The Global Orthopedic Navigation Systems Market size is expected to reach $5.5 billion by 2030, rising at a market growth of 12.2% CAGR during the forecast period.

Patients often pose different anatomies and different patients require a personalized procedure to answer their needs. Ambulatory surgical centers (ASCs) are suited for just that as they are equipped to provide specialized care focused on specific procedures, including joint replacements, ligament repairs, and arthroscopic surgeries. Consequently, Ambulatory surgical centers would occupy nearly 20% of the total market share by 2030. Ambulatory surgical centers (ASCs) offer several advantages for orthopedic surgeries, including faster turnover times, reduced infection rates, and enhanced patient satisfaction.

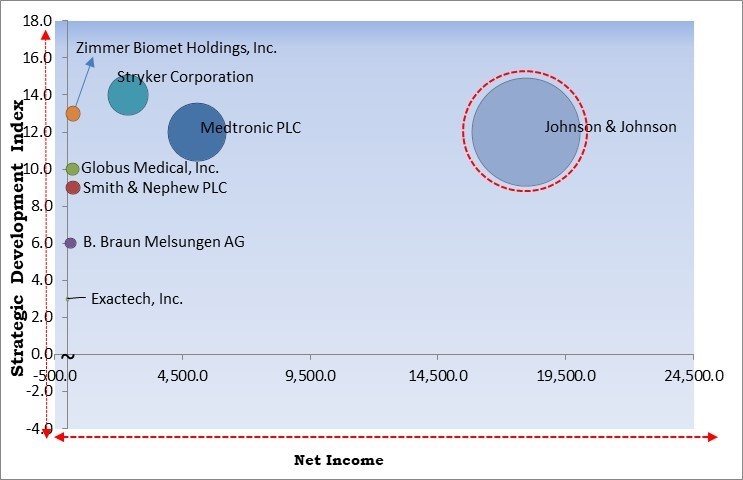

The major strategies followed by the market participants are Acquisitions as the key developmental strategy to keep pace with the changing demands of end users. For instance, in September, 2019, Globus Medical, Inc. acquired StelKast Inc., an orthopaedics manufacturer. The acquisition strengthens Globus Medical's position in the joint arthroplasty market. Additionally, in March,2019, Smith & Nephew PLC acquired the orthopedic joint reconstruction business of Brainlab, a software-driven medical technology provider. The acquisition aids Smith & Nephew in expanding its multi-asset digital surgery and robotic ecosystem.

Based on the Analysis presented in the KBV Cardinal matrix; Johnson & Johnson is the forerunner in the Market. In February, 2022, Johnson & Johnson acquired CrossRoads Extremity Systems, a foot and ankle company. The acquisition complements and strengthens Johnson & Johnson's foot and ankle procedure offerings. Companies such as Medtronic PLC, Stryker Corporation and Zimmer Biomet Holdings, Inc. are some of the key innovators in the Market.

In the initial phases of the pandemic, many healthcare facilities worldwide postponed elective surgeries, including various orthopedic procedures. This led to a temporary decline in the utilization of orthopedic navigation systems as hospitals focused primarily on urgent and emergency cases. Disruptions in the supply chain and manufacturing delays affected the availability of orthopedic navigation systems. Additionally, patients opted to postpone elective orthopedic surgeries such as joint replacements, arthroscopic procedures, and orthopedic trauma surgeries unless they were deemed urgent or necessary. This led to a noticeable decline in the number of scheduled orthopedic procedures. Therefore, the COVID-19 pandemic had a negative impact on the market.

Orthopedic navigation systems offer real-time, dynamic guidance to surgeons during procedures. By using advanced imaging technologies and tracking systems, these tools continuously update and display the precise location of surgical instruments in relation to a patient's anatomy. This aids surgeons in making more accurate assessments and adjustments during the operation. Moreover, in procedures requiring precise bone cuts, such as joint replacement surgeries, orthopedic navigation systems guide the surgeon in executing the necessary cuts accurately. This accuracy is crucial in preserving healthy bone tissue, achieving better joint stability, and reducing the risk of complications post-surgery. These factors will help in expanding the market.

As individuals age, the wear and tear on joints and bones can lead to various orthopedic issues such as osteoarthritis, joint degeneration, fractures, and mobility-related problems. These conditions are more prevalent in older age groups, contributing to the need for orthopedic interventions. The aging population often experiences chronic health issues like osteoporosis, rheumatoid arthritis, and other musculoskeletal disorders. Additionally, joint degeneration, a natural part of the aging process, often results in joint pain, reduced mobility, and compromised quality of life. Orthopedic surgeries, especially joint replacements, serve as effective interventions to alleviate pain and restore functionality in aging individuals. These factors are expected to drive the demand in the market.

The purchase of orthopedic navigation systems involves a substantial capital investment. The initial cost to procure the system and associated equipment can be significant, placing a strain on the budget of healthcare facilities, especially smaller clinics or those in resource-constrained settings. Additionally, comprehensive training for surgeons and staff is crucial for effectively using orthopedic navigation systems. Training programs come with additional costs, including hiring specialized trainers or sending staff for training sessions, which could be a financial burden for facilities with limited budgets. These aspects will restrain the growth of the market in the upcoming years.

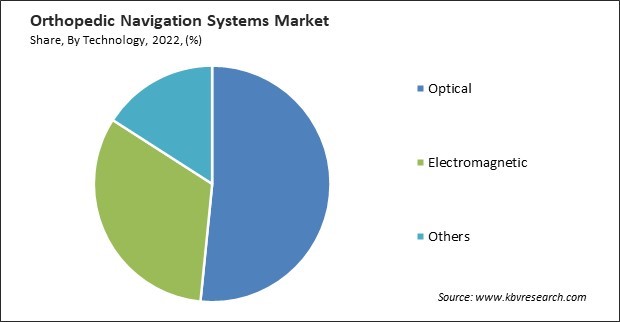

On the basis of technology, the market is divided into electromagnetic, optical, and others. In 2022, the electromagnetic segment witnessed a substantial revenue share in the market. Electromagnetic navigation systems offer high levels of accuracy in tracking and guiding instruments within the surgical field. They provide real-time, continuous updates on instrument positions, enabling surgeons to perform procedures with enhanced precision. The versatility and adaptability of electromagnetic navigation systems make them applicable in a wide range of orthopedic specialties. Thus, the segment will witness increased growth in the coming years.

Based on end-use, the market is divided into hospitals and ambulatory surgical centers. In 2022, the ambulatory surgical centers segment witnessed a substantial revenue share in the market. These centers are equipped to provide specialized care focused on specific procedures, including joint replacements, ligament repairs, and arthroscopic surgeries. Orthopedic navigation systems support the precision and accuracy required in these procedures, contributing to positive patient outcomes in ASCs. Thus, these aspects will boost the demand in the segment.

Based on application, the market is segmented into knee, hip, and spine. In 2022, the hip segment garnered a significant revenue share in the market. The evolution of hip replacement techniques and procedures has seen remarkable advancements. It offers a substantial advantage in hip replacement surgeries by providing precise guidance to surgeons, improving implant placement accuracy, and optimizing the overall alignment and stability of hip implants. Therefore, these aspects will increase the demand in the segment.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 2.2 Billion |

| Market size forecast in 2030 | USD 5.5 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 12.2% from 2023 to 2030 |

| Number of Pages | 249 |

| Number of Table | 344 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Technology, Application, End-use, Region |

| Country scope |

|

| Companies Included | B. Braun Melsungen AG, Stryker Corporation, Medtronic PLC, Smith & Nephew PLC, Johnson & Johnson, Zimmer Biomet Holdings, Inc., Vuzix Corporation, Kinamed Inc., Globus Medical, Inc. and Exactech, Inc. |

| Growth Drivers |

|

| Restraints |

|

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. The North America segment procured the highest revenue share in the market in 2022. North America is a hub for technological innovation in the healthcare sector. The region witnesses continuous advancements in orthopedic navigation systems, integrating cutting-edge technologies such as augmented reality, artificial intelligence, and real-time 3D imaging to enhance surgical precision and outcomes. It plays a crucial role in surgical procedures by offering real-time guidance, allowing for smaller incisions, reduced tissue damage, and quicker patient recovery, which are highly sought after in the region. These factors are expected to pose lucrative growth prospects for the North America segment.

Free Valuable Insights: Global Orthopedic Navigation Systems Market size to reach USD 5.5 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include B. Braun Melsungen AG, Stryker Corporation, Medtronic PLC, Smith & Nephew PLC, Johnson & Johnson, Zimmer Biomet Holdings, Inc., Vuzix Corporation, Kinamed Inc., Globus Medical, Inc. and Exactech, Inc.

By End-use

By Application

By Technology

By Geography

This Market size is expected to reach $5.5 billion by 2030.

Need for greater accuracy in orthopedic procedures are driving the Market in coming years, however, High cost of acquisition, installation, and maintenance restraints the growth of the Market.

B. Braun Melsungen AG, Stryker Corporation, Medtronic PLC, Smith & Nephew PLC, Johnson & Johnson, Zimmer Biomet Holdings, Inc., Vuzix Corporation, Kinamed Inc., Globus Medical, Inc. and Exactech, Inc.

The expected CAGR of this Market is 12.2% from 2023 to 2030.

The Knee segment is generating the highest revenue in the Market by Application in 2022;there by, achieving a market value of $3.2 billion by 2030.

The North America region dominated the Market by Region in 2022 and would continue to be a dominant market till 2030;there by, achieving a market value of $2.3 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.