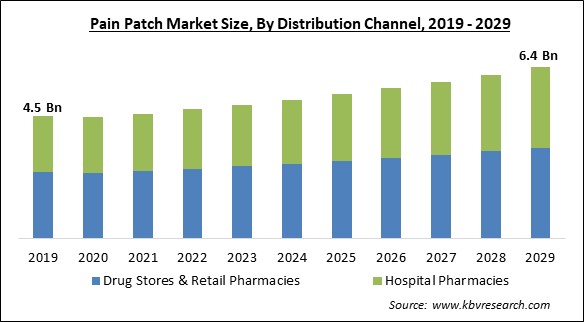

The Global Pain Patch Market size is expected to reach $6.4 billion by 2029, rising at a market growth of 4.4% CAGR during the forecast period.

Transdermal patches used to treat pain are called pain patches. Since they provide a practical and non-invasive method of delivering medication directly to the location of pain, they are a well-liked substitute for conventional pain medications, such as pills or injections. In order to transfer medication through the skin and into the bloodstream, pain patches use a matrix or reservoir technology. They can be found in a range of formulations, including those that contain opioids, nonsteroidal anti-inflammatory medicines (NSAIDs), and other analgesics.

In addition to postoperative pain, arthritis, and neuropathic pain, they can be used to treat a variety of acute and chronic pain problems. One benefit of a pain patch is its ability to deliver long-lasting pain relief without the requirement for repeated dosage. This is due to the fact that instead of being administered in a single dose, the drug is released gradually and continuously over time. Also, since pain patches are applied directly to the skin, they can lessen the systemic side effects of oral painkillers, such as gastrointestinal distress or drowsiness.

An increase in pain disorders, the availability of better healthcare infrastructure, rise in unmet healthcare needs, growth in the prevalence of chronic diseases cases, and growing demand for powerful painkillers with fewer side effects are among the key factors fueling the growth of the pain patch market. In addition, the market is expanding as a result of the growing need for effective pain patches and the popularity of personalization in pain management.

The COVID-19 pandemic has slowed economic growth across a number of countries. The pandemic is expected to affect the expansion of the pain patch market. Both outpatient and elective interventional operations were restricted or discontinued during the COVID-19 pandemic to reduce the risk of viral spread because the majority of chronic pain facilities were assessed to be non-urgent. Additionally, it has been reported that patients with COVID-19 who are receiving opioid treatment may be more susceptible to respiratory depression and that fever may increase the absorption of the drug fentanyl when it is administered transdermally, such as with a fentanyl patch, which could worsen opioid side effects. As a result, these side effects restricted the usage of pain patches, which had a detrimental influence on the market's expansion.

Recurrent tension-type headaches, the most prevalent symptom of chronic conditions, were reported to impact 1.9 billion people globally, adding to the burden of chronic pain. In terms of years spent living with a disability, low back and neck pain routinely rank first, with other chronic pain illnesses making significant appearances in the top 10. Thus, when constant pain management is required for a protracted length of time, pain patches are used to treat moderate to severe chronic pain, thereby with the increasing cases of chronic and other illness-related pain, the demand for pain patches is also expected to rise to help patients with pain relief and aid in market growth.

As a result of the aging population and the possibility of longer lifespans, it has been predicted that the number of people over the age of 80 will triple globally by the year 2050, with the age distribution over 65 years rising to 36%. There is a possibility of age-related pain, given that 73% of older persons living in communities and 80% of nursing facilities report experiencing pain frequently. Studies show that acute pain is also inadequately controlled in this population, not just chronic pain. Cancer causes discomfort and individuals over 65 account for 67% of cancer fatalities. Older adults may also experience osteoarthritis, post-herpetic neuralgia, post-stroke pain, and diabetic neuropathy, all non-malignant pain illnesses. These factors are driving the market growth.

Physical activities are secure and may lessen pain intensity while enhancing function and quality of life. Several physical therapy techniques, like mirror therapy and graded motor imagery (GMI), have been reported to help patients with complex regional pain syndrome with pain and function (CRPS). Also, it was discovered that GMI and mirror treatment was helpful for phantom limb pain. Thus, it is projected that the availability of several alternative therapies, such as acupuncture, chiropractic adjustments, and pain management equipment, will decrease the demand for pain patches, as such measures have no side effects and thereby hinder the market expansion.

By distribution channel, the pain patch market is classified into hospital pharmacies, drug stores and retail pharmacies and online providers. The hospital pharmacies segment projected a prominent revenue share in the pain patch market in 2022. This is because the frequent patient visits and admissions for pain management hospitals had a substantial portion of the market. This was especially true for patients with musculoskeletal disorders and other conditions that can cause acute and chronic pain. In addition, using painkillers for an extended period of time typically results in an increased risk of experiencing unpleasant effects associated with the medication.

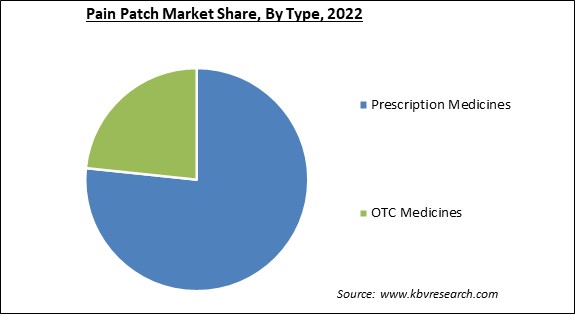

On the basis of type, the pain patch market is divided into prescription medicines and OTC medicines. The prescription medicines segment registered the highest revenue share in the pain patch market in 2022. This is because pain patches are one type of prescription medication that medical professionals may recommend to people who suffer from a wide variety of medical ailments. In addition, they are frequently utilized in the treatment of back pain, knee discomfort, nerve pain, as well as various other kinds of pain. Their usage of treating pain from various diseases and with minimal side effects to the consumer as they are authorized by the medical experts will surge the segment's expansion.

Based on product type, the pain patch market is segmented into non-opioid patches and opioid patches. The non-opioid patches segment dominated the pain patch market with maximum revenue share in 2022. This is because of the growing need for alternatives to opioids that can effectively relieve pain without the hazards associated with opioids. Non-opioids are employed to reduce discomfort and offer effective medicine delivery for an extended period. In addition, they are more effective at delivering drugs because they skip the first-pass metabolism and keep consumers from developing a drug addiction. Hence, the ability to provide pain relief without any side effects like in opioids and other factors is expected to propel the segment's growth.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 4.8 Billion |

| Market size forecast in 2029 | USD 6.4 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 4.4% from 2023 to 2029 |

| Number of Pages | 240 |

| Number of Table | 430 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Product Type, Distribution Channel, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the pain patch market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region generated the highest revenue share in the pain patch market in 2022. This is because of the rising number of elderly people with rheumatoid arthritis. An increasing number of people in North America are turning to opioids for pain management following surgery and in cases involving injuries and other types of traumas, severe and chronic diseases, and other painful conditions. The market in this region is being driven in part by a number of reasons, including the growing prevalence of pain and pain-related illnesses and the expanding opioid epidemic in the region.

Free Valuable Insights: Global Pain Patch Market size to reach USD 6.4 Billion by 2029

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include NEXGEL, Inc. Viatris, Inc. Johnson & Johnson. Teva Pharmaceutical Industries Ltd. Grunenthal GmbH. Sorrento Therapeutics, Inc. Hisamitsu Pharmaceutical Co. Inc. Endo International PLC. Purdue Pharma L.P. Amneal Pharmaceuticals, Inc.

By Distribution Channel

By Type

By Product Type

By Geography

The Market size is projected to reach USD 6.4 billion by 2029.

Presence of alternative treatments are driving the Market in coming years, however, Increasing incidence of chronic pain restraints the growth of the Market.

NEXGEL, Inc. Viatris, Inc. Johnson & Johnson. Teva Pharmaceutical Industries Ltd. Grunenthal GmbH. Sorrento Therapeutics, Inc. Hisamitsu Pharmaceutical Co. Inc. Endo International PLC. Purdue Pharma L.P. Amneal Pharmaceuticals, Inc.

The expected CAGR of this Market is 4.4% from 2023 to 2029.

The Drug Stores & Retail Pharmacies segment is generating highest revenue share in the Global Pain Patch Market by Distribution Channel in 2022 thereby, achieving a market value of $2.65 billion by 2029.

The North America market dominated the Market by Region in 2022, and would continue to be a dominant market till 2029; thereby, achieving a market value of $2.2 billion by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.