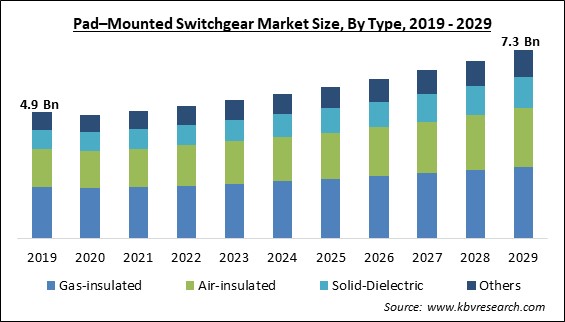

The Global Pad-Mounted Switchgear Market size is expected to reach $7.3 billion by 2029, rising at a market growth of 5.3% CAGR during the forecast period.

Electric power is transferred and distributed via a particular kind of electrical equipment called pad-mounted switchgear. It can be divided into various categories, such as gas-insulated pad-mounted switchgear, air-insulated pad-mounted switchgear, and others (e.g., vacuum). Circuit breakers are used in pad-mounted switchgear to prevent overloads and short circuits in the power supply. Typically, commercial, industrial, and residential applications use pad-mounted switchgear.

Most pad-mounted switchgear is air-insulated, which contains circuit breakers to guard against short circuits or overloads in the power supply. Since many people and governments regard gas as a cleaner fuel than coal, the share of gas-insulated pad-mounted switchgear has been rising. The IEEE C37.74 standard specifies pad-mounted switchgear. Pad-mounted switchgear is used for subsurface distribution networks rated from 5 - 38 kV that must be functional above grade.

The best alternative for feeder sectionalizing, circuit protection, and utility distribution applications is pad-mounted switchgear because of its outdoor-rated, low-profile, and tamper-resistant construction. To safeguard loads, isolate faults, and reduce outages, devices such as switches, fuses, as well as vacuum interrupters are employed. Up to six ways of pad-mounted switchgear are available in a typical insulated sealed tank. Air, SF6 gas, liquid, solid-dielectric-in-air technology, and solid materials are all examples of insulation methods.

Circuit protection devices such as circuit breakers, fuses, and switches are called electrical switchgear and are used to isolate, protect, and control electrical equipment. A switchgear assembly or line-up groups one or more of these buildings. Switchgear is frequently found in medium- to large-sized commercial or industrial facilities, as well as across electric utility transmission & distribution (T&D) systems. In North America, IEEE and IEC determine the standards for electrical switchgear, while other regions of the world use IEC standards.

The pandemic highlighted the need for more environmentally friendly fuel usage and a favorable attitude toward climate change. In many nations, particularly after the pandemic, smart grid and meter installation and operation have advanced. The power industry's transition, which includes improving the transmission and distribution networks, the growing usage of sustainable power plants, etc., are some of the factors that are expected to cause the demand to grow. Therefore, though the pandemic negatively influenced the market initially, the demand for pad-mounted switchgear is bound to grow in the coming years.

Increased electricity demand and grid construction are driving market expansion. Using energy resources effectively is crucial, especially because of rising industrialization and electrical consumption. Emission-free energy sources, such as electricity transmission utilizing HVDC systems, have become more popular. As a result, power consumption in the industrial, domestic, and commercial sectors has increased. Pad-mounted switchgear technologies have gained acceptance due to their usage in underground long-distance transmission and reduced energy prices. Due to increased energy consumption and the development of underground energy transmission, the market is expected to rise significantly over the next several years.

Transmission and distribution (T&D) networks must be dependable and stable due to the rising demand for energy. Only a system with abrupt power shorts and drops can provide uninterrupted electricity. In developed countries, substations are updated to guarantee a constant power supply with minimal losses. This is accomplished by swapping outdated components for more contemporary, effective ones. These improvements are smart and much more resistant to overcurrent circumstances. Investments in distribution systems help the distribution system handle long-distance power flow and reduce energy losses brought on by strong currents. Hence, the market will grow in the upcoming years due to the rising investments in infrastructure improvements.

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

The local companies sell goods made in-house under their local brand. In regard to price competitiveness as well as the local supply system they maintain, which is challenging for international firms to do, these market participants from the unorganized sector outperform major players. If low-quality products are marketed as the industry leaders' products, the surge in switchgear sales from the gray market damages their reputation. The possibility for leading companies to raise their revenue is diminished by the rising sales from both the gray market and local players. All these factors hamper the growth of the market.

Based on type, the pad-mounted switchgear market is categorized into air-insulated, gas-insulated, solid-dielectric, and others. The gas-insulated segment garnered the highest revenue share in the pad-mounted switchgear market in 2022. For insulation, the gas-insulated switchgear uses SF6 gas. When employed at a reasonable pressure for phase-to-phase and phase-to-ground insulation, SF6 offers good dielectric characteristics. Switches, circuit breaker interrupters, and fuses are enclosed with SF6 gas within grounded metal enclosures in gas-insulated pad-mounted switchgear solutions.

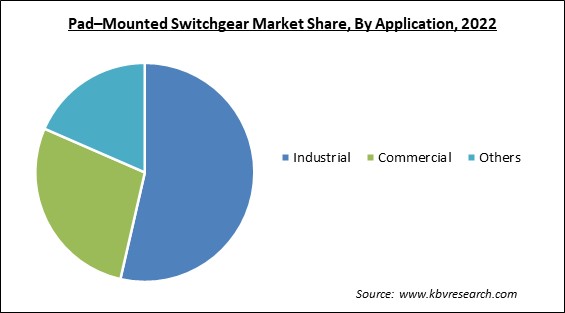

On the basis of application, the pad-mounted switchgear market is divided into industrial, commercial, and residential. The industrial segment acquired the largest revenue share in the pad-mounted switchgear market in 2022. Manufacturing and process industries like mining, oil & gas, chemical & pharmaceutical, food & beverage, steel, cement, and automotive are included in the industrial sector. These sectors need a consistent power source and dependable backup power. Some sectors favor pad-mounted switchgear systems to prevent power outages and guarantee a steady supply of electricity.

Based on voltage, the pad-mounted switchgear market is segmented into 15-25 kV, 25-38 kV, and others. The 15 to 25 kV segment garnered a remarkable growth rate in the pad-mounted switchgear market in 2022. Generators for wind farms frequently utilize gas-insulated medium voltage switchgear. In distant areas, medium voltage switchgear with SF6 gas insulation is built specifically for the safety of wind turbines. Regardless of the type of circuit breaker incorporated into the system, the primary necessity of medium voltage power networks is to disrupt the current when it is incorrect.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 5.2 Billion |

| Market size forecast in 2029 | USD 7.3 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 5.3% from 2023 to 2029 |

| Number of Pages | 202 |

| Number of Table | 360 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Voltage, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

On the basis of region, the pad-mounted switchgear market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe segment recorded the highest revenue share in the pad-mounted switchgear market in 2022. Due to the rising need for underground distribution, it is predicted that the demand for pad-mounted switchgear will increase in Europe region. In response to the growing use of renewable energy, distribution network investments are rising. The market for pad-mounted switchgear in Europe is anticipated to be driven by this rise in distribution network expenditure.

Free Valuable Insights: Global Pad-Mounted Switchgear Market size to reach USD 7.3 Billion by 2029

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Eaton Corporation PLC, ABB Ltd, Hubbell Incorporated, S&C Electric Company, Powell Industries, Inc., G&W Electric, Electro-Mechanical, LLC (Graycliff Partners LP), ENTEC Electric & Electronic Co. Ltd, NOJA Power Switchgear Pty. Ltd., and The International Electrical Products company (Al Tuwairqi Holding Co. ltd).

By Type

By Voltage

By Application

By Geography

The Market size is projected to reach USD 7.3 billion by 2029.

Upgrades and expansions to the infrastructure supporting power distribution are driving the Market in coming years, however, High costs associated with the installation and maintenance of switchgear systems restraints the growth of the Market.

Eaton Corporation PLC, ABB Ltd, Hubbell Incorporated, S&C Electric Company, Powell Industries, Inc., G&W Electric, Electro-Mechanical, LLC (Graycliff Partners LP), ENTEC Electric & Electronic Co. Ltd, NOJA Power Switchgear Pty. Ltd., and The International Electrical Products company (Al Tuwairqi Holding Co. ltd).

The 25 - 38 kV segment is leading the Market by Voltage in 2022 thereby, achieving a market value of $3.6 billion by 2029.

The Europe market dominated the Market by Region in 2022, and would continue to be a dominant market till 2029; thereby, achieving a market value of $2.5 billion by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.