“Global Packaged Bread Market to reach a market value of USD 904.8 Billion by 2031 growing at a CAGR of 13.7%”

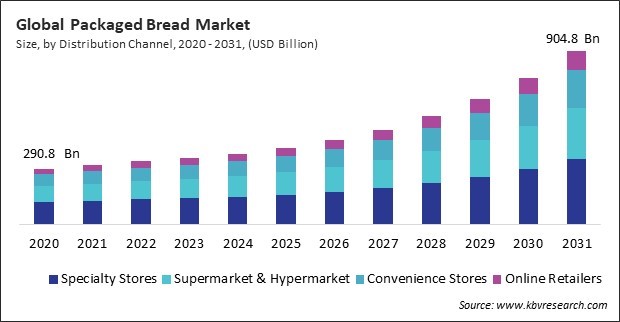

The Global Packaged Bread Market size is expected to reach $904.8 billion by 2031, rising at a market growth of 13.7% CAGR during the forecast period. In the year 2023, the market attained a volume of 96,528.1 Kilo Tonnes, experiencing a growth of 4.0% (2020-2023).

White bread’s dominance is primarily attributed to its broad consumer appeal, stemming from its soft texture, mild flavor, and versatility in various culinary applications. This widespread acceptance has cemented its position as a staple in households, catering to a diverse demographic, including children and adults. Therefore, in 2023, the white bread segment registered nearly 1/2 of revenue share in the market. In terms of volume, 114,949.8 kilo tonnes of white bread are expected to be consumed by the year 2031. The popularity of white bread can also be linked to its convenience and affordability, making it a preferred choice for quick meals and snacks. Its ability to pair well with various spreads and fillings further enhances its desirability, contributing to its substantial market share.

Retailers and e-commerce platforms can leverage data analytics to tailor their marketing strategies and promotions to specific consumer preferences and shopping behaviors. This targeted approach enhances the visibility of packaged bread products, helping brands reach their target audience more effectively. Special promotions, discounts, and personalized recommendations can encourage impulse buying and increase sales. In conclusion, the expansion of retail and e-commerce channels enhancing product accessibility is propelling the market's growth. Additionally, Advancements in packaging technology have improved the shelf life and freshness of packaged bread products. Vacuum sealing, resealable bags, and smart packaging solutions help maintain product quality and extend usability, which is crucial for convenience-oriented consumers. Consumers are increasingly experimenting with different types of bread, leading to a higher demand for packaged options. Thus, rising consumer demand for convenience and ready-to-eat products drives the market's growth.

However, when production costs rise due to increased raw material prices, manufacturers may pass these costs onto consumers through higher retail prices. However, this can lead to decreased demand if consumers are unwilling or unable to pay more for packaged bread. Price sensitivity among consumers can vary, but significant price increases could push buyers to seek alternatives, such as homemade bread or other low-cost substitutes. This competitive pressure can result in reduced market share, diminished profitability, or, in some cases, even business closures. Thus, fluctuations in raw material prices impact production costs and hamper market growth.

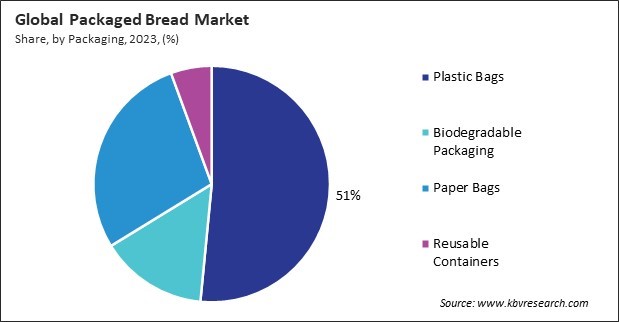

Based on packaging, the market is divided into plastic bags, biodegradable packaging, paper bags, and reusable containers. The paper bags segment attained 28% revenue share in the packaged bread market in 2023. In terms of volume, 62,613.9 kilo tonnes of bread packed in paper bags are expected to be utilized by the year 2031. This substantial share indicates a growing consumer shift towards environmentally friendly and sustainable packaging options. Paper bags are biodegradable and recyclable, appealing to eco-conscious consumers increasingly prioritizing sustainability in their purchasing decisions. The rise in environmental awareness and the push for reducing plastic waste has significantly contributed to the popularity of paper bags.

On the basis of distribution channel, the bread market is segmented into specialty stores, supermarket & hypermarket, convenience stores, and online retailers. In 2023, the supermarket & hypermarket segment attained 29% revenue share in the market. In terms of volume, it is expected that 63,580.6 kilo tonnes of packaged breads would be sold through supermarket & hypermarket by the year 2031. These large retail chains are integral to the bread market due to their extensive reach and convenience. Supermarkets and hypermarkets offer a wide range of bread options, from basic staples to premium selections, all under one roof. Their ability to cater to a broad audience and the convenience of one-stop shopping drives significant sales volume. These stores' competitive pricing and frequent promotions also attract cost-conscious consumers, contributing to their substantial market share.

By product, the market is divided into white bread, brown bread, multigrain bread, whole wheat bread, and sourdough bread. The whole wheat bread segment procured 22% revenue share in the packaged bread market in 2023. In terms of volume, 42,755.7 kilo tonnes of whole wheat packaged bread is expected to be consumed by the year 2031. This segment’s growth is driven by increasing health consciousness among consumers seeking more nutritious options. Whole wheat bread, known for its higher fiber content and richer nutrient profile than white bread, attracts those who prioritize health benefits.

Free Valuable Insights: Global Packaged Bread Market size to reach USD 904.8 Billion by 2031

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe region witnessed 37% revenue share in the market in 2023. In terms of volume, 42,682.1 kilo tonnes of packaged bread are expected to be consumed by this region by the year 2031. This dominant position can be attributed to the high consumption of bread, a staple food in many European countries. The region’s rich tradition of bread-making, coupled with a strong preference for a variety of bread types such as whole grain, sourdough, and artisanal bread, drives this significant market share.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 346.7 Billion |

| Market size forecast in 2031 | USD 904.8 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 13.7% from 2024 to 2031 |

| Quantitative Data | Volume in Kilo Tonnes, Revenue in USD Billion, and CAGR from 2020 to 2031 |

| Number of Pages | 378 |

| Number of Tables | 770 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, -Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Packaging, Product, Distribution Channel, Region |

| Country scope |

|

| Companies Included | Grupo Bimbo, McKee Foods Corporation, General Mills, Inc., Flowers Foods Inc., Aryzta AG, Associated British Foods PLC (Wittington Investments Limited), The Kraft Heinz Company, Yamazaki Mazak Corporation, PepsiCo, Inc., Rich Products Corporation (RE Rich Family Holding Corporation) |

By Packaging (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By Distribution Channel (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By Product (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By Geography (Volume, Kilo Tonnes, USD Billion, 2020-2031)

This Market size is expected to reach $904.8 billion by 2031.

Rising Consumer Demand for Convenience and Ready-To-Eat Products are driving the Market in coming years, however, Fluctuations in Raw Material Prices Impacting Production Costs restraints the growth of the Market.

Grupo Bimbo, McKee Foods Corporation, General Mills, Inc., Flowers Foods Inc., Aryzta AG, Associated British Foods PLC (Wittington Investments Limited), The Kraft Heinz Company, Yamazaki Mazak Corporation, PepsiCo, Inc., Rich Products Corporation (RE Rich Family Holding Corporation)

In the year 2023, the market attained a volume of 96,528.1 Kilo Tonnes, experiencing a growth of 4.0% (2020-2023).

The Specialty Stores segment is leading the Market by Distribution Channel in 2023; thereby, achieving a market value of $340.5 billion by 2031.

The Europe region dominated the Market by Region in 2023; thereby, achieving a market value of $323.2 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges