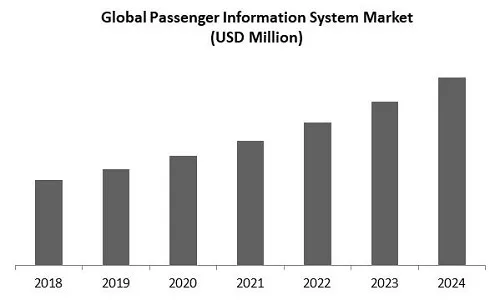

“Global Passenger Information System Market to reach a market value of USD 87.05 Billion by 2032 growing at a CAGR of 13.7%”

The Global Passenger Information System Market size is expected to reach USD 87.05 billion by 2032, rising at a market growth of 13.7% CAGR during the forecast period.

Passenger information system encompasses technologies utilized by public transport providers to deliver both real-time and static journey information to travelers across modes like railways, airports, metros, and buses. Passenger information system has developed into a dynamic, real-time system driven by wireless communications, digital displays, and GPS/AVL. Modern PIS integrates onboard computers, multiple communication channels, and central servers, including mobile apps, station displays, and onboard screens to provide accurate service updates, arrival times, disruption alerts, and wayfinding. With rising urbanization and reliance on public transit, passenger information system has become a key component of intelligent transportation systems, proven to improve passenger satisfaction and encourage public transport usage globally.

Recently, PIS deployment has been supported by trends including digital signage, multimodal integration, real-time data delivery, and the adoption of advanced technologies such as big data, cloud computing, predictive analytics, and IoT. These innovations improve information accuracy while supporting transit agencies in scheduling, fleet management, and operational efficiency. The passenger information system market is highly fragmented, including system integrators, technology vendors, OEMs, and public transit authorities with varied budgets and needs. The market is witnessing intensive competition centering on integration capability, reliability, system flexibility, accessibility, and multi-channel support.

The COVID-19 pandemic made transportation around the world very difficult, and the number of people using rail, air, bus, and metro services dropped sharply. Lockdowns and travel restrictions made transport companies put off or cancel plans to buy passenger information systems (PIS). Authorities had to put off upgrading technology because they didn't have enough money due to lower ticket sales and higher sanitation costs. Supply chain problems and a lack of electronic parts made it even harder to make and deploy PIS. A lot of vendors had to deal with slower project completion and lower sales. Uncertainty about how many people would ride the bus again limited new contract opportunities. In general, the PIS market slowed down for a short time during the pandemic. Thus, the COVID-19 pandemic had a negative impact on the market.

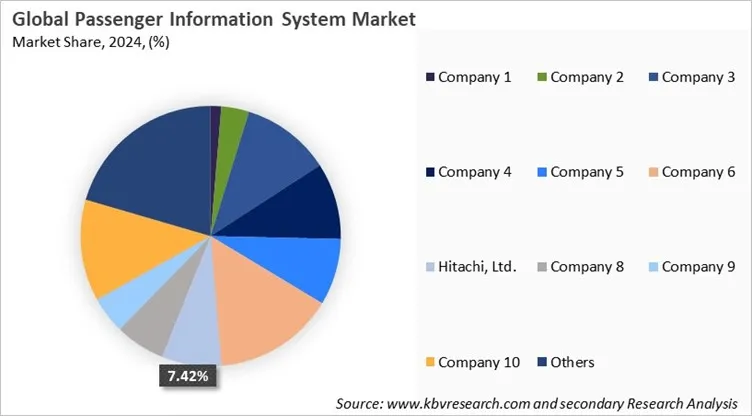

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Based on Location, the Passenger Information System Market is segmented into On Board, and In Station. The In Station segment acquired 43.23% revenue share in the market in 2024. The In Station segment of the Passenger Information System Market is centered around providing timely and accurate information to passengers while they are within transportation hubs, such as railway stations, bus terminals, and metro stations. These systems utilize a combination of electronic displays, public announcement systems, and mobile applications to deliver crucial information about arrivals, departures, platform changes, delays, and emergency announcements.

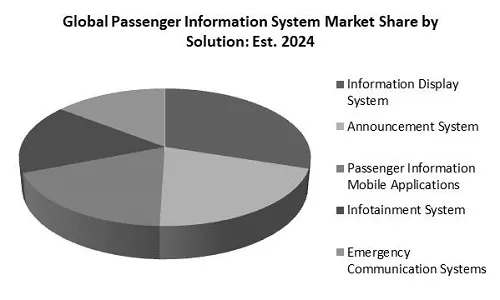

Based on Component, the Passenger Information System Market is segmented into Solution, and Services. The Services segment acquired 26.89% revenue share in the market in 2024. The Services segment of the Passenger Information System Market involves the various support, maintenance, and professional services that ensure the continuous and optimal functioning of passenger information systems. This includes installation services, system integration, technical support, software updates, training programs for transit personnel, and consultancy services aimed at optimizing system performance.

Free Valuable Insights: Passenger Information System Market size to reach USD 87.05 Billion by 2032

Region-wise, the Passenger Information System Market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment recorded 34.90% revenue share in the market in 2024. The passenger information system market is estimated to experience substantial expansion in North America and Europe. In North America, airports and transit agencies are investing in cloud-enabled, integrated solutions (mobile passenger alerts, real-time vehicle tracking) to enhance passenger experience and operational efficiency. Further, the growth is supported by ongoing transit modernization, fleet electrification programs, and robust budgets for smart city pilots. In addition to this, the European passenger information system market is also expanding with a heavier regulatory and accessibility lens. EU funding for strict accessibility and passenger information mandates, cross-border rail upgrades, and widespread retrofits of bus fleets and legacy rail encourage the adoption of standardized, multilingual PIS platforms and real-time passenger information services.

In the Asia Pacific and LAMEA regions, the passenger information system market is anticipated to grow at a significant rate during the forecast period. This is because of increasing air travel volumes, rapid metro and airport expansion, and large-scale smart city programs, which are driving the deployment of passenger information systems and noticeable uptake of mobile-first, cloud/SaaS models. Urban transport and regional aviation growth unveils sizeable near-term spending on wayfinding, displays, and integrated passenger apps. Furthermore, the LAMEA passenger information system market is expanding with major Gulf and Latin America modernization projects, and airport upgrades, creating pockets of investment.

| Report Attribute | Details |

|---|---|

| Market size value in 2025 | USD 35.41 Billion |

| Market size forecast in 2032 | USD 87.05 Billion |

| Base Year | 2024 |

| Historical Period | 2021 to 2023 |

| Forecast Period | 2025 to 2032 |

| Revenue Growth Rate | CAGR of 13.7% from 2025 to 2032 |

| Number of Pages | 563 |

| Number of Tables | 461 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Location, Component, Transportation Mode, Type, Region |

| Country scope |

|

| Companies Included | Acapela Group, Advantech Co., Ltd., Alstom SA, Wabtec Corporation, Mitsubishi Electric Corporation, Siemens AG (Siemens Mobility), Hitachi, Ltd., Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Nokia Corporation and Thales Group S.A. |

By Location

By Component

By Transportation Mode

By Type

By Geography

The market size is projected to reach USD 87.05 billion by 2032.

The passenger information system market is projected to grow at a CAGR of 13.7% between 2025 and 2032.

Growing demand for real-time transit information, supported by the expansion of urban mobility and smart transportation infrastructure.

Acapela Group, Advantech Co., Ltd., Alstom SA, Wabtec Corporation, Mitsubishi Electric Corporation, Siemens AG (Siemens Mobility), Hitachi, Ltd., Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Nokia Corporation and Thales Group S.A.

The Display Systems segment led the Global Passenger Information System Market by Type in 2024; thereby, achieving a market value of $21.74 billion by 2032.

The North America region dominated the Global Passenger Information System Market by Region in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $29.12 billion by 2032.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges