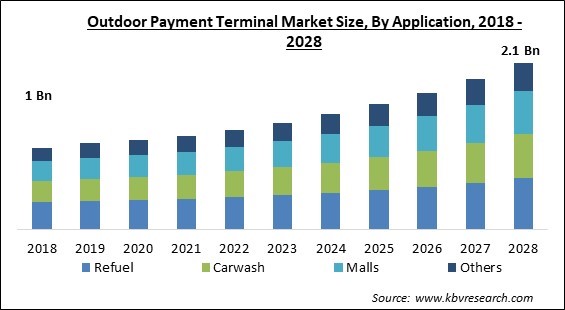

The Global Outdoor Payment Terminal Market size is expected to reach $2.1 billion by 2028, rising at a market growth of 8.9% CAGR during the forecast period.

Outdoor payment terminals, or OPTS, are Unattended payment terminals called that offer quick and secure self-service transaction choices to customers using contactless or contact payment methods. Outdoor payment terminals enable customers to benefit from services and pay effortlessly without the need for additional workers in end-user businesses that see significant daily transaction volumes, such as gas stations.

Outdoor payment terminals enhance transaction processes' security, effectiveness, and flexibility. The use of outdoor payment terminals also improves customer service, boosts service availability around-the-clock, and lowers operating expenses by removing the requirement for staff to handle transactions. Additionally, communication between outside payment terminals and management systems enhances monitoring and control of transaction processes.

Reduce maintenance, improve terminal serviceability, and maximize the terminals' service uptime as a result. Any fuel dispenser at a gas station can be controlled by the Outdoor Payment Terminal from both an OPT and a PoS system. It is used to analyze the sale of fuel at the outlet and collect data remotely. It offers an intuitive user interface and a layout that greatly minimizes maintenance problems.

Systems for outdoor payment terminals are designed to maximize their service uptime, lower their maintenance requirements, and improve their serviceability. The systems are built to be extremely dependable and are put through rigorous testing to survive a variety of challenging outside environmental climate conditions and changes, including temperature, water, dust resistance, and anti-corrosion technology.

The terminals are designed to be redundant, allowing for continuous and uninterrupted functioning around-the-clock without the requirement for staff manual intervention. With redundant communication channels over Ethernet and 3G, outdoor payment terminal systems are made with anti-vandalism built, anti-fraud technology, and anti-tamper devices. They also offer an EMV and PCI-approved service, providing a constant level of connectivity.

Lockdowns imposed globally to stop the diffusion of the pandemic put constraints on the development of people and goods, which led to shop network disruptions and a decline in demand for outdoor payment terminals. However, the number of users conducting contactless transactions has surged during the outbreak. It is estimated that the market would benefit from customers and merchants turning to contactless payment methods to stop the spread of the virus. Due to the growing concerns about payment security, retail merchants also make sure to offer a secure platform to their clients with the deployment of OPTs.

Smartphones are a basic necessity for people across the world in the modern era. A majority of people own a smartphone as it is allowing them to manage a lot of their work as well as personal routines. Due to the rising popularity of smartphones, manufacturers and key market players are increasing their efforts in order to introduce new and more efficient smartphones at affordable rates. By adding a layer of authentication to payment portals to secure information, users have increased customer trust.

In the modern era, in which people are living very hectic and busy schedules, vendors and business owners are compelled to respond as quickly as they can. This entails promptly securing a sale. Vendors must not make their customers wait inordinately long to make a purchase. They might then determine they do not actually require the product. This is particularly problematic if a brick-and-mortar store frequently experiences lengthy or slowly moving lineups. By using a wireless credit card processing terminal, this issue can be simply addressed.

One of the major stumbling blocks in the demand for outdoor payment terminals is the considerable deployment and maintenance cost of this machine. When choosing cutting-edge technology, like outdoor payment terminals (OTP), debit cards, UPI, and online banking, the cost is a crucial factor. Outdoor payment terminals are made with high precision along with advanced technologies. Applications with high security are often expensive. In contrast to online banking and cash-based transactions, PoS Terminal machines have very high initial costs as well as ongoing maintenance costs.

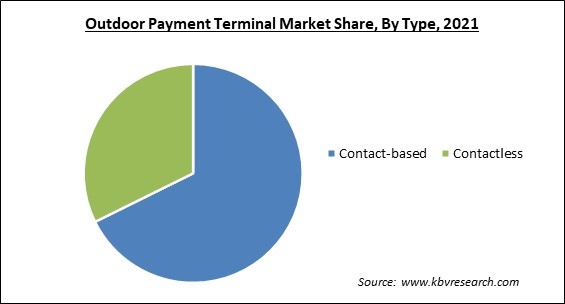

On the basis of Type, the Outdoor Payment Terminal Market is bifurcated into Contactless and Contact-based. In 2021, the contact-based segment procured the largest revenue share of the outdoor payment terminal market. Contact OPTs are extremely popular because they are both widely regarded by the general public and companies as being safe and cost-effective. One of the main drivers of the segment's growth is also the contact payment terminals' established infrastructure and capacity to accept payments made by debit and credit cards.

By Application, the Outdoor Payment Terminal Market is segregated into Refuel, Carwash, Malls, and Others. In 2021, the carwash segment registered a significant revenue share of the outdoor payment terminal market. The OPTs allow users to employ a variety of payment methods, including card-based and mobile payments at kiosks, depending on their convenience and to reduce waiting times for customers. Thus, the growing understanding of the benefits of OPT adoption is fueling segment expansion.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 1.2 Billion |

| Market size forecast in 2028 | USD 2.1 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 8.9% from 2022 to 2028 |

| Number of Pages | 150 |

| Number of Tables | 260 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-Wise, the Outdoor Payment Terminal Market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, North America witnessed the outdoor payment terminal market. People in nations, like the US and Canada are becoming more interested in payment methods including debit, credit, prepaid cards, and others, which is fueling the expansion of the outdoor payment terminals industry across the region. Growth is also being fueled by the expansion of self-checkout retail establishments in the region.

Free Valuable Insights: Global Outdoor Payment Terminal Market size to reach USD 2.1 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Apple, Inc., NCR Corporation, Temenos AG, VeriFone Holdings, Inc. (Francisco Partners), Capgemini SE, Scheidt & Bachmann GmbH, Finastra Group Holdings Limited (Vista Equity Partners), Dover Fueling Solutions (Dover Corporation), Invenco Group Ltd., and Gilbarco, Inc. (Fortive Corporation).

By Application

By Type

By Geography

The Outdoor Payment Terminal Market size is projected to reach USD 2.1 billion by 2028.

Increasing Penetration Of Smartphones All Over The World are driving the market in coming years, however, High Deployment And Maintenance Cost restraints the growth of the market.

Apple, Inc., NCR Corporation, Temenos AG, VeriFone Holdings, Inc. (Francisco Partners), Capgemini SE, Scheidt & Bachmann GmbH, Finastra Group Holdings Limited (Vista Equity Partners), Dover Fueling Solutions (Dover Corporation), Invenco Group Ltd., and Gilbarco, Inc. (Fortive Corporation).

The expected CAGR of the Outdoor Payment Terminal Market is 8.9% from 2022 to 2028.

The Refuel segment acquired maximum revenue share in the Global Outdoor Payment Terminal Market by Application in 2021 thereby, achieving a market value of $646.9 Million by 2028.

The North America market dominated the Global Outdoor Payment Terminal Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $763 Million by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.