopedic bracing procedures in the region.

Free Valuable Insights: Global Orthopedic Braces & Supports Market size to reach USD 5.1 Billion by 2028

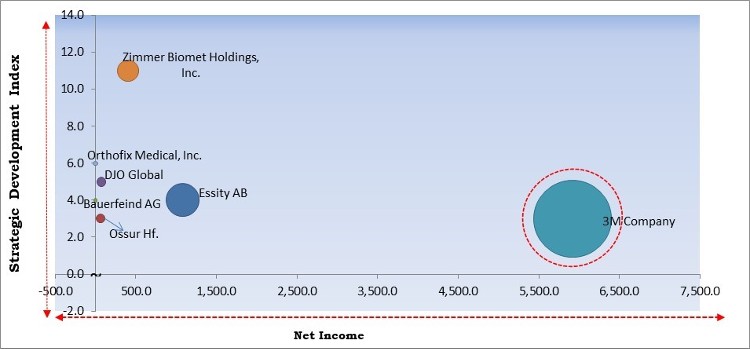

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; 3M Company are the forerunners in the Orthopedic Braces & Supports Market. Companies such as Zimmer Biomet Holdings, Inc., DJO Global, Inc., Breg, Inc. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include DJO Global (Colfax Corporation), 3M Company, Essity AB, Ossur Hf., Orthofix Medical, Inc. (Breg, Inc.), Zimmer Biomet Holdings, Inc., Ottobock SE & Co. KGaA, Nippon Sigmax Co., Ltd., Bauerfeind AG, and Becker Orthopedic.

By Type

By Product

By Distribution Channel

By Application

By Geography

The orthopedic braces & supports market size is projected to reach USD 5.1 billion by 2028.

Rising Number of Injuries are increasing are driving the market in coming years, however, adoption of pain medications and lack of effectiveness growth of the market.

DJO Global (Colfax Corporation), 3M Company, Essity AB, Ossur Hf., Orthofix Medical, Inc. (Breg, Inc.), Zimmer Biomet Holdings, Inc., Ottobock SE & Co. KGaA, Nippon Sigmax Co., Ltd., Bauerfeind AG, and Becker Orthopedic.

The expected CAGR of the orthopedic braces & supports market is 6.3% from 2022 to 2028.

The Knee segment acquired maximum revenue share in the Global Orthopedic Braces & Supports Market by Product in 2021, thereby, achieving a market value of $1.2 billion by 2028.

The North America is the fastest growing region in the Global Orthopedic Braces & Supports Market by Region in 2021, thereby, achieving a market value of $1.7 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.